Cartridge Seals Market Size 2024-2028

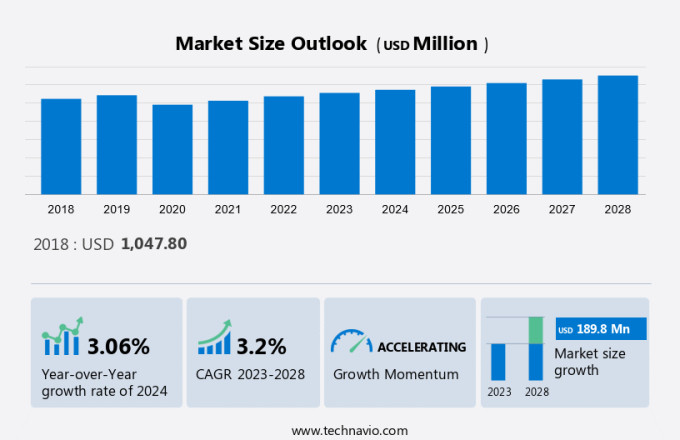

The Global Cartridge Seals Market size is estimated to grow by USD 189.8 million between 2023 and 2028 accelerating at a CAGR of 3.2%. The market is experiencing significant growth due to multiple driving factors. Firstly, the after-market demand is increasing as equipment ages and requires maintenance or replacement. Secondly, the manufacturing sector's expansion is boosting the market, as they are essential components in various industries, including automotive, oil and gas, and power generation. Lastly, the transition to renewable energy sources is contributing to market growth, as renewable energy technologies require efficient sealing systems to operate effectively. These factors collectively create a robust demand, ensuring the market's continued expansion.

What will be the Market Size During the Forecast Period?

To learn more about this report, Request Free Sample

Technavio’s Exclusive Market Customer Landscape

The market report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Market Dynamics

In the dynamic and stringent market of industrial sealing solutions, cartridge seals have gained significant traction due to their ability to ensure product integrity in various applications. These seals, primarily made of materials such as polyurethane, industrial rubber, and fluorosilicone, are essential in maintaining food safety standards in the storage and processing industries. The market is subjected to strict laws and regulations, particularly in the machine tool industry, where rotating parts like shafts and vertical parts require unwavering sealing performance. Cartridge seals are widely used in pump housings, where structure analysis is crucial to prevent unbalanced seals and potential machinery failure.

Cartridge seals' importance lies in their ability to provide reliable sealing solutions for conventional seals, ensuring the continued operation of machinery and maintaining the integrity of the products being processed. The market for cartridge seals continues to grow, driven by the need for enhanced product safety, efficiency, and regulatory compliance. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Drivers

Rising demand in manufacturing industries is a prominent market driver. They are essential components in manufacturing industries for sealing pumps and mixers. The manufacturing industry is rapidly growing, particularly in emerging economies, due to factors such as favorable government initiatives, increasing demand for consumer goods, and rising urbanization. This growth in manufacturing is driving the demand for various industrial components, as they are critical to the efficient functioning of pumps and mixers.

According to the United Nations Conference on Trade and Development (UNCTAD), global foreign direct investment (FDI) will grow vigorously in 2021 to USD 1.58 trillion, up 64% from the exceptionally low level in 2020. This implies that there will be strong growth in the manufacturing sector in the coming decade. Moreover, many countries are now adopting investment policies that will boost the growth of the manufacturing sector, which, in turn, will drive the growth of the global market during the forecast period.

Significant Market Trends

Increasing demand for power generation is a major market trend. They are widely used in the power generation industry to prevent leakage of fluids such as water and steam in rotating equipment such as pumps and compressors. Rising demand for power generation driven by factors such as population growth, urbanization, and industrialization has correspondingly increased the demand.

According to the International Energy Agency, total net electricity generation in February 2022 was 887.5 terawatt hours (TWh), down 11.6% from January 2022 but up 1.4% from February 2021. Increased global electricity demand is expected to increase capacity factors across the energy sector. Various capacity expansions are coming soon to meet the excess demand. Many companies are investing in the global cartridge seal market to take advantage of this growing demand. Hence, increasing demand for power generation will drive the growth of the global cartridge seals market during the forecast period.

Major Market Challenge

Fluctuating prices of raw materials is a market challenge hindering the market. The main raw materials used in manufacturing cartridge seals include steel, silicon carbide, tungsten carbide, and carbon. Fluctuations in the prices of steel and related materials, therefore, affect the global market. Increased raw material prices are borne by the supplier when commodity prices reach threshold levels, commodity suppliers are forced to pass on increased costs to downstream industries. Such raw material supplier decisions are influencing the growth of various markets, including the global cartridge gasket market.

In addition, commodity price fluctuations can affect a manufacturer`s profit margins. These factors are expected to hamper the growth of the global market during the forecast period.

Who are the Major Cartridge Seals Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

A.W. Chesterton Co: The company offers sealing solutions for different rotating equipment such as turbines, pumps, mixers, cooling fans, valves, flanges, heat exchangers, and many more.

AES Engineering Ltd: The company offers engineering and consultancy services for different projects. It also offers different cartridge seals such as high-performance mechanical seals, single mechanical cartridges, and Bi metal FIDC cartridges.

We also have detailed analyses of the market’s competitive landscape and offer information on 15 market Companies, including:

- Anhui YALAN Seal Component Co. Ltd.

- Avon Seals Pvt. Ltd.

- EnPro Industries Inc.

- Flexaseal Engineered Seals and Systems LLC

- Flowserve Corp.

- Leak Pack Engineering Pvt. Ltd.

- Meccanotecnica Umbra S.p.A.

- MICROTEM Srl

- PPC Mechanical Seals

- Quba Seals India Pvt. Ltd.

- Saisi Mechanical Seal Co. Ltd.

- Smiths Group Plc

- Tenneco Inc.

- The Timken Co.

The report offers clients a deeper understanding of the market and its players through a combined qualitative and quantitative analysis of the Companies. The analysis classifies Companies into categories based on their business approach, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak to understand the dos and don’ts of business which in turn can help a client make the best decision.

Market Segmentation by Application, Type, and Geography

Application Analysis

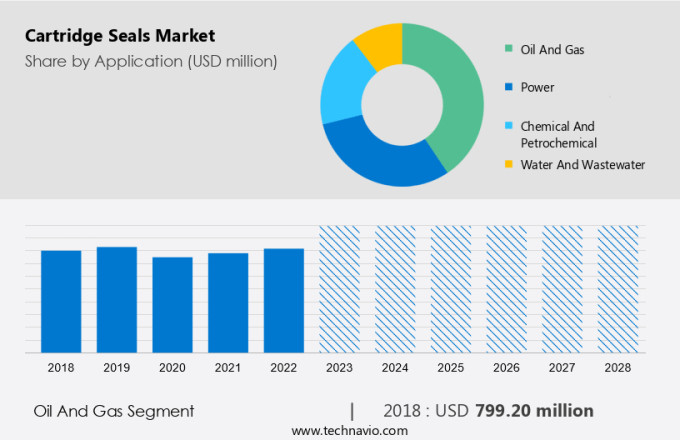

The oil and gas segment will contribute a major share of the cartridge seals market industry. Cartridge seals are annular mechanical seals that form a sealing surface under the pressure of an incompressible liquid. These cartridge seals have been used for decades in the oil and gas sector because they offer several advantages over other types of seals such as no leakage at high temperatures, long service life, etc. In the oil and gas industry, cartridge seals can be used in reciprocating compressors used to compress natural gas for transportation through pipelines.

Get a glance at the market contribution of various segments Request Free Sample

The oil and gas segment was valued at USD 799.20 million in 2018. These seals help prevent leaks and reduce maintenance costs. In addition, cartridge seals are also used in pipeline pumps used to transport oil and gas over long distances. These seals ensure the reliable operation of the pump and help prevent leaks. Therefore, rising demand for cartridge seals in the oil and gas industry is expected to boost the growth of the global cartridge seals market during the forecast period.

Type Analysis

A single seal is known as a check valve. It works on the principle that liquids and gases can only flow in one direction through the seal. This is accomplished by using springs that block the return flow of liquid or gas when pressure builds up from a particular side. This type of seal is used primarily in offshore oil and gas applications, onshore pipelines, and multiphase lines. Check valves are widely used in various industries such as plumbing, water treatment, oil and gas, and chemical processing. They are used to prevent backflow, which can be a serious problem for many applications.

Regional Analysis

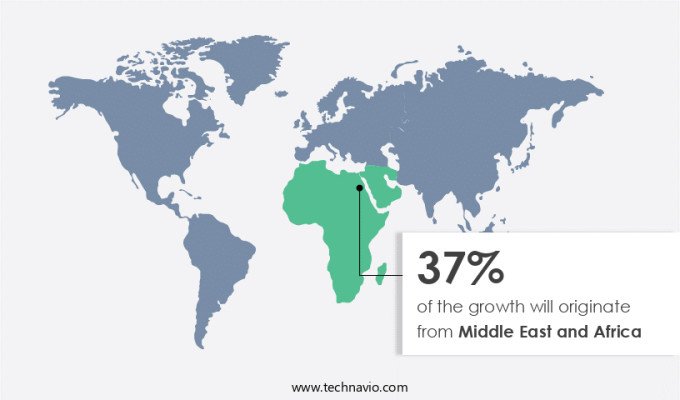

Middle East and Africa is estimated to contribute 37% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region offering significant growth opportunities to vendors is North America. The North American cartridge seals market is expected to register moderate growth during the forecast period. The United States is the largest revenue contributor to the North American cartridge seals market. According to the U.S. Energy Information Administration (EIA), oil production per rig will increase in 2022. Increased demand for oil has led companies to expand the number of oil and gas rigs in operation to produce more oil from their current reserves. High E and P activity due to technological development will lead to the production of large amounts of oil and gas from non-traditional sources. Additionally, the trade dispute between the United States and Iran has increased the need for domestic oil production in North America. Such factors have increased the demand for cartridge seals in this region.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Oil and gas

- Power

- Chemical and petrochemical

- Water and wastewater

- Type Outlook

- Single seals

- Double seals

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

In the dynamic and complex world of industrial processes, they have emerged as a critical solution for fluid containment and leakage prevention in various industries, including petrochemical plants. These seals, integral components of enclosed seal systems, consist of several elements such as glands, sleeves, seal faces, energizing force sources, lock collars, and carbon rings. They come in single and dual configurations, catering to diverse process requirements. Single cartridge seals house all the seal components within a single cartridge, while dual cartridge seals feature separate cartridges for the primary and secondary seals. The choice between cartridge seal types depends on business planning and decision-making factors, including process efficiency, safety, and cost-effectiveness. They employ various seal faces, such as Xtradiamond and Xtralast, and orings like FFKM orings, to ensure optimal performance in different applications.

Gaslubricated seals and CobraGDS mechanical seals are popular cartridge seal options, offering enhanced leak control and reliability. The energizing force source and lock collar play crucial roles in ensuring safe operation and effective sealing. Climate-critical leakage is a significant concern in various industries, often featuring polytetrafluoroethylene (PTFE) materials, help mitigate this issue. Circulating materials, such as ethane production, benefit from the robustness and efficiency in agitators and other process equipment. In summary, cartridge seals, with their diverse elements and configurations, play a pivotal role in ensuring safe, efficient, and reliable fluid containment in various industries, including petrochemical plants.

In the market, various types of seals are utilized to ensure efficient flow control and leak prevention in industrial applications. These seals include SL, Xtradiamond Seal Face, Xtralast FFKM Orings, and others. They are essential components in rotating parts such as shafts and vertical parts of pumps, particularly in the pump housing. Balanced seals, non-pusher seals, pusher seals, split seals, dry gas seals, cassette seals, slurry seals, bellow seals, and component seals are some of the commonly used these. These seals play a crucial role in maintaining productivity by controlling mixtures and preventing product contamination or heat loss. Heat-resistant seals are particularly important in high-temperature applications. Export limitations and production stoppages can significantly impact the demand in various industries. The market caters to a wide range of applications, from oil and gas to power generation and chemical processing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 189.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Regional analysis |

North America, Middle East and Africa, Europe, APAC, and South America |

|

Performing market contribution |

Middle East and Africa at 37% |

|

Key countries |

US, Saudi Arabia, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A.W. Chesterton Co., AES Engineering Ltd., Anhui YALAN Seal Component Co. Ltd., Avon Seals Pvt. Ltd., Enpro Inc., Flexaseal Engineered Seals and Systems LLC, Flowserve Corp., Hefei Supseals International Trade Co. Ltd., Kaman Corp., Leak Pack Engineering Pvt. Ltd., Meccanotecnica Umbra S.p.A., MICROTEM Srl, PPC Mechanical Seals, Quba Seals India Pvt. Ltd., Saisi Mechanical Seal Co. Ltd., Smiths Group Plc, Tenneco Inc., The Timken Co., Trelleborg AB, and TREM Engineering JSC |

|

Market dynamics |

Parent market analysis, Market forecasting growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Cartridge Seals Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the Cartridge Seals Market between 2023 and 2027

- Precise estimation of the market research and growth, market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Market growth analysis across North America, Middle East and Africa, Europe, APAC, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about Companies

- Comprehensive analysis of factors that will challenge the growth of cartridge seals market Companies

We can help! Our analysts can customize this report to meet your requirements.