Cash Management System Market Size 2025-2029

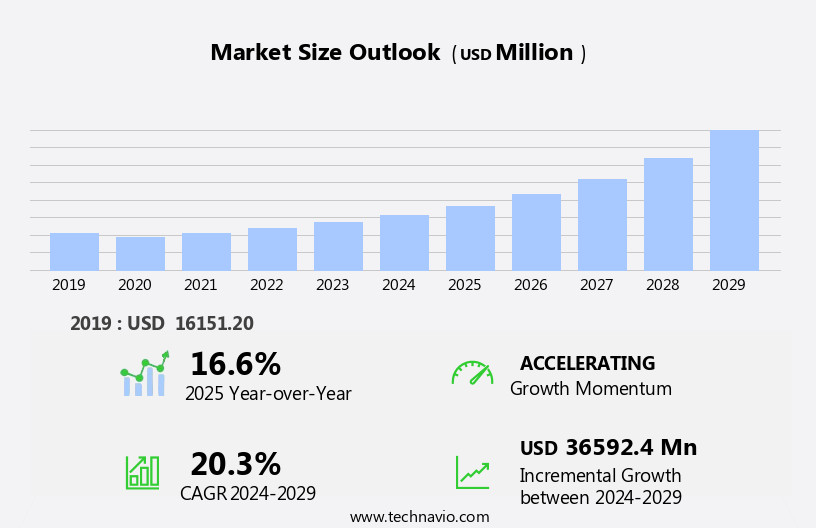

The cash management system market size is forecast to increase by USD 36.59 billion at a CAGR of 20.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for real-time tracking of cash movements and digital transformation among end-users. In today's fast-paced business environment, organizations require efficient and accurate cash management solutions to optimize liquidity, reduce operational costs, and mitigate financial risks. The market is witnessing a shift towards cloud-based and mobile cash management systems, enabling users to access real-time information and perform transactions from anywhere, at any time. However, the market also faces challenges, with cybersecurity concerns emerging as a major challenge. With the increasing number of cyberattacks and data breaches, organizations must prioritize security measures to protect their financial data.

- Additionally, regulatory compliance and data privacy regulations add complexity to the implementation and maintenance of cash management systems. Companies seeking to capitalize on market opportunities and navigate challenges effectively must prioritize security, invest in advanced technologies such as artificial intelligence and machine learning, and collaborate with trusted partners to ensure compliance with evolving regulations.

What will be the Size of the Cash Management System Market during the forecast period?

- The market encompasses a range of financial technology solutions designed to optimize cash flow, enhance treasury management, and improve liquidity for businesses and financial institutions. This market includes offerings for cash handling automation, payment processing, digital banking, currency management, and electronic funds transfer. The retail industry and commercial sector are significant markets for cash management systems, with a focus on cash logistics, cash forecasting, cash security, and cash visibility. Solutions in this market also address cashless transactions, point-of-sale systems, cash recycling, and cash monitoring.

- Additionally, fraud detection, risk management, and cash reconciliation are essential components of cash management systems. The market is experiencing growth due to the increasing demand for efficient cash management, digital banking, and advanced payment solutions. The integration of artificial intelligence and machine learning technologies is further driving innovation in this space, enabling real-time cash flow analysis and automated cash forecasting.

How is this Cash Management System Industry segmented?

The cash management system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- US

- Canada

- Mexico

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

Cash management systems play a crucial role in businesses, particularly In the banking sector and highly regulated industries, where financial data security and compliance are paramount. On-premises cash management solutions continue to be popular due to their ability to provide businesses with complete control over their data and enhanced security features. Strict regulatory requirements and the sensitivity of financial data make cloud-based solutions less appealing to some organizations. Moreover, businesses that have invested significantly in legacy on-premises systems may find the cost and complexity of transitioning to cloud-based solutions prohibitive. Cash management systems encompass various applications, including cash flow optimization, treasury management, payment processing, digital banking, cash logistics, currency management, electronic funds transfer, and liquidity management.

Other essential features include cash forecasting, cash security, cash visibility, payment solutions, cash monitoring, fraud detection, risk management, cash deposit systems, cash withdrawal systems, cash management software, real-time payments, and cash position tracking. The adoption of cash management systems is driven by the need for financial efficiency, improved transaction risk management, and enhanced cash flow analysis capabilities. The retail industry, commercial sector, e-commerce sector, and automotive applications are significant end-users of cash management systems. The banking sector, too, is a significant adopter, with the increasing popularity of retail banking, commercial banking, ATM networks, mobile banking, and cash vaults.

Cash handling automation, cash recycling, cashless transactions, and cash reconciliation are some of the advanced features that are gaining traction In the cash management systems market. The integration of artificial intelligence, machine learning, and blockchain technology is expected to further enhance the capabilities of cash management systems. In , the demand for cash management systems is driven by the need for financial efficiency, data security, and regulatory compliance. The adoption of these systems is widespread across various industries, including banking, finance, retail, and commercial sectors. The integration of advanced features, such as cashless transactions, cash handling automation, and real-time payments, is expected to further fuel the growth of the cash management systems market.

Get a glance at the market report of share of various segments Request Free Sample

The On-premises segment was valued at USD 8.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

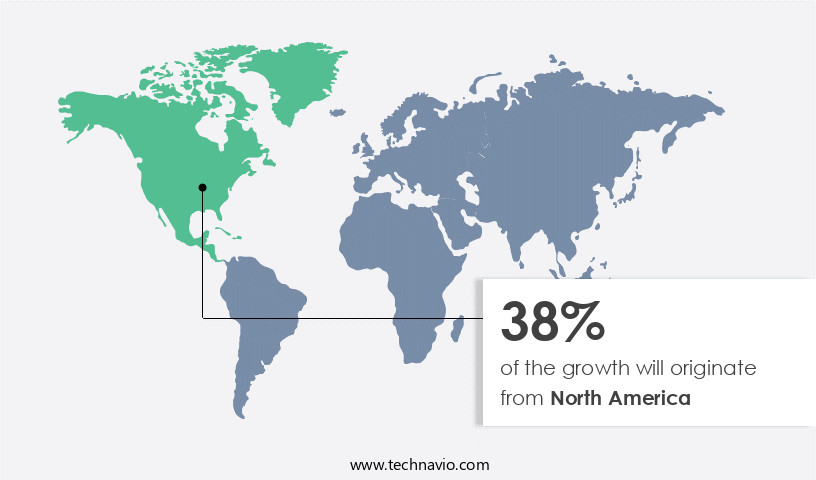

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In North America, where the US and Canada comprise a significant and diverse economy, advanced cash management systems are essential for handling intricate financial operations. The presence of numerous multinational corporations necessitates sophisticated solutions for managing extensive cash flows, client accounts, and investments. Financial institutions in this region, including major banks and investment firms, require reliable cash management systems to ensure financial efficiency and regulatory compliance. With stringent financial regulations and compliance requirements, particularly In the US, comprehensive cash management and treasury solutions are necessary to meet these demands.

Cash management systems in North America encompass various applications, such as cash flow optimization, liquidity management, payment processing, digital banking, and cash handling automation. These solutions offer features like cash forecasting, cash security, fraud detection, and risk management to ensure financial institutions operate effectively and securely.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cash Management System Industry?

Demand for real-time tracking of cash movement is the key driver of the market.

- Cash management systems have become essential tools for businesses seeking real-time visibility into their cash positions and financial data. These systems provide organizations with immediate insights into their cash flows, enabling them to make informed decisions and respond to changing financial conditions. Real-time tracking of cash positions allows businesses to monitor incoming and outgoing transactions as they occur, ensuring accurate and up-to-date information. This visibility is crucial for current liquidity levels and making informed financial decisions. Moreover, real-time tracking enables instant verification of transactions, reducing the risk of discrepancies, errors, or fraudulent activities.

- Real-time data also facilitates more accurate and dynamic cash flow forecasting, providing businesses with a clearer picture of their financial future. By implementing cash management systems, organizations can streamline their financial processes, improve operational efficiency, and mitigate financial risks.

What are the market trends shaping the Cash Management System Industry?

Digital transformation among end-users is the upcoming market trend.

- Cash management systems have gained significance In the digital business landscape, serving as integral components of broader transformation initiatives. Companies are automating their financial processes to optimize cash flow management, minimize manual tasks, and boost efficiency. The automation of cash management tasks, including data entry, reconciliation, and transaction processing, reduces errors, enhances productivity, and enables finance professionals to focus on strategic activities. Digital transformation facilitates seamless integration with banks, payment providers, and financial institutions via application programming interfaces (APIs).

- This integration streamlines transactions and data exchange, ensuring faster processing times. Modern cash management systems prioritize user experience, providing intuitive interfaces and user-friendly dashboards for enhanced usability. By digitizing cash management, businesses can improve operational efficiency, reduce risks, and gain real-time insights into their financial operations.

What challenges does the Cash Management System Industry face during its growth?

Increasing cyberattacks and data breaches concern is a key challenge affecting the industry growth.

- Cash management systems have gained significant importance In the business world due to their ability to streamline financial operations and enhance operational efficiency. However, data security remains a major concern that can hinder the adoption of these systems. Given the sensitive nature of financial data handled by cash management systems, security measures are essential. Data encryption, authentication, and protection against cyber threats are crucial to ensure the confidentiality and integrity of financial information. High-profile data breaches and cyberattacks can result in substantial financial losses, regulatory fines, and reputational damage, making organizations wary of implementing cash management systems.

- The compromise of financial data, including bank account information, transaction details, and financial statements, can have severe consequences, potentially leading to a loss of trust In these systems. Organizations must prioritize data security to mitigate risks and ensure the successful implementation and continued use of cash management systems.

Exclusive Customer Landscape

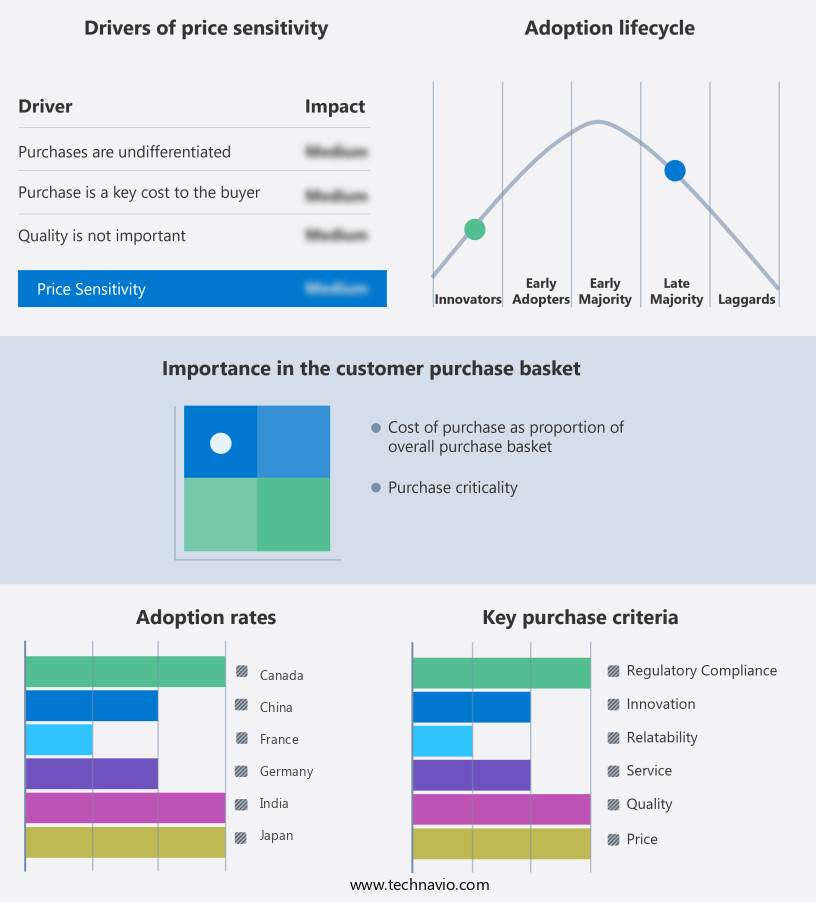

The cash management system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cash management system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cash management system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Agricultural Bank of China Ltd. - The company provides comprehensive cash management solutions through its subsidiary, Securevalue India. These offerings encompass ATM cash replenishment, CIT, retail cash management, doorstep banking, complete line maintenance, cash processing, and vaulting services. All aspects of cash handling are addressed to ensure optimal efficiency and security.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agricultural Bank of China Ltd.

- AGS Transact Technologies Ltd.

- Allied Universal

- ALVARA Holding GmbH

- Aurionpro Solutions Ltd.

- AXIOM Armored

- Banco Santander SA

- BNP Paribas SA

- CMS Info Systems Ltd.

- Credit Agricole SA

- Deutsche Bank AG

- Finastra

- GardaWorld Security Corp.

- Giesecke Devrient GmbH

- Glory Ltd.

- GSLS

- HCL Technologies Ltd.

- HSBC Holdings Plc

- ICBC Co. Ltd.

- Infosys Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cash management systems have become an essential component of modern financial infrastructure, enabling businesses and financial institutions to optimize their cash flow, enhance financial efficiency, and mitigate risks. These systems facilitate the effective management of money flow through various applications, including treasury management, payment processing, cash logistics, currency management, and electronic funds transfer. The implementation of cash management systems has gained significant traction in various sectors, including retail and commercial, due to the need for streamlined financial operations and improved liquidity management. Cash handling automation, cash forecasting, and cash security are among the key features that have contributed to the growing popularity of these systems.

Payment solutions have evolved significantly with the advent of digital banking and cashless transactions. Real-time payments and mobile banking have become the norm, and cash management systems have adapted to accommodate these trends. Cash position tracking, cash monitoring, and fraud detection are critical functions that ensure the security and accuracy of financial transactions. Cash management strategies have become increasingly sophisticated, with the integration of automated applications and cloud-based solutions. ATM networks and point-of-sale systems have also been enhanced to provide greater cash visibility and cash reconciliation capabilities. Cash recycling and cashless transactions have become more prevalent, particularly In the e-commerce sector.

Furthermore, cash management systems have expanded their scope to include payment solutions, liquidity management, and risk management. Financial institutions and businesses rely on these systems to optimize their cash flow, minimize transaction risk, and maintain financial efficiency. Cash withdrawal systems and cash deposit systems have also been developed to facilitate seamless cash transactions. Cash management software has become an essential tool for financial institutions and businesses seeking to gain greater control over their cash flow and financial operations. These solutions provide real-time insights into cash positions, enable automated cash forecasting, and offer advanced fraud detection capabilities. In , cash management systems have become indispensable in today's financial landscape.

They offer a range of features and functions designed to optimize cash flow, enhance financial efficiency, and mitigate risks. From payment processing and cash logistics to liquidity management and risk management, cash management systems have evolved to meet the evolving needs of businesses and financial institutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.3% |

|

Market growth 2025-2029 |

USD 36592.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, Canada, China, Mexico, Japan, India, UK, Germany, South Korea, France, |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cash Management System Market Research and Growth Report?

- CAGR of the Cash Management System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, Middle East and Africa,

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cash management system market growth of industry companies

We can help! Our analysts can customize this cash management system market research report to meet your requirements.