CCaas Market Size 2025-2029

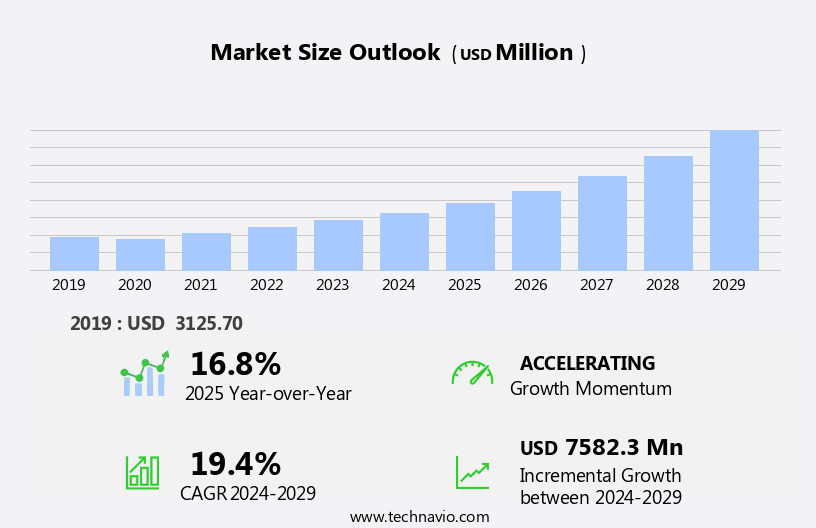

The ccaas market size is forecast to increase by USD 7.58 billion, at a CAGR of 19.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of cloud-based offerings and the growing demand for social interaction in customer engagement. Companies are recognizing the benefits of cloud solutions, such as scalability, flexibility, and cost savings, leading to a shift away from traditional on-premises systems. Furthermore, the need for seamless and personalized customer experiences across various channels, including social media, is fueling the demand for CCaaS solutions that enable effective communication and collaboration. However, the market is not without challenges. The increased use of cloud technologies also brings heightened risks related to data security and privacy.

- As businesses store and process sensitive customer information in the cloud, they become vulnerable to cyber threats and data breaches. Ensuring robust security measures and adhering to regulatory compliance are essential for CCaaS providers and their clients to maintain trust and protect their reputations. Companies must prioritize these concerns to effectively capitalize on market opportunities and navigate challenges in the evolving CCaaS landscape.

What will be the Size of the CCaas Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The Customer Relationship Management (CRM) market continues to evolve, with dynamic market dynamics shaping its growth and applications across various sectors. Subscription models, sales pipeline management, and hybrid solutions are increasingly popular, enabling businesses to optimize customer interactions and streamline operations. Data privacy and security are paramount, with customer feedback management and customer support being key areas of focus. Customer experience management, customer relationship management, and customer service automation are integrated to enhance the overall customer journey. Technical support and issue resolution are critical components, ensuring seamless problem resolution and maintaining customer satisfaction. Social media marketing and customer engagement strategies are also essential, requiring marketing automation and self-service portals to effectively manage lead generation and customer onboarding.

The market's ongoing evolution includes the integration of AI-powered chatbots, customer analytics, and net promoter score to improve customer engagement and personalize interactions. Sales forecasting and lead scoring help businesses anticipate customer needs and prioritize resources effectively. Training services and consulting are also valuable, ensuring successful implementation and integration with CRM, ERP, and other systems. Market activities remain robust, with ongoing compliance regulations and evolving customer expectations driving continuous innovation. Cloud-based and on-premise solutions cater to diverse business needs, while customer churn reduction, customer advocacy, and customer loyalty initiatives remain key priorities. The market's continuous dynamism underscores the importance of adaptability and ongoing investment in customer-centric technologies and strategies.

How is this CCaas Industry segmented?

The ccaas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Services

- End-user

- BFSI

- IT and telecom

- Consumer goods and retail

- Healthcare

- Others

- Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Functionality

- Automatic Call Distribution (ACD)

- Call Recording

- Customer Collaboration

- Interactive Voice Response (IVR)

- Workforce Optimization

- Reporting & Analytics

- Computer Telephony Integration (CTI)

- Dialer

- Deployment Type

- Cloud

- Hybrid

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

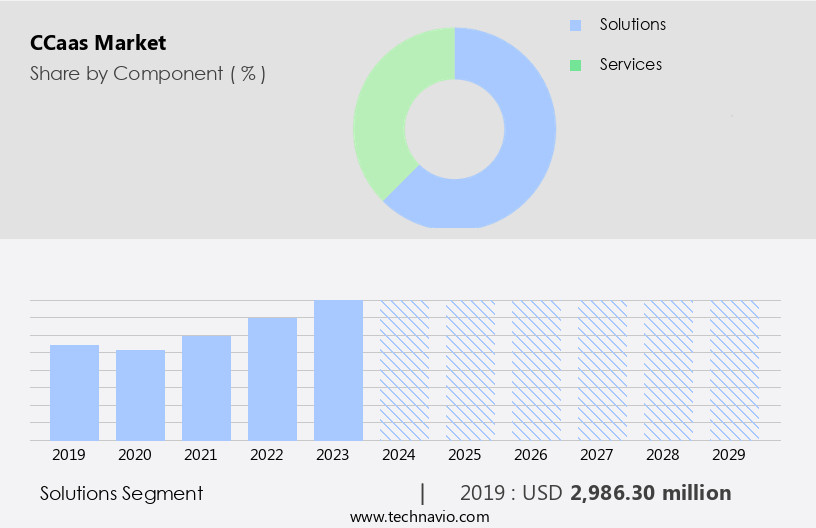

The solutions segment is estimated to witness significant growth during the forecast period.

The market witnessed substantial growth in 2024, with the solutions segment leading the way. Enterprises across industries, including finance and retail, adopted CCaaS to manage and analyze customer inquiries efficiently. These solutions offer automated responses, call distribution, and customer collaboration, enhancing the overall customer experience. When call volumes are high or agents are occupied, CCaaS solutions ensure calls are directed appropriately, reducing wait times. Moreover, the integration of AI-powered chatbots and customer journey mapping in CCaaS solutions has streamlined support services. These tools enable personalized interactions, issue resolution, and product support, leading to increased customer satisfaction. Sales automation and lead generation are other significant benefits, allowing businesses to optimize their sales pipeline and improve forecasting.

Pricing models, customer analytics, and compliance regulations are essential considerations in the market. Subscription models and hybrid solutions cater to various business needs, while data privacy and security remain top priorities. CRM integration, customer segmentation, and lead scoring are essential features for effective customer relationship management. The market also offers consulting services, training, and implementation to ensure a smooth transition to CCaaS platforms. Technical support, self-service portals, and knowledge base management are essential for ongoing customer support and retention. Social media marketing and customer experience management further expand the reach and engagement opportunities for businesses. In summary, the market's growth is driven by the need for efficient customer engagement and support.

Solutions that offer automation, analytics, and personalized interactions are increasingly preferred by businesses to improve customer satisfaction and loyalty.

The Solutions segment was valued at USD 2.99 billion in 2019 and showed a gradual increase during the forecast period.

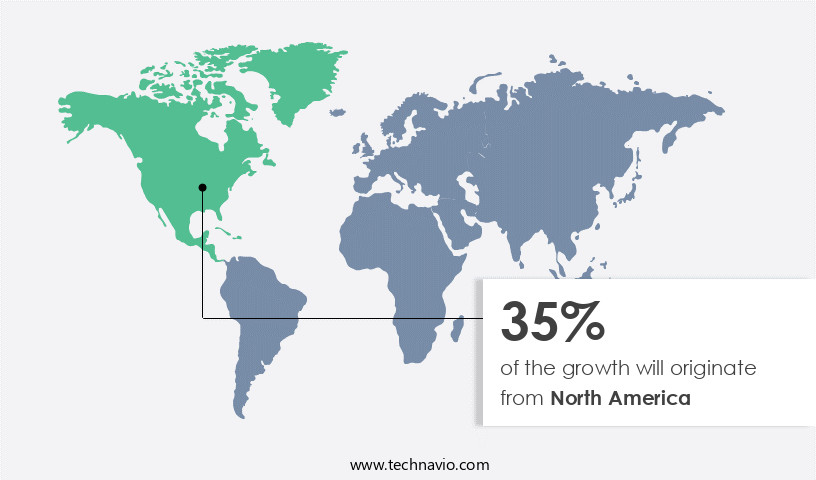

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing adoption of public cloud services by enterprises and the necessity to analyze customer data. Advanced technological infrastructure and the presence of numerous cloud service providers, including Microsoft, Salesforce, Oracle, and Adobe, are fueling market expansion in the region. Enterprises are shifting towards cloud services to implement enterprise applications and optimize business processes. CCaaS solutions allow organizations to reduce customer contact costs and pay only for potential leads, while also decreasing IT spending by investing in pertinent software and applications. Sales automation, content marketing, and lead generation are key functionalities driving the demand for CCaaS.

Pricing models have evolved to subscription-based structures, enabling businesses to pay for only the services they require. Customer analytics, customer success, training services, and net promoter score are essential components of CCaaS, contributing to improved customer engagement and retention. Hybrid solutions that integrate with CRM systems and ERP platforms are gaining popularity, offering seamless data flow between departments. Compliance regulations, data privacy, and sales pipeline management are critical considerations for businesses implementing CCaaS. AI-powered chatbots, issue resolution, product support, and self-service portals are essential features for enhancing customer experience and reducing support costs. Customer feedback management, customer support, customer service automation, and technical support are essential for maintaining a positive customer relationship.

Social media marketing and customer experience management are increasingly important for businesses to engage with their customers and build brand loyalty. Marketing automation, customer churn reduction, customer advocacy, customer escalation, data security, and cloud-based solutions are other essential aspects of CCaaS. On-premise solutions are still used by some businesses, but the trend is shifting towards cloud-based solutions due to their flexibility and cost-effectiveness. Customer training, customer retention, knowledge base management, and customer satisfaction are crucial elements for ensuring long-term success with CCaaS. Overall, the market in North America is evolving to meet the changing needs of businesses, with a focus on enhancing customer engagement, reducing costs, and improving operational efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of CCaas Industry?

- The significant growth in the market can be attributed to the increasing adoption of cloud-based offerings by businesses and organizations. These cloud-based solutions provide numerous benefits, including cost savings, scalability, and flexibility, making them an attractive option for companies looking to streamline their operations and enhance productivity.

- The market is experiencing significant growth due to enterprises increasing their IT spending on cloud computing strategies. This trend is driving the adoption of cloud-based call center solutions, including Interactive Voice Response (IVR), 360-degree customer support, and cloud-based call recording. The global potential for cloud applications is vast, given the benefits of cloud computing, such as scalability, reliability, and high resource availability. These advantages are compelling businesses to adopt cloud architecture for their business models. Moreover, the use of cloud computing eliminates the requirement for a dedicated IT support team and can lead to operational cost savings.

- Additionally, customer engagement strategies like SMS marketing, customer effort score, customer lifetime value, and net promoter score are increasingly being integrated into CCaaS platforms. Sales automation, content marketing, customer analytics, customer success, training services, and AI-powered chatbots are also essential features that enhance the value proposition of CCaaS solutions. Pricing models are also becoming more flexible and customizable to cater to various business needs. The integration of a customer data platform and service automation further strengthens the capabilities of CCaaS platforms. Overall, the market is poised for continued growth as businesses increasingly adopt cloud-based solutions to improve customer engagement and streamline operations.

What are the market trends shaping the CCaas Industry?

- The increasing preference for social connection represents a significant market trend. This demand for enhanced interaction is a key focus area for professionals and businesses alike.

- The Customer as a Service (CCaas) market is witnessing significant growth due to the integration of social media services with call centers. This integration enables businesses to gain valuable insights for lead generation and product development by predicting social customer behavior. The primary components of social interactions are social customer prediction and social customer conversation. Social customer prediction identifies potential buyers by analyzing social media communications, while social customer conversation engages likely buyers and moves them further in the demand requirement process. Advanced analytics platforms are being adopted to integrate social data into their forecast models, allowing companies to examine social contacts in real time.

- This approach combines keyword analysis and predictive algorithms to provide a more comprehensive understanding of customer needs and preferences. Furthermore, CCaas solutions offer various features such as email marketing, customer journey mapping, support services including live chat and consulting, self-service portals, issue resolution, and product support. Compliance regulations and customer segmentation are also crucial aspects of CCaas, ensuring businesses maintain a positive reputation and cater to diverse customer needs effectively.

What challenges does the CCaas Industry face during its growth?

- The escalating risks to data security and privacy pose a significant challenge to the industry's growth, requiring robust measures to mitigate potential threats and ensure compliance with regulatory frameworks.

- Cloud-based call center software, also known as Contact Center as a Service (CCaaS), offers US businesses subscription models for managing sales pipeline, customer feedback, and support operations. While the cloud provides flexibility and cost savings, data privacy and security are paramount concerns. The shift to CCaaS involves transferring control of customer interaction and data to service providers, increasing dependence and potential risks of information leakage. Misuse or manipulation of customer data could result in legal and reputational issues. Hybrid solutions that combine cloud and on-premises systems can offer a balance between flexibility and control.

- Sales forecasting, customer experience management, customer relationship management, technical support, social media marketing, and customer service automation are key features of CCaaS. Implementation services ensure smooth transition and optimization of these functionalities. Organizations must carefully evaluate the security measures and reliability of CCaaS providers to mitigate risks and ensure compliance with data privacy regulations.

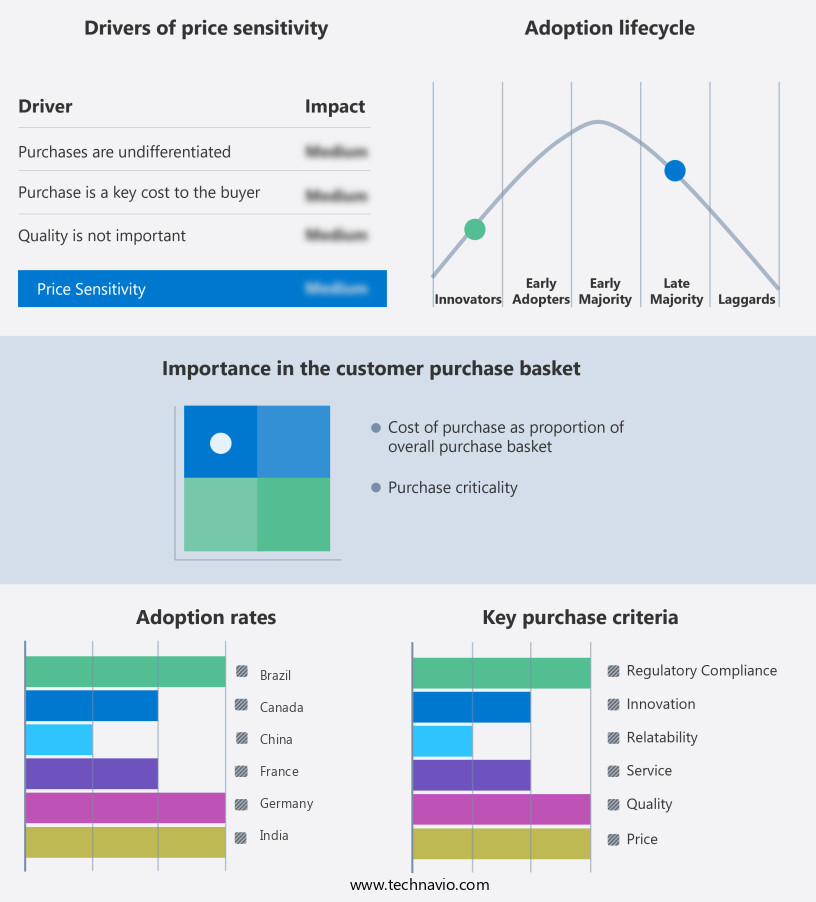

Exclusive Customer Landscape

The ccaas market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ccaas market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ccaas market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon Web Services Inc. - The company delivers a Cloud Contact Center as a Service (CCaaS) solution, 3CLogic Cloud Call Center, empowering businesses with advanced communication capabilities. This innovative technology integrates voice, chat, email, and social media channels to streamline customer interactions. By leveraging artificial intelligence and automation, it enhances agent productivity, improves customer satisfaction, and drives operational efficiency. The platform's robust reporting and analytics features offer valuable insights, enabling data-driven decision-making. 3CLogic Cloud Call Center is a versatile, scalable, and customizable solution, catering to diverse industries and business sizes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon Web Services Inc.

- Microsoft Corporation

- Cisco Systems Inc.

- Genesys

- NICE Ltd.

- Five9 Inc.

- Talkdesk Inc.

- Zendesk Inc.

- RingCentral Inc.

- 8x8 Inc.

- Vonage Holdings Corp.

- Avaya Inc.

- Mitel Networks Corporation

- Twilio Inc.

- Dialpad Inc.

- UJET Inc.

- Freshworks Inc.

- LivePerson Inc.

- Content Guru

- Odigo

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in CCaas Market

- In January 2024, Microsoft Teams announced the integration of its Communication Platform as a Service (CPaaS) capabilities with Salesforce CRM, enabling seamless customer interactions and improving sales productivity (Microsoft Press Release).

- In March 2024, Twilio acquired Segment, a customer data infrastructure company, for approximately USD3.2 billion, expanding its offerings beyond communication services and enhancing its data-driven marketing and customer engagement capabilities (Twilio Press Release).

- In May 2024, Zoom Video Communications reported a 35% increase in Q1 revenue, reaching USD1.05 billion, driven by the continued demand for remote work solutions and the expansion of its CCaas offerings (Zoom Q1 2024 Earnings Report).

- In April 2025, Google Cloud Platform launched a new CCaas solution, Google Meet Series One, which includes hardware devices for video conferencing and advanced AI capabilities, targeting enterprise customers (Google Cloud Blog).

Research Analyst Overview

- In the Customer Relationship Management (CRM) landscape, Contact Center as a Service (CCaaS) solutions have emerged as a game-changer for businesses seeking to enhance customer engagement and optimize customer journeys. The market for CCaaS is dynamic, with a focus on customer insights and journey analytics to drive customer success. Security is paramount, ensuring data privacy and protection. Automation plays a significant role, enabling proactive customer support and personalized experiences. Customer feedback analysis and relationship intelligence fuel continuous improvement and innovation.

- Integration with various systems and omnichannel customer experience strategies are essential for scalability and multichannel support. Customer-centric design and a customer-driven approach are key to delivering customer service excellence. Privacy and security remain top priorities as businesses strive for customer experience strategy success.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled CCaas Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.4% |

|

Market growth 2025-2029 |

USD 7582.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.8 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this CCaas Market Research and Growth Report?

- CAGR of the CCaas industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ccaas market growth of industry companies

We can help! Our analysts can customize this ccaas market research report to meet your requirements.