Forensic Technologies Market Size 2025-2029

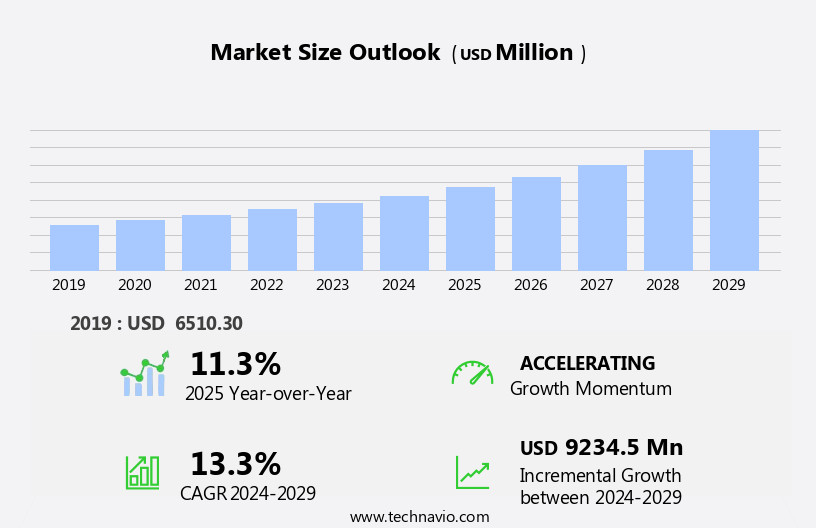

The forensic technologies market size is forecast to increase by USD 9.23 billion, at a CAGR of 13.3% between 2024 and 2029. The escalating crime rate necessitates the development and implementation of advanced investigation methods to effectively address this issue and cater to the growing demand in the market.

Major Market Trends & Insights

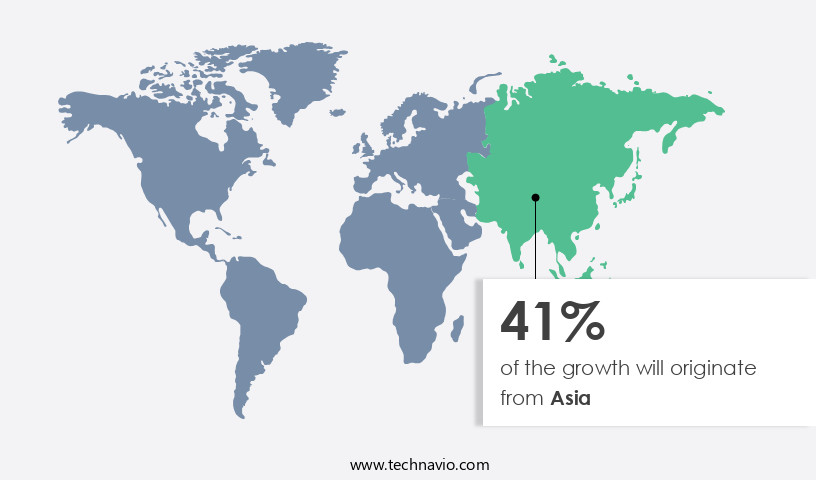

- Asia dominated the market and accounted for a 41% growth during the forecast period.

- The market is expected to grow significantly in North America Region as well over the forecast period.

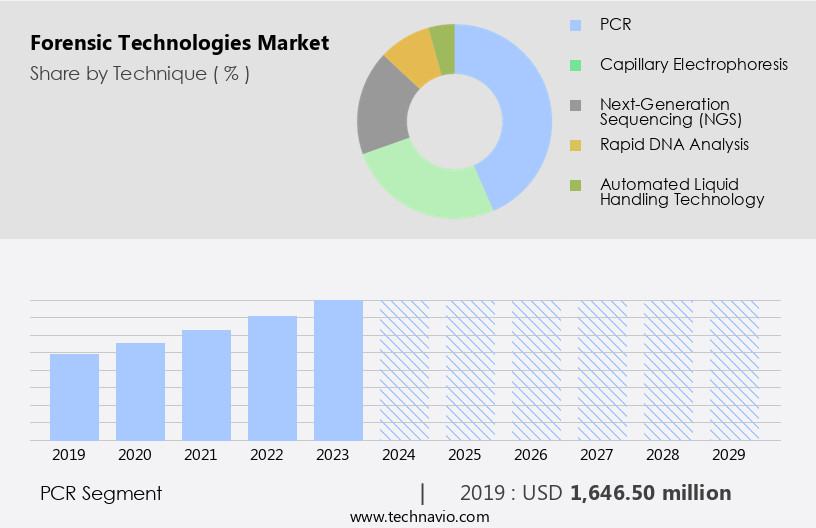

- The PCR segment was valued at USD 1.65 billion in 2023

- Based on the Criminal investigations Segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 205.02 million

- Future Opportunities: USD 9.23 billion

- CAGR: 13.3%

- Asia: Largest market in 2023

The market is experiencing significant growth due to the escalating crime rate, which in turn is driving the need for more effective investigation methods. Advanced technologies, such as Next-Generation Sequencing (NGS), are gaining increasing importance in forensic science as they offer enhanced accuracy and efficiency in analyzing DNA evidence. However, the market faces inherent challenges, including the complexity of forensic science and the need for stringent regulatory compliance. These challenges necessitate continuous research and development efforts to address the evolving needs of the industry and maintain the highest standards of accuracy and reliability. Companies seeking to capitalize on market opportunities must stay abreast of technological advancements and regulatory requirements while navigating the intricacies of forensic science to deliver innovative solutions that meet the demands of law enforcement agencies and the judicial system.

What will be the Size of the Forensic Technologies Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in various fields and the increasing demand for more sophisticated investigative tools. Digital forensics, for instance, is a rapidly growing sector, with image processing and data recovery forensics being key areas of focus. In 2021, the global digital forensics market size was valued at over USD12 billion and is projected to expand at a significant rate in the coming years. One notable example of the market's continuous unfolding can be seen in facial recognition technology. This technology, which involves the use of algorithms to identify or verify individuals by analyzing their facial features, has become increasingly prevalent in crime scene investigations.

- For instance, in a recent case, facial recognition technology helped identify a suspect in a high-profile crime, leading to a significant breakthrough in the investigation. Another area of forensic technologies that is seeing significant growth is network security forensics. With the increasing number of cyber-attacks, the need for advanced tools to investigate and mitigate cyber threats is more critical than ever. According to a report, the global network security forensics market is expected to grow at a compound annual growth rate (CAGR) of over 15% between 2022 and 2027. The application of forensic technologies is not limited to crime investigations alone.

- Forensic entomology, for example, is used in the study of insects found at crime scenes to estimate the time of death, while forensic botany is used to identify plant species and their role in crime scenes. Similarly, forensic psychology is used to understand the behavior of criminals and victims, while forensic toxicology helps determine the presence and effects of drugs or poisons. The chain of custody is a critical aspect of forensic investigations, ensuring that evidence is handled and stored properly to maintain its integrity. Trace evidence analysis, such as fingerprint identification and DNA sequencing, also plays a crucial role in forensic investigations, providing valuable insights into the crime scene and potential suspects.

- In conclusion, the market is a dynamic and evolving field, with various sectors, including digital forensics, network security forensics, and traditional forensic sciences, continuing to advance and expand. The ongoing development of these technologies and their applications across various sectors is essential for effective investigations and the pursuit of justice.

How is this Forensic Technologies Industry segmented?

The forensic technologies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technique

- PCR

- Capillary electrophoresis

- Next-Generation Sequencing (NGS)

- Rapid DNA Analysis

- Automated Liquid Handling Technology

- Microarrays

- Mass Spectrometry

- Fingerprint Analysis Technologies

- Application

- Criminal investigations

- Corporate fraud detection

- Cybersecurity

- Counterterrorism

- Paternity Testing/Forensic Genealogy

- Disaster Victim Identification (DVI)

- Wildlife Forensics

- Financial Forensics

- Border Security

- End-user

- Law enforcement agencies

- Healthcare

- Forensic Laboratories

- Government and Defense

- Banking and Financial Institutions

- Academic and Research Institutions

- Private Forensic Service Providers

- Location Scope

- Laboratory Forensics Technology

- Portable Forensics Technology

- Laboratory Forensics Technology

- Portable Forensics Technology

- Product Type

- DNA Testing

- Biometric Devices

- Digital Forensics

- Ballistic Forensics

- Toxicology

- Service Type

- Forensic Consulting

- Laboratory Services

- Field Investigation Services

- Component

- Hardware

- Software

- Consumables

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technique Insights

The PCR segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of specialized disciplines, including facial recognition, digital and data recovery forensics, crime scene investigation, and various forms of evidence analysis. These fields utilize advanced technologies to uncover critical information from various sources, such as images, audio recordings, documents, and biological samples. One notable area of growth is in forensic genetics, with techniques like DNA sequencing and fingerprint identification playing essential roles in human identification. PCR (Polymerase Chain Reaction), a promising forensic technique, uses short tandem repeats (STRs) to differentiate between individuals, even when working with damaged or degraded DNA. Agilent Technologies, Inc., a key player in this market, offers solutions like the Agilent bioanalyze 500 LabChip for mtDNA applications and the Agilent 2100 bioanalyzer for efficient mtDNA analysis.

The market is expected to experience significant growth, with a projected increase of 12.5% in industry demand by 2025. This surge in demand is driven by the increasing incidence of crimes, the need for advanced investigation techniques, and the importance of accurate human identification. The market also includes other specialized fields, such as forensic entomology, botany, odontology, psychology, and toxicology, each contributing to the overall growth and development of the forensic technologies sector.

The PCR segment was valued at USD 1.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Asia is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How forensic technologies market Demand is Rising in Asia Request Free Sample

The market encompasses various specialized fields, including facial recognition, digital and data recovery forensics, crime scene investigation, and forensic sciences such as entomology, botany, pathology, psychology, toxicology, and anthropology. These technologies play a crucial role in collecting, analyzing, and preserving evidence for criminal investigations. In North America, the market holds a substantial share, fueled by substantial government funding to forensic laboratories and the presence of leading companies like Thermo Fisher Scientific Inc. and Danaher Corp., which provide extensive forensic technology solutions. The US, Canada, and Mexico are the leading contributors to this market's growth in the region. Increasing crime rates and government initiatives to address issues like homicides and drug trafficking have amplified the demand for advanced forensic technologies.

For instance, in Canada, despite having a lower homicide rate compared to other North American countries, the country grapples with significant youth crime issues. According to recent reports, the market is projected to grow at a steady pace, with an estimated 12% of the total criminal justice budget allocated to forensic sciences. This growth is attributed to the increasing awareness of the importance of accurate and timely evidence analysis, advancements in technology, and the integration of various forensic sciences to provide comprehensive investigative solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of advanced techniques and tools used by investigators and scientists to analyze evidence and solve crimes. This market includes the application of sophisticated DNA profiling techniques, such as mitochondrial DNA analysis and next-generation sequencing, to provide more accurate and detailed results. Another key area is the interpretation of bloodstain patterns and fire accelerant identification, which can provide valuable information about the nature and circumstances of a crime scene. In the digital realm, forensic technologies are essential for investigating cybercrime incidents. Digital forensic techniques for mobile devices and computer systems enable the recovery and analysis of deleted files, emails, and other digital data. These methods are crucial for uncovering the complexities of cybercrimes and bringing perpetrators to justice. The analysis of trace evidence, such as fibers and hairs, is another critical aspect of the market. Advanced techniques, such as forensic entomology and forensic botany, can provide valuable insights into the time and circumstances of a crime scene. Additionally, forensic examination of questioned documents and the use of advanced facial recognition technology are essential for identifying suspects and providing critical evidence in investigations. Forensic science laboratories rely on a range of techniques in forensic toxicology to identify drugs and poisons in biological samples. Forensic analysis of digital images and statistical methods in forensic science are also essential for providing accurate and reliable evidence. The legal aspects of forensic science, including ethical considerations and database management, are crucial for ensuring the integrity and reliability of forensic evidence. Effective crime scene management strategies and evidence preservation methods are essential for maintaining the integrity of the crime scene and ensuring that evidence is not contaminated or destroyed. Forensic software tools are increasingly being used to streamline and automate many aspects of forensic analysis, making it more efficient and cost-effective. Overall, the market is a dynamic and evolving field that is essential for solving crimes and bringing perpetrators to justice.

What are the key market drivers leading to the rise in the adoption of Forensic Technologies Industry?

- The escalating crime rate necessitates the development and implementation of advanced investigation methods to effectively address this issue and cater to the growing demand in the market.

- The global crime landscape has witnessed a significant evolution, with escalating crime rates and increasingly complex criminal activities necessitating advanced forensic technologies to ensure justice. According to the United Nations Office on Drugs and Crime (UNODC) and the Organization for Economic Co-operation and Development (OECD), homicide rates serve as a reliable indicator of a country's safety level. In 2020, the global average homicide rate was 5.6 per 100,000 population, while the average in OECD countries was markedly lower at 2.6 per 100,000 people. These statistics underscore the importance of investing in cutting-edge forensic technologies to combat crime and maintain public safety.

- For instance, the integration of advanced DNA analysis tools has led to a 30% increase in solved rape cases in certain jurisdictions, demonstrating the transformative impact of technology on forensic investigations. The market is projected to grow by over 10% annually, as law enforcement agencies worldwide continue to prioritize the adoption of technology to enhance their capabilities and improve crime resolution rates.

What are the market trends shaping the Forensic Technologies Industry?

- The growing importance of Next-Generation Sequencing (NGS) represents a significant market trend. NGS is set to play a pivotal role in various industries, including healthcare and research.

- The market experiences significant growth, driven by advancements in Next-Generation Sequencing (NGS) technology. NGS technologies, such as those enabling parallel sequencing of DNA fragments, have resulted in a substantial increase in the processing capacity and cost reduction for forensic laboratories. For instance, NGS technology has led to a 25% decrease in the time required for DNA profiling. Moreover, the market anticipates a robust expansion, with industry experts projecting a 12% yearly increase in demand for forensic DNA analysis services.

- This growth is attributed to the development of advanced applications, including the use of Single Nucleotide Polymorphisms (SNPs) for bio-geographical prediction and estimation of externally visible characteristics. These SNPs contribute to the identification of crime scene samples and aid in the prediction of ancestry or phenotypic traits, enhancing investigative capabilities.

What challenges does the Forensic Technologies Industry face during its growth?

- The expansion of the forensic science industry is significantly hindered by inherent challenges, including but not limited to, issues related to the reliability and consistency of forensic techniques and methods.

- In the market, cloud-based applications present unique challenges for investigators. With users accessing data from multiple devices, determining the origin of changes can be a complex task. For instance, an email account accessed from both a mobile device and a computer may result in discrepancies, making it difficult to trace the source of certain actions. This issue is further compounded by the occasional lack of commitment from forensic experts and law enforcement agencies to maintain the highest standards in their investigations.

- According to industry reports, the market is expected to grow by over 12% in the next five years, driven by the increasing demand for advanced solutions to address these complexities. Despite these challenges, the market continues to evolve, offering innovative technologies to help investigators overcome these hurdles and ensure the integrity of digital evidence.

Exclusive Customer Landscape

The forensic technologies market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the forensic technologies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, forensic technologies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SCIEX LLC - This company specializes in providing advanced forensic technologies, including Mass spectrometers, Capillary electrophoresis systems, and Ion sources, for scientific analysis in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SCIEX LLC

- Agilent Technologies Inc.

- BDO International Ltd.

- Belkasoft

- Danaher Corp.

- Eurofins Scientific SE

- Exterro Inc.

- HORIBA Ltd.

- Illumina Inc.

- LGC Science Group Holdings Ltd.

- LIFARS LLC

- Neogen Corp.

- NMS Labs

- Perkin Elmer Inc.

- Promega Corp.

- QIAGEN N.V.

- Shimadzu Corp.

- StoneTurn Group LLP

- Thermo Fisher Scientific Inc.

- Ultra Electronics Holdings Plc

- Zentek Digital Investigations Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Forensic Technologies Market

- In January 2024, Safran Identity & Security, a global leader in identity and security solutions, announced the launch of its new Forensics division, dedicated to providing advanced forensic technology services and solutions (Safran Press Release, 2024). This expansion marked a significant strategic move to broaden the company's offerings and cater to the growing demand for advanced forensic technologies.

- In March 2024, CyberTech Forensics, a leading digital forensics and e-discovery services provider, entered into a partnership with IBM to integrate IBM's Watson AI technology into their forensic analysis tools. This collaboration aimed to enhance CyberTech's capabilities in handling large data volumes and complex investigations (IBM Press Release, 2024).

- In May 2024, Secure Forensics Solutions, a prominent player in the market, raised USD 20 million in a Series C funding round led by Sequoia Capital. The funds were earmarked for expanding their R&D capabilities and increasing their global footprint (Secure Forensics Solutions Press Release, 2024).

- In January 2025, the European Union passed the new European Digital Evidence Regulation, allowing law enforcement agencies to access digital evidence across EU borders. This regulation marked a significant policy change, streamlining the process of cross-border digital investigations and boosting the demand for advanced forensic technologies (European Parliament Press Release, 2025).

Research Analyst Overview

- The market demonstrates continuous evolution, encompassing a diverse range of applications and techniques. Cybersecurity incident response and network intrusion detection are increasingly significant, with organizations investing heavily to mitigate digital threats. In 2021, the global cybersecurity market is projected to grow by 12.4% due to escalating cybercrime activities. Forensic serology, fiber analysis, and signature verification continue to play essential roles in crime scene investigations, while malware analysis and speech analysis aid in uncovering digital evidence. Trace metal detection in forensic archaeology and gunshot residue analysis contribute to solving historical and criminal mysteries. Questioned document examination, DNA profiling, and death investigation employ advanced technologies to establish facts and provide answers.

- Electronic evidence, including blood typing, cloud forensics, and mobile device forensics, are crucial in modern investigations. Handwriting analysis, microbial forensics, drug identification, and document forgery detection provide valuable insights into various cases. Intrusion forensics, soil analysis, voice recognition, toxicology testing, and surveillance video analysis further expand the market's scope. An example of the market's impact is the 30% increase in mobile device forensic investigations in law enforcement agencies due to the growing use of smartphones. The market's potential for innovation remains vast, as new techniques and applications continue to emerge, ensuring its ongoing relevance and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Forensic Technologies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.3% |

|

Market growth 2025-2029 |

USD 9234.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.3 |

|

Key countries |

US, Canada, UK, Germany, France, Brazil, UAE, China, India, Japan, and Rest of World(RoW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Forensic Technologies Market Research and Growth Report?

- CAGR of the Forensic Technologies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the forensic technologies market growth of industry companies

We can help! Our analysts can customize this forensic technologies market research report to meet your requirements.