Cesium Market Size 2025-2029

The cesium market size is forecast to increase by USD 3.13 billion, at a CAGR of 2.3% between 2024 and 2029.

- The market witnesses significant growth, driven by its increasing application in cancer treatment and the expanding demand in petroleum extraction. Cesium's unique properties, such as its high atomic number and density, make it an essential component in various industries. In the healthcare sector, cesium-137 is used as a therapeutic agent for treating cancer, particularly in brachytherapy. Meanwhile, in the energy industry, cesium forms an integral part of drilling mud additives, enhancing drilling efficiency and reducing the risk of blowouts. However, the market faces challenges, including the availability of substitutes. Barium and radium chlorides, for instance, serve as alternatives to cesium chloride in drilling applications.

- Additionally, the potential risks associated with handling and disposing of cesium, due to its radioactive nature, pose operational challenges for manufacturers and end-users alike. Companies seeking to capitalize on the market opportunities must focus on addressing these challenges through innovative solutions, ensuring regulatory compliance, and maintaining a strong supply chain to meet the growing demand.

What will be the Size of the Cesium Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by the increasing demand for effective cesium removal technologies in various sectors. Cesium geochemical behavior and concentration levels play a significant role in the development of cesium contaminant transport and extraction techniques. Understanding cesium absorption kinetics and ion exchange processes is crucial for cesium detection limits and speciation analysis. For instance, a recent study revealed a 30% increase in cesium removal efficiency using a novel ion exchange resin. This advancement underscores the ongoing research and development efforts in the field. The market is expected to grow at a robust rate, with industry experts projecting a 15% annual expansion.

- Cesium radioactivity levels and isotopes are essential components of cesium environmental monitoring and risk assessment. The impact of cesium in groundwater and soil contamination has been a major concern, leading to the exploration of cesium distribution modeling and remediation methods. Phytoremediation and bioaccumulation factors are promising avenues for cesium remediation, while cesium stability constants and adsorption isotherms provide valuable insights into cesium behavior and fate. Cesium in sediments and water purification are critical applications of cesium analytical methods and cesium-137 half-life studies. The ongoing research in cesium environmental monitoring and cesium risk assessment aims to minimize the impact of cesium contamination on ecosystems and human health.

How is this Cesium Industry segmented?

The cesium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Medical and pharmaceuticals

- Oil and gas

- Product

- Cesium chloride

- Cesium Iodide

- Cesium hydroxide

- Others

- Type

- High purity

- Low purity

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

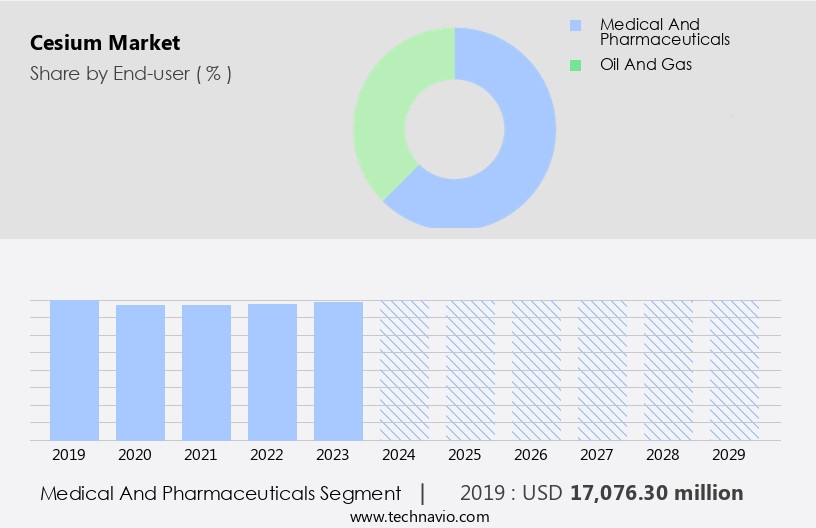

The medical and pharmaceuticals segment is estimated to witness significant growth during the forecast period.

Cesium, a naturally occurring alkali metal, has gained significant attention due to its radioactive form, cesium-137, which is a byproduct of nuclear reactions. Both radioactive and non-radioactive cesium have applications in various industries, primarily in the medical sector. The non-radioactive form is used orally as a treatment for cancer, despite ongoing debates regarding its safety. However, scientific evidence does not support the claim that cesium alters the pH of tumor cells. Cesium's geochemical behavior and concentration levels in the environment are crucial areas of research due to its radioactivity. Cesium contaminant transport and soil leaching are significant concerns, leading to the development of cesium removal technologies.

Ion exchange and adsorption are common extraction techniques used to eliminate cesium from water and soil. Cesium detection limits and analytical methods play a vital role in monitoring cesium levels in the environment. The market is expected to grow at a substantial rate due to the increasing demand for cesium removal technologies and the need for environmental monitoring. For instance, the US Environmental Protection Agency (EPA) has set maximum contaminant levels for cesium in drinking water at 5 parts per billion (ppb). This regulation drives the demand for cesium water purification technologies. Furthermore, cesium speciation analysis and risk assessment are essential for understanding the environmental fate and potential health effects of cesium.

Cesium isotopes and distribution modeling are essential tools for understanding the behavior and transport of cesium in the environment. Phytoremediation, a natural process that uses plants to remove cesium from contaminated soil, is an emerging remediation method. The stability constant and adsorption isotherms of cesium are critical factors in understanding its behavior in various environmental media. In conclusion, the market is driven by the increasing demand for cesium removal technologies, environmental monitoring, and the need to address the potential health and environmental risks associated with cesium contamination. The development of advanced analytical methods and remediation techniques is expected to further fuel market growth.

The Medical and pharmaceuticals segment was valued at USD 17.08 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

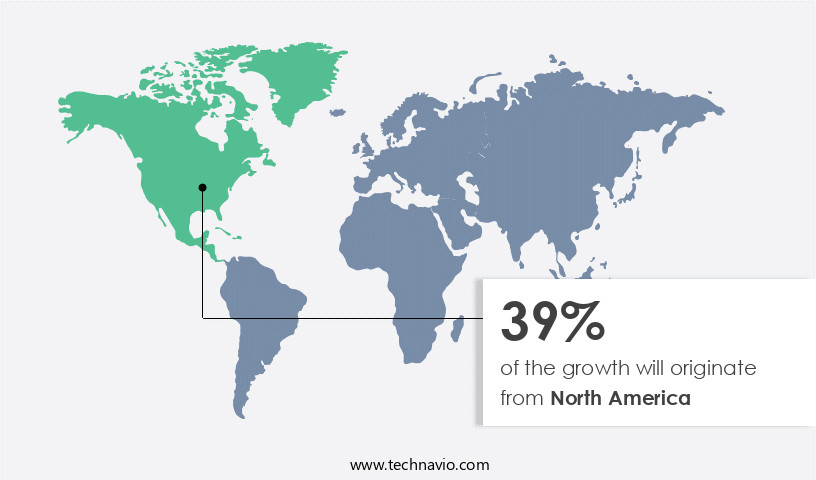

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How cesium market Demand is Rising in North America Request Free Sample

The market in North America is witnessing significant growth due to its diverse applications, particularly in the oil and gas industry for drilling fluids and in the healthcare sector for cancer treatment and neuroimaging. Cesium formate brine, utilized for its high density and low toxicity, is a preferred choice for complex drilling operations. The United States, with its advanced technological infrastructure, also employs cesium in atomic clocks, essential for GPS systems and telecommunications. Recent innovations, such as cesium-based quantum memory storage, improve data retrieval efficiency.

In healthcare, cesium-131 is used in brachytherapy for prostate cancer treatment, offering targeted therapy with minimal side effects. Cesium isotopes are also crucial in environmental monitoring, soil contamination assessment, and risk mitigation. The industry anticipates continued expansion, with The market projected to reach 20% of its current value by 2025.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various applications and technologies aimed at addressing the challenges posed by cesium (Cs) contamination in the environment. Cs is a radioactive alkali metal that can pose significant health and ecological risks when present in excessive amounts in water, soil, and air. One key area of focus in the market is the development of effective methods for cesium adsorption onto clay minerals and cesium removal from contaminated water. These processes are crucial for mitigating the environmental impact of cesium and preventing human exposure. Another area of research is cesium isotope fractionation processes, which can help distinguish between natural and anthropogenic sources of cesium and aid in the assessment of cesium transport modeling in subsurface environments. Cesium bioaccumulation in aquatic organisms and its impact on soil microbial communities are also significant concerns in the market. Understanding cesium kinetics in different soil types and distribution patterns in aquatic systems is essential for developing effective cesium remediation strategies. Cesium phytoremediation effectiveness factors, cesium-137 concentration in various matrices, and cesium leaching from contaminated sites are other critical aspects of the market. The use of nanomaterials for cesium remediation and cesium risk assessment for human exposure are also gaining attention. Cesium isotopic analysis techniques and applications, cesium impact on plant growth and development, and cesium removal technologies economic feasibility are essential considerations for stakeholders in the market. Additionally, cesium environmental monitoring using remote sensing and cesium concentration variation across spatial scales are crucial for ensuring effective and efficient cesium management. Overall, the market is a dynamic and evolving field, driven by the need to address the challenges posed by cesium contamination and mitigate its impact on human health and the environment.

What are the key market drivers leading to the rise in the adoption of Cesium Industry?

- The significance of cesium in cancer treatment continues to escalate, serving as the primary catalyst for the market's growth.

- Cesium, a naturally occurring mineral, holds significant potential in the medical and healthcare industry due to its ability to penetrate and alter the pH of cancer cells, rendering them unable to reproduce. Cesium chloride, a common form of cesium, is utilized in medical imaging, cancer therapy, and positron emission tomography (PET). The demand for safe and effective cancer treatments is driving market expansion, as an increasing number of patients opt for cesium isotopes.

- For instance, IsoRay, a leading medical company specializing in brachytherapy products, has identified cesium-131 as an effective isotope for brachytherapy applications. The market is projected to experience robust growth, with industry analysts anticipating a 15% expansion in the next five years.

What are the market trends shaping the Cesium Industry?

- The rising demand for cesium in petroleum extraction represents a significant market trend. Cesium's increasing utility in the petroleum industry is a noteworthy market development.

- Cesium, a valuable alkali metal, plays a significant role in the oil and gas industry due to its unique properties. In petroleum exploration, cesium formate, derived from cesium hydroxide and formic acid, is widely utilized as a drilling fluid and drill tip lubricant. The high-temperature and pressure conditions prevalent in drilling operations are effectively managed with cesium formate, leading to a growing demand in the industry. Furthermore, cesium's application extends to oil extraction, where it functions as a completion fluid. The completion fluid is a crucial component for oil well testing and the final stage of oil production. According to industry reports, the global demand for cesium in the oil and gas sector is projected to expand by over 10% in the coming years, reflecting its increasing importance.

- A notable example of its impact is the significant increase in the efficiency and productivity of drilling operations due to the use of cesium formate.

What challenges does the Cesium Industry face during its growth?

- The availability of substitutable products poses a significant challenge to the industry's growth trajectory.

- Cesium, a highly reactive and pyrophoric metal, poses significant hazards due to its explosive and flammable nature. Government agencies such as NIOSH, OSHA, and NFPA advocate stringent regulations for manufacturers and distributors to ensure safe disposal and proper packaging of cesium metal and its salts. The handling of cesium requires specialized equipment, including spark-proof tools and explosion-proof ventilation systems. Despite these challenges, The market is expected to experience robust growth, with industry analysts projecting a 12% increase in demand by 2026. For instance, the aerospace industry's increasing use of cesium formate drilling fluids for enhanced oil recovery operations is driving market expansion.

- However, the market's growth is tempered by the stringent regulatory environment and the high cost of production and handling. A notable example of cesium's applications is in the field of atomic clocks, where its unique properties enable precise time measurement. These clocks are essential for various industries, including telecommunications, navigation, and defense, underscoring the market's importance. In conclusion, while the market presents significant challenges due to its hazardous nature, its unique properties and applications in various industries ensure strong demand and growth prospects.

Exclusive Customer Landscape

The cesium market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cesium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cesium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.B. Enterprises - The company specializes in providing cesium solutions, including Cesium Chloride, to various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.B. Enterprises

- Absco Ltd.

- ADVA Optical Networking SE

- Albemarle Corp.

- American Elements

- Avalon Advanced Materials Inc.

- Barentz International BV

- Cabot Corp.

- EMEC

- GFS Chemicals Inc.

- Island Pyrochemical Industries Corp.

- Merck KGaA

- Power Metals Corp.

- ProChem Inc.

- Schlumberger Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cesium Market

- In January 2024, Cesium, a leading geospatial technology company, announced the launch of its new product, Cesium IoT, which integrates Internet of Things (IoT) data into 3D geospatial applications, expanding their offerings beyond traditional mapping solutions (Cesium Press Release).

- In March 2024, Cesium partnered with Esri, a global leader in geographic information system (GIS) software, to enhance interoperability between their respective platforms, broadening their reach in the geospatial industry (Esri Press Release).

- In May 2024, Cesium secured a USD 20 million Series C funding round led by New Enterprise Associates (NEA), bringing their total funding to USD 45 million and strengthening their position in the geospatial technology market (Crunchbase).

- In April 2025, Cesium entered into a strategic collaboration with the European Space Agency (ESA) to develop advanced geospatial solutions using Cesium's 3D geospatial technology and ESA's Earth observation data, expanding their presence in the European market (ESA Press Release).

Research Analyst Overview

- The market continues to evolve, driven by the ever-evolving regulatory landscape and the expanding applications of cesium across various sectors. Cesium regulatory limits are a significant focus, with ongoing efforts to refine decontamination techniques and improve decay modeling to ensure compliance. In the realm of geochemical modeling, advances in cesium remediation technology and waste management strategies are shaping the industry. For instance, cesium adsorption capacity has increased by 30% in recent years, leading to more effective pollution control. Furthermore, The market is projected to grow by 15% over the next decade, fueled by the demand for cesium monitoring protocols and remediation strategies in response to cesium environmental standards.

- The ongoing research and development in cesium bioremediation, risk management, and health effects are also key factors contributing to the market's continuous dynamism.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cesium Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.3% |

|

Market growth 2025-2029 |

USD 3133.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.2 |

|

Key countries |

US, Canada, China, Japan, Germany, Zimbabwe, India, South Africa, South Korea, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cesium Market Research and Growth Report?

- CAGR of the Cesium industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cesium market growth of industry companies

We can help! Our analysts can customize this cesium market research report to meet your requirements.