Child Care Market Size 2025-2029

The child care market size is forecast to increase by USD 365.1 billion, at a CAGR of 17.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing parental awareness towards the importance of early childhood education and care. This trend is further fueled by corporations providing child care services as employee benefits, recognizing the value of work-life balance and the positive impact on employee productivity. However, the market faces challenges as well. Health concerns for children in child care centers have become a major focus, with a growing emphasis on ensuring the highest standards of hygiene and safety to mitigate potential health risks.

- Companies entering this market must navigate these challenges effectively, prioritizing the well-being of children while maintaining a strong business model. By addressing these trends and obstacles, market participants can capitalize on the growing demand for quality child care services and position themselves as leaders in the industry.

What will be the Size of the Child Care Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping the industry across various sectors. Curriculum development in early childhood education is a key focus, aligning with evolving early learning standards. Childcare facilities ensure legal compliance and provide staff training to meet these requirements. Waldorf and Montessori schools offer unique approaches to education, while retention strategies are essential for maintaining a stable workforce. Affordable childcare and financial aid are critical for families, with financial assistance programs and subsidies playing a crucial role. Educational toys and continuing education for staff enhance the learning experience. Parent involvement and communication are also vital, with assessment tools and childcare software facilitating effective engagement.

Childcare marketing and technology integration help attract and retain families, with learning materials and academic enrichment programs ensuring a well-rounded educational experience. Childcare facilities prioritize safety and emergency preparedness, offering indoor and outdoor play areas, in-home care, and transportation services. Behavioral intervention and teacher-student ratio are essential for effective classroom management, with liability insurance and emergency preparedness plans ensuring peace of mind for families. Nutrition programs and special needs care cater to diverse needs, while summer camps and learning centers provide opportunities for seasonal enrichment. Inclusion programs and daycare centers prioritize accessibility and equity, with licensing and regulations ensuring the highest standards.The ongoing unfolding of market activities and evolving patterns in the child care industry reflect the continuous commitment to providing quality care and education for young children.

How is this Child Care Industry segmented?

The child care industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Delivery

- Organized care facilities

- Home-based settings

- Type

- Early education and daycare

- Early care

- Backup care

- Provider Type

- Corporate

- Non-Profit

- Private

- Age Group

- Infants

- Toddlers

- Preschoolers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

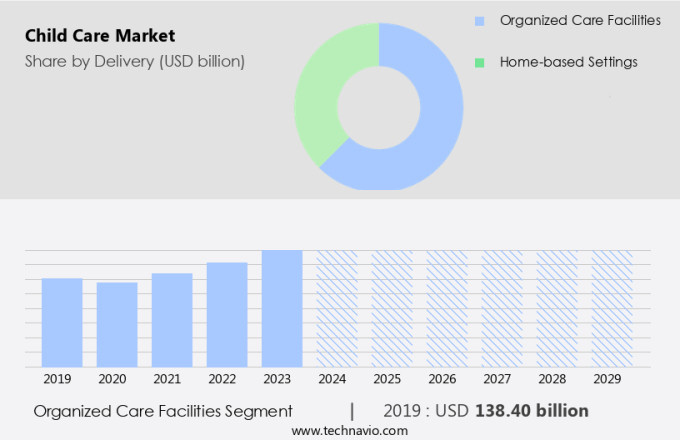

By Delivery Insights

The organized care facilities segment is estimated to witness significant growth during the forecast period.

The market is characterized by the dominance of organized child care facilities, driven by the increasing number of working parents and the resulting demand for quality early childhood education. In these facilities, a strong emphasis is placed on adhering to early learning standards and delivering curriculum development that fosters literacy, language, and overall personality development. Parent communication and assessment tools are essential for maintaining transparency and ensuring effective education. Childcare insurance, staff recruitment, and retention strategies are crucial for maintaining a well-trained and dedicated workforce. Legal compliance, staff training, and safety standards are top priorities to ensure a nurturing and secure environment.

Waldorf and Montessori schools offer alternative approaches to early education, emphasizing play-based learning and hands-on experiences. Affordable childcare and financial aid programs cater to families in need, while technology integration and academic enrichment provide opportunities for continuous learning. Nutrition programs, special needs care, and liability insurance address the diverse needs of children, while emergency preparedness and background checks ensure peace of mind for parents. In-home care, after-school programs, and summer camps offer flexible solutions for families. Childcare legislation and inclusion programs promote accessibility and equity in early childhood education. Daycare centers, learning centers, and transportation services cater to the diverse needs of families, offering convenience and comprehensive solutions.

Professional development opportunities and continuing education for staff ensure the ongoing improvement of the child care industry.

The Organized care facilities segment was valued at USD 138.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is experiencing significant growth due to several factors. The increasing number of women joining the labor force and the rising disposable income of households are key drivers. According to the Bureau of Labor Statistics, the labor force participation rate for women reached an all-time high of 77.0% in February 2023, surpassing the 2019 level of 76.0%. This trend is expected to continue, fueling the demand for quality child care solutions. Child care facilities are responding to this demand by offering innovative solutions. Curriculum development and early learning standards are being prioritized to provide children with a strong foundation.

Childcare insurance, staff recruitment, parent communication, assessment tools, and childcare advocacy are essential components of modern child care facilities. Family support services, enrollment management, and staff retention strategies are also critical to ensure a smooth operation. Legal compliance, staff training, and technology integration are essential for maintaining a safe and effective learning environment. Waldorf and Montessori schools are gaining popularity due to their focus on child development and play-based learning. Affordable childcare, financial aid, and educational toys are essential for making quality child care accessible to all families. Childcare marketing, childcare subsidies, and continuing education for staff are crucial for attracting and retaining families.

Behavioral intervention, teacher-student ratio, classroom management, academic enrichment, nutrition programs, special needs care, liability insurance, emergency preparedness, indoor and outdoor play, after-school programs, safety standards, professional development, summer camps, learning centers, transportation services, and inclusion programs are all integral parts of the evolving child care landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global child care market size and forecast projects growth, driven by child care market trends 2025-2029. B2B child care service solutions leverage smart child care technologies for safety. Child care service market growth opportunities 2025 include child care for working parents and preschool programs for early learning, meeting demand. Child care management software optimizes operations, while child care market competitive analysis highlights key providers. Sustainable child care practices align with eco-friendly child care trends. Child care regulations 2025-2029 shapes child care demand in North America 2025. Tech-enhanced child care solutions and premium child care insights boost appeal. Child care for special needs and customized child care programs target niches. Child care market challenges and solutions address staffing, with direct procurement strategies for child care and child care pricing optimization enhancing profitability. Data-driven child care analytics and AI-enhanced child care trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Child Care Industry?

- Enhancing parental awareness and understanding of the importance of early childhood education and care serves as the primary catalyst for market growth.

- Early childhood education plays a pivotal role in shaping a child's development from birth to age five. Parents understand the significance of this stage in their child's life and are investing more in early education and care. Research underscores the importance of cognitive, social, and emotional development during these formative years. As a result, there is a growing demand for high-quality childcare facilities that prioritize curriculum development aligned with early learning standards. Childcare providers face challenges such as childcare insurance, staff recruitment, parent communication, assessment tools, childcare advocacy, family support services, enrollment management, staff retention, and child development.

- To address these challenges, innovative solutions are being adopted, including advanced technology for communication and assessment, professional development programs for staff, and partnerships with community organizations for family support services. Parents are looking for childcare facilities that prioritize their child's development and offer transparency and communication. Providers that can demonstrate a commitment to these areas are likely to thrive in this competitive market. Additionally, partnerships with educational institutions and advocacy groups can help childcare providers stay informed of the latest research and best practices in early childhood education.

What are the market trends shaping the Child Care Industry?

- Corporate child care services have emerged as a significant trend in the business world, with an increasing number of corporations providing this benefit to their employees. This initiative not only enhances the company's reputation as an employer of choice but also contributes to employee productivity and work-life balance.

- In today's business landscape, providing child care benefits has become an essential component of employee assistance programs. Employers recognize the significance of supporting working parents and promoting work-life balance to maintain productivity, minimize absenteeism, and retain top talent. By offering on-site or subsidized child care facilities, companies alleviate the financial burden on families and provide convenient access to child care during working hours. Legal compliance and staff training are crucial aspects of child care services. Employers must adhere to regulations and ensure their facilities meet the necessary safety and educational standards. Continuous staff training is essential to keep up with the latest child development research and best practices.

- The demand for high-quality child care services extends beyond on-site facilities. Many parents prefer educational programs inspired by philosophies like Montessori and Waldorf, which emphasize immersive, harmonious learning environments. Providing access to these programs or partnering with local providers can be attractive benefits for potential employees. Affordability is another critical factor for working parents. Financial aid and flexible payment plans can help make child care more accessible. Utilizing childcare software and learning materials can streamline operations and enhance the overall experience for both parents and staff. Parent involvement is essential for a child's development. Encouraging open communication and offering opportunities for parents to engage with their children's education can foster a strong sense of community and support.

- Investing in child care services not only benefits employees but also strengthens a company's competitive position. By offering comprehensive child care benefits, businesses can attract and retain top talent and create a more productive, engaged workforce.

What challenges does the Child Care Industry face during its growth?

- The escalating health concerns related to children in child care centers poses a significant challenge to the industry's growth trajectory.

- The market faces challenges due to parents' growing concerns over health and safety in shared environments. Contagious diseases, allergies, and hygiene standards are major concerns that can negatively impact parents' trust and enrollment decisions. This loss of trust can lead to decreased enrollment rates, thereby hindering market growth. Moreover, outbreaks of contagious diseases within child care centers can result in temporary closures, disrupting operations and further eroding parents' confidence. To mitigate these concerns, child care centers are integrating technology to enhance safety and hygiene practices. Technology integration includes contactless check-in systems, temperature screening, and sanitization robots.

- Behavioral intervention techniques, teacher-student ratio improvement, and classroom management strategies are also being emphasized to provide a harmonious learning environment. Academic enrichment, nutrition programs, special needs care, and liability insurance are essential offerings to meet the diverse needs of families. Emergency preparedness plans, indoor play areas, and in-home care options are other features that can help build trust and differentiate child care providers. Background checks and rigorous hiring processes are also crucial to ensure the safety and well-being of children.

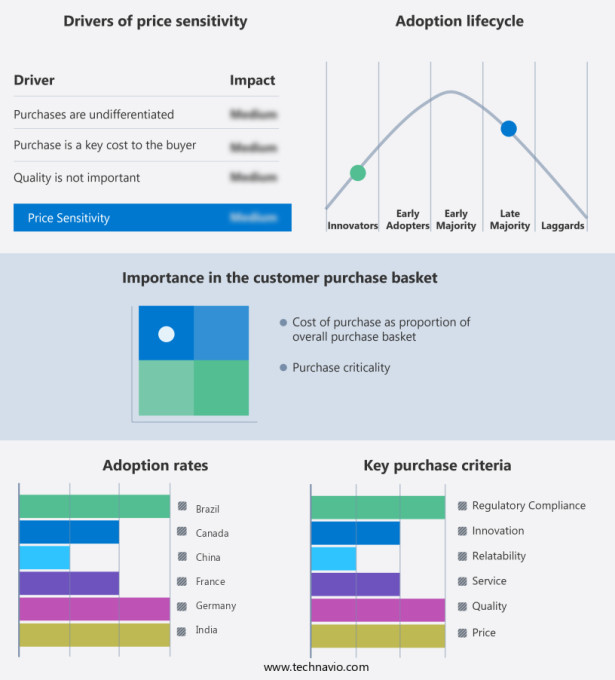

Exclusive Customer Landscape

The child care market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the child care market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, child care market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bright Horizons Family Solutions Inc. - A leading educational institution specializes in early childhood education, catering to children aged 2 to 6 through kindergarten programs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bright Horizons Family Solutions Inc.

- Busy Bees Nurseries Ltd.

- Cadence Education LLC

- Care.com Inc.

- Childcare Network

- G8 Education Limited

- Goodstart Early Learning

- Kiddie Academy Franchising

- Kids âR' Kids International Inc.

- Kindercare Learning Centers LLC

- La Petite Academy (Learning Care Group)

- Learning Care Group Inc.

- Montessori Schools

- Nobel Learning Communities Inc.

- Primrose Schools Franchising Company

- Spring Education Group

- The Goddard School

- Winmark Corporation (Primrose)

- Wonderschool Inc.

- YMCA of the USA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Child Care Market

- In January 2024, KinderCare Education, a leading provider of early childhood education and care in the United States, announced the launch of its new digital platform, KinderCare Connect. This innovative solution allows parents real-time access to their child's daily activities, development progress, and communication with teachers (KinderCare Education press release).

- In March 2024, Bright Horizons Family Solutions, another major player in the market, entered into a strategic partnership with Microsoft to integrate Microsoft Teams into their child care centers. This collaboration aimed to enhance communication between families, teachers, and administrators, as well as streamline operational processes (Bright Horizons Family Solutions press release).

- In April 2025, Care.Com Home Care, a subsidiary of Care.Com, raised USD100 million in a Series D funding round led by BlackRock. The investment will be used to expand their home care services, including child care, elder care, and pet care, and further develop their technology platform (Care.Com Home Care press release).

- In May 2025, the U.S. Government passed the Child Care for Working Families Act, which provides significant investments in child care infrastructure and affordability. The bill includes measures to increase funding for child care centers, expand eligibility for subsidies, and implement a sliding fee scale based on family income (White House press release).

Research Analyst Overview

- The market is witnessing significant trends and developments, with community partnerships playing a pivotal role in enhancing access to quality care. Childcare business models are evolving, incorporating early childhood specialists in sensory integration and addressing the unique needs of children with autism spectrum disorder and developmental delays. Grant writing and accreditation from agencies are essential for securing funding and ensuring high standards in language development, cognitive development, and social-emotional development. Franchise opportunities and nonprofit childcare organizations offer diverse business models, while volunteer opportunities and childcare consulting provide avenues for engagement. Childcare technology, including apps and online registration, streamlines operations and improves communication with parents.

- Special education services and early intervention programs cater to children with diverse needs, from dual language immersion and gifted education to physical development and play therapy. Public-private partnerships and marketing strategies, such as social media marketing and parent portals, expand reach and foster cultural diversity. Accreditation agencies and early intervention programs prioritize developmental milestones and offer essential resources for families. Cognitive development and language development are key focus areas, with a growing emphasis on social-emotional development and special needs services.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Child Care Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.7% |

|

Market growth 2025-2029 |

USD 365.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.2 |

|

Key countries |

US, Germany, UK, China, France, Canada, Japan, Italy, India, Brazil, UAE, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Child Care Market Research and Growth Report?

- CAGR of the Child Care industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the child care market growth of industry companies

We can help! Our analysts can customize this child care market research report to meet your requirements.