Chromium Phosphate Market Size 2024-2028

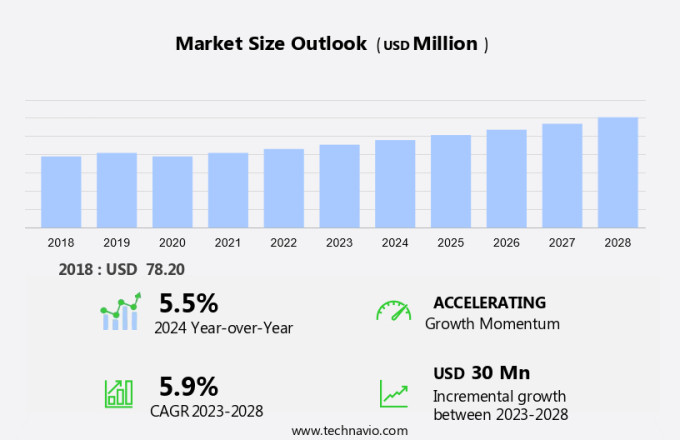

The chromium phosphate market size is forecast to increase by USD 30 million at a CAGR of 5.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. One of these factors is the expanding automotive industry in Asia-Pacific, which is leading to increased demand for architectural and construction coatings, including chromium phosphate-based products. Another trend influencing market growth is the development of advanced coatings with self-cleaning and self-healing properties. Furthermore, there is a growing focus on using nanoparticles in chromium phosphate coatings for their anti-angiogenic properties, which have potential applications in cancer treatment and chemotherapy. However, the market is also facing challenges, such as increasing regulations related to the use of chromium phosphate in coatings due to environmental concerns. In response, manufacturers are exploring alternative coating technologies and developing more sustainable production methods to meet these regulatory requirements.

What will be the Size of the Market During the Forecast Period?

- Chromium phosphate is a complex inorganic compound, primarily used as a catalyst and corrosion inhibitor in various industries. Its unique properties make it an essential ingredient in numerous chemical processes and applications. Chemical manufacturing industries rely on chromium phosphate for its catalytic properties. In this role, it enhances the efficiency of chemical reactions, reducing production costs and increasing overall productivity. Chromium phosphate's catalytic function is not limited to industrial applications; it also plays a significant role in the production of pharmaceuticals. For instance, it is used in the synthesis of leukemia, arthritis, hemangioma, and cancer cell inhibitors, contributing to the development of chemotherapy drugs.

- Moreover, chromium phosphate is an integral component in architectural coatings and corrosion inhibitor coatings. Its ability to prevent corrosion makes it an ideal choice for protecting aluminum structures, particularly in harsh environments. In the medical field, chromium phosphate is used to prevent hospital-acquired infections (HAIs), ensuring the safety and well-being of patients. Aerospace and automotive industries also benefit from chromium phosphate's anti-corrosion properties. In the aerospace sector, it is used to protect aircraft components from the harsh conditions they encounter during flight. In the automotive industry, it is used in the production of high-performance pigments for automotive coatings, enhancing the durability and appearance of vehicles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Architectural purposes

- Corrosion protection

- Medical

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

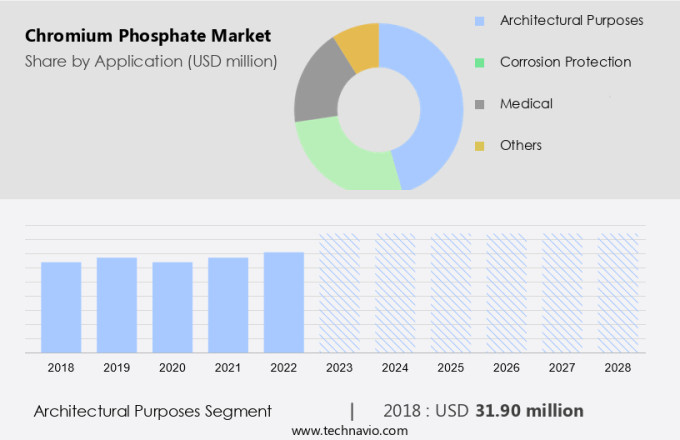

By Application Insights

- The architectural purposes segment is estimated to witness significant growth during the forecast period.

Chromium phosphate is a vital component in various industries, particularly in architectural coatings and construction. In the medical field, it holds significance due to its anti-angiogenic properties, which inhibit the growth of hemangioma and cancer cells. For architectural applications, chrome phosphate is utilized as a pretreatment coating and metal finishing agent. This conversion coating enhances the surface area of the treated object, allowing acrylic coatings to bind more effectively, resulting in a stronger and more durable bond. The strict regulations governing the use and disposal of chrome phosphate, being a controlled hazardous substance, further underscore its importance. By increasing the surface area of metals, chrome phosphate pretreatment enables more efficient and effective metal finishing processes. Its application in architectural coatings and construction extends the life and durability of structures while adhering to stringent government regulations.

Get a glance at the market report of share of various segments Request Free Sample

The architectural purposes segment was valued at USD 31.90 million in 2018 and showed a gradual increase during the forecast period.

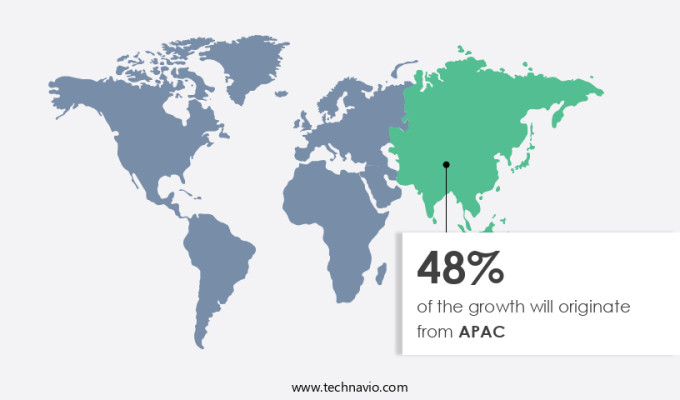

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the APAC region is experiencing significant growth due to the increasing demand for advanced medical devices and implantable medical components. Chromium Phosphate, a type of architectural coating and corrosion inhibitor coating, plays a crucial role in enhancing the biocompatibility and thrombogenicity of these devices. Major players in the industrial coatings industry are expanding their operations in APAC to capitalize on the region's burgeoning medical device sector. Countries like India and China, with their large populations and growing economies, offer attractive business opportunities for these companies. Additionally, the expanding healthcare industry and increasing disposable income in the region are fueling the demand for medical devices, further driving the growth of the market.

This trend is expected to continue, making it an exciting space for investors and industry players alike. From a business perspective, this growth presents significant opportunities for companies specializing in Chromium Phosphate coatings to expand their customer base and increase their market share in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Chromium Phosphate Market?

The growing automotive industry in APAC is the key driver of the market.

- In the medical sector, Chromium Phosphate continues to be a significant raw material due to its application as a catalyst in various processes. This includes the production of pharmaceuticals and the manufacturing of chemical intermediates. Moreover, Chromium Phosphate is widely used as a corrosion inhibitor in medical equipment, contributing to the reduction of Hospital-Acquired Infections (HAIs). The aerospace industry also utilizes Chromium Phosphate as a coating for its anti-corrosive properties. Chromium Phosphate is a crucial component in numerous industries, including medical, catalyst, and chemical manufacturing. In the medical field, it catalyzes various pharmaceutical processes and as a corrosion inhibitor in medical equipment, contributing to the prevention of Hospital-Acquired Infections (HAIs).

- In the aerospace sector, Chromium Phosphate is used as a coating due to its anti-corrosive properties. Furthermore, its application extends to the automotive industry, where it is employed as a corrosion inhibitor and a coating for improved durability. The demand for Chromium Phosphate is driven by its versatile applications in various industries. In the medical sector, its role as a catalyst and corrosion inhibitor is essential in reducing Hospital-Acquired Infections (HAIs) and maintaining the longevity of medical equipment. In the aerospace industry, Chromium Phosphate's anti-corrosive properties make it an indispensable coating material. The automotive industry, particularly in APAC, is a significant contributor to The market due to the high volume of automobile sales and production.

What are the market trends shaping the Chromium Phosphate Market?

The emergence of self-cleaning and self-healing coatings is the upcoming trend in the market.

- Chromium phosphate is a crucial component in various chemical processes, catalyzing numerous industrial applications. Its primary use lies in the production of corrosion inhibitors, particularly for aluminum-based materials. However, the pharmaceutical industry also employs chromium phosphate in the synthesis of certain drugs, such as those used to treat leukemia and arthritis. In the realm of industrial coatings, the advancement of self-cleaning and self-healing technologies poses both opportunities and challenges.

- Despite these advancements, the high production costs associated with self-cleaning and self-healing coatings hinder their mass production. Nevertheless, these technologies hold immense potential and could disrupt the industrial coatings market significantly. Manufacturers of these advanced coatings are investing heavily in research and development to create paints and coatings that reduce the need for multiple applications.

What challenges does the Chromium Phosphate Market face during its growth?

Increasing regulations related to chromium phosphate-based coating is a key challenge affecting the market growth.

- Chromium phosphate is a chemical used in the production of anti-corrosion coatings, which are essential in various industries such as electronics, water treatment, and electric vehicles. However, the manufacturing process of chromium phosphate involves hazardous emissions, making it subject to strict regulations in the US and other regions. The US Environmental Protection Agency (EPA) enforces air toxics standards for chromium compounds, controlling emissions of particulate matter (PM) from sources.

- The Clean Air Act regulates volatile organic compounds (VOC) and hazardous air pollutants (HAP) emissions, while the Clean Water Act sets limits on toxic chemicals in solvent-based coatings and wastewater streams. In January 2021, new regulations were implemented to limit VOC content in these products. Compliance with these regulations is crucial for companies producing high-performance pigments, ensuring they meet industry standards and minimize environmental impact.

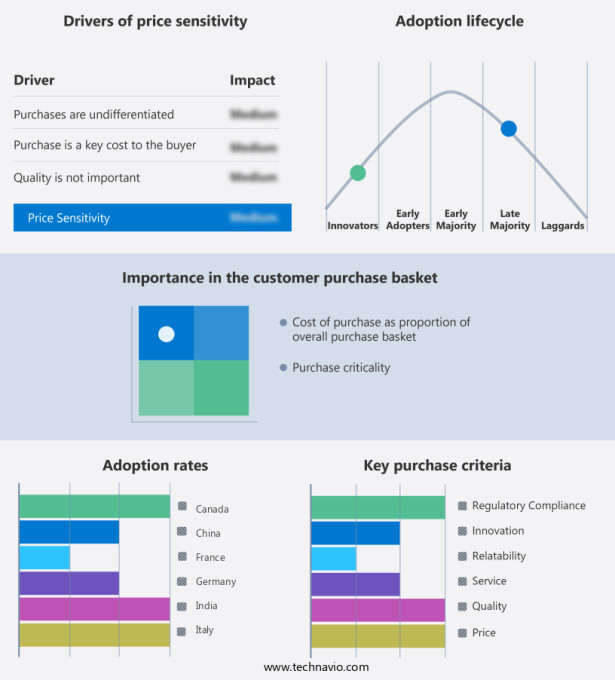

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AD International B.V.

- Alpha Chemika

- American Elements

- BASF SE

- Chargen Life Sciences LLP

- CHEMOS GmbH and Co. KG

- Ganesh Chem Industries Pvt. Ltd.

- Merck KGaA

- Nippon Chemical Industrial Co. Ltd.

- Otto Chemie Pvt. Ltd.

- Oxkem Ltd.

- Parchem Fine and Specialty Chemicals Inc.

- Qingdao ECHEMI Digital Technology Co. Ltd.

- Stanford Advanced Materials

- Yixing Jinlan Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Chromium phosphate is a critical raw material used in various industries, including chemical manufacturing, aerospace, and construction. In chemical processes, chromium phosphate serves as a catalyst, accelerating reactions and improving efficiency. It is also widely used as a corrosion inhibitor in aluminum production. Beyond industrial applications, chromium phosphate finds significant use in medical fields. It is employed in the production of nanoparticles with anti-angiogenic properties, which have potential applications in cancer treatment, including leukemia, arthritis, and hemangioma. In medical coatings, chromium phosphate contributes to reducing hospital-acquired infections (HAIs) by imparting antimicrobial properties to surfaces. Chromium phosphate is also used in medical device coatings (MDCs) to enhance biocompatibility and reduce thrombogenicity, making it essential for implantable medical devices and advanced medical devices.

Furthermore, the use of chromium phosphate in architectural coatings, such as acrylic and polyester, provides additional benefits, including improved corrosion resistance and reduced volatile organic compounds (VOCs). In summary, chromium phosphate is a versatile raw material with applications in various industries, including chemical manufacturing, aerospace, construction, electronics, water treatment, and medical fields. Its role as a catalyst, corrosion inhibitor, and essential component in medical coatings makes it a valuable asset in numerous applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 30 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, China, Japan, India, UK, Canada, South Korea, Germany, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch