Circadian Lighting Market Size 2025-2029

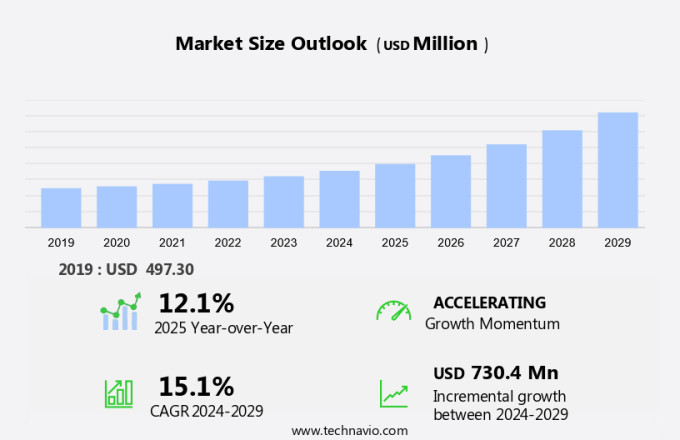

The circadian lighting market size is forecast to increase by USD 730.4 million at a CAGR of 15.1% between 2024 and 2029.

- In the realms of retail and hospitality industries, the implementation of Circadian Lighting has emerged as a significant trend. This techno-biological innovation is designed to mimic natural light patterns, aligning with the body's internal clock to optimize health and productivity. Internet connectivity plays a crucial role in the integration of Circadian Lighting systems, enabling remote monitoring and control. The therapeutic features of Circadian Lighting have gained traction, particularly in healthcare settings, where patient healing and well-being are paramount. IoT (Internet of Things) integration is another key development, allowing for seamless automation and customization of lighting solutions. Despite its advantages, the market faces challenges, including competition from traditional lighting alternatives and the need for higher upfront investment. However, the potential for energy savings, improved health outcomes, and enhanced customer experience make it a worthwhile investment for businesses in the long run.

What will be the Size of the Market During the Forecast Period?

- The market refers to the use of advanced lighting technologies designed to mimic natural daylight and support the body's natural sleep-wake cycle. This market encompasses various applications, including healthcare facilities, commercial spaces, and smart home systems. The circadian rhythm, a 24-hour internal clock regulated by the hypothalamus, plays a crucial role in our health and well-being. Disruptions to this cycle, such as those caused by irregular sleep patterns or artificial lighting, can negatively impact our health. Smart building technology and the Internet of Things (IoT) have revolutionized the lighting industry, enabling the development of novel circadian lighting solutions. These solutions incorporate intensity tuning, color tuning, and stimulus tuning to create lighting environments that align with the body's natural circadian cycle. Seasonal Affective Disorder (SAD) and sleep disorders are significant health concerns that can be addressed through circadian lighting. By providing the right light intensity and color temperature, these solutions can help regulate sleep-wake cycles, improve mood, and enhance overall wellness. Healthcare facilities, particularly hospitals, have embraced circadian lighting to create therapeutic environments. Proper lighting can contribute to patient healing, reduce stress, and improve staff productivity. In office environments, circadian lighting can boost employee performance and focus, leading to increased productivity and job satisfaction.

- Circadian lighting solutions are not limited to large commercial spaces. Smart home systems now offer energy-efficient LED lighting with circadian capabilities, allowing individuals to optimize their home environments for health and wellness. The integration of circadian lighting with IoT technology enables remote monitoring and control, ensuring that lighting conditions align with the user's needs throughout the day. This techno-biological approach to interior lighting not only benefits individuals but also contributes to energy efficiency and cost savings. In conclusion, the market represents a significant opportunity for businesses and individuals seeking to improve health and wellness through optimized lighting solutions. By incorporating advanced lighting technologies, businesses and homeowners can create environments that support the body's natural circadian rhythm, leading to better sleep, increased productivity, and overall improved health.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Intensity tuning

- Color tuning

- Stimulus tuning

- End-user

- Commercial

- Others

- Geography

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Europe

By Type Insights

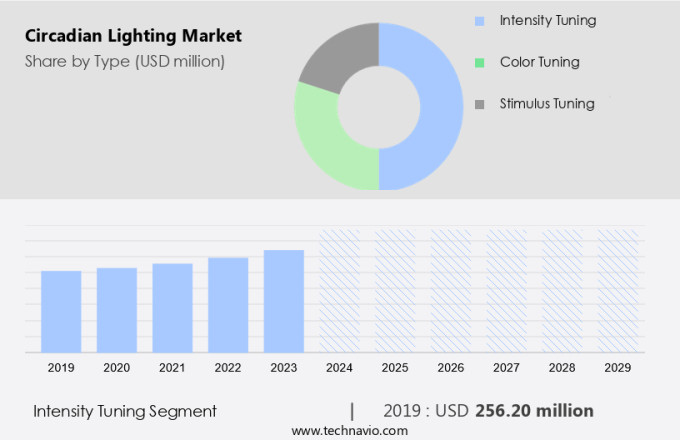

- The intensity tuning segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of lighting solutions designed to mimic natural daylight and support the human circadian clock, located in the hypothalamus region of the brain. One popular segment within this market is intensity tuning, which adjusts the light intensity to align with the natural progression of daylight. This is accomplished through a controlled dimming system that gradually increases or decreases the light intensity throughout the day. In the morning, lower light intensities are employed to simulate sunrise and help individuals awaken gently.

Moreover, as the day advances, the intensity increases, mimicking the brightness of natural daylight and promoting alertness and productivity. This approach to circadian lighting is cost-effective and can be implemented in both residential and commercial settings. By adhering to the natural circadian rhythms, individuals can improve their sleep quality and overall well-being.

Get a glance at the market report of share of various segments Request Free Sample

The intensity tuning segment was valued at USD 256.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

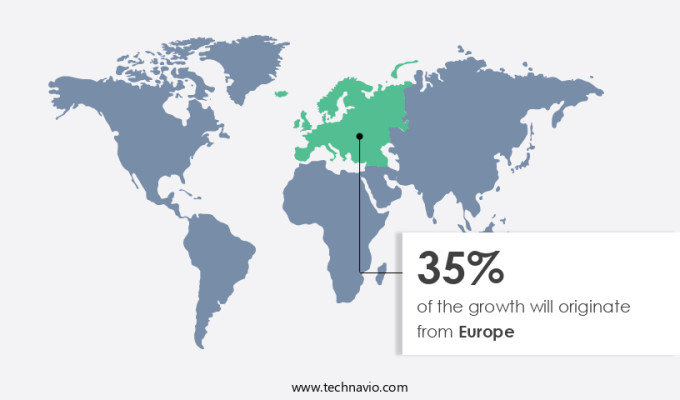

- Europe is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is witnessing significant growth due to the rising awareness of energy-efficient lighting solutions and the emphasis on sustainability. One illustrative instance of this trend is a Norwegian industrial group, which supplied specialized lighting fixtures for Norway's largest zero-emissions ferry. Completed in September 2024, this project showcased the innovative application of tunable LED bulbs that gradually brighten as the vessel nears the harbor. This feature not only alerts passengers to prepare for disembarkation but also benefits those with hearing impairments, underscoring the inclusive capabilities of circadian lighting. The energy savings from using circadian lighting can be substantial, as it mimics natural light patterns to optimize energy usage for animals, plants, and humans, including the fruit fly Drosophila.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Circadian Lighting Market?

Application in automotive industry is the key driver of the market.

- The market is gaining traction, particularly in the automotive industry, due to technological advancements and a heightened emphasis on health and wellness. A significant innovation in this area is Hyundai Mobis' human-centric interior lighting system. This cutting-edge technology adjusts color and brightness according to the biological rhythms of users and environmental conditions. By recognizing individual biometric rhythms, it tailors lighting to various colors, brightness levels, and patterns, offering a customized and interactive experience. The primary objective is to align with the natural circadian rhythms of drivers and passengers, thereby enhancing alertness, mood, and overall comfort during travel.

- Smart home systems are also incorporating circadian lighting technology, allowing users to create personalized lighting environments that mimic natural daylight and support their sleep patterns. The integration of LED technology in circadian lighting further enhances its energy efficiency and longevity. This market trend underscores the growing importance of creating healthier and more personalized living and working environments.

What are the market trends shaping the Circadian Lighting Market?

Rising investments is the upcoming trend in the market.

- The market is experiencing notable growth due to the increasing awareness of its advantages in various office environments. A recent collaboration among six international partners, including companies from Switzerland, Poland, and Denmark, has allocated USD 9.4 million towards the advancement of personalized and adjustable circadian lighting systems. This project, currently underway in a Danish nursing home, aims to enhance the living conditions for both residents and staff by utilizing these innovative lighting solutions. By mimicking natural circadian rhythms, these systems can improve productivity, mood, and overall well-being.

What challenges does Circadian Lighting Market face during the growth?

Competition from alternatives is a key challenge affecting the market growth.

- The market in the Retail and Hospitality sectors is witnessing growing interest due to its techno-biological benefits. These systems are designed to mimic natural light patterns, aligning with the body's internal clock to improve well-being and productivity. However, the market faces competition from traditional LED lights, which are more affordable and energy-efficient. While these lights do not offer circadian features, some smart LED models can adjust color temperature and brightness, providing a more cost-effective alternative.

- Internet connectivity and IoT integration enable remote control and customization, adding therapeutic features to interior lighting. Patient healing and employee wellness are key drivers for the adoption of circadian lighting systems. Despite challenges, the market's potential for growth remains strong, with continuous innovation and advancements in technology.

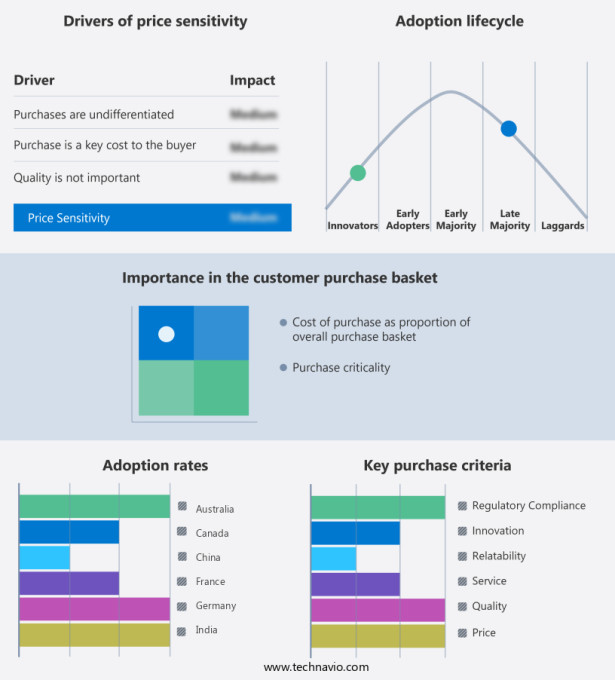

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- amBX Ltd.

- Biological Innovation and Optimization Systems LLC

- Circadian Lighting Ltd.

- Ekinex India Pvt Ltd.

- Halla as

- Koninklijke Philips NV

- KUMUX

- LED Lighting Inc

- Swann Lighting Ltd.

- The Tuo Life

- TRILUX GmbH and Co. KG

- USAI Lighting LLC

- Varni Digital Pvt Ltd

- Visa Lighting

- WalaLight Healthy LED Lighting System

- Wipro Lighting

- WLS Lighting Systems Inc

- WSP Global Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Circadian rhythm lighting refers to the use of artificial light sources that mimic natural daylight and support the body's natural sleep-wake cycle. This type of lighting is essential for maintaining optimal health and wellness, particularly for individuals suffering from conditions such as seasonal affective disorder. Smart building technology and the Internet of Things (IoT) are revolutionizing the way we use circadian rhythm lighting in various sectors. The circadian cycle, governed by the hypothalamus in the brain, is influenced by light intensity and color temperature. Novel lighting solutions, including intensity tuning, color tuning, and stimulus tuning, are being developed to optimally align with natural daylight and support the body's circadian clock. Circadian rhythm lighting is gaining popularity in healthcare facilities, educational institutions, hospitality, transportation, and commercial spaces.

Consequently, these sectors are recognizing the importance of human-centric lighting in improving sleep quality, energy, and overall health and wellness. LED technology is at the forefront of circadian rhythm lighting innovation, with specialized fixtures and bulbs designed to provide the right amount of light at the right time. Animal studies, including those on drosophila, mammals, and even humans, have shown the positive effects of circadian rhythm lighting on sleep quality and patient healing. Smart home systems and adjustable lighting systems are also integrating circadian rhythm lighting technology, allowing individuals to customize their lighting environment to their personal needs. The techno-biological benefits of circadian rhythm lighting extend beyond healthcare and wellness, with energy efficiency and IoT integration becoming increasingly important considerations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.1% |

|

Market growth 2025-2029 |

USD 730.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

US, Germany, UK, China, Japan, France, Canada, India, Australia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch