Lighting Fixtures Market Size 2024-2028

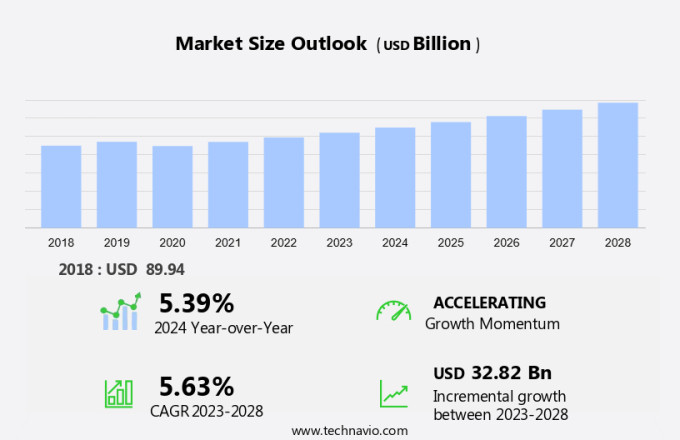

The lighting fixtures market size is forecast to increase by USD 32.82 billion at a CAGR of 5.63% between 2023 and 2028. The market hinges on several key factors driving its growth and evolution. Advances in LED technology, which are also closely linked to innovations in semiconductor materials, play a significant role, offering improved efficiency, durability, and versatility in lighting solutions across various applications. Rising urbanization and infrastructure development further fuel the demand for navigation lighting systems, especially in densely populated areas and expanding urban landscapes. Additionally, the rise of e-commerce and online shopping amplifies the need for efficient transportation and logistics, enhancing the importance of reliable navigation lighting for safe and timely delivery of goods. Furthermore, the integration of navigation lighting systems with modern technologies, such as speakers for enhanced communication and safety, is contributing to the overall market growth. These factors collectively contribute to the growth and innovation within the navigation lighting market, as industries adapt to evolving technological trends and market dynamics to meet the demands of modern navigation challenges.

Market Analysis

The global market for Lighting Fixtures encompasses various electrical instruments used for Electric Lighting in diverse applications. The market comprises Fixture Bodies, Lamps, Bulbs, LED Fixtures, LED Lighting Control Switches, and Permanent Lighting Fixtures. Architects, Lighting Designers, and Electrical Engineers play pivotal roles in specifying and designing these fixtures for Consumers and the Real Estate Sector. High-class Communities and outdoor settings, such as Yards, are prime targets for advanced LED Light Modules and LED Lights, replacing Conventional Lights and Fluorescent Bulbs. The market caters to various needs, from Wall Switches and Electrical Devices to Electric Ballasts and Apertures, all contributing to the Outer Shell of the Lighting Fixture. Electrical Instruments manufacturers continually innovate to meet evolving consumer demands and energy efficiency standards. The market's growth is driven by the increasing focus on energy-efficient solutions and the expanding infrastructure in various sectors.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

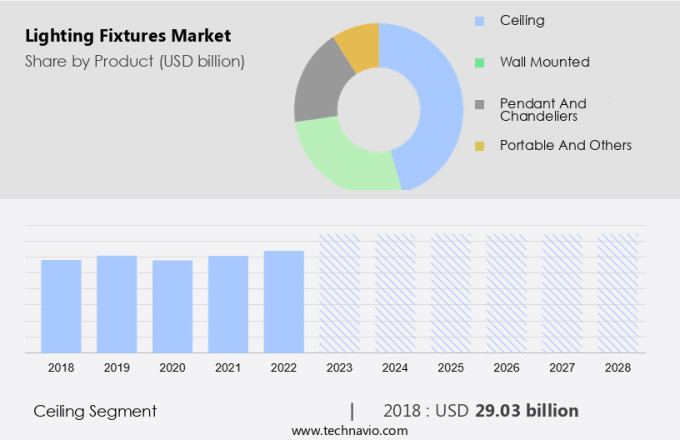

- Product

- Ceiling

- Wall mounted

- Pendant and chandeliers

- Portable and others

- Application

- Residential

- Commercial

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

The ceiling segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of electrical devices, including portable lamps and fixed installations such as electric lamps with lamp sockets and electric ballasts. These fixtures come in various forms, including aperture-covered outer shells for fluorescent lamps, and high-class designs for chandeliers and pendant lights. Architects, lighting designers, and electrical engineers specify lighting solutions for diverse applications, from home renovations and remodeling of offices to manufacturing plants, warehouses, banks, retail stores, and outdoor spaces. Pendant lighting is a popular choice for workspaces and residential areas, providing focused illumination for specific tasks. High-bay luminaries and mid-bay luminaries are essential for large industrial spaces and warehouses, while landscape lighting and wireless lighting fixtures add aesthetic value to outdoor environments.

Further, floodlights offer powerful illumination for security and outdoor activities. Consumers and businesses in the real estate sector seek energy-efficient and eco-friendly lighting options, such as LED light modules and conventional lights with fluorescent bulbs or incandescent bulbs. Safety and environmental concerns have led to the phasing out of toxic materials in lighting fixtures. Smart home projects and digital systems have revolutionized lighting control, with dimmers and control devices enabling wireless lighting and analog or digital systems for customized lighting experiences.

Get a glance at the market share of various segments Request Free Sample

The ceiling segment was valued at USD 29.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

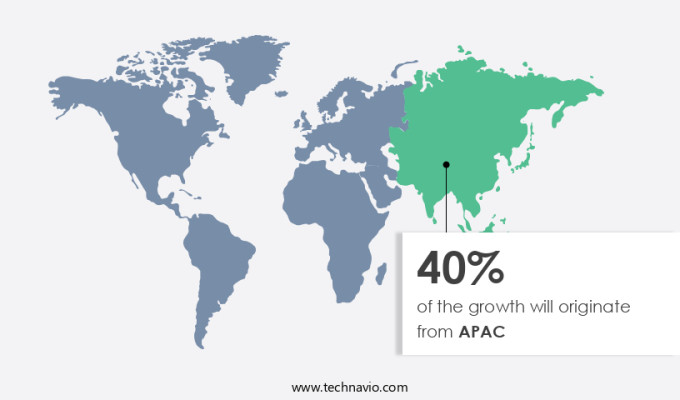

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The portable electrical device category of lighting fixtures is witnessing substantial growth in the APAC region. These devices, which include electric lamps, are essential components of modern living spaces and commercial establishments. The lamp socket and electric ballast are integral parts of these fixtures, ensuring the proper functioning of the electric lamp. Architects, lighting designers, and electrical engineers are increasingly specifying the use of various types of lighting fixtures in home renovations, remodeling of offices, workspaces, manufacturing plants, warehouses, banks, retail stores, and other infrastructure projects. Pendant lighting, high-bay luminaries, mid-bay luminaries, landscape lighting, wireless lighting fixtures, floodlights, and more are in high demand.

In summary, the market in the APAC region is experiencing significant growth due to urbanization, economic growth, and increasing consumer demand for energy-efficient and eco-friendly lighting solutions. The market encompasses a wide range of portable electrical devices, including electric lamps, pendant lighting, high-bay luminaries, mid-bay luminaries, landscape lighting, wireless lighting fixtures, floodlights, and more. The use of LED light modules and other energy-efficient lighting solutions is on the rise, driven by government regulations and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Advances in LED technology is the key driver of the market. LED lighting fixtures, characterized by advanced sensors, smart bulbs, and integration with Wi-Fi and IoT technology, have revolutionized the lighting market. These energy-efficient alternatives to incandescent lamps with metallic filament and gas-powered bulbs, significantly reduce power consumption. The longer lifespan of LED bulbs, which is a result of new product development and fine material quality, offers numerous benefits. Businesses and households can save on maintenance costs, while consumers enjoy improved reliability and quality of light. Energy-efficient products, such as LED bulbs, have become increasingly popular in various sectors including hospitals, shopping malls, educational institutes, offices, and shops. Attractive designs and affordable prices have made LED lighting an essential element of home decor.

Additionally, government support for energy-efficient lights, as well as the availability of LED bulbs through both offline and online channels, including e-commerce platforms, have contributed to the market's growth. Additionally, the integration of LED lighting with air purifiers and air conditioning systems further enhances their appeal.

Market Trends

The emergence of smart lighting is the upcoming trend in the market. The market encompasses a range of advanced solutions, including smart bulbs and Wi-Fi-enabled switches, that cater to the growing demand for energy efficiency and convenience. IoT technology plays a pivotal role in enabling remote control and seamless integration with other smart home devices. While traditional incandescent lamps and metallic filament bulbs continue to be used, gas-powered fixtures are gradually being replaced due to their high power consumption and shorter lifespan. Smart lighting solutions offer numerous advantages, such as longer lifespan, energy efficiency, and low cost. Users can customize lighting to their preferences through adjustable brightness levels and scheduling, leading to significant energy savings.

Moreover, new product development in the market is focused on energy-efficient products, such as LED bulbs, that offer attractive designs, fine material quality, and affordable prices. The market caters to various sectors, including households, hospitals, shopping malls, educational institutes, offices, and shops. Government support for energy-efficient lights and the increasing popularity of e-commerce platforms have contributed to the market's growth. In conclusion, the market is witnessing a windfall due to the increasing adoption of energy-efficient products, smart devices, and IoT technology. The market offers a wide range of solutions for interior lighting, home decor, and various commercial applications, making it an essential component of modern living and working spaces.

Market Challenge

The presence of counterfeit lighting fixture products is a key challenge affecting the market growth. The market encompasses a range of advanced technologies, including sensors, smart bulbs, Wi-Fi, and IoT integration. From incandescent lamps with metallic filaments to gas-powered fixtures, energy consumption and longer lifespan are key considerations. Energy efficiency and low cost are essential factors, driving the demand for energy-efficient products such as LED bulbs. Compatibility with smart lighting and smart devices is a priority for interior lighting in households, hospitals, shopping malls, educational institutes, and various commercial spaces. New product development in the market focuses on attractive designs, fine material quality, and affordability. Energy-efficient lights, air purifiers, and air conditioning systems are increasingly popular, with government support and e-commerce platforms facilitating offline and online sales.

However, LED bulbs have become a windfall for manufacturers due to their home decor appeal and energy savings. Despite these advancements, the market faces challenges from counterfeit lighting fixtures. These limitations may not adhere to safety and quality standards, posing risks of electrical hazards, fires, and other safety issues. The reputation of legitimate manufacturers can be damaged when consumers associate subpar quality with reputable brands. Price competition from counterfeiters can impact the profitability of legitimate businesses, leading to price erosion and reduced revenue and profit margins. In conclusion, the market is characterized by advanced technologies, energy efficiency, and affordability. However, the presence of counterfeit products poses risks to consumer safety, market reputation, and business profitability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acuity Brands Inc: The company offers lighting fixtures such as track fixtures, linear accents, and LED lighting fixtures for homes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amerlux LLC

- ams OSRAM AG

- Bajaj Electricals Ltd.

- Eaton Corp. Plc

- ELK Home

- Energize CT

- Everlight Electronics Co. Ltd.

- Fagerhults Belysning AB

- General Electric Co.

- Havells India Ltd.

- Hubbell Inc.

- IDEAL INDUSTRIES Inc.

- Koninklijke Philips N.V.

- Nichia Corp.

- Panasonic Holdings Corp.

- Seoul Semiconductor Co. Ltd.

- Siemens AG

- Zumtobel Group AG

- LSI Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed for illumination in various applications. These fixtures include LED lights, bulbs, lamps, and other types of lighting solutions. The industry is driven by the increasing demand for energy-efficient and cost-effective lighting options. The use of advanced technologies such as smart lighting and wireless connectivity is also gaining popularity. The market is segmented based on product type, application, and geography. LED lighting fixtures hold a significant market share due to their energy efficiency and long lifespan.

In conclusion, the market is expected to grow at a steady pace in the coming years, with increasing urbanization and infrastructure development being key growth drivers. The adoption of lighting fixtures in residential, commercial, and industrial sectors is also contributing to the market growth. The market is competitive, with several players offering a wide range of products to cater to diverse customer needs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.63% |

|

Market Growth 2024-2028 |

USD 32.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.39 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 40% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acuity Brands Inc., Amerlux LLC, ams OSRAM AG, Bajaj Electricals Ltd., Eaton Corp. Plc, ELK Home, Energize CT, Everlight Electronics Co. Ltd., Fagerhults Belysning AB, General Electric Co., Havells India Ltd., Hubbell Inc., IDEAL INDUSTRIES Inc., Koninklijke Philips N.V., Nichia Corp., Panasonic Holdings Corp., Seoul Semiconductor Co. Ltd., Siemens AG, Zumtobel Group AG, and LSI Industries Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch