Cold Pressed Juices Market Size 2025-2029

The cold pressed juices market size is forecast to increase by USD 525.1 million, at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing organized retailing of these beverages. This trend is attributed to the rising health consciousness among consumers and the growing preference for natural and nutrient-dense food and beverage options. Another key factor fueling market expansion is the continuous innovation in juice flavors, catering to diverse consumer tastes and preferences. However, the market faces challenges, primarily due to the short shelf life of cold-pressed juices. This limitation necessitates efficient distribution networks and careful logistics planning to ensure product freshness and minimize wastage.

- Companies seeking to capitalize on market opportunities must focus on developing effective strategies for managing the supply chain and maintaining product quality while navigating the challenges posed by the perishable nature of cold-pressed juices. Innovative solutions, such as aseptic packaging or the implementation of high-pressure processing techniques, may offer potential solutions to extend shelf life and enhance market competitiveness.

What will be the Size of the Cold Pressed Juices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by shifting consumer preferences and industry innovations. In the food service industry, the demand for natural, clean eating options has led to an increase in the inclusion of cold pressed juices on restaurant menus. Pulp separation and ingredient transparency are key factors in maintaining nutrient retention and consumer trust. Packaging formats, such as glass bottles, have gained popularity due to their ability to preserve the natural taste and nutrient content of cold pressed juices. Weight management and digestive health are major consumer trends, leading to the exploration of ingredient combinations and nutritional labeling.

Premium pricing and product differentiation are essential strategies for brands in this competitive market. Ethical sourcing and sustainable practices, including water conservation and waste reduction, are becoming increasingly important to consumers. Emerging ingredients and functional beverages, such as those with antioxidant content and anti-inflammatory properties, are driving new product development. High-pressure processing and organic certification are also key considerations for brands seeking to meet consumer demands for food safety and health consciousness. The market's dynamism is further reflected in the use of natural preservatives, refrigerated storage, and innovative distribution channels, such as online marketplaces and subscription services. The ongoing unfolding of market activities and evolving patterns underscore the importance of quality control and flavor profile in the market.

How is this Cold Pressed Juices Industry segmented?

The cold pressed juices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Conventional

- Organic

- Type

- Fruit and vegetable blend juices

- Fruit juices

- Vegetable juices

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

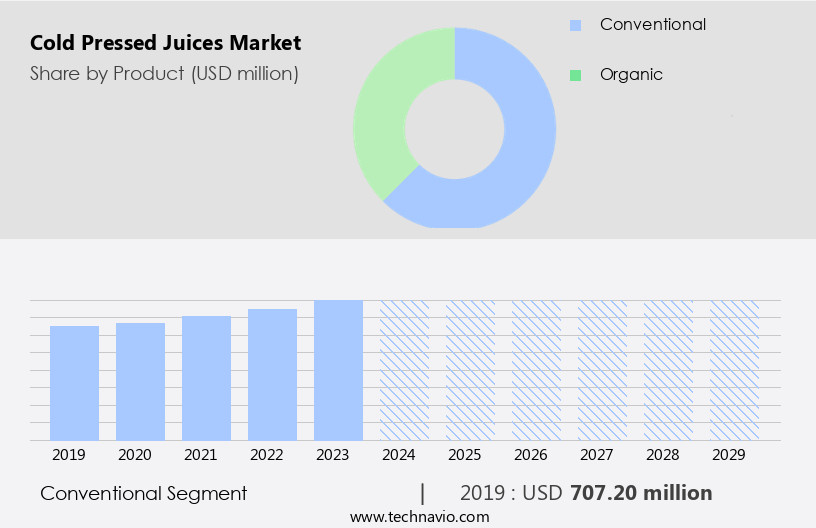

By Product Insights

The conventional segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of products, with conventional offerings made from traditional ingredients that may not be certified organic or free from additives. These affordably priced juices cater to a broad consumer base seeking healthy, convenient beverage options. Cold pressed methods, which preserve nutrients and enzymes, have gained popularity due to their health benefits. These juices are available in various channels, including supermarkets, juice bars, and online platforms, with a focus on mass-market accessibility. Natural preservatives and ingredient sourcing are essential considerations for both conventional and organic cold pressed juices. Refrigerated storage and energy-efficient production processes help maintain the juices' freshness and nutrient content.

The food service industry has embraced cold pressed juices, leading to their inclusion in restaurant menus and juice bars. Food safety regulations and water conservation are crucial aspects of the market. Emerging ingredients and flavor combinations cater to evolving consumer trends, such as clean eating and plant-based diets. New product development, including functional beverages and juice cleanses, targets specific health concerns, such as immune system support and digestive health. Packaging formats, such as pet bottles and glass bottles, impact the market's sustainability and environmental footprint. Transparency in ingredient sourcing and labeling is essential for consumer trust.

Premium pricing and product differentiation based on nutrient retention and health claims continue to drive market growth. Ethical sourcing and high-pressure processing ensure the quality and safety of cold pressed juices. Anti-inflammatory properties and functional ingredients add value to the market. Waste reduction and shelf life are key challenges for manufacturers. Subscription services offer convenience and cost savings for consumers. The market's future growth will depend on continued innovation, consumer education, and regulatory compliance. The market's evolution reflects the increasing importance of health consciousness and the demand for convenient, nutrient-dense beverage options.

The Conventional segment was valued at USD 707.20 million in 2019 and showed a gradual increase during the forecast period.

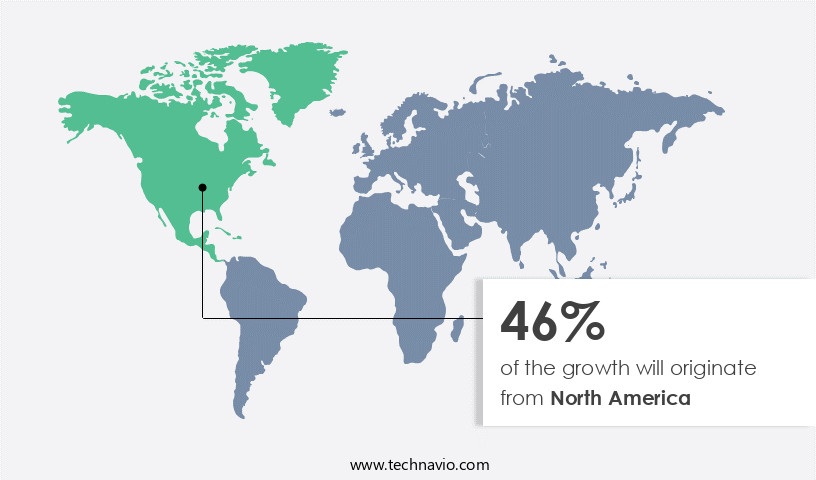

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the increasing preference for healthy, raw, and organic food products among consumers, particularly the younger demographic. Convenience and health benefits are key factors fueling this trend. Cold pressed juices offer higher nutrient retention and natural preservatives compared to other juice extraction methods. The food service industry is responding to this trend by incorporating cold pressed juices into their menus, contributing to market growth. Food safety regulations and water conservation are important considerations in the production of cold pressed juices. Refrigerated storage and pulp separation ensure product freshness and quality.

Glass bottles and tetra pak cartons are popular packaging formats, with glass bottles emphasizing the premium nature of cold pressed juices. Weight management and digestive health are health claims associated with cold pressed juices, making them appealing to consumers. New product development focuses on emerging ingredients, such as functional beverages and anti-inflammatory properties, to cater to evolving consumer preferences. Ethical sourcing and high-pressure processing are essential for ensuring product authenticity and shelf life. Nutritional labeling and ingredient transparency are crucial for consumer trust and compliance with food safety regulations. Premium pricing and product differentiation based on flavor profiles and ingredient combinations are strategies used by market players.

The rise of plant-based diets and health consciousness is driving the demand for cold pressed juices. Subscription services offer convenience and regular delivery, further boosting sales. The market is expected to continue growing due to the increasing popularity of clean eating and the decline in soft drink consumption.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cold Pressed Juices Industry?

- The expansion of organized retailing sectors, particularly in cold-pressed juices, is the primary catalyst driving market growth.

- The market is experiencing significant growth due to increasing consumer preference for natural and healthy food options. This trend is particularly noticeable in the food service industry, where juice bars and clean eating establishments are gaining popularity. Cold pressed juices are made without the use of heat or pasteurization, ensuring the preservation of essential nutrients and enzymes. This process also results in a lower carbon footprint compared to traditional juicing methods. Ingredient sourcing is a critical factor in the production of cold pressed juices. Companies prioritize the use of locally sourced, organic, and ethically produced ingredients to meet consumer demand for transparency and food safety regulations.

- Refrigerated storage is essential to maintain the freshness and energy levels of cold pressed juices, which are typically sold in PET bottles or other eco-friendly containers. Emerging ingredients, such as turmeric, ginger, and kale, are increasingly being used to create unique and nutrient-dense cold pressed juice blends. Water conservation is another important consideration for cold pressed juice companies, as the production process requires a significant amount of water. Waste reduction is also a priority, with companies exploring methods for repurposing fruit pulp and other byproducts. In conclusion, the market is expected to continue its growth trajectory during the forecast period, driven by consumer demand for natural, healthy, and sustainable food options.

- Companies that prioritize ingredient sourcing, refrigerated storage, and waste reduction are well-positioned to succeed in this competitive market.

What are the market trends shaping the Cold Pressed Juices Industry?

- The trend in the market is leaning towards innovative juice flavors. (Alternatively: Innovative juice flavors are currently gaining popularity in the market.)

- The market is experiencing significant growth due to the increasing health consciousness among consumers. These juices, which undergo pulp separation to preserve nutrient retention, are gaining popularity for their natural ingredients and high nutritional value. Consumers are no longer satisfied with traditional juice offerings and are instead seeking innovative blends and flavors. Companies, such as Suja Life, are responding to this trend by investing in research and development to launch new and appealing cold pressed juice products. Transparency in ingredient sourcing and nutritional labeling is also a key factor driving the market. Cold pressed juices are often sold in glass bottles to maintain the premium image and ensure the product's freshness.

- Weight management is another consumer trend influencing the market, with cold pressed juices offering a convenient and nutritious option for those seeking to maintain a healthy lifestyle. Packaging formats, such as bottles and pouches, are also evolving to cater to changing consumer preferences. Ethical sourcing of ingredients is becoming increasingly important, with companies focusing on sustainable and organic sourcing to differentiate their products from competitors. Premium pricing is another strategy used by market players to position their products as high-quality and health-conscious offerings. In conclusion, the market is expected to continue growing due to the increasing health consciousness among consumers and their preference for natural, nutrient-rich, and innovative beverage options.

- Companies are responding to this trend by investing in research and development, focusing on transparency and ethical sourcing, and offering a range of packaging formats and flavors to meet evolving consumer preferences.

What challenges does the Cold Pressed Juices Industry face during its growth?

- The short shelf life of cold-pressed juices poses a significant challenge to the growth of the industry, as these beverages require rapid consumption to maintain their freshness and nutritional value.

- Cold pressed juices, produced through cold-pressed extraction without the use of heat or added preservatives, offer consumers higher antioxidant content and improved digestive health benefits compared to conventional juices. However, their relatively shorter shelf life, typically up to three days, poses a challenge for the market. This is due to the absence of preservatives and the quicker production time. High-pressure processing (HPP) can extend the shelf life to 30-60 days, but it still falls short of the 6-12 months for pasteurized juices.

- Despite this limitation, the demand for cold pressed juices continues to grow due to their health claims and functional ingredients, such as juice blends and juice cleanses. Retail sales and online marketplaces have facilitated easy access to these products, further fueling their popularity. Organic certification adds to their appeal, ensuring consumers receive a natural and healthy beverage option.

Exclusive Customer Landscape

The cold pressed juices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cold pressed juices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cold pressed juices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bolthouse Farms Inc. - This company specializes in producing high-quality cold pressed juices, including Carrot and Pomegranate varieties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bolthouse Farms Inc.

- Garden Bar

- Greenhouse Juice Co.

- Kuka Juice LLC

- MOJU Ltd.

- Native Cold Pressed

- Nook Vibrant Kitchen

- Organic Press Juices Co LLC

- PepsiCo Inc.

- Platinum Goods Corp.

- Pomona Organic Juices

- Pressed Juicery Inc.

- Pulp and Press Juice Co.

- Rakyan Beverages Pvt. Ltd.

- Starbucks Corp.

- Suja Life LLC

- The Coca Cola Co.

- The Cold Pressed Juicery

- The Hain Celestial Group Inc.

- Village Juicery

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cold Pressed Juices Market

- In February 2023, PepsiCo, a global food and beverage leader, announced the expansion of its Suja Juice brand into the European market. This strategic move marks a significant geographic expansion for the cold-pressed juice industry giant, aiming to cater to the growing health-conscious consumer base in Europe (BusinessWire).

- In March 2024, Amazon Fresh, Amazon's grocery delivery service, unveiled a new line of private label cold-pressed juices. This strategic partnership with Pressed Juicery, a leading cold-pressed juice company, allows Amazon to strengthen its presence in the health food sector and offer a wider range of products to its customers (CNBC).

- In May 2024, Bolthouse Farms, a leading producer of cold-pressed juices and smoothies, completed the acquisition of Daily Greens, a California-based cold-pressed juice company. This strategic move will enable Bolthouse Farms to expand its product offerings and strengthen its presence in the competitive cold-pressed juice market (PR Newswire).

- In October 2024, the European Food Safety Authority (EFSA) approved the use of certain plant-based extracts as functional ingredients in cold-pressed juices. This key regulatory approval opens up new opportunities for innovation and product development in the European cold-pressed juice market (EFSA).

- These significant developments in the cold-pressed juices market demonstrate strategic expansions, partnerships, and regulatory approvals shaping the industry's growth and competition landscape.

Research Analyst Overview

- The market is experiencing dynamic growth, with industry events and trade shows fostering innovation and collaboration among key players. R&D investments in HPP technology and product positioning are driving product development, while pricing strategies and sales forecasting help companies stay competitive. Cold chain logistics and food safety standards are crucial considerations for ensuring product quality and consumer trust. Social media marketing and influencer partnerships are effective strategies for building brand awareness, and e-commerce platforms facilitate easy access to a wide range of juices.

- Juicer manufacturers and packaging suppliers are essential partners, providing essential equipment and materials. Brand loyalty is a significant factor, with companies focusing on quality assurance and content marketing to engage customers. Ingredient suppliers play a vital role in maintaining product integrity, while marketing strategies and innovation centers drive continuous improvement. Bottling equipment and labeling solutions are essential components of the production process.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cold Pressed Juices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 525.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, China, UK, France, Brazil, Japan, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cold Pressed Juices Market Research and Growth Report?

- CAGR of the Cold Pressed Juices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cold pressed juices market growth of industry companies

We can help! Our analysts can customize this cold pressed juices market research report to meet your requirements.