Colorants Market Size 2025-2029

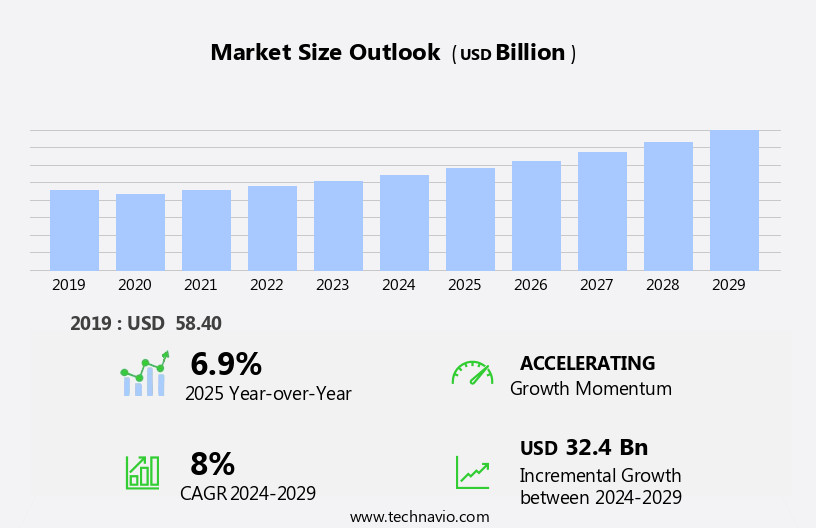

The colorants market size is forecast to increase by USD 32.4 billion, at a CAGR of 8% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for natural dyes and pigments in various applications such as wool, silk, and cotton in the apparel industry, as well as in cosmetics and personal care products. Additionally, the trend towards clean-label products is driving the demand for organic dyes and pigments in food and beverages, including juices, as well as in industrial coatings and construction materials. However, the high prices of colorants, particularly those derived from natural sources, pose a challenge for market growth. Key applications of colorants include textiles, plastics, rubber, adhesives, paints and coatings, and construction materials. Zinc oxide and titanium dioxide are commonly used pigments in various industries, while masterbatches are used to produce uniform color in polymers. The market is also witnessing the emergence of new technologies, such as nanotechnology, which offer improved colorant performance and efficiency.

What will be the Size of the Colorants Market During the Forecast Period?

- The market encompasses a wide range of industries, including food, cosmetics, textiles, paints, and automobiles, among others. The market's growth is driven by the increasing demand for visual appeal, identification, and differentiation in various applications. Both natural and synthetic colorants, including dyes and pigments, are utilized extensively in this market. Natural colorants derived from plants, minerals, and other sources are gaining popularity due to consumer preferences for organic and health-conscious products. However, synthetic colorants continue to dominate the market due to their superior color strength, stability, and cost-effectiveness. The market's size is significant, with major applications including food and beverages, personal care, industrial grade coatings, and automobiles.

- The use of colorants in these industries contributes to product differentiation and consumer appeal. The market's direction is towards the development of eco-friendly and non-toxic colorants, as concerns over toxic elements and potential health risks, such as cancer, continue to rise. Technological advancements in color concentrates and masterbatches have also facilitated the production of high-performance, cost-effective colorants. Different industries have unique requirements for colorants, such as solvent-borne, powder, or rubber-based, depending on the application. The market's growth is expected to remain strong, driven by the increasing demand for colorants in various industries and the ongoing research and development efforts to create more sustainable and effective colorants.

How is this Colorants Industry segmented and which is the largest segment?

The colorants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Pigment

- Dyes

- Color concentrates

- Others

- End-user

- Paints and coatings

- Textile

- Personal care

- Food

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Mexico

- US

- Europe

- Germany

- UK

- Italy

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

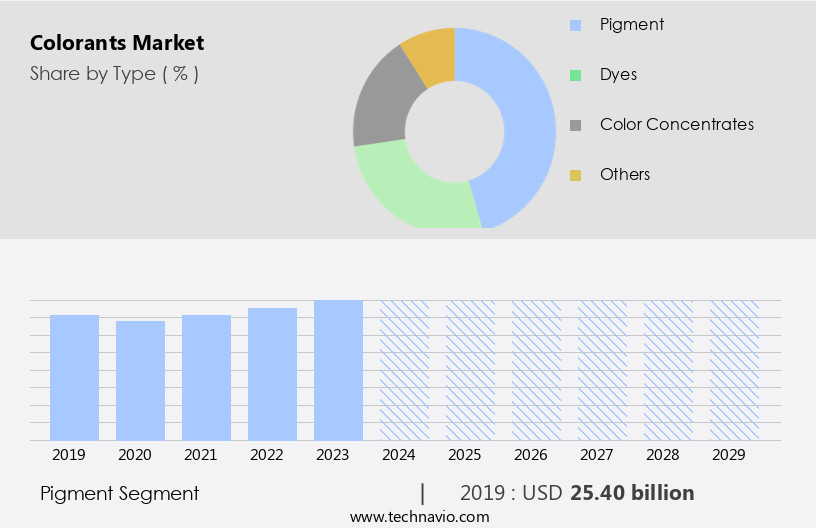

- The pigment segment is estimated to witness significant growth during the forecast period.

Pigments, insoluble compounds used in cosmetics, plastics, paints and coatings, and printing ink, come in both organic and inorganic forms. Inorganic pigments, including zinc oxide and iron oxides, dominate the cosmetics sector. Young demographics and the expanding social media user base are driving growth in the global cosmetics industry, which holds a significant third of its market share in APAC. Titanium oxide and iron oxides are commonly used in manufacturing nail paints. The food industry also utilizes pigments, particularly in beverages, for visual appeal and identification. Sustainable, eco-friendly, and renewable sources, as well as clean-label and green alternatives, are gaining popularity in various industries, including textiles, automobiles, and consumer goods. Pigments, including dyes, lakes, and color concentrates, serve essential functions in these sectors while adhering to safety regulations regarding toxic elements, allergenic properties, and hazardous substances.

Get a glance at the Colorants Industry report of share of various segments Request Free Sample

The pigment segment was valued at USD 25.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

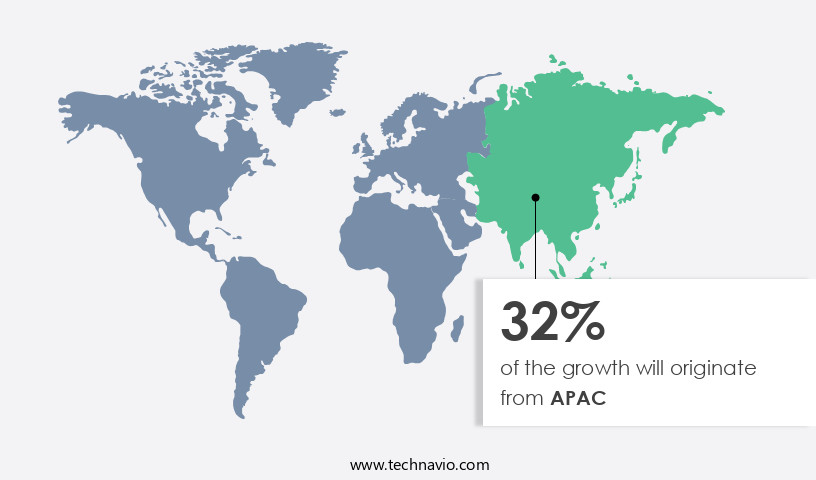

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region represents a substantial and expanding market for colorants, fueled by growing industrialization, a thriving automotive industry, particularly in China and India, and increasing focus on reducing products with high petrochemical or volatile organic compound (VOC) content. End-use industries, including automotive and construction, are key drivers of market growth in APAC. China, India, and Japan collectively account for over 40% of global automotive production, with China alone producing more than 33% in 2024. Stringent government regulations are further propelling the market's expansion.

Additionally, the APAC market caters to various sectors, including food, cosmetics, textiles, paints, visual appeal, identification, differentiation, and additives in plastics, beverages, consumer goods, industrial products, and coatings. This market encompasses natural and synthetic colorants, such as dyes, pigments, inks, color concentrates, master batches, and lakes, as well as eco-friendly and sustainable alternatives. Key sectors include paper and printing, building and construction, automobiles, food and beverages, personal care, pharmaceuticals, and rubber. The market caters to diverse consumer demographics, including the geriatric population and dual income households.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Colorants Industry?

Increasing consumer demand for natural food colorants is the key driver of the market.

- In the realm of consumer goods, the preference for natural and eco-friendly products continues to escalate. By 2024, this trend is particularly noticeable in the food and beverage sector, where consumers demand ethical sourcing and minimal environmental impact. Artificial food colorants, derived from synthetic dyes and pigments, have faced increasing scrutiny due to their potential health and environmental concerns. In response, companies are investing in research and development to introduce advanced technologies and natural colorants, derived from renewable sources. These natural alternatives offer superior visual appeal while minimizing the environmental footprint.

- The cosmetics, textiles, paints, plastics, and paper industries also follow suit, embracing sustainable and eco-friendly colorants to cater to the evolving consumer preferences. The shift towards natural and sustainable colorants is not only driven by consumer awareness but also by regulatory bodies and industry standards. The demand for clean-label products, free from allergenic properties and hazardous substances, is on the rise. This trend is observed across various industries, including food and beverages, personal care, pharmaceuticals, building and construction, and automobiles. The adoption of natural and organic colorants is expected to continue, as consumers seek to reduce their exposure to toxic elements and support sustainable production methods.

What are the market trends shaping the Colorants Industry?

Increasing consumer demand for clean-label products is the upcoming market trend.

- The market is driven by the growing demand for clean-label products. Consumers are increasingly preferring products with natural and organic ingredients, including food colorants, over synthetic alternatives. Clean labeling, which involves providing clear information about product ingredients through labeling, is a key trend in various industries, including food and beverages. This trend is expected to boost the market for colorants derived from natural sources. Natural colorants are gaining popularity due to their perceived health benefits and aesthetic appeal. They are used in various applications, including food and beverages, cosmetics, textiles, paints, and plastics. In the food industry, natural colorants are used to enhance the visual appeal of products and provide identification and differentiation.

- In the cosmetics industry, they are used for their aesthetic properties and to cater to consumer preferences for eco-friendly and sustainable products. The demand for sustainable and eco-friendly products is also driving the market for natural colorants. These products are derived from renewable sources and have lower environmental impact compared to synthetic colorants. Additionally, the increasing awareness of the potential health risks associated with some synthetic colorants, such as toxic elements and hazardous substances, is leading to the adoption of natural alternatives. In the textile industry, natural colorants are used to produce a wide range of colors and shades, while in the automotive industry, they are used to produce eco-friendly and sustainable coatings.

- In the building and construction industry, natural colorants are used in paints and coatings to provide a clean-label alternative to traditional solvent-borne and powder coatings. The market is expected to grow significantly during the forecast period, driven by the increasing demand for clean-label products and the adoption of natural and sustainable alternatives to synthetic colorants. This trend is expected to impact various industries, including food and beverages, cosmetics, textiles, paints and coatings, plastics, and building and construction.

What challenges does the Colorants Industry face during its growth?

High prices of colorants is a key challenge affecting the industry growth.

- Colorants, derived from natural sources or synthetically produced, play a crucial role in various industries including Food, Cosmetics, Textiles, Paints, and Plastics, to enhance visual appeal, identification, and differentiation. Natural colorants, extracted from trees, plant saps, flowers, fruits, and vegetable juices, face challenges due to their high production costs and complex extraction processes. Synthetic colorants, such as dyes, pigments, inks, and lakes, offer cost-effective alternatives, but come with potential hazardous substances and allergenic properties. Specialty colorants, used in advanced applications like cosmetics, food, and high-performance industrial coatings, are expensive due to their complex formulations and stringent regulatory requirements.

- Sustainable, eco-friendly, and renewable sources, as well as clean-label and green alternatives, are gaining popularity in response to consumer demand for safer and healthier products. The building and construction, automotive, paper and printing, and plastic industries also rely heavily on colorants, with waterborne, solvent-borne, powder, and rubber forms used extensively. The geriatric population and dual income households continue to fuel the demand for colorants in various consumer goods and industrial products.

Exclusive Customer Landscape

The colorants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the colorants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, colorants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ampacet Corp. - The company offers products such as Clean Icy Bright Cool effect Masterbatch Colorant in the colors of Mint Ice, Mint Whisper, Minty Frost, Citrus Ice, Citrus Whisper, Periwinkle Ice, and Periwinkle Whisper.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archroma Management

- Atul Ltd.

- Avient Corp.

- BASF SE

- Cabot

- ChromaScape LLC

- Clariant International Ltd.

- DIC Corp.

- Divis Laboratories Ltd.

- DuPont de Nemours Inc.

- DyStar Singapore Pte. Ltd.

- Flint Group

- Heubach GmbH

- Holland Colours NV

- Huntsman Corp.

- LyondellBasell Industries NV

- Solvay SA

- Sudarshan Chemical Industries Ltd.

- Vibrantz

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of industries, including food, cosmetics, textiles, paints, and plastics. These colorants serve various purposes, such as enhancing visual appeal, identification, and differentiation. The market consists of both natural and synthetic colorants, with each offering unique advantages and challenges. Natural colorants, derived from various sources like plants, minerals, and animals, have gained popularity due to their eco-friendliness and perceived health benefits. However, they often present challenges in terms of consistency, availability, and cost. Synthetic colorants, on the other hand, offer superior color stability, brightness, and affordability. Yet, they raise concerns regarding their chemical composition and potential allergenic properties, as well as the hazardous substances they may contain.

Further, the demand for sustainable and eco-friendly products has led to a growing trend towards the use of renewable sources for colorants. This includes the development of clean-label products and green alternatives, which appeal to consumers seeking healthier and more environmentally-friendly options. Additionally, the increasing awareness of toxic elements, such as cancer-causing agents, has driven the market towards the elimination of hazardous substances. The market caters to various industries, including paper and printing, building and construction, consumer goods, additives, and industrial products. In the food and beverages sector, colorants are used to enhance the visual appeal and identification of products.

In the cosmetics industry, they serve the same purpose while also contributing to differentiation and consumer preference. In the textile industry, colorants play a crucial role in the production of fabrics, while in the automotive sector, they are used for aesthetic purposes and to improve product identification. The paints and coatings industry utilizes both natural and synthetic colorants, with waterborne, solvent-borne, and powder varieties available. The rubber industry also relies on colorants for product differentiation and identification. The building and construction sector uses colorants for various applications, including architectural coatings, concrete, and masonry products. In the plastics industry, colorants are used to produce a wide range of products, from consumer goods to industrial applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market Growth 2025-2029 |

USD 32.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, China, India, Germany, Mexico, UK, Japan, Italy, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Colorants Market Research and Growth Report?

- CAGR of the Colorants industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the colorants market growth of industry companies

We can help! Our analysts can customize this colorants market research report to meet your requirements.