Commercial Aircraft Disassembly, Dismantling, And Recycling Market Size 2025-2029

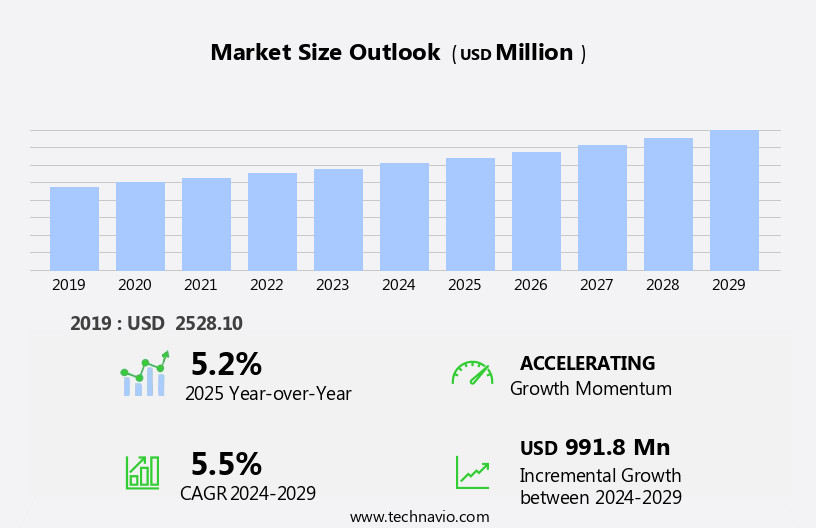

The commercial aircraft disassembly, dismantling, and recycling market size is forecast to increase by USD 991.8 million, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of aircraft retirements and the establishment of more recycling and dismantling facilities. Retirements of older aircraft, particularly from the fleets of major airlines, continue to fuel market expansion. Simultaneously, the growth of these facilities is enabling more efficient and cost-effective disassembly and recycling processes. However, challenges persist in this market. One major obstacle is the complex nature of aircraft recycling, which requires specialized expertise and infrastructure. The dismantling process involves the safe removal of hazardous materials, such as batteries and fuel, and the separation of valuable components for resale.

- These challenges necessitate substantial investments in technology and skilled labor, making it a capital-intensive industry. Despite these hurdles, companies that can navigate these challenges effectively stand to capitalize on the growing demand for aircraft disassembly and recycling services.

What will be the Size of the Commercial Aircraft Disassembly, Dismantling, And Recycling Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The commercial aircraft disassembly and recycling market continue to evolve, driven by the increasing demand for sustainable aviation practices and the continuous retirement of older aircraft. This dynamic industry encompasses various processes, including fuselage separation, fuel system removal, component reclamation, and material sorting for recycling. Aircraft disassembly involves intricate disassembly processes, such as engine core removal, avionics removal, and hydraulic system removal, to optimize material recovery. Recycling technologies, including composite recycling, energy recovery, and wing detachment, play a crucial role in maximizing the value of end-of-life aircraft. Plastic recycling and non-metallic recycling are essential components of the market, with inventory tracking and material valuation ensuring efficient and cost-effective operations.

Downtime minimization and regulatory compliance are essential considerations, with safety procedures and hazardous waste management integral to the disassembly process. The market is further characterized by the adoption of advanced technologies, such as AI-powered systems, to streamline processes and improve efficiency metrics. Workforce training and risk assessment are critical aspects of the industry, ensuring a skilled workforce and minimizing risks during the disassembly process. The recycling infrastructure continues to expand, with a focus on turnaround time, inventory management, and quality control to meet the evolving demands of the market. Regulatory compliance and environmental regulations are key drivers, with engine removal, spare part recovery, and tail section dismantling all contributing to the overall value proposition of the market.

How is this Commercial Aircraft Disassembly, Dismantling, And Recycling Industry segmented?

The commercial aircraft disassembly, dismantling, and recycling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Recycling

- Component management

- Disassembly and dismantling

- Aircraft storage

- Engine teardown

- Type

- Narrow body

- Wide body

- Regional jets

- Used Serviceable Materials

- Engines

- Landing Gear

- Avionics

- Recycling and Material Recovery

- Aluminum

- Titanium

- Composites

- Component Management

- Flight Controls

- Fuselage Sections

- Doors

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The recycling segment is estimated to witness significant growth during the forecast period.

The commercial aircraft disassembly and recycling market encompass the process of repurposing aircraft components and materials into new products. Aircraft recyclers disassemble end-of-life aircraft to recover valuable parts and materials. The Aircraft Fleet Recycling Association (AFRA) is a leading international organization dedicated to promoting sustainable and responsible practices in aircraft recycling. Key players in this sector include TARMAC Aerosave and China Aircraft Leasing Group Holdings. Sustainable and safe recycling practices are crucial in the commercial aviation industry, particularly in handling complex components like carbon fiber windows and wings. Downtime minimization, inventory tracking, and cost analysis are essential efficiency metrics for aircraft recyclers.

Process optimization and recycling technologies, such as composite recycling, energy recovery, and plastic recycling, are crucial for maximizing material value. Regulatory compliance, hazardous waste management, and risk assessment are integral parts of the recycling process. Safety procedures and environmental regulations are essential to ensure a harmonious and immersive work environment for the workforce. Disassembly processes, including engine core removal, avionics removal, fuel system removal, and material sorting, are optimized to minimize downtime and maximize material recovery. Aircraft decommissioning involves various disassembly processes, including airframe disassembly, tail section dismantling, landing gear removal, and component recycling. Ai-powered systems are increasingly used to streamline processes, improve quality control, and enhance inventory management.

The market for commercial aircraft recycling is continuously evolving, with a focus on innovative recycling technologies, part reuse, and material recovery.

The Recycling segment was valued at USD 679.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the high number of commercial aircraft retirements in the region. With major players such as Boeing Co., American Airlines Group, United Airlines Inc., and Bombardier Inc., based in North America, there is a substantial demand for commercial aircraft services. These companies are focusing on aircraft retirements to optimize their fleets and reduce downtime, leading to an increase in the need for disassembly, dismantling, and recycling services. The process involves various stages including fuselage separation, fuel system removal, component reclamation, and material recovery. Recycling technologies, such as composite recycling and energy recovery, are being employed to minimize waste and maximize material valuation.

Safety procedures and environmental regulations are strictly adhered to during the disassembly process. Material sorting and inventory tracking are essential for efficient cost analysis and efficiency metrics. Process optimization and airframe disassembly are crucial for minimizing downtime and ensuring quality control. Engine core removal, spare part recovery, hazardous waste management, and regulatory compliance are also critical aspects of the market. Recycling infrastructure is being developed to facilitate the disassembly process, including the removal of avionics, interior stripping, wing detachment, and landing gear removal. Component recycling, non-metallic recycling, and tail section dismantling are also important parts of the market.

AI-powered systems and data analytics are being integrated into the disassembly process to improve efficiency and risk assessment. The market is expected to continue growing as more commercial aircraft reach the end of their life cycle, with a focus on part reuse and engine removal. Workforce training and risk assessment are essential to ensure a safe and effective disassembly process.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The commercial aircraft disassembly and recycling market is a burgeoning industry that focuses on the end-of-life processing of retired commercial aircraft. This market encompasses various stages, including disassembly, dismantling, and recycling. Disassembly involves the systematic removal of components and systems from the aircraft, while dismantling entails the breaking down of larger parts into smaller ones for easier transportation. Recycling comes last, with materials being sorted, processed, and prepared for reuse or resale. Aircraft components, such as engines, landing gear, and avionics, hold significant value in this market. The disassembly process ensures the safe and efficient recovery of these valuable parts, reducing the environmental impact of aircraft retirement. The recycling market also presents opportunities for the repurposing of aircraft materials in various industries, including construction and manufacturing. This circular economy approach not only benefits the environment but also creates economic value from retired aircraft.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft Disassembly, Dismantling, And Recycling Industry?

- The significant rise in aircraft retirements serves as the primary catalyst for market growth in this industry.

- Commercial aircraft retirement is a significant process in the aviation industry, with approximately 12,000 aircraft anticipated to retire by 2028 due to age restrictions and fleet renewal needs. Timely retirement is crucial for aircraft operators, enabling the recovery of residual value from reusable parts and recycling of materials. The primary drivers for retirement are internal fleet planning, such as fleet expansion and replacement. Upon retirement, commercial aircraft undergo disassembly, a process that includes fuselage separation, fuel system removal, avionics removal, and component reclamation. This process is essential for supply chain management, ensuring the efficient flow of materials and minimizing downtime.

- Material valuation and data analytics play a significant role in the disassembly process. Material sorting and recovery are crucial steps to ensure the highest possible return on investment. Health and safety regulations are strictly adhered to throughout the disassembly process, ensuring the safety of workers and the environment. The commercial aircraft disassembly market is dynamic, with various stakeholders, including airlines, dismantlers, and material buyers, contributing to the value chain. The market pricing for reusable parts and recycled materials is influenced by various factors, including demand, supply, and market trends. In conclusion, the commercial aircraft disassembly process is an integral part of the aviation industry's circular economy.

- It allows for the efficient recovery of valuable materials and components, reducing waste and minimizing the environmental impact of aircraft retirement.

What are the market trends shaping the Commercial Aircraft Disassembly, Dismantling, And Recycling Industry?

- The increasing demand for aircraft recycling and dismantling facilities represents a significant market trend. This trend is driven by the growing need to manage the ever-increasing number of retired aircraft and to recover valuable materials and components for reuse.

- The commercial aircraft disassembly and recycling market are witnessing significant growth due to the increasing focus on process optimization and the adoption of advanced recycling technologies. Airframe disassembly is a crucial process in this industry, with companies employing innovative methods to maximize efficiency and minimize costs. Recycling technologies, such as composite recycling and energy recovery, are gaining popularity as they offer sustainable solutions for end-of-life aircraft. Wing detachment and interior stripping are essential steps in the disassembly process, with inventory tracking and cost analysis playing a vital role in ensuring efficiency metrics.

- Metal recycling and plastic recycling are key areas of focus, with companies investing in advanced technologies to recover valuable materials from dismantled aircraft. The aviation industry's shift towards more environmentally-friendly and cost-effective practices is driving the demand for these services, making the aircraft disassembly and recycling market an attractive proposition for investors and service providers alike.

What challenges does the Commercial Aircraft Disassembly, Dismantling, And Recycling Industry face during its growth?

- The growth of the aviation industry is significantly impacted by the complexities and challenges inherent in recycling aircraft.

- Commercial aircraft disassembly and recycling involve the process of removing valuable components, such as engines and spare parts, from retired aircraft for reuse or scrap metal value. This market encompasses various activities, including engine core removal, hazardous waste management, regulatory compliance, and workforce training. Engine cores are removed for repair or sale, while spare parts are recovered and resold. Hazardous waste management is crucial due to the presence of materials like hydraulic fluids, lubricants, and batteries. Regulatory compliance is essential to ensure the safe and environmentally sound disposal of these materials. Carbon fiber, a lightweight and fuel-efficient composite material used in aircraft manufacturing, poses unique challenges in recycling.

- It cannot be melted and reformed like other metals due to its complex structure. Additionally, some expensive alloys used in aircraft engines require specialized recycling facilities. The recycling infrastructure for commercial aircraft is continually evolving to address these challenges. Engine removal, hydraulic system removal, and electrical system removal are critical steps in the disassembly process. Risk assessment is essential to ensure the safety of workers and the environment during the disassembly process. The market for commercial aircraft disassembly, dismantling, and recycling is driven by the increasing demand for raw materials and the need to minimize waste.

- The reuse of parts is a significant aspect of this market, as it reduces the need for new production and lowers overall costs. The market also faces challenges related to the complexity of the recycling process and the need for specialized facilities and workforce training.

Exclusive Customer Landscape

The commercial aircraft disassembly, dismantling, and recycling market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft disassembly, dismantling, and recycling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft disassembly, dismantling, and recycling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A J Walter Aviation Ltd. - The company specializes in the commercial disassembly and recycling of aircraft, focusing on the production of spare parts for the aviation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A J Walter Aviation Ltd.

- AAR Corp.

- AerCap Holdings N.V.

- Aerocircular

- AerSale Corp.

- Air Salvage International Ltd.

- Aircraft End-of-Life Solutions BV

- Ascent Aviation Services

- Bombardier Inc.

- Carlyle Aviation Partners

- CAVU Aerospace Inc.

- China Aircraft Leasing Group Holdings Ltd.

- GA Telesis LLC

- HVF West LLC

- KLM UK Engineering Ltd.

- Magellan Aviation Group LLLP

- RBS Global Media Ltd.

- Tarmac Aerosave

- Vallair

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Disassembly, Dismantling, And Recycling Market

- In January 2024, Boeing and GE Aviation announced a strategic partnership to explore the recycling of aircraft components, focusing on the reuse of materials from retired Boeing commercial airplanes. This collaboration aimed to reduce waste, lower costs, and promote sustainability in the aviation industry (Boeing Press Release, 2024).

- In March 2024, Lufthansa Technik AG, a leading provider of maintenance, repair, and overhaul services, opened a new facility in the United States dedicated to the disassembly and recycling of aircraft. The new facility, located in Marion, Ohio, will create over 200 jobs and process up to 15 aircraft per year (Lufthansa Technik AG Press Release, 2024).

- In April 2025, United Technologies Corporation (UTC) completed the acquisition of Collins Aerospace, a leading supplier of technologically advanced aerospace and defense products. The acquisition expanded UTC's presence in the market, enabling the company to offer more comprehensive services to customers (UTC Press Release, 2025).

- In May 2025, the European Union passed the Circular Aviation Initiative, a regulatory framework aimed at promoting the circular economy in the aviation sector. The initiative includes incentives for airlines to recycle and reuse aircraft components, as well as requirements for improved end-of-life management strategies for aircraft (European Commission Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant activity as reverse logistics gains prominence in the aviation industry. Demolition techniques are evolving, focusing on waste reduction strategies such as part identification and component segregation. Demand forecasting and supply chain visibility are crucial for business planning, while data-driven decision making and strategic planning guide material characterization and circular economy initiatives. Environmental impact analysis is a key consideration, driving the adoption of sustainable practices and carbon footprint reduction. Heavy equipment and specialized tools are essential for efficient disassembly processes, while predictive modeling and inventory optimization streamline operations. Safety equipment and risk management are paramount in this complex and intricate process.

- Financial modeling, investment analysis, and treatment technologies are integral to the economic viability of the market. Circular economy principles and lifecycle assessment are shaping the future of the industry, with process automation and safety measures ensuring regulatory compliance. Market research and data-driven insights are essential for staying competitive, as the industry continues to evolve and adapt to the demands of a changing market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Disassembly, Dismantling, And Recycling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 991.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, Indonesia, Russia, Canada, UK, Germany, France, Brazil, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Disassembly, Dismantling, And Recycling Market Research and Growth Report?

- CAGR of the Commercial Aircraft Disassembly, Dismantling, And Recycling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft disassembly, dismantling, and recycling market growth of industry companies

We can help! Our analysts can customize this commercial aircraft disassembly, dismantling, and recycling market research report to meet your requirements.