Singapore Commercial Aircraft Market Size 2025-2029

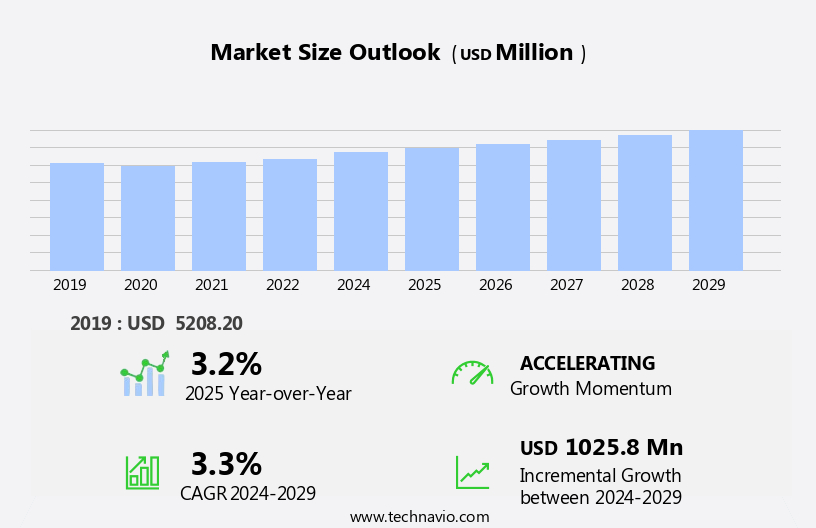

The Singapore commercial aircraft market size is forecast to increase by USD 1.03 billion, at a CAGR of 3.3% between 2024 and 2029.

- The commercial aircraft market is experiencing significant growth fueled by the burgeoning tourism industry and the increasing preference for low-cost carriers. The tourism sector's robust expansion drives a surging demand for air travel, leading to increased orders for commercial aircraft. Additionally, the emergence of low-cost carriers has made air travel more accessible and affordable, further expanding the market's reach. Another trend influencing the market is the adoption of additive manufacturing technologies to produce belt buckles, enabling customization and reducing production costs. However, the market faces a substantial challenge in the form of the time-consuming aircraft manufacturing process. This intricate and labor-intensive process can hinder market growth and increase production costs.

- Companies in the commercial aircraft industry must address this challenge by implementing innovative manufacturing solutions and optimizing their production processes to remain competitive. To capitalize on the market's opportunities and navigate challenges effectively, industry players should focus on improving efficiency, reducing production time, and collaborating with suppliers to streamline their operations. The market encompasses the production and supply of safety belts used in air travel.

What will be the size of the Singapore Commercial Aircraft Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic commercial aircraft market, cargo capacity and structural integrity are key focus areas for manufacturers. Advanced computational fluid dynamics and finite element analysis ensure optimal aerodynamic performance and maintain high safety standards. Quality assurance is ensured through rigorous technical documentation and flight testing. High-speed internet, digital twin technology, and software updates enhance the passenger experience. Safety regulations and emissions standards are stringently enforced, while aircraft financing options cater to various business models. Supersonic aircraft and unmanned aerial vehicles are emerging trends, pushing technological boundaries.

- Cabin pressurization, baggage security, and seat comfort are essential considerations for charter flights. Navigation systems, environmental control systems, and flight envelope analysis ensure efficient operations. Air traffic control, just-in-time manufacturing, and predictive analytics optimize fleet management. High-thrust engines, advanced materials, and noise levels are critical factors in aircraft design. Sustainable aviation fuels and aircraft liability insurance complete the landscape of this complex industry. Additionally, the integration of artificial intelligence and machine learning technologies in avionic systems is a key trend, aiming to improve system performance and reduce maintenance costs.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Aircraft Type

- Narrow-body aircraft

- Wide-body aircraft

- Regional aircraft

- Type

- Turbofan

- Turboprop

- Application

- Passenger aircraft

- Freighter

- Ownership

- Owned

- Leased

- Geography

- APAC

- Singapore

- APAC

By Aircraft Type Insights

The narrow-body aircraft segment is estimated to witness significant growth during the forecast period. Narrow-body aircraft remain the cornerstone of short to medium-haul flights, providing airlines with operational efficiency and flexibility. Singapore serves as a significant hub for Southeast Asian and international connectivity. The expansion of low-cost carriers (LCCs) fuels the demand for fuel-efficient narrow-body models, enabling them to optimize operating costs. Airlines invest in advanced technology, such as next-generation aircraft, which offer enhanced fuel efficiency, reduced emissions, and superior passenger comfort. Technological innovations, including hybrid propulsion systems and sustainable aviation fuels (SAFs), are revolutionizing the narrow-body aviation sector. Furthermore, the burgeoning e-commerce industry necessitates cost-effective cargo transport solutions, leading to the growing popularity of narrow-body freighters.

Airline operations, supply chain management, and air traffic management are undergoing digital transformation, with wi-fi access, avionics systems, and satellite communications playing crucial roles. Safety standards, spare parts, and aftermarket support are essential components of the industry, ensuring the continued reliability and maintenance of aircraft. Aircraft certification, structural analysis, and aircraft testing are integral parts of the design and manufacturing process, ensuring compliance with regulations and maintaining high safety standards. Freight carriers and regional jets also contribute significantly to the market, with electric propulsion and airborne radar systems enhancing their capabilities. The aviation industry continues to evolve, with a focus on fuel efficiency, cabin comfort, and sustainability initiatives, including carbon offset programs and biofuel development.

Production capacity, baggage handling, and aircraft maintenance are essential aspects of the industry's infrastructure, enabling seamless operations and enhancing the overall passenger experience. This market is driven by the aviation industry's commitment to passenger safety and evolving safety standards.

Get a glance at the market share of various segments Request Free Sample

The Narrow-body aircraft segment was valued at USD 3.31 billion in 2019 and showed a gradual increase during the forecast period.

The Commercial Aircraft Market in Singapore is thriving with advancements in technology and sustainable aviation solutions. The demand for twin-aisle aircraft and long-range aircraft continues to grow, catering to global travel needs, while short-haul aircraft remain essential for regional connectivity. Innovations in high-bypass turbofan engines and lightweight materials enhance engine performance and reduce fuel consumption. Smart communication systems and cockpit automation improve operational efficiency. Aircraft painting, assembly line, line maintenance, and heavy maintenance ensure fleet reliability. Cutting-edge artificial intelligence and machine learning optimize flight planning and cargo handling. This rise in international travel necessitates seamless airport operations, including flight information displays, biometric authentication, baggage carousels, lounge services, and airport logistics.

Emerging technologies like hydrogen propulsion, hybrid electric aircraft, and drone delivery signal a greener future. Singapore's focus on spacecraft technology, low-earth orbit, and satellite constellations strengthens aerospace capabilities, while innovations in on-demand entertainment, passenger boarding, aircraft evacuation, and flight data recorders enhance the passenger experience and safety standards. With evolving aircraft valuation, aircraft certification standards, supply chain optimization, and lean manufacturing, the region ensures efficient aircraft delivery schedules and comprehensive customer support for global and regional airlines. Airport infrastructure, including terminal operations, data analytics, and airport technology, has become essential for managing passenger satisfaction, safety protocols, and cost optimization.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft in Singapore Industry?

- The robust growth in the tourism sector serves as the primary catalyst for market expansion. The commercial aircraft market is experiencing significant growth due to increasing demand for air travel and the need for fleet expansion among airlines. Hypersonic flight technology is an emerging trend, with potential for faster and more efficient air travel, although FAA certification is a key challenge. Widebody aircraft continue to dominate the market, requiring intricate structural analysis during aircraft testing.

- Aircraft delivery and financing are crucial aspects of the industry, with general aviation also playing a role. The market is driven by the increasing number of passengers and the demand for connectivity, with Singapore serving as a prime example of a thriving global hub for tourism and business. Freight carriers also contribute to market growth, necessitating technology upgrades for improved safety standards and air traffic management. Spare parts, flight simulation, MRO services, and turbofan engines are essential components of the aftermarket support system.

What are the market trends shaping the Commercial Aircraft in Singapore Industry?

- The increasing preference for low-cost carriers represents a significant market trend in the aviation industry. This trend is driven by the growing demand for affordable air travel options among consumers. The commercial aircraft market is experiencing significant growth, driven by the increasing demand for fuel-efficient and cost-effective solutions. Low-cost carriers (LCCs) in the Asia-Pacific region are leading this trend, with their expansion shaping the aviation industry. These airlines prioritize narrowbody aircraft, such as regional jets, for short-haul routes due to their fuel efficiency and affordability.

- The digital transformation of the industry is further impacting the market, with a focus on material sourcing, quality control, emergency procedures, and digital cockpit solutions. Overall, the commercial aircraft market is dynamic and competitive, with LCCs leading the charge towards innovation and cost-effectiveness. Passengers seek safety, comfort, and convenience, leading to the integration of advanced technologies like airborne radar, flight control systems, and security systems. Carbon offset programs and emissions regulations are also influencing the market, driving the adoption of electric propulsion and composite materials.

What challenges does the Commercial Aircraft in Singapore Industry face during its growth?

- The time-consuming nature of aircraft manufacturing is a significant challenge that impedes industry growth. This intricate and labor-intensive process, which involves the assembly of various components, is a key factor limiting the expansion and profitability of the aviation sector. In the aerospace sector, commercial aircraft manufacturing continues to advance, driven by the need for increased production capacity and cabin comfort. EASA certification is a critical factor in ensuring safety and regulatory compliance. Airframe manufacturing is evolving with the integration of data analytics, which optimizes production processes and reduces costs. Sustainability initiatives, such as biofuel development and engine overhaul, are essential for reducing carbon emissions and preserving the environment. Air cargo logistics is a growing market, with the integration of in-flight connectivity enabling real-time tracking and monitoring. Air mobility, including private jets and urban air mobility, is expanding, offering new opportunities for manufacturers.

- The push for sustainability also extends to aircraft insurance, which is increasingly offering incentives for operators adopting eco-friendly practices. Baggage handling and aircraft maintenance are ongoing challenges, with manufacturers investing in advanced technologies to streamline processes and improve efficiency. Production capacity remains a critical concern, with manufacturers exploring new methods, such as modular manufacturing and outsourcing, to meet demand. The commercial aircraft market is dynamic, with technological advancements driving innovation while posing challenges for manufacturers. Balancing cost constraints with quality assurance and regulatory compliance is essential to remain competitive. The integration of data analytics, sustainability initiatives, and advanced manufacturing methods are key trends shaping the future of the industry.

Exclusive Customer Landscape

The commercial aircraft market in Singapore forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft market in Singapore report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft market in Singapore forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company specializes in the commercial aviation sector, providing aircraft solutions featuring the Airbus A380, A340, and A321 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- AMETEK Inc.

- Embraer SA

- General Dynamics Corp.

- RTX Corp.

- SATS Ltd.

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Market In Singapore

- In February 2023, Boeing announced the successful first test flight of its new 737 MAX 10, marking the entry of a larger variant into the 737 MAX family (Boeing, 2023). This expansion aims to cater to the growing demand for larger single-aisle aircraft in the commercial aviation sector.

- In May 2024, Airbus and Rolls-Royce signed a strategic partnership to develop and produce a new generation of sustainable aviation fuels (SAF) for their commercial aircraft (Airbus, 2024). This collaboration is a significant step towards reducing carbon emissions in the aviation industry and addressing environmental concerns.

- In October 2024, Embraer and Boeing finalized their merger, creating a new entity called Boeing Embraer Commercial Aviation (Boeing, 2024). This merger is expected to strengthen Boeing's position in the regional jet market and expand its product portfolio.

- In January 2025, the European Union Aviation Safety Agency (EASA) granted certification for the Airbus A321XLR, allowing the long-range version of the popular A321neo family to commence commercial operations (Airbus, 2025). This certification marks a major milestone in the commercial aviation sector, as the A321XLR offers extended range and improved fuel efficiency.

Research Analyst Overview

The commercial aircraft market continues to evolve, driven by dynamic market forces and technological advancements. Cabin comfort and passenger experience are paramount, leading to innovations in route optimization, aircraft assembly, and cabin interiors. Airborne surveillance and satellite communications enhance safety and efficiency, while crew training and passenger entertainment engage passengers. Autonomous flight and noise reduction are shaping the future of airline operations, with fuel efficiency and safety standards top priorities. Aircraft design and certification processes are undergoing digital transformation, enabling technology upgrades and FAA certification for widebody and narrowbody aircraft. Structural analysis and aircraft testing ensure safety and reliability, while aftermarket support and MRO services maintain fleet readiness.

Freight carriers and cargo transportation are capitalizing on technology advancements, including electric propulsion and hypersonic flight. Biofuel development and sustainability initiatives are crucial for reducing emissions and promoting eco-friendly practices. Air mobility and urban air mobility are emerging sectors, offering innovative solutions for transportation in various industries. Composite materials, emergency procedures, and emissions regulations are key considerations for aircraft manufacturers. Aircraft financing, leasing, and insurance cater to the diverse needs of the aviation industry, with general aviation and business aviation segments experiencing growth. Spare parts, flight simulation, and air traffic management optimize supply chain management and enhance operational efficiency.

In-flight connectivity, avionics systems, and digital transformation are transforming the passenger experience, with Wi-Fi access and avionics upgrades enhancing convenience and comfort. Seating configuration, flight control systems, and security systems ensure a safe and enjoyable journey for passengers. Continuous innovation and adaptation to market dynamics are essential for success in the commercial aircraft market. The evolving landscape offers opportunities for growth and collaboration across various sectors, from airframe manufacturing to air cargo logistics and beyond. Pushback tractors and catering trucks are essential components of ground handling services, ensuring the safe and timely movement of aircraft and the delivery of catering services.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Market in Singapore insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 1.03 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks, market research and growth, market growth and forecasting, Market forecasting, market report, market forecast |

What are the Key Data Covered in this Commercial Aircraft Market in Singapore Research and Growth Report?

- CAGR of the Commercial Aircraft in Singapore industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Singapore

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft market in Singapore growth of industry companies

We can help! Our analysts can customize this commercial aircraft market in Singapore research report to meet your requirements.