Competitive Intelligence Tools Market Size 2025-2029

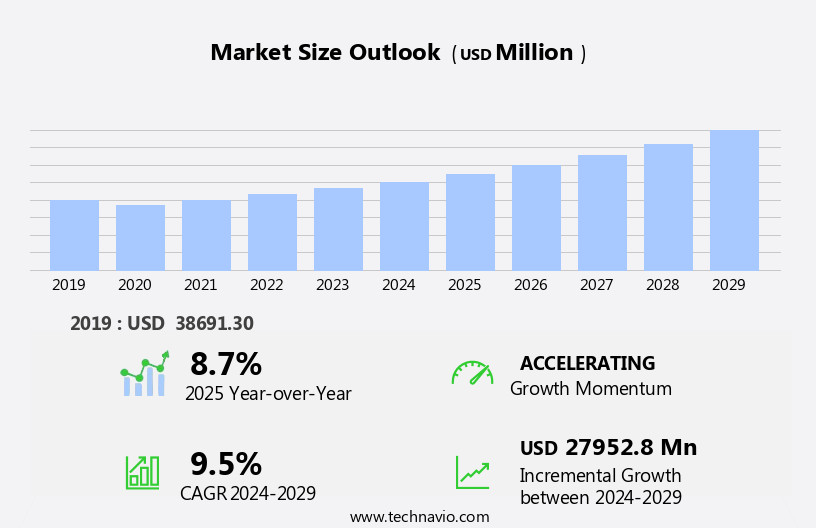

The competitive intelligence tools market size is forecast to increase by USD 27.95 billion, at a CAGR of 9.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the exponential increase in data and the rising adoption of smart connected devices. This data-intensive environment presents both opportunities and challenges for market participants. On the one hand, the abundance of data offers valuable insights for businesses looking to gain a competitive edge. On the other hand, data privacy and security concerns pose a significant obstacle. As companies increasingly rely on competitive intelligence tools to analyze market trends and customer behavior, ensuring the confidentiality and integrity of their data becomes paramount.

- Navigating this complex landscape requires a strategic approach, with a focus on advanced data security measures and robust data privacy policies. Companies that successfully address these challenges will be well-positioned to capitalize on the opportunities presented by the market's data-driven dynamics.

What will be the Size of the Competitive Intelligence Tools Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic nature of business environments and the constant need for insights to inform strategic decisions. Businesses across various sectors leverage these tools for data acquisition, market sizing, data mining, industry analysis, and competitive benchmarking. Industry experts and data scientists employ machine learning algorithms, natural language processing, and data analytics to extract valuable insights from proprietary databases and real-time data. Competitive landscape analysis, data visualization, and trend analysis help organizations understand their competitive position and anticipate market shifts. Data integration and product portfolio analysis enable effective business development and strategic planning.

Competitive intelligence consulting and social media monitoring provide valuable external perspectives and brand monitoring capabilities. Market research reports and analyst reports offer comprehensive industry insights, while patent analysis and sentiment analysis provide unique competitive intelligence. Data security remains a critical concern, with ongoing advancements in data governance and data security solutions. Industry conferences and competitive intelligence platforms facilitate knowledge sharing and networking opportunities. The market for competitive intelligence tools is continually unfolding, with new applications and technologies emerging to meet the evolving needs of businesses. Data subscription services and sales forecasting solutions offer valuable insights to organizations, enabling them to stay informed and adapt to market changes.

The integration of various data sources and advanced analytics techniques continues to enhance the value of competitive intelligence tools, making them indispensable for businesses seeking a competitive edge.

How is this Competitive Intelligence Tools Industry segmented?

The competitive intelligence tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud-based

- On-premises

- Distribution Channel

- Large enterprises

- SMEs

- End-user

- IT and telecom

- Healthcare

- Retail

- Financial services

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

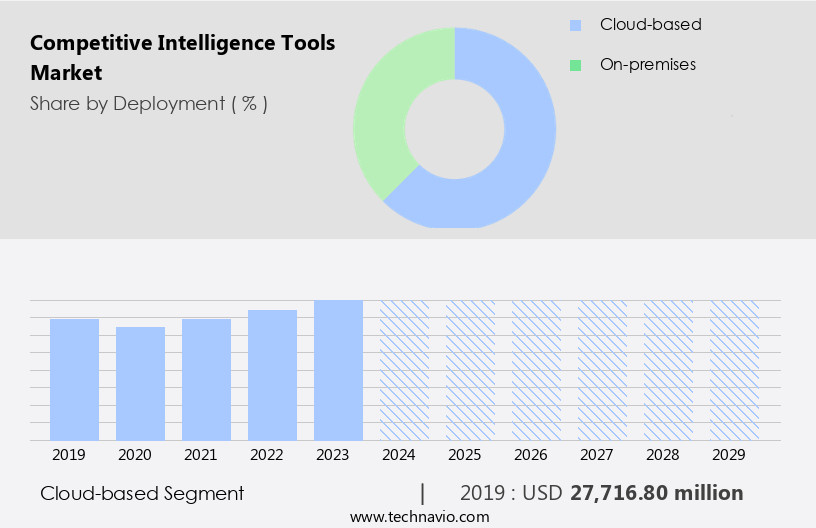

The cloud-based segment is estimated to witness significant growth during the forecast period.

In today's business landscape, cloud-based competitive intelligence tools are gaining significant traction as organizations seek to reduce hardware expenses and minimize in-house storage requirements. These solutions, which include software as a service (SaaS) and subscription-based offerings, are increasingly popular. For instance, in October 2024, EY (Ernst and Young) introduced a new cloud-based competitive intelligence platform, EY Competitive Edge, that utilizes generative AI (GenAI) technologies and is built on Microsoft Azure. This platform provides real-time, customized insights on industries, companies, and sectors, contributing to the expansion of the cloud-based segment within The market. Data-driven decision-making is a key priority for businesses, leading to a heightened demand for advanced analytics capabilities.

Machine learning algorithms, natural language processing, and data mining are integral components of these tools, enabling trend analysis, sentiment analysis, and customer segmentation. Moreover, data visualization and real-time data capabilities offer businesses actionable insights, allowing them to adapt quickly to market changes. Competitive landscape analysis, industry analysis, and competitive benchmarking are essential elements of competitive intelligence. Proprietary databases and market research reports provide valuable industry insights, while data governance ensures data security and compliance. Business development teams and strategic planning departments rely on these tools to gain a competitive edge and make informed decisions. Competitive intelligence teams leverage these tools to monitor competitors, analyze brand reputation, and conduct patent analysis.

Social media monitoring and web scraping are also essential components, enabling businesses to stay updated on industry trends and competitors' activities. Industry experts and analyst reports offer additional insights, adding depth to the competitive intelligence process. Data acquisition and data integration are crucial aspects of these tools, ensuring seamless data flow and compatibility. Data scientists play a vital role in extracting meaningful insights from the data, making data analytics and trend analysis possible. Overall, the market is evolving rapidly, with a focus on advanced analytics, cloud-based solutions, and real-time data capabilities.

The Cloud-based segment was valued at USD 27.72 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

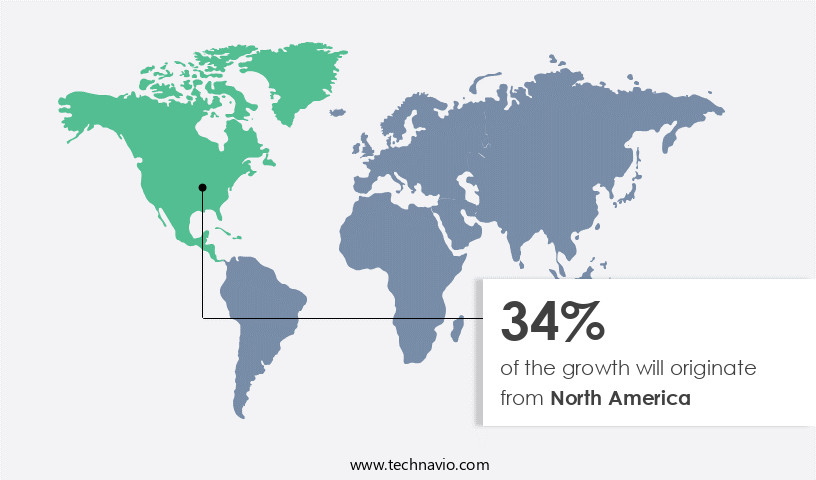

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US business landscape is witnessing a significant surge in the adoption of competitive intelligence tools. The digitalization trend in the country is driving this demand, with more companies leveraging cloud services to enhance their IT infrastructure. Approximately two-thirds of new jobs in the private sector are held by small- and medium-sized businesses (SMEs), making it essential for them to stay competitive. As a result, the use of competitive intelligence tools is increasingly prevalent in these organizations. Machine learning algorithms, data analytics, data visualization, and data security are some of the key features that businesses seek in these tools.

Proprietary databases, industry experts, and real-time data are also crucial elements that companies look for to gain a competitive edge. Industry conferences, market research reports, and data subscription services provide valuable insights, while natural language processing and sentiment analysis help businesses understand their competitors and customers better. Competitive landscape analysis, product portfolio analysis, brand monitoring, competitive benchmarking, and data integration are other essential functions of competitive intelligence tools. Data scientists and trend analysts use these tools to analyze customer segmentation, market sizing, data mining, and patent analysis. Social media monitoring and web scraping are additional features that enable businesses to stay informed about industry developments and competitors' activities.

Microsoft's introduction of a cloud-based competitive intelligence suite during its Ignite conference in November 2024 is a testament to the growing importance of these tools. As more businesses adopt cloud systems, the demand for competitive intelligence tools is expected to soar. The ability to access data and insights in real-time, coupled with advanced analytics capabilities, makes these tools indispensable for businesses looking to stay competitive in today's dynamic marketplace.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Competitive Intelligence Tools Industry?

- The exponential growth of data is the primary factor fueling market expansion.

- In today's data-driven business landscape, managing and analyzing large volumes of data from various sources has become a significant challenge for organizations. The increasing variety, volume, and velocity of data, collectively known as the 3Vs, require efficient handling and analysis to extract valuable insights. Furthermore, veracity, the fourth component in big data management systems, is essential to eliminate irrelevant data that can result in incorrect information, such as consumer behavior and buying patterns. Competitive intelligence tools provide a solution to this problem by transforming unstructured and semi-structured data into structured and meaningful information. These tools employ advanced technologies like machine learning algorithms, natural language processing, and data analytics to extract valuable insights from data.

- Moreover, data visualization and data security features ensure the accurate and precise data is presented in an easily understandable format and protected from unauthorized access. Industry conferences and market research reports are valuable resources for staying updated on the latest trends and developments in competitive intelligence platforms. These platforms offer proprietary databases, enabling organizations to access relevant and up-to-date information on their competitors, customers, and industry trends. By utilizing these tools, businesses can make informed decisions, gain a competitive edge, and ultimately drive growth. Data security is a critical aspect of competitive intelligence, ensuring sensitive information is protected from unauthorized access.

- With the increasing importance of data security, these tools employ robust security measures to protect the data from cyber threats and data breaches. In conclusion, competitive intelligence tools are an essential investment for businesses seeking to gain a competitive edge in today's data-driven business environment.

What are the market trends shaping the Competitive Intelligence Tools Industry?

- The increasing prevalence of smart, connected devices represents a significant market trend. This trend is driven by the growing adoption of advanced technology in everyday consumer products.

- In today's business landscape, the proliferation of intelligently connected devices worldwide is a significant trend. By 2025, it is anticipated that approximately 21 billion smart gadgets will be installed globally. Managing and monitoring the data generated from these devices can be a daunting task for organizations. To address this challenge, competitive intelligence tools have emerged as essential solutions. These tools facilitate machine-to-machine and machine-to-human interactions, enabling efficient monitoring and management of physical assets across various industries. Competitive intelligence tools employ data acquisition techniques from technologies such as radio-frequency identification (RFID), sensors, barcodes, and the global positioning system (GPS) for business analytics.

- Data mining, market sizing, product portfolio analysis, brand monitoring, competitive benchmarking, and data integration are some of the key functionalities of these tools. Industry experts leverage these features to gain valuable insights and maintain a competitive edge. Data integration is crucial for businesses to derive meaningful insights from the vast amounts of data generated by their devices. Competitive intelligence consulting services further enhance the value of these tools by providing expert analysis and strategic recommendations. By harnessing the power of competitive intelligence tools, organizations can make informed decisions, optimize operations, and ultimately, improve their bottom line.

What challenges does the Competitive Intelligence Tools Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, necessitating robust measures to protect sensitive information and maintain trust with customers.

- In today's business landscape, competitive intelligence tools play a pivotal role in helping organizations stay informed and agile. These tools encompass various functionalities such as social media monitoring, patent analysis, sentiment analysis, trend analysis, and customer segmentation. Data scientists leverage real-time data from these tools to gain insights and make informed decisions. Social media monitoring allows businesses to track mentions of their brand, competitors, and industry trends. Patent analysis provides valuable information on competitors' intellectual property, while sentiment analysis helps gauge public perception. Trend analysis offers insights into market shifts and consumer behavior. Customer segmentation enables businesses to target their marketing efforts more effectively.

- Analyst reports and web scraping are additional features that provide valuable industry insights and competitive intelligence. Sentiment analysis, for instance, uses natural language processing and machine learning algorithms to identify and extract subjective information from text data, helping businesses understand customer opinions and emotions. Despite the benefits, concerns around data security and privacy persist. Enterprises, particularly those in highly regulated industries, require robust security measures to protect their sensitive data. Private clouds offer a more secure storage solution compared to public clouds, as they provide greater control over data security policies. In conclusion, competitive intelligence tools offer valuable insights that can help businesses stay ahead of the competition.

- By incorporating functionalities such as social media monitoring, patent analysis, sentiment analysis, trend analysis, customer segmentation, and data security, businesses can make informed decisions, improve customer engagement, and enhance overall performance.

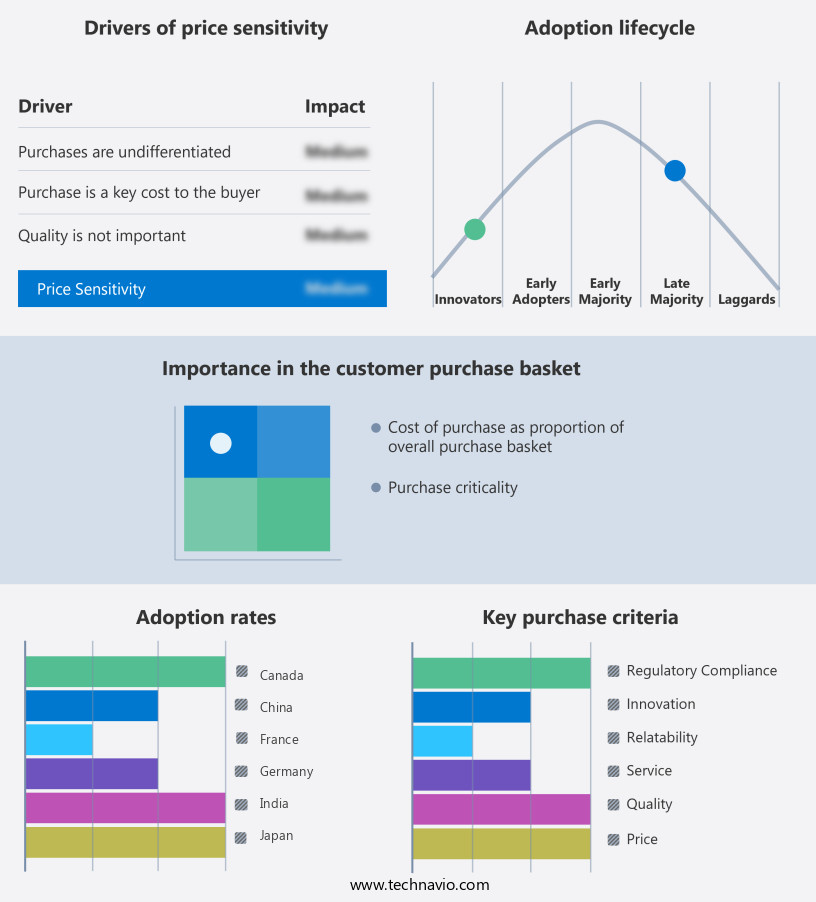

Exclusive Customer Landscape

The competitive intelligence tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the competitive intelligence tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, competitive intelligence tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adthena Ltd. - This company specializes in providing competitive intelligence solutions for search marketing optimization. Our offerings include comprehensive paid search visibility analysis, in-depth competitor benchmarking, and robust brand protection services. By leveraging advanced data analytics and proprietary algorithms, we empower businesses to make informed decisions, enhance online presence, and safeguard their brand reputation. Our solutions enable users to monitor industry trends, identify opportunities, and stay ahead of competitors, ultimately driving business growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adthena Ltd.

- Brandwatch

- BuzzSumo Ltd.

- CI Radar LLC

- Clootrack Software Labs Pvt. Ltd.

- Comintelli AB

- Crayon Inc.

- Crunchbase Inc.

- Digimind

- Evalueserve Inc.

- G2.com Inc.

- Klue Labs Inc.

- Meltwater NV

- NetBase Solutions Inc.

- Pathmatics Inc.

- Semrush Holdings Inc.

- Slintel LLC

- SpyFu

- Talkwalker Sarl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Competitive Intelligence Tools Market

- In January 2024, IBM announced the acquisition of HCL Technologies' competitive intelligence business, including its AI-powered platform, for an undisclosed sum. This acquisition aimed to strengthen IBM's position in the competitive intelligence market and enhance its AI capabilities (IBM Press Release, 2024).

- In March 2024, SAS and S&P Global Market Intelligence formed a strategic partnership to integrate SAS' advanced analytics capabilities with S&P's market intelligence data. This collaboration enabled clients to gain more comprehensive insights and make data-driven decisions (SAS Press Release, 2024).

- In May 2024, Clarabridge, a leading competitive intelligence solutions provider, secured a USD30 million series C funding round led by Insight Partners. The investment was earmarked for product development, sales, and marketing efforts to expand Clarabridge's presence in the competitive intelligence market (Clarabridge Press Release, 2024).

- In February 2025, Cognizant and SAP announced a strategic partnership to integrate Cognizant's competitive intelligence services with SAP's market intelligence offerings. This collaboration aimed to provide clients with a more comprehensive and integrated solution for their competitive intelligence needs (Cognizant Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant growth as businesses increasingly rely on data-driven decision making to gain a competitive edge. Market entry strategies and sales optimization are key areas where these tools are making an impact, enabling companies to forecast technology trends and identify competitive threats. AI-powered competitive intelligence and business intelligence software are driving innovation adoption and competitive differentiation, while strategic partnerships and knowledge management are essential for strategic decision support. Market opportunity assessment and market research software provide valuable insights for product development strategies, risk mitigation, and business process optimization. Disruptive technologies, such as predictive analytics and big data analysis, are transforming the technology landscape and market share growth.

- Information retrieval systems and customer relationship management are also critical components of competitive intelligence, ensuring businesses stay informed and connected with their customers. Overall, the market for competitive intelligence tools is dynamic and evolving, with a focus on innovation analysis and strategic decision making.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Competitive Intelligence Tools Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 27952.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.7 |

|

Key countries |

US, China, Germany, UK, India, Canada, Japan, France, South Korea, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Competitive Intelligence Tools Market Research and Growth Report?

- CAGR of the Competitive Intelligence Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the competitive intelligence tools market growth of industry companies

We can help! Our analysts can customize this competitive intelligence tools market research report to meet your requirements.