Concentrating Solar Collectors Market Size 2026-2030

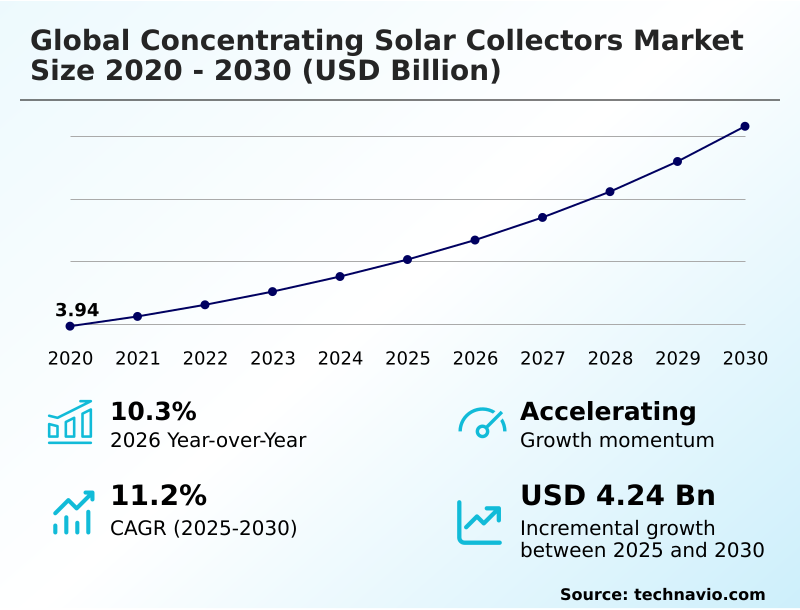

The concentrating solar collectors market size is valued to increase by USD 4.24 billion, at a CAGR of 11.2% from 2025 to 2030. Rising utility-scale solar thermal deployment for dispatchable renewable power will drive the concentrating solar collectors market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 46.3% growth during the forecast period.

- By End-user - Industrial segment was valued at USD 2.57 billion in 2024

- By Type - Parabolic trough segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 6.36 billion

- Market Future Opportunities: USD 4.24 billion

- CAGR from 2025 to 2030 : 11.2%

Market Summary

- The concentrating solar collectors market is expanding as the global energy transition prioritizes dispatchable renewable power sources capable of ensuring grid stability. This technology, particularly systems incorporating thermal energy storage, provides a reliable alternative to intermittent renewables by delivering consistent power.

- A key market trend is the diversification of applications beyond electricity generation into industrial process heat, where high-temperature heat is essential for sectors like chemicals and mining. For instance, a manufacturing facility can integrate concentrating solar collectors to produce steam for its operations, reducing reliance on fossil fuels and mitigating exposure to volatile energy prices and carbon taxes.

- However, the market's momentum is constrained by significant challenges, including the high upfront capital investment needed for large-scale projects and long project payback periods. Furthermore, the technology faces intense competition from the falling costs of solar photovoltaics and battery storage, which presents a difficult financial hurdle for project developers and investors to overcome.

What will be the Size of the Concentrating Solar Collectors Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Concentrating Solar Collectors Market Segmented?

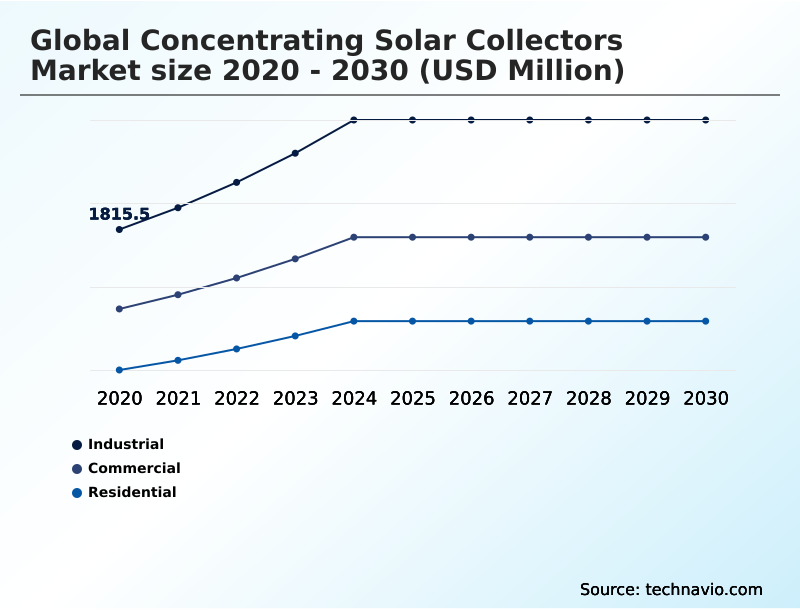

The concentrating solar collectors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Type

- Parabolic trough

- Linear fresnel

- Others

- Technology

- Single-axis tracking systems

- Fixed tilt systems

- Dual-axis tracking systems

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Canada

- Mexico

- Europe

- Spain

- Italy

- France

- South America

- Brazil

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of World (ROW)

- APAC

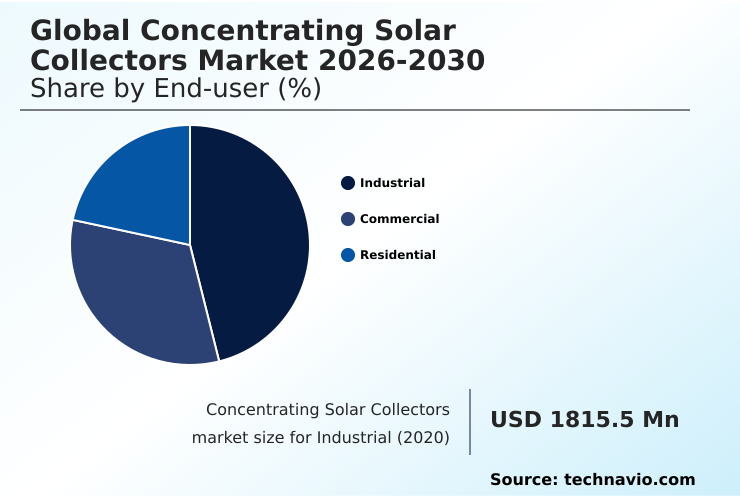

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The industrial segment is a critical growth area, driven by the demand for high-temperature heat solutions for applications like industrial process heat and green hydrogen production.

This sector leverages advanced thermal energy storage and parabolic trough systems to secure dispatchable renewable power, aligning with corporate sustainability goals.

As carbon pricing mechanisms expand, adopting low-carbon heat solutions becomes a strategic imperative for manufacturers to meet renewable energy targets. The push for thermal detoxification and enhanced energy independence supports investment in this solar thermal technology.

One key region spearheading this industrial adoption accounts for over 46% of the market's incremental growth, underscoring the geographic concentration of demand and fulfillment of clean energy goals.

The Industrial segment was valued at USD 2.57 billion in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46.3% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Concentrating Solar Collectors Market Demand is Rising in APAC Request Free Sample

The geographic landscape is primarily defined by direct normal irradiance levels, with regions offering high solar resources leading development.

APAC is a dominant force, projected to contribute nearly 47% of the market's growth, driven by ambitious renewable energy infrastructure programs aimed at reaching peak carbon emissions.

In these areas, large-scale concentrated solar power plants featuring vast solar field installations of heliostats and receiver tube systems are common. These projects often integrate molten salt for thermal storage, ensuring grid connection and the supply of high-temperature heat generation.

The development of a robust solar manufacturing ecosystem further supports this expansion, facilitating the production of components for renewable power generation and solidifying the region's central role in the industry's future.

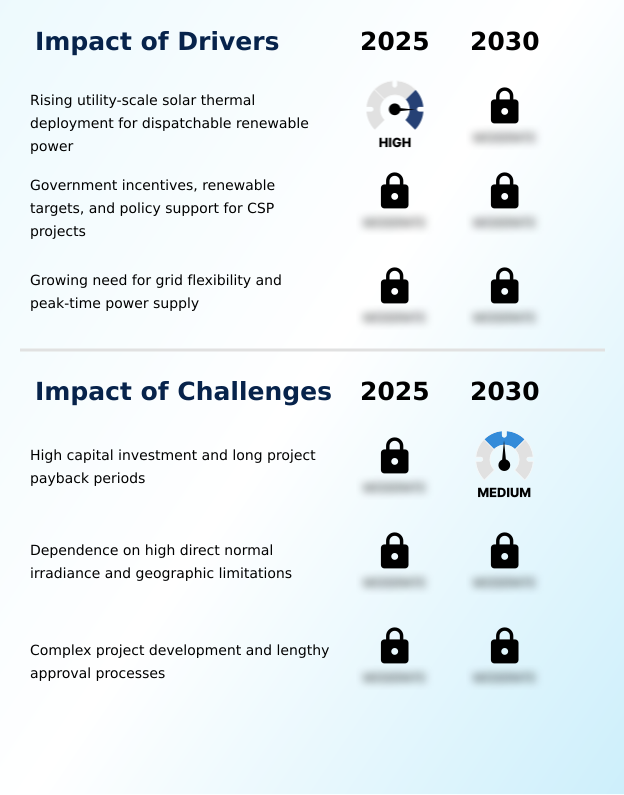

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic decisions in the concentrating solar collectors market are increasingly complex, weighing the benefits of solar thermal energy against operational hurdles. A key consideration is the growing viability of concentrating solar for industrial heat, which diversifies revenue beyond electricity sales. When evaluating technologies, the parabolic trough vs linear fresnel debate continues, with choices depending on project scale and cost targets.

- The integration of CSP with thermal energy storage is becoming standard for ensuring dispatchable power from solar thermal, a critical factor for grid integration of CSP plants. This capability is particularly vital for high-DNI concentrating solar projects, where maximizing output is paramount.

- Applications are also expanding, with significant interest in the solar thermal for desalination process and the potential for CSP for green hydrogen production. However, challenges in CSP plant operation, such as water consumption in CSP plants, require innovative solutions.

- The future of concentrating solar power will depend on reducing the levelized cost of electricity for CSP, which remains higher than some alternatives. Optimizing tracking systems for solar collectors and developing viable CSP project financing models are crucial for improving concentrating solar collector efficiency and market competitiveness.

- Other emerging areas include hybrid CSP-PV plant design and solar thermal district heating systems, which reflect the broadening industrial applications of solar thermal and the continuous innovation in molten salt technology in CSP.

What are the key market drivers leading to the rise in the adoption of Concentrating Solar Collectors Industry?

- The growing deployment of utility-scale solar thermal systems for generating dispatchable renewable power serves as a primary driver for market expansion.

- The primary market driver is the critical need for dispatchable power to ensure grid stability and energy security, a demand that utility-scale solar thermal plants are uniquely positioned to meet.

- Large-scale solar thermal plants equipped with molten salt storage systems can provide continuous electricity for over eight hours after sunset, a capability that intermittent renewables lack.

- This feature enhances grid flexibility and supports reliable power delivery, with advanced thermal systems achieving over 99% operational uptime.

- The deployment of solar power tower projects using molten salt receiver technology in regions with high direct solar irradiation is accelerating, driven by government policies promoting dispatchable power generation.

- This focus on utility-scale CSP projects is central to expanding the role of solar thermal in the global energy mix.

What are the market trends shaping the Concentrating Solar Collectors Industry?

- The increasing utilization of concentrating solar collectors for industrial process heat applications is a significant emerging trend. This development addresses the industrial sector's need for reliable, low-carbon thermal energy solutions.

- An emergent trend is the expanded use of concentrating solar technologies for industrial process heat applications, moving beyond traditional power generation. Industries are adopting these systems as renewable heat sources to achieve decarbonization commitments, with some pilot projects demonstrating a reduction in fossil fuel reliance by over 50%.

- This shift leverages concentrating solar collectors' ability to deliver consistent, high-temperature thermal energy, which is essential for sectors like mining and chemicals. Deployments of linear fresnel and solar air heating systems are increasing, valued for their efficient thermal absorption.

- This trend is creating new opportunities for csp project development and strengthening the solar value chain, supported by long-term power purchase agreements that secure project financing and promote sustainable fuel production.

What challenges does the Concentrating Solar Collectors Industry face during its growth?

- High capital investment requirements and extended project payback periods present a key challenge that can impede the market's growth trajectory.

- A significant challenge remains the high capital investment required for concentrated solar power projects, which directly impacts the levelized cost of electricity. Upfront costs for concentrated solar thermal systems can be more than double those of solar photovoltaic installations, creating substantial financial hurdles and extending payback periods.

- This cost disparity complicates efforts to secure financing, especially when competing with cheaper alternatives. While solar thermal solutions offer unique benefits, the solar thermal energy market must innovate to lower costs. The industry faces pressure from the rapid price declines in hybrid renewable portfolios combining PV with battery storage.

- Consequently, developers are exploring water-efficient and dry cooling technologies to improve project economics and compete effectively under renewable portfolio standards.

Exclusive Technavio Analysis on Customer Landscape

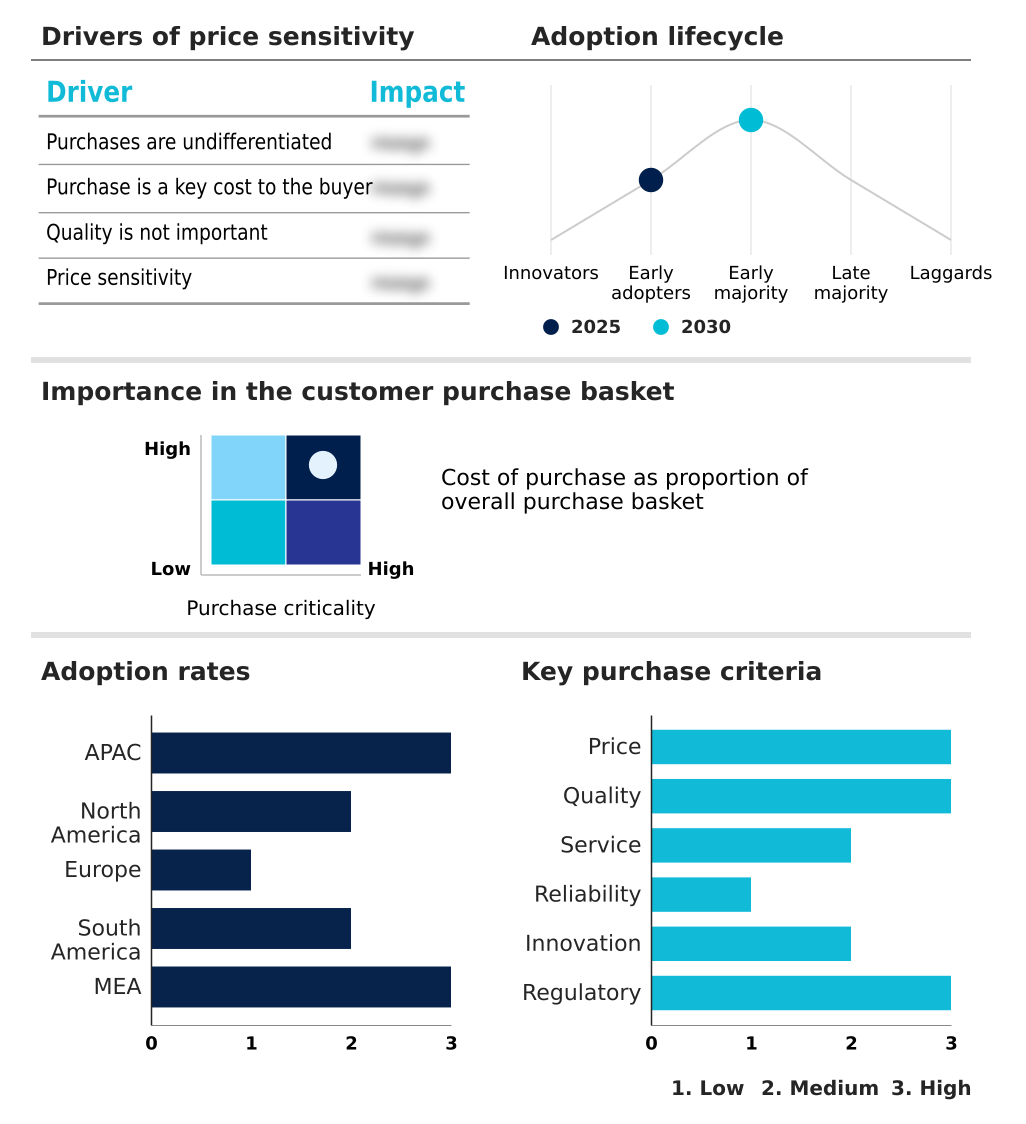

The concentrating solar collectors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the concentrating solar collectors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Concentrating Solar Collectors Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, concentrating solar collectors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ariston Holding NV - Offerings center on high-performance flat plate, evacuated tube, and concentrating solar collector systems designed for residential, commercial, and industrial thermal applications, including space heating and hot water production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ariston Holding NV

- Canadian Solar Inc.

- Conserval Engineering Inc.

- DIMAS SA

- Grammer Solar

- GREENoneTEC Solarindustrie

- Himin Solar Co. Ltd.

- Kingspan Group Plc

- Nobel International EAD

- Ritter Energiem

- Sharp Corp.

- Sunrain Group Co. Ltd

- Sunshore Solar Energy Co Ltd

- Trina Solar Co. Ltd.

- Viessmann Climate Solutions

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Concentrating solar collectors market

- In March, 2025, the Xinjiang Tower Concentrated Solar Power project in China successfully passed a critical pre-commissioning hydraulic pressure test for its thermal system, marking a major milestone toward grid connection and commissioning.

- In April, 2025, Vast Renewables' South Australia Solar Fuels project received USD 470,000 in funding through the Australia-Singapore Low Emissions Technologies initiative to advance the production of green methanol for decarbonizing the shipping sector.

- In May, 2025, the Dubai Electricity and Water Authority announced that its Mohammed bin Rashid Al Maktoum Solar Park set a new world record for operating the highest-capacity single-operator concentrated solar power plant at 700 megawatts.

- In April, 2025, TotalEnergies and the Oman Convention and Exhibition Centre commissioned a landmark rooftop solar PV project in Muscat, which is now operational and supplies approximately 25% of the venue's electricity needs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Concentrating Solar Collectors Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 283 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 11.2% |

| Market growth 2026-2030 | USD 4237.8 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 10.3% |

| Key countries | China, India, Japan, South Korea, Australia, Indonesia, US, Canada, Mexico, Spain, Italy, France, Germany, Portugal, The Netherlands, Brazil, Chile, Argentina, South Africa, Saudi Arabia, UAE, Egypt and Morocco |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The concentrating solar collectors market is defined by a continuous push toward improving the levelized cost of electricity and ensuring grid stability. Core technologies such as parabolic trough and linear fresnel systems, enhanced with single-axis tracking or dual-axis tracking, remain central to utility-scale solar thermal projects.

- The strategic integration of thermal energy storage, often using molten salt in a dedicated thermal system, enables the delivery of dispatchable power, a key advantage over other renewables. This is achieved in a solar power tower or a solar field of heliostats, which concentrate energy onto a receiver tube containing heat transfer fluid.

- One operational project successfully generates 25% of its host facility's energy needs, demonstrating viability. The market is also expanding into industrial process heat and process heat applications like thermal detoxification and green hydrogen production.

- Advances in flat plate collectors and evacuated tube systems support these efforts, while deployments in areas with high direct solar irradiation, such as gobi desert land, underscore the importance of geography for achieving grid connection and peak-time power supply within hybrid renewable portfolios.

What are the Key Data Covered in this Concentrating Solar Collectors Market Research and Growth Report?

-

What is the expected growth of the Concentrating Solar Collectors Market between 2026 and 2030?

-

USD 4.24 billion, at a CAGR of 11.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Industrial, Commercial, and Residential), Type (Parabolic trough, Linear fresnel, and Others), Technology (Single-axis tracking systems, Fixed tilt systems, and Dual-axis tracking systems) and Geography (APAC, North America, Europe, South America, Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising utility-scale solar thermal deployment for dispatchable renewable power, High capital investment and long project payback periods

-

-

Who are the major players in the Concentrating Solar Collectors Market?

-

Ariston Holding NV, Canadian Solar Inc., Conserval Engineering Inc., DIMAS SA, Grammer Solar, GREENoneTEC Solarindustrie, Himin Solar Co. Ltd., Kingspan Group Plc, Nobel International EAD, Ritter Energiem, Sharp Corp., Sunrain Group Co. Ltd, Sunshore Solar Energy Co Ltd, Trina Solar Co. Ltd. and Viessmann Climate Solutions

-

Market Research Insights

- Market dynamics are increasingly shaped by the pursuit of dispatchable power generation and energy security, which favors concentrating solar technologies. The performance of these systems is influenced by regional factors, with certain geographic areas contributing over 45% of incremental growth, a rate almost double that of other key regions.

- This disparity highlights the importance of local policy support and climate conditions. In project bidding environments, price sensitivity remains a high-impact factor for buyers, influencing technology selection and vendor negotiations.

- At the same time, the integration of advanced thermal energy storage can improve project viability, enabling facilities to supply power for over eight hours post-sunset and enhancing their value proposition for grid operators.

We can help! Our analysts can customize this concentrating solar collectors market research report to meet your requirements.