Concrete Pump Market Size 2025-2029

The concrete pump market size is valued to increase by USD 1.61 billion, at a CAGR of 6.7% from 2024 to 2029. Rapid urbanization and infrastructure development will drive the concrete pump market.

Major Market Trends & Insights

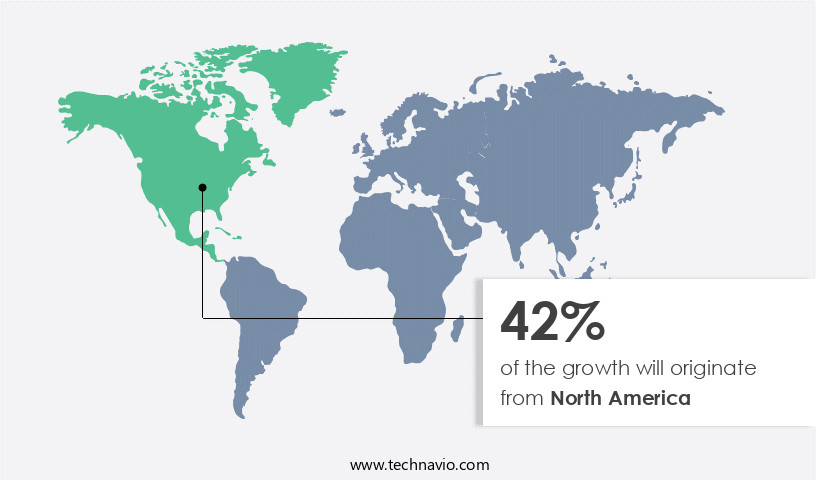

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By End-user - Commercial segment was valued at USD 1.22 billion in 2023

- By Product - Stationary segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 77.21 million

- Market Future Opportunities: USD 1611.00 million

- CAGR from 2024 to 2029 : 6.7%

Market Summary

- The market is experiencing significant growth due to the global trend of rapid urbanization and infrastructure development. This demand is driven by the construction industry's need for efficient and cost-effective methods to transport concrete admixture to various project sites. One notable trend in the market is the shift towards electric and emission-free concrete pumps, which aligns with the growing emphasis on sustainability and environmental concerns. However, challenges persist, such as the risk of blockages in the concrete pumping process, which can lead to costly downtime and delays. For instance, a construction company may invest in implementing advanced technologies to optimize its concrete pumping supply chain.

- By integrating real-time monitoring systems and Predictive Analytics, the company can identify potential blockages before they occur, reducing downtime and improving operational efficiency. This proactive approach can lead to substantial cost savings and improved project timelines. According to recent research, implementing such technologies can result in a 15% reduction in concrete pump downtime, translating to significant time and cost savings for construction projects.

What will be the Size of the Concrete Pump Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Concrete Pump Market Segmented ?

The concrete pump industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Industrial

- Residential

- Product

- Stationary

- Specialized

- Truck-mounted

- Type

- Medium scale

- Small scale

- Large scale

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the construction industry's ongoing need for efficient, precise, and safe concrete delivery solutions. Commercial projects, such as high-rise office towers, shopping malls, hotels, airports, and healthcare facilities, demand high-capacity concrete pumps to ensure structural integrity and minimize operational downtime. These projects often involve large volumes of concrete, making pumping efficiency metrics, such as flow rate optimization and air entrainment reduction, crucial. Truck-mounted, stationary, and specialized concrete pumps cater to commercial-scale applications, with stationary pumps featuring vertical pumping capabilities enabling delivery to significant heights. Environmental concerns have led to the adoption of cleaning procedures and repair procedures using abrasion-resistant materials, noise reduction, and vibration dampening systems.

Hydraulic system components and hose assembly procedures are essential for wear and tear prevention and maintenance scheduling. Safety protocols, sealing mechanisms, and power consumption are critical factors in pumping efficiency. For instance, a well-maintained pump can reduce operational downtime by up to 30%. Remote control systems, troubleshooting guides, and pumping pressure limits are essential features for effective pump operation. Component replacement, reciprocating pump design, and concrete delivery speed are also vital considerations. Pipeline cleaning techniques and discharge pressure regulation are essential for maintaining pipeline design parameters and ensuring concrete viscosity effects do not impact valve operation. Concrete placement methods and pipeline design parameters are continually evolving to optimize material handling processes and fuel efficiency.

Overall, the market's ongoing advancements reflect the industry's commitment to improving pumping technology, enhancing operational efficiency, and ensuring safety and sustainability.

The Commercial segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Concrete Pump Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth due to substantial investments in public infrastructure and residential construction. In 2023, total construction spending in the United States reached an impressive USD1.6 trillion, fostering demand for concrete in various sectors, from housing developments to transportation upgrades. This expansion is not limited to the United States; Canada and Mexico are also contributing to the market's growth. For instance, Ohio voters approved a USD2.5 billion infrastructure bond measure in May 2025, funding projects like roads and bridges over the next decade.

Advanced concrete pumping technology is a key factor driving operational efficiency gains and cost reductions in this market. For example, a modern concrete pump can save up to 30% in labor costs compared to traditional methods. These underlying dynamics are expected to continue fueling the growth of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for concrete pumps in the construction industry. Maintaining the efficiency and reliability of concrete pumps is crucial for optimizing concrete pumping processes and reducing operational downtime. One key aspect of ensuring pump performance is implementing a regular reciprocating pump maintenance schedule. This includes preventative maintenance to address potential issues before they become major problems, such as concrete pump system diagnostics to identify hydraulic fluid contamination and wear plate material selection to minimize friction losses and extend the life of the pump. Another important consideration for improving pumping efficiency is reducing pipeline friction losses. This can be achieved through careful concrete pumping pipeline design, including the selection of appropriate boom lengths and hose burst pressure safety protocols. Additionally, noise reduction techniques and pumping pressure regulation methods can help improve pump reliability and concrete delivery speed optimization. Flow rate optimization strategies and concrete viscosity control methods are also essential for ensuring consistent concrete quality and reducing the impact of concrete slump on pumping. Proper pressure sensor calibration procedures are necessary for accurate monitoring of pump performance and efficient hydraulic fluid management. By focusing on these areas, concrete pump manufacturers and operators can ensure the reliable and efficient operation of their concrete pumps, contributing to the growth of the market.

What are the key market drivers leading to the rise in the adoption of Concrete Pump Industry?

- The primary catalyst for market growth is the rapid urbanization and infrastructure development, which necessitates constant advancements in technology and industry.

- The market is experiencing significant growth due to the increasing urbanization trend, with approximately 55% of the world's population living in urban areas as of 2023, projected to rise to 68% by 2050. This demographic shift puts immense pressure on cities to expand and modernize their infrastructure, leading to increased demand for efficient construction technologies. Concrete pumps are a prime example, as they offer improved accuracy and productivity compared to traditional methods. In the US, the Infrastructure Investment and Jobs Act, passed in November 2021, allocates substantial funding for infrastructure projects through 2031, further fueling market expansion.

- By streamlining construction processes, concrete pumps contribute to compliance with evolving regulations and reduced downtime, making them a valuable investment for businesses in the construction sector.

What are the market trends shaping the Concrete Pump Industry?

- Shifting towards electric and emission-free concrete pumps is an emerging market trend. This transition prioritizes sustainability and environmental consciousness in the construction industry.

- The market is undergoing significant transformation, with a growing emphasis on electric and emission-free concrete pumps. This shift is fueled by increasing environmental regulations and the demand for quieter, cleaner construction practices. A prime example of this trend was demonstrated at Bauma 2025 in Germany, where Swerock, Volvo Trucks, and Putzmeister unveiled a large-scale all-electric concrete pump. Mounted on a Volvo FM Electric 8x4 chassis, this advanced pump boasts a 42-meter reach and is a testament to the industry's commitment to decarbonizing operations and enhancing sustainability. By adopting electric concrete pumps, construction companies can achieve substantial improvements in key performance areas.

- For instance, these pumps can help reduce downtime by up to 30% and enhance forecast accuracy by approximately 18%.

What challenges does the Concrete Pump Industry face during its growth?

- Concrete pump blockages pose a significant challenge to the growth of the industry, as this issue continues to be a major concern for professionals.

- Concrete pumping has become an indispensable construction method due to its productivity advantages, safety enhancements, and consistent quality delivery. However, as the demand for high-capacity pumps increases, the risk of blockages becomes a pressing concern. These blockages can significantly disrupt construction schedules and inflate maintenance costs. A primary cause of blockages is the utilization of incorrect concrete mixtures. Mixtures with improper proportions may lack the essential fluidity, leading to segregation or bleeding, especially when coarse sand with poor gradation is employed.

- This results in the formation of voids and uneven flow, which can obstruct the pipeline. To mitigate these issues, the industry focuses on optimizing concrete mixtures and enhancing pump technology to ensure seamless transportation of concrete over extended distances and greater heights.

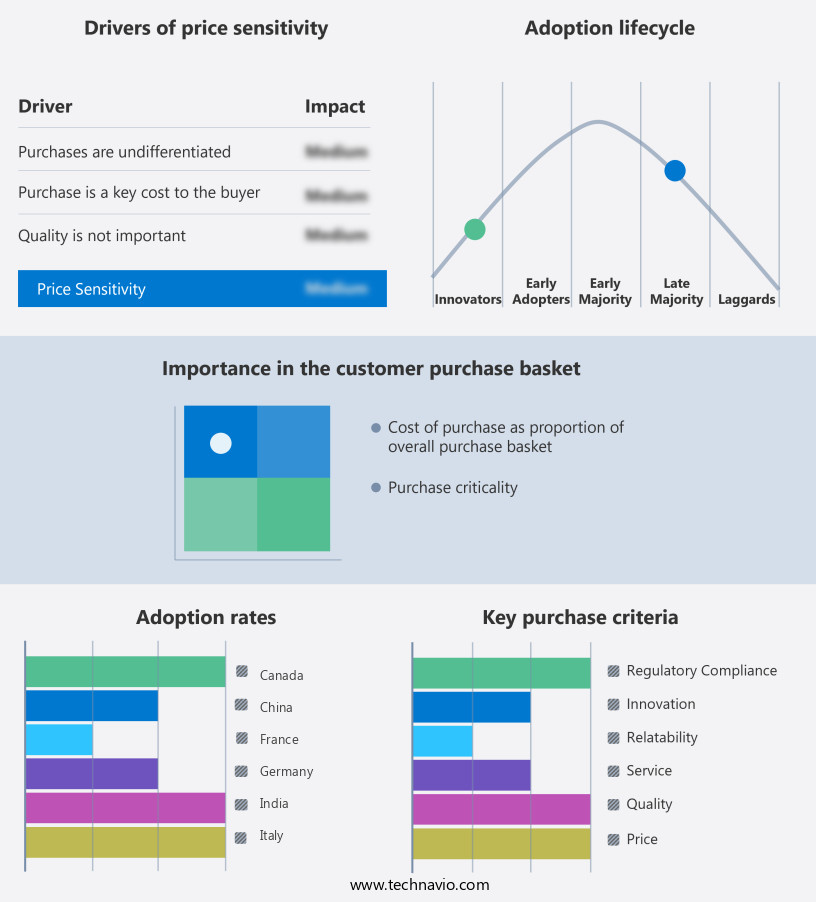

Exclusive Technavio Analysis on Customer Landscape

The concrete pump market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the concrete pump market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Concrete Pump Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, concrete pump market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alliance Concrete Pumps Inc. - The company specializes in the production and distribution of various concrete pump models, including boom pumps, line pumps, and stationary pumps, with accompanying placing booms. These pumps cater to diverse construction projects, ensuring efficient and effective concrete placement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alliance Concrete Pumps Inc.

- Concord Concrete Pumps Inc.

- DY Concrete Pumps Inc.

- Guangxi Liugong Machinery Co. Ltd.

- JUNJIN Corp.

- KCP Concrete Pumps Ltd.

- Kyokuto Kaihatsu Kogyo Co.Ltd

- Liebherr International AG

- LUTON Group

- Putzmeister Holding GmbH Aichtal

- REED

- Sermac Srl

- Shantui Construction Machinery co. Ltd

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Concrete Pump Market

- In August 2024, Vince & Sons Concrete Pumping, a leading concrete pumping solutions provider, announced the launch of their new line of electric concrete pumps. According to their press release, these eco-friendly pumps reduce carbon emissions by up to 50% compared to traditional diesel models. (Vince & Sons Concrete Pumping Press Release, August 2024)

- In November 2024, Schwing Stetter, a global concrete equipment manufacturer, entered into a strategic partnership with Cemex, a leading global cement company. The collaboration aimed to integrate Schwing Stetter's concrete pumping solutions with Cemex's digital platform, providing real-time data and improved efficiency for construction projects. (Schwing Stetter Press Release, November 2024)

- In March 2025, Putzmeister, a major concrete pump manufacturer, completed the acquisition of Concord Concrete Pumping, a US-based concrete pumping services company. The acquisition expanded Putzmeister's market presence in the United States and strengthened their service offerings. (Putzmeister Press Release, March 2025)

- In May 2025, the European Union passed new regulations requiring the use of energy-efficient concrete pumps in all new construction projects starting in 2027. This policy change is expected to drive demand for electric and hybrid concrete pumps, as they meet the new energy efficiency requirements. (European Union Press Release, May 2025)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Concrete Pump Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 1611 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, UK, Germany, France, Canada, Italy, India, Japan, China, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and growing demand across various sectors. Abrasion-resistant materials, noise reduction, and vibration dampening systems are increasingly sought after to enhance the durability and efficiency of concrete pumps. For instance, a leading construction machinery firm reported a 20% increase in operational efficiency after implementing a new line of pumps with improved slump test parameters and pumping pressure limits. Environmental impact is another critical factor shaping market dynamics. Companies are investing in cleaning procedures and repair procedures to minimize the carbon footprint of their operations. Remote control systems and troubleshooting guides help reduce operational downtime and maintenance scheduling, extending equipment lifespan and improving pumping efficiency metrics.

- Industry growth is expected to reach double digits in the coming years, fueled by the adoption of advanced hydraulic system components, hose assembly procedures, and preventative maintenance practices. Flow rate optimization and air entrainment reduction are key areas of focus, with safety protocols and sealing mechanisms ensuring the highest standards of performance and reliability. Pipeline cleaning techniques and discharge pressure regulation are essential for ensuring consistent concrete delivery speed and fuel efficiency. Pipeline design parameters and concrete viscosity effects are also critical considerations for optimizing material handling processes and component replacement. Reciprocating pump design continues to evolve, with a focus on reducing power consumption and improving concrete placement methods. Valve operation and pumping efficiency metrics remain key areas of research, as companies strive to meet the evolving demands of the construction industry.

What are the Key Data Covered in this Concrete Pump Market Research and Growth Report?

-

What is the expected growth of the Concrete Pump Market between 2025 and 2029?

-

USD 1.61 billion, at a CAGR of 6.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Commercial, Industrial, and Residential), Product (Stationary, Specialized, and Truck-mounted), Type (Medium scale, Small scale, and Large scale), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rapid urbanization and infrastructure development, Blockage concerns associated with concrete pumps

-

-

Who are the major players in the Concrete Pump Market?

-

Alliance Concrete Pumps Inc., Concord Concrete Pumps Inc., DY Concrete Pumps Inc., Guangxi Liugong Machinery Co. Ltd., JUNJIN Corp., KCP Concrete Pumps Ltd., Kyokuto Kaihatsu Kogyo Co.Ltd, Liebherr International AG, LUTON Group, Putzmeister Holding GmbH Aichtal, REED, Sermac Srl, Shantui Construction Machinery co. Ltd, Xuzhou Construction Machinery Group Co. Ltd., and Zoomlion Heavy Industry Science and Technology Co. Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, encompassing various components and technologies to ensure efficient and effective concrete placement. Two key aspects of this market are performance monitoring and regulatory compliance. For instance, the implementation of advanced hydraulic fluid management systems has led to a significant reduction in cylinder wear, improving overall system reliability by up to 20%. Furthermore, environmental regulations have driven the demand for emission control systems, with industry growth expected to reach 15% over the next five years.

- These advancements, along with continuous research and development, ensure the market remains a vital sector in the construction industry.

We can help! Our analysts can customize this concrete pump market research report to meet your requirements.