Condiments Market Size 2024-2028

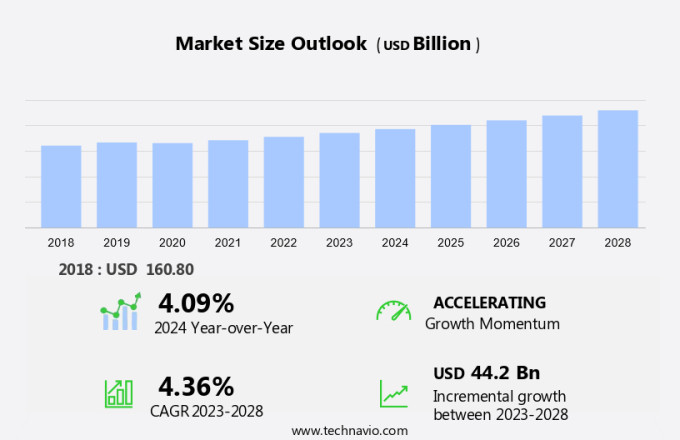

The condiments market size is forecast to increase by USD 44.2 billion at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing popularity of ready-to-serve meals and cultural influences from Western and international cuisines. Yellow mustard sauce, with its calcium-rich content, continues to be a favorite condiment among consumers, particularly among young adult customers. The trend towards exotic ingredients and foreign cuisine is also fueling market growth, as street foods and international dishes gain popularity. Tomato ketchup, soy sauce, hot sauce, mayonnaise, mustard sauce, pickles, and other condiments have become essential ingredients in modern cooking. These condiments add flavor, texture, and visual appeal to dishes, making them more appealing to consumers. The social media landscape is another key driver, with consumers sharing their food experiences and discovering new condiment options online. However, the market also faces challenges, including frequent product recalls and warnings, which can impact consumer trust and market growth.

The market is witnessing significant growth in the bakery, confectionery, and savory sectors. Rising disposable incomes and expanding urbanization have led to a transformation in the culinary landscape, driving the demand for various condiments. Several organoleptic properties, such as taste, texture, and aroma, contribute to the popularity of these condiments.

Furthermore, cross-cultural eating patterns have also played a crucial role in their widespread adoption. The veganism trend and vegetarianism have influenced the market significantly. As a result, there is an increasing demand for vegan food items and condiments made from organic and natural ingredients. Sorbic acid, a preservative commonly used in condiments, is gaining popularity due to its ability to extend the shelf life of these products. The market caters to various sectors, including food service and supermarkets/hypermarkets. Glass jars and pet bottles are the primary packaging materials used for these condiments. The conventional and organic segments cater to different consumer preferences, with organic condiments gaining traction due to their health benefits.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Table sauces

- Cooking ingredients

- Mustard

- Others

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

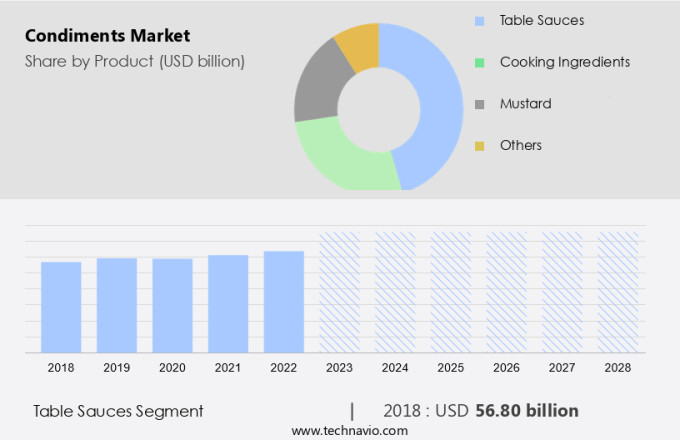

The table sauces segment is estimated to witness significant growth during the forecast period. In the global market, condiments such as salad dressings, brown sauces, butter sauces, emulsified sauces, fish sauces, green sauces, tomato sauces, hot sauces, mayonnaise, meat based sauces, white sauces, and sweet sauces are widely used in various sectors including bakery and confectionery, as well as savory dishes.

Furthermore, the expansion of urbanization and rising disposable incomes in countries like the US, Canada, Mexico, and the Netherlands have led to an increase in the consumption and adoption of sauces. Among the sub-categories, barbecue sauces, and hot sauces have seen significant growth in many countries, making them major variants of table sauces.

Get a glance at the market share of various segments Request Free Sample

The table sauces segment was valued at USD 56.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

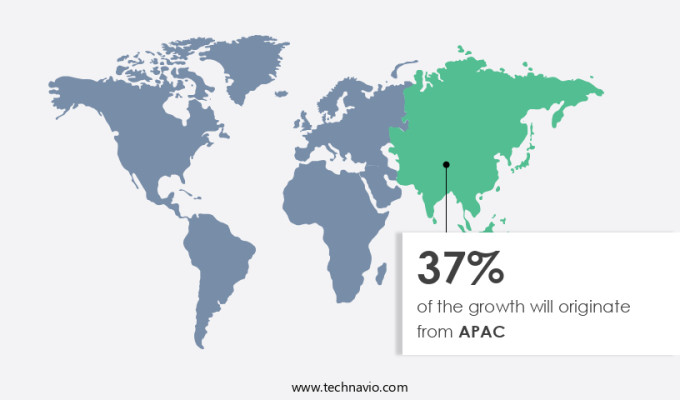

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) is characterized by a large number of players, both regional and global. Major countries with significant demand for condiments in APAC are Japan, China, India, Vietnam, Australia, Indonesia, the Philippines, South Korea, Singapore, Bangladesh, Pakistan, and Taiwan. Among these, China has been the leading market for condiments in APAC. The demand for condiments in China has been on the rise, particularly for sauces such as soy sauce and mayonnaise. Veganism and vegetarianism are growing trends in the market in APAC.

Furthermore, there has been an increase in the production and demand for vegan and vegetarian condiments. Spices, sauces and ketchup, dressings, and other condiments are available in various packaging types, including bottles, pouches, and sachets. The market in APAC is not limited to store-based sales but also includes non-store-based sales through e-commerce platforms. New product releases in the market cater to the changing consumer preferences, with a focus on natural and organic ingredients.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Frequent product launches is the key driver of the market. The market, encompassing sauces, pickles, dressings, and mustard, experiences continuous expansion due to the increasing number of new product introductions in the United States. companies in this sector prioritize innovation by experimenting with unique flavors and ingredients to cater to evolving consumer taste palates. For instance, in July 2022, Eastern Condiments unveiled two new spicy variants of chicken masala, Vermicelli and Macaroni, to cater to the growing demand for bold and exciting flavors. These offerings cater to the health-conscious consumer base by providing condiments rich in essential minerals like potassium and phosphorus, contributing to heart health.

Additionally, Cremica Food Industries launched a new line of versatile sauces in June 2022, suitable for making salad dressings, dips, or serving as sandwich and wrap fillers. The young population's growing preference for convenient and flavorful food options, coupled with the increasing awareness of the health benefits associated with certain condiments, presents significant growth opportunities for sauce manufacturers.

Market Trends

An increase in new deals and acquisitions is the upcoming trend in the market. companies in The market are actively expanding their reach in regional and international markets to expand their customer base. They are pursuing strategic partnerships with organized retailers and local distributors to increase distribution channels. Additionally, some companies are opting for inorganic growth by acquiring established regional players. Notable instances of such deals include Nestle SA's acquisition of The Bountiful Company's core brands in August 2021, and The Kraft Heinz Company's agreement with Simplot Food Group in February 2022. These strategic moves enable companies to offer a wider range of condiments, including popular ethnic variants like those found in Chinese, Japanese, Thai, and Indian cuisines, to a larger consumer base.

Furthermore, with the increasing popularity of vegetarian and vegan diets, companies are also focusing on developing natural and vegetarian alternatives, such as a vegetarian oyster-flavored sauce, to cater to this demographic. Millennials, who are known for their preference for ethnic food and natural ingredients, are a significant target market for these companies. To stay competitive, companies are investing in research and development to introduce innovative and unique condiment blends and sauce mixtures.

Market Challenge

Frequent warnings and product recalls in the market is a key challenge affecting the market growth. The market faces challenges due to product recalls, particularly in sub-categories such as sauces, mayonnaise, pickles, seasonings, and mustard. Recalls can damage a company's reputation and lead to financial and operational losses.

Furthermore, several instances of recalls have occurred in the market, with either companies or regulatory bodies, such as the Food and Drug Administration (FDA), issuing warnings and recalls due to bacterial contamination or the presence of unapproved ingredients. Calcium-rich yellow mustard sauce, a popular condiment, is a staple in Western culture, particularly in ready-to-serve meals and street foods. Its use extends to international cuisines, appealing to young adult customers. Furthermore, the social media landscape has also influenced the popularity of foreign cuisine and exotic ingredients. However, ensuring food safety remains a critical concern for market players. Product recalls can undermine consumer trust and hinder market growth.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ADF Foods Ltd. - The company offers various condiments such as biriyani paste, tandoori paste, tikka paste, and butter chicken paste.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADF Foods Ltd.

- Ajinomoto Co. Inc.

- Conagra Brands Inc.

- Cremica Food Industries Ltd.

- Dabur India Ltd.

- Dr. August Oetker KG

- General Mills Inc.

- Halcyon Proteins Pty. Ltd.

- Hormel Foods Corp.

- Kerry Group Plc

- Kewpie Corp.

- McCormick and Co. Inc.

- Midas Foods International

- Nestle SA

- NutriAsia Inc.

- Patanjali Ayurved Ltd.

- PepsiCo Inc.

- The Kraft Heinz Co.

- Three Threes Condiments Pty Ltd.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products including tomato ketchup, soy sauce, hot sauce, mayonnaise, mustard sauce, pickles, and honey. This market caters to various segments such as bakery, confectionery, and savory. The expanding urbanization and rising disposable incomes have led to a significant shift in the culinary landscape, driving the demand for these condiments. The veganism trend and the increasing popularity of plant-based diets have resulted in the launch of vegan food items and sauces. Mother's recipes and exotic global sauces have gained popularity among consumers, offering organoleptic properties that cater to cross-cultural eating patterns. The market for condiments is witnessing growth opportunities due to the rising snacking trends and at-home consumption.

Furthermore, consumers are increasingly opting for keto products and ready-to-serve meals, leading to an increase in demand for sauces and dressings. Packaging types for condiments include glass jars, pet bottles, and pouches & sachets. The market is segmented into store-based and non-store-based channels, with supermarkets/hypermarkets, food service, convenience stores, and online retail being the major distribution channels. The young population's changing taste palates and health benefits associated with certain condiments, such as potassium and phosphorous in tomato ketchup and calcium in yellow mustard sauce, have contributed to the market's growth. Cultural influence, especially from Western culture, has led to the popularity of sauces and condiments in international cuisines like Chinese, Japanese, Thai, and Indian.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market Growth 2024-2028 |

USD 44.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.09 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADF Foods Ltd., Ajinomoto Co. Inc., Conagra Brands Inc., Cremica Food Industries Ltd., Dabur India Ltd., Dr. August Oetker KG, General Mills Inc., Halcyon Proteins Pty. Ltd., Hormel Foods Corp., Kerry Group Plc, Kewpie Corp., McCormick and Co. Inc., Midas Foods International, Nestle SA, NutriAsia Inc., Patanjali Ayurved Ltd., PepsiCo Inc., The Kraft Heinz Co., Three Threes Condiments Pty Ltd., and Unilever PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch