Construction Adhesive Tapes Market Size 2025-2029

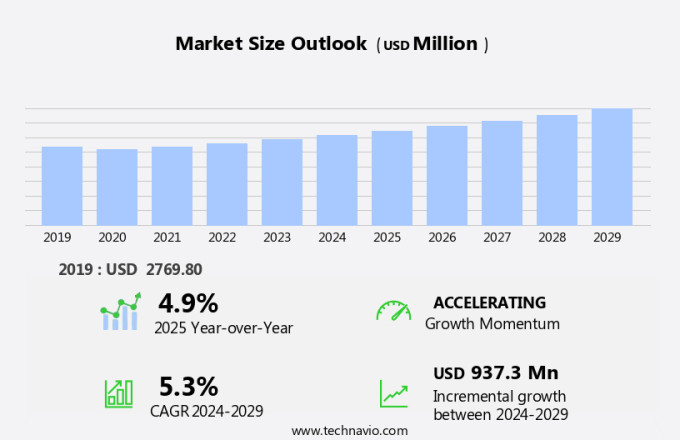

The construction adhesive tapes market size is forecast to increase by USD 937.3 million at a CAGR of 5.3% between 2024 and 2029.

- The market is witnessing significant growth due to the expansion of the construction industry. This sector's focus on vertical integration is another key trend driving market growth. However, the market faces challenges from the volatility in prices of raw materials, which can impact the profitability of manufacturers. To mitigate this risk, companies are exploring alternative sources and investing in research and development to create cost-effective solutions. Additionally, the increasing demand for sustainable and eco-friendly construction materials is pushing manufacturers to innovate and develop green adhesive tape products. Overall, the market is expected to experience steady growth in the coming years, with opportunities in both established and emerging markets.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the economy's strong state and the infrastructure sector's expanding requirements. Urbanization and rapid urbanization have led to an increase in the demand for high-grade infrastructure, resulting in an increase in the usage of adhesive tapes in various applications. Concrete and metal structures are the primary focus areas for these tapes, with their strong adhesion properties ensuring the structural integrity of buildings. Technologies such as hot melt technology and optimizing processes have revolutionized the production of adhesive tapes, making them more efficient and cost-effective. Government investments in public infrastructure projects have further fueled the market's growth, with adhesive tapes being used extensively in soundproofing, insulation, and connecting materials.

- Furthermore, the infrastructure sector's expansion has led to an increase in the demand for petroleum materials and resins used in the production of adhesive tapes. However, regulations regarding the use of solvents and raw material prices pose a challenge to profit margins. The building industry's shift towards customized solutions has led to the development of novel formulations, including those made from thermoplastic polymers, for specific applications such as insulation and woodworking. The commercial sector's focus on efficiency and durability has also resulted in the adoption of high-performance adhesive tapes. Pricing policies and competition in the market are key factors influencing the market dynamics. The market's growth is expected to continue as the construction sector continues to strengthen and urbanization progresses.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Flooring

- Roofing

- Windows and doors

- Walls

- HVAC and insulation

- Technology

- Hot-melt based

- Solvent-based

- Others

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Application Insights

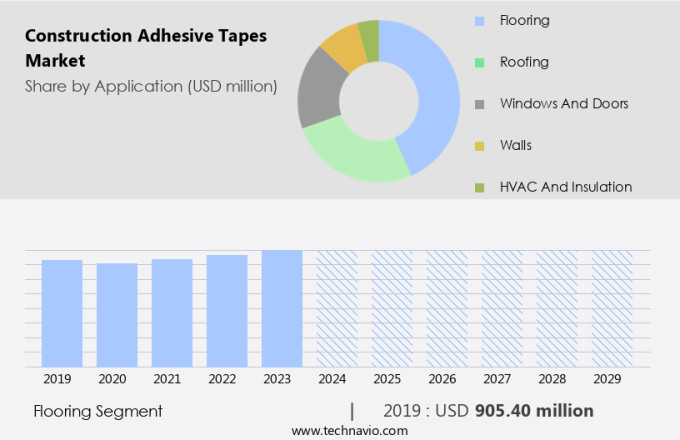

- The flooring segment is estimated to witness significant growth during the forecast period.

Construction adhesive tapes are indispensable in various flooring applications, providing protection and ensuring secure installation. During renovation or relocation projects, these tapes safeguard floors from damage with temporary floor protection solutions, such as polyethylene films coated with acrylic adhesive. In carpet installation, they facilitate both temporary and permanent setups, securing carpets and fabric interiors for stability and ease of installation. Adhesive tapes are also essential for bonding different flooring materials, ensuring a durable installation. Hot melt pressure-sensitive adhesives (HMPSAs) are particularly effective, offering strong adhesion on various carpet backing types, including vinyl, composite, polyurethane, and rubber foams. Building design and architectural plans incorporate these tapes in construction projects for risk management and construction management purposes.

Get a glance at the market report of share of various segments Request Free Sample

The flooring segment was valued at USD 905.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

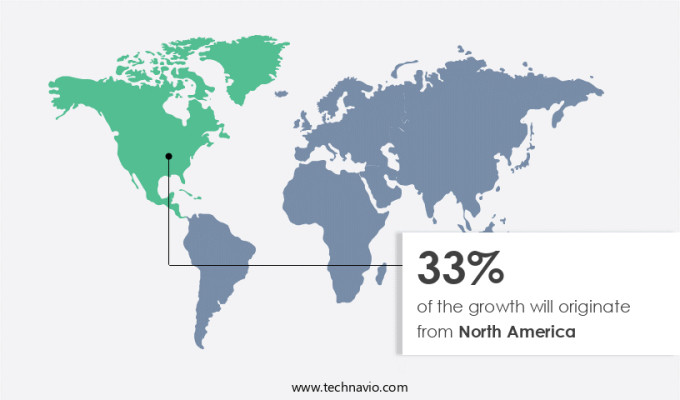

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing growth due to the region's high urbanization rate and strong construction activity. With approximately 311.87 million people living in North America and over 80% of them residing in urban areas, the demand for construction materials, including adhesive tapes, is increasing. In 2023, the US construction industry spent USD 2.0 trillion, representing 4.4% of the country's GDP and the completion of approximately 1.5 million homes. Adhesive tapes are essential in various applications within the construction industry, from residential to commercial projects, including masking, double-sided, hot-melt, and HVAC insulation. Cost estimation and supply chain management are critical factors in the construction industry, making cost-effective and efficient adhesive tape solutions a priority.

In addition, green practices are also becoming increasingly important, with the use of eco-friendly adhesives gaining popularity. Equipment rental companies offer flexible solutions for construction projects, further increasing the demand for construction adhesive tapes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Construction Adhesive Tapes Market?

Growth of construction industry is the key driver of the market.

- The market is experiencing significant growth due to innovation and trends in the construction industry. Green building practices, urban renewal, and infrastructure modernization are driving the demand for high-performance adhesives and tapes. In the US, economic growth and population expansion are leading to an increase in residential and commercial construction projects. According to the US Census Bureau, housing starts rose by 17% in 2021, and commercial construction spending increased by 11% in the same period. Construction financing, building codes, and project management are crucial factors influencing the market. Smart cities and smart home technology are also increasing the use of adhesive tapes in automation systems for window and door installation, HVAC insulation, and building automation.

- In addition, safety standards and risk management are essential considerations in the use of adhesive tapes, particularly in construction safety and building design. Construction equipment rental and supply chain management are essential in the efficient use of adhesive tapes. Cost analysis, cost estimation, and cost estimation are also critical in the decision-making process for using various types of adhesive tapes, such as acrylic adhesive, rubber adhesive, solvent-based adhesive, and hot-melt adhesive. Building materials manufacturers are also investing in sustainable materials and eco-friendly sealants to meet the growing demand for green practices. The construction industry trends include the use of double-sided tape for mounting accessories, masking tape for painting applications, and weather-resistant tapes for roofing and walls applications.

What are the market trends shaping the Construction Adhesive Tapes Market?

Focus on vertical integration is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing focus on innovation and trends in the construction industry. Green building practices, infrastructure modernization, and urban renewal are driving the demand for sustainable construction materials, including adhesive tapes. Construction financing, building codes, and project management are key considerations in the construction industry trends, leading to cost analysis and project planning. Construction safety is another critical factor, with the need for high-performance adhesives and weather-resistant tapes. Smart cities and automation systems require adhesive tapes for window and door installation, HVAC insulation, and masking tape applications. Construction labor and materials manufacturing also impact the market, with cost estimation and supply chain management playing essential roles.

- Furthermore, the market comprises various tape types, including acrylic adhesive, rubber adhesive, hot-melt adhesive, and solvent-based adhesive. Tape distributors and suppliers offer a range of tape benefits, such as moisture resistance, durability, and VOC emissions reduction. Building trends, population growth, and economic growth in industrial and commercial construction also contribute to the market's expansion. Building design and architectural trends, as well as interior design trends, further influence the demand for various tape applications. Construction technology and safety standards continue to evolve, with smart home technology and building automation requiring advanced adhesive solutions.

What challenges does Construction Adhesive Tapes Market face during the growth?

Volatility in prices of raw materials is a key challenge affecting market growth.

- The market is experiencing volatility due to the unpredictable pricing of raw materials, particularly resins and solvents, which are derived from crude oil. This market instability arises from the direct correlation between crude oil prices and the cost of these fundamental ingredients, leaving manufacturers facing uncertainty. Over the past few years, the average closing price of crude oil has exhibited notable fluctuations.

- In addition, construction projects require various types of adhesive tapes for applications such as window and door installation, HVAC insulation, masking, and mounting accessories. The market caters to both residential and non-residential end users, with commercial and industrial construction being significant contributors. Cost analysis, building codes, project planning, risk management, and supply chain management are crucial factors influencing the market. Smart cities, building automation, and eco-friendly sealants are emerging trends. Double-sided tape, hot-melt adhesive, and rubber adhesive are popular tape types. Weather-resistant tapes, moisture resistance, and durability are essential features for construction applications. Tape suppliers offer various tape brands and types, providing benefits such as cost savings, improved productivity, and enhanced safety standards.

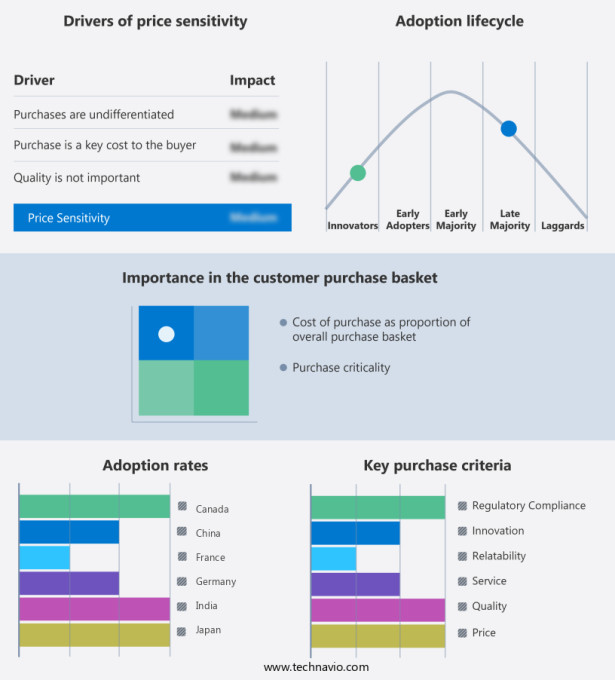

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - This company offers construction adhesive tapes such as the 3M VHB Tapes, which utilize multi-purpose acrylic adhesive on both sides of a conformable, foam core.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashland Inc.

- Berry Global Inc.

- Bostik Ltd.

- DuPont de Nemours Inc.

- Gorilla Glue Inc.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Intertape Polymer Group Inc.

- KCC SILICONE CORPORATION.

- Kolon Industries Inc.

- Nippon Industries

- Nitto Denko Corp.

- Shurtape Technologies LLC

- Sika AG

- Solvay SA

- Tapecon Inc.

- tesa SE

- The Dow Chemical Co.

- YAMATO Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction industry is witnessing a period of innovation and transformation, driven by various trends and factors. One area of significant growth is the use of construction adhesive tapes in various applications. These tapes play a crucial role in enhancing the performance, durability, and sustainability of buildings and infrastructure. Construction adhesive tapes are essential components in construction projects, providing solutions for bonding various materials, sealing joints, and ensuring the structural integrity of buildings. The market for construction adhesive tapes is expected to grow due to several factors. One of the primary drivers of the construction adhesive tape market is the increasing focus on green building and sustainable construction practices.

Moreover, the use of eco-friendly sealants and adhesive tapes is becoming a priority in the industry, as builders and developers seek to reduce their carbon footprint and promote energy efficiency. Another trend in the construction industry is the adoption of smart cities and smart home technology. Construction adhesive tapes are used extensively in the installation of automation systems, windows, and doors, ensuring seamless integration and efficient operation. Urban renewal and infrastructure modernization are also driving the demand for construction adhesive tapes. Infrastructure development projects require high-performance adhesives that can withstand extreme weather conditions and heavy traffic. Similarly, urban planning development projects require tapes that can ensure the structural integrity of buildings and reduce the need for maintenance.

In addition, the construction industry is known for its complex supply chain management and cost analysis. Construction adhesive tape suppliers and distributors play a crucial role in ensuring the timely delivery of products and providing cost-effective solutions to contractors and builders. Safety standards and risk management are other critical factors influencing the construction adhesive tape market. The use of safety standards-compliant tapes is essential to ensure the safety of construction workers and the public. Additionally, the use of risk management strategies, such as the implementation of project management and cost estimation tools, can help mitigate risks and ensure the successful completion of construction projects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 937.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, Canada, Germany, China, UK, India, France, Japan, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch