Construction Equipment Rental Market Size 2025-2029

The construction equipment rental market size is forecast to increase by USD 39.95 billion, at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by increased investment in infrastructure projects worldwide. This trend is expected to continue as governments and private entities prioritize infrastructure development to boost economic growth and improve public services. Another key driver is the increasing adoption of automation in the construction industry. Automated equipment rental solutions offer numerous benefits, including increased efficiency, improved safety, and reduced labor costs. However, the market faces a notable challenge: the lack of a skilled workforce in the construction industry. As the demand for construction equipment rental services grows, ensuring a sufficient workforce to operate and maintain the equipment is becoming a significant concern for market players.

- To capitalize on the market's opportunities and navigate these challenges effectively, companies must focus on workforce training and development programs, as well as explore partnerships and collaborations to address the labor shortage. Additionally, investing in research and development to create more automated and user-friendly equipment rental solutions can help companies stay competitive and meet the evolving needs of their customers.

What will be the Size of the Construction Equipment Rental Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Light equipment, telehandlers, backhoes, and excavators are in high demand for infrastructure projects, while generators and industrial equipment are essential for utility services and industrial applications. Safety standards, a critical aspect of the rental industry, are continually evolving, with civil engineering projects requiring operator certification, safety training, and adherence to OSHA regulations. Rental agreements come in various forms, including long-term and short-term, with operational costs including equipment availability, maintenance, cleaning, and fuel. Equipment damage and rental contract terms are significant considerations, with insurance coverage and liability insurance playing crucial roles in mitigating risks.

Bulldozers, skid steers, and rollers are integral to heavy construction projects, while cranes and forklifts are essential for commercial and residential construction. Fuel efficiency and environmental compliance are increasingly important factors, with digital platforms and mobile app integration streamlining equipment rental processes. Equipment financing, fleet management, and data analytics are also key areas of focus, with rental rates varying from daily to weekly to monthly. Delivery and pickup, equipment inspection, and customer service are essential components of a successful rental experience. Market trends include the growing popularity of online rental booking, equipment repair, and equipment tracking, as well as the integration of specialty equipment, such as boom and scissor lifts, into rental offerings.The market's continuous dynamism is driven by the evolving needs of various sectors, from infrastructure and industrial projects to commercial and residential construction, and disaster relief operations.

How is this Construction Equipment Rental Industry segmented?

The construction equipment rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- ECRCE

- MHE

- Type

- ICE

- Electric

- Product Type

- Backhoes

- Excavators

- Loaders

- Crawler dozers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

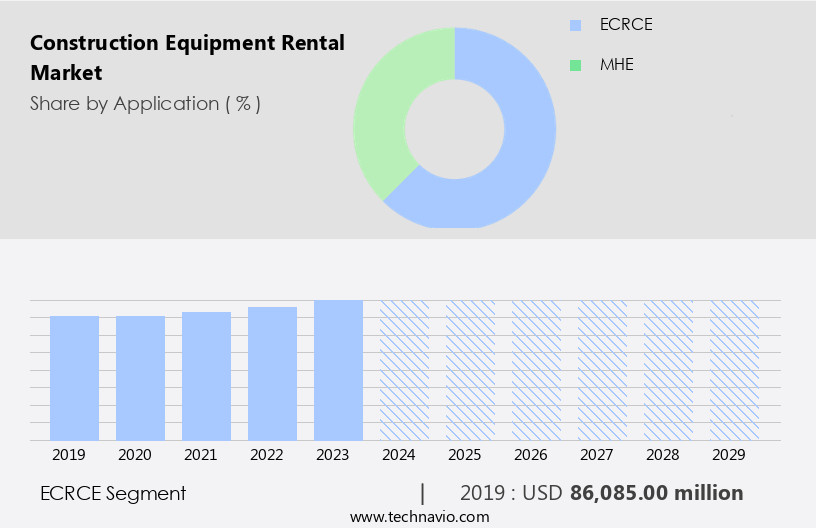

By Application Insights

The ecrce segment is estimated to witness significant growth during the forecast period.

The earthmoving concrete and road construction equipment (ECRCE) rental market encompasses power-propelled vehicles designed for carrying, digging, spreading, or moving materials. This segment includes excavators, loaders, dozers, and Motor Graders. The infrastructure industry's growing investments, driven by the public and private sectors, present significant expansion opportunities for earthmoving equipment rental companies. Urbanization's rapid expansion, particularly in developing countries, will result in an increase in megacities throughout the forecast period. Equipment availability, maintenance costs, and operator certification are crucial factors influencing the market's dynamics. Online rental booking and equipment repair services facilitate the rental process, ensuring fleet management efficiency. Light equipment, such as telehandlers, backhoes, and skid steers, are increasingly popular due to their versatility.

Infrastructure projects, industrial projects, and commercial construction sites rely on heavy equipment like bulldozers, compactors, and rollers for efficient execution. Safety standards, such as OSHA regulations, play a vital role in the rental process. Rental agreements, operational costs, and equipment damage are essential contract terms. Fuel costs, daily and weekly rental rates, and equipment inspection are critical operational considerations. Construction projects, including building construction and civil engineering, require various equipment types and utilization rates. Data analytics and digital platforms streamline equipment rental processes, offering real-time insights into equipment utilization and maintenance. Specialty equipment, such as boom lifts, scissor lifts, and cranes, cater to specific project requirements.

Utility services, generator rental, and fuel efficiency are essential considerations for projects in remote locations. Equipment financing, insurance coverage, and liability insurance are crucial aspects of the rental process. Mining operations and disaster relief projects necessitate heavy equipment rental, with mobile app integration and equipment tracking enabling seamless coordination. Fuel efficiency, environmental compliance, and safety training are essential factors for companies in the ECRCE rental market. The market's growth is driven by the increasing demand for efficient and cost-effective construction solutions.

The ECRCE segment was valued at USD 86.09 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, particularly in the US, is experiencing growth due to the maturing economy and anticipated expansion in the construction industry. Despite federal spending cuts, the industry is poised to grow at a steady pace, fueled by low-interest rates on housing loans and an influx of infrastructure projects. The new US administration's plan to invest USD2.3 trillion in infrastructure development, which includes upgrading old bridges, roads, and drainage systems, is a significant driver. However, the high cost of construction remains a challenge, necessitating the use of cost-effective rental solutions for equipment such as excavators, bulldozers, backhoes, telehandlers, and cranes.

Equipment rental options cater to various project durations, with both short-term and long-term rentals available. Long-term rental agreements offer equipment warranty, fleet management, and lower per-day rates, making them an attractive choice for large-scale projects. In contrast, short-term rentals provide flexibility for smaller projects or those with shorter timelines. Utility services, including Power Generation and HVAC, are increasingly being offered as part of rental packages. Specialty equipment, such as boom lifts and scissor lifts, are also popular choices for construction projects, requiring operator certification for safe use. Online rental booking systems and digital platforms facilitate the rental process, ensuring equipment availability and efficient scheduling.

Maintenance costs and equipment cleaning are essential considerations for rental companies, ensuring their equipment remains in optimal condition for customers. Safety standards and operator training are also crucial, with OSHA regulations mandating compliance. Construction projects encompass various sectors, including commercial, residential, industrial, and infrastructure, each with unique requirements. Rental rates vary based on equipment type, rental duration, and project location. Data analytics and equipment tracking help rental companies optimize their fleet utilization and reduce operational costs. Construction equipment financing and insurance coverage are essential services offered by rental companies, providing customers with flexible payment options and risk mitigation.

Additionally, rental companies cater to disaster relief efforts and mining operations, offering specialized equipment and services. Monthly rental rates offer an affordable alternative to long-term rental agreements, providing flexibility for projects with varying durations. Customer service and equipment delivery and pickup are crucial aspects of the rental experience, ensuring a positive customer experience. In conclusion, the market in North America is experiencing growth, driven by infrastructure projects and the need for cost-effective solutions. Equipment rental options cater to various project durations, sizes, and industries, with a focus on safety, maintenance, and customer service.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Construction Equipment Rental Industry?

- A significant investment in infrastructure serves as the primary catalyst for market growth. The market is experiencing growth due to the increasing investment in infrastructure projects worldwide. Governments are allocating substantial resources towards the development of sports infrastructure and facilities, leading to a significant increase in capital-intensive projects and infrastructure development over the next decade. One of the key reasons for this trend is the cost-effective nature of equipment rental for large-scale projects. Renting allows contractors to access the latest equipment without the financial burden of ownership. This is particularly important for specialized machinery, which can be expensive to purchase and maintain. Additionally, rental companies offer equipment warranty, maintenance, cleaning, and repair services, reducing the operational burden on contractors.

- The market also caters to the rental of short-term and long-term utility services, including excavator and scissor lift rental, as well as specialty equipment and operator certification. Online rental booking systems have streamlined the process, making it easier for contractors to manage their equipment needs efficiently. Fleet management solutions further enhance the value proposition by ensuring equipment availability and optimizing utilization.

What are the market trends shaping the Construction Equipment Rental Industry?

- The adoption of automation is gaining momentum in the market, representing an emerging trend. This trend reflects the increasing implementation of technology to streamline processes and enhance efficiency.

- The market is witnessing significant growth due to the increasing demand for light equipment such as telehandlers and skid steers in infrastructure and industrial projects. Rental agreements for backhoes, bulldozers, and generators are common in civil engineering projects to manage operational costs effectively. Safety standards are a top priority in this industry, leading to stringent rental contract terms regarding equipment damage and fuel costs. Daily rental rates vary depending on the type and size of the equipment. Automated guided vehicles (AGVs) are increasingly being adopted in the construction industry to improve efficiency and productivity.

- These vehicles determine the optimal route for material transportation, reducing the need for manual intervention. Although initially guided manually, the introduction of computer-aided design (CAD) systems has enabled AGVs to select and optimize routes autonomously. In conclusion, the market is driven by the need for cost-effective solutions and increased efficiency in infrastructure and industrial projects. The adoption of automated guided vehicles is a significant trend in this market, enhancing productivity and safety while reducing labor costs. Rental agreements remain a popular choice for managing operational expenses, with safety standards and equipment condition playing crucial roles in contract terms.

What challenges does the Construction Equipment Rental Industry face during its growth?

- The construction industry's growth is significantly hindered by the workforce shortage, which poses a major challenge that must be addressed.

- The construction industry faces a significant challenge in meeting the growing demand for new commercial and building projects due to a shortage of skilled labor. This issue is particularly acute in the case of technicians, site managers, and plumbers. According to industry reports, this labor shortage is hindering the growth of the construction sector in many countries, including Germany, where the German Chambers of Commerce and Industry have identified it as a major concern. To mitigate the impact of this labor shortage, construction companies are increasingly turning to equipment rental services. Weekly rental rates for heavy equipment, such as rollers and compactors, have become an attractive option for companies looking to maximize equipment utilization and reduce the need for a large, permanent workforce.

- Equipment inspection, maintenance, and safety training are essential considerations for companies when renting equipment. Digital platforms and data analytics tools are being used to optimize equipment utilization, reduce downtime, and ensure that equipment is in good working order before it is rented out. Construction equipment financing is also an important factor in the rental market. Companies can save on upfront costs by renting equipment instead of purchasing it outright. Additionally, rental rates can be adjusted based on the specific needs of each construction project. In the event of disaster relief efforts, equipment rental plays a crucial role in providing the necessary heavy equipment to aid in the recovery process.

- Companies offering rental services can quickly deploy equipment to disaster-stricken areas, helping to expedite the relief efforts and minimize the impact on communities. In conclusion, the market is an essential component of the construction industry, providing companies with the flexibility to manage their workforce and equipment needs effectively while ensuring safety, maintenance, and cost savings.

Exclusive Customer Landscape

The construction equipment rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction equipment rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction equipment rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aktio Corp. - This company specializes in providing comprehensive construction equipment rental solutions, including Scissor Lift Rentals. Our offerings cater to various industries and projects, ensuring optimal productivity and efficiency. With a vast inventory of well-maintained equipment, we deliver flexible rental options tailored to clients' unique requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aktio Corp.

- Associated Equipment Rentals Pvt. Ltd.

- Briggs Equipment

- Byrne Equipment Rental

- Caterpillar Inc.

- Cramo Oy

- Finning International Inc.

- Herc Holdings Inc.

- HSS ProService Ltd.

- Kanamoto Co. Ltd.

- Komatsu Ltd.

- Kwipped Inc.

- LGH

- Liebherr International AG

- Loxam

- Nishio Rentall Co. Ltd.

- Sarens NV

- Sunstate Equipment Co. LLC

- Titan Machinery Inc.

- United Rentals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Construction Equipment Rental Market

- In March 2024, Caterpillar Inc. Announced the launch of its new Cat Rental Store in Peru, expanding its presence in South America and addressing the growing demand for construction equipment rentals in the region (Caterpillar Inc. Press Release, 2024).

- In August 2024, Volvo Construction Equipment and Gehl Company, a part of Volvo Group, entered into a strategic partnership to offer integrated rental solutions, combining Volvo's construction equipment with Gehl's compact equipment offerings (Volvo Construction Equipment Press Release, 2024).

- In January 2025, Sunbelt Rentals, a leading provider of construction equipment rental services in North America, completed the acquisition of RSC Equipment Rental, significantly increasing its market share and expanding its geographic reach (Sunbelt Rentals Press Release, 2025).

- In May 2025, Komatsu Ltd. Showcased its new intelligent Machine Control System, a significant technological advancement in the market, at Bauma China 2025, enabling machines to automatically grade and level surfaces with increased precision and efficiency (Komatsu Ltd. Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements driven by the integration of emerging technologies and the shift towards sustainable practices. Automated equipment and 3D printing are revolutionizing the industry, enhancing productivity and reducing emissions. Sustainable construction is a growing trend, with the adoption of green technology and zero-emission equipment becoming increasingly popular. Data-driven insights and machine learning enable equipment optimization and remote control, improving jobsite efficiency and reducing carbon footprint. Equipment technology advancements, including IoT integration, augmented reality (AR), and artificial intelligence (AI), are transforming the rental industry. Hybrid equipment and BIM integration streamline projects and increase productivity.

- Electric equipment and equipment customization cater to specific project requirements and client preferences. The rental industry is consolidating, with larger players investing in these emerging technologies to stay competitive. Virtual reality (VR) and machine learning are enabling remote equipment monitoring and predictive maintenance, ensuring optimal performance and reducing downtime. Productivity enhancement and emissions reduction are key priorities, with companies investing in machine learning algorithms and AI to optimize equipment usage and reduce waste. Modular construction is gaining traction, with the integration of AR and VR enabling more accurate planning and execution. In summary, the market is undergoing a technological revolution, driven by the integration of advanced technologies such as 3D printing, automation, AI, and IoT.

- Sustainability, productivity, and emissions reduction are top priorities, with companies investing in green technology, equipment optimization, and remote monitoring to meet client demands and stay competitive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Construction Equipment Rental Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 39945.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Canada, UK, Germany, Italy, France, The Netherlands, China, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Equipment Rental Market Research and Growth Report?

- CAGR of the Construction Equipment Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction equipment rental market growth of industry companies

We can help! Our analysts can customize this construction equipment rental market research report to meet your requirements.