Contract Development And Manufacturing Organization Outsourcing Market Size 2025-2029

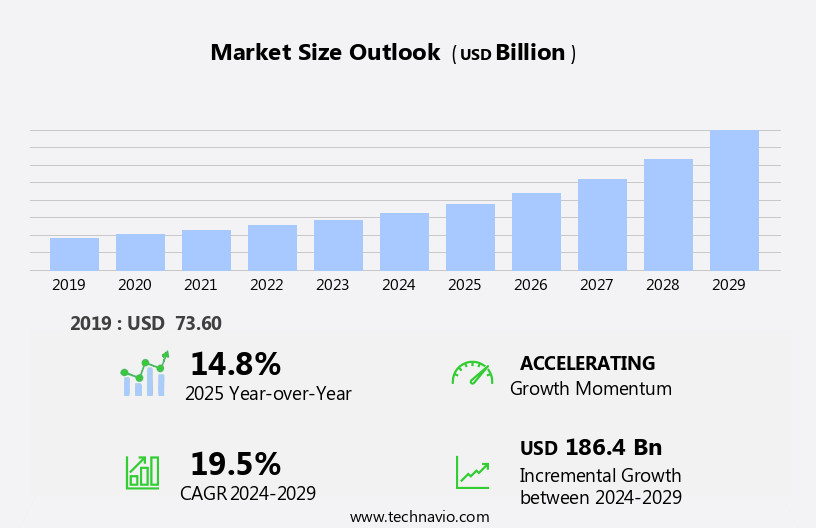

The contract development and manufacturing organization outsourcing market size is forecast to increase by USD 186.4 billion, at a CAGR of 19.5% between 2024 and 2029.

- The Contract Development and Manufacturing Organization (CDMO) outsourcing market is experiencing significant growth, driven primarily by the expanding generic drugs and pharmaceutical industry. The increasing demand for cost-effective and efficient solutions in drug development and manufacturing is propelling the market forward. Furthermore, the adoption of advanced analytics by CDMOs is digital therapeutics transforming the industry, enabling more data-driven decision-making and improved process optimization. However, the market faces challenges, including the threat of intellectual property (IP) rights infringement. As the outsourcing of complex pharmaceutical processes becomes more prevalent, ensuring the protection of IP becomes a critical concern for companies.

- Navigating this challenge requires a robust IP strategy, including thorough due diligence, clear contract terms, and effective monitoring and enforcement mechanisms. Companies seeking to capitalize on market opportunities and mitigate risks must stay informed of these trends and challenges, adopting agile strategies and innovative solutions to remain competitive.

What will be the Size of the Contract Development And Manufacturing Organization Outsourcing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The contract development and manufacturing organization (CDMO) outsourcing market continues to evolve, driven by the dynamic nature of pharmaceutical research and development. Small molecule drugs, novel drug delivery systems, and gene therapy are just a few of the applications where CDMOs play a pivotal role. Project management, regulatory affairs, and targetted drug delivery are integral components of CDMO services, ensuring seamless integration of technology transfer, virtual drug development, and machine learning in pharmaceutical research. API synthesis, pharmaceutical packaging, and process automation are essential services offered by CDMOs, enabling the production of generic pharmaceuticals. Data analytics, supply chain management, and digitalization in pharma are transforming CDMO operations, enhancing efficiency and reducing costs.

GMP manufacturing, scale-up manufacturing, sterile manufacturing, and process development are critical areas where CDMOs excel, providing clinical trial management and drug product services. Cell therapy, drug formulation, inventory management, and drug discovery are additional applications where CDMOs offer expertise. Quality assurance (QA), single-use technology, continuous manufacturing, biotechnology services, and pharmaceutical outsourcing are evolving trends shaping the market. Stability testing, pharmaceutical development services, personalized medicine, analytical services, drug delivery systems, and commercialization support are some of the value-added services CDMOs offer. The CDMO market is a continuously unfolding landscape, with new patterns emerging as technology and industry needs evolve.

How is this Contract Development And Manufacturing Organization Outsourcing Industry segmented?

The contract development and manufacturing organization outsourcing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Small molecules

- Biologics

- Service

- API/bulk drugs

- Drug Development product manufacturing

- Packaging

- Clinical Trial Services

- End-user

- Pharmaceutical companies

- Biotechnology companies

- Government and academic research institutes

- Therapeutic Area

- Oncology

- Cardiology

- Neurology

- Infectious Diseases

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Switzerland

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

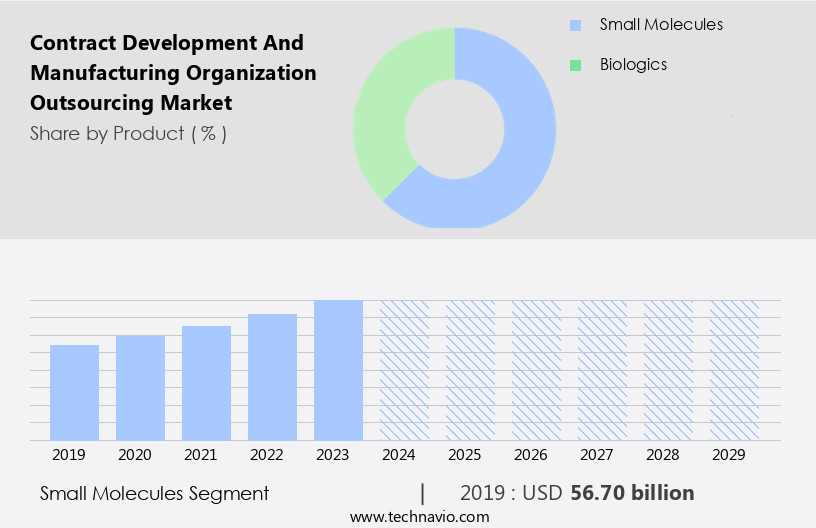

By Product Insights

The small molecules segment is estimated to witness significant growth during the forecast period.

Small molecule drugs, which are naturally occurring compounds re-synthesized or isolated in laboratories, are gaining significant attention in the pharmaceutical industry due to their numerous benefits. Unlike large biologics, small molecules are not dependent on the manufacturing process and can be formulated into orally delivered doses, offering better patient compliance and lower costs compared to injectables. Their small structure allows them to penetrate cell membranes easily, enhancing their therapeutic efficacy in certain cases. The increasing prevalence of chronic diseases, such as cancer and diabetes, is driving the demand for small molecule drugs. Furthermore, advancements in technology, including process automation, digitalization in pharma, and continuous manufacturing, are streamlining the production process and reducing costs.

Additionally, the integration of biotechnology services, such as gene therapy and cell therapy, is expanding the application scope of small molecules in drug discovery and development. Project management, regulatory affairs, and quality assurance (QA) are crucial aspects of the pharmaceutical industry that ensure the safety and efficacy of small molecule drugs. Data analytics and supply chain management optimize the production process, while clinical trial management and inventory management ensure timely delivery of drugs to patients. Pharmaceutical outsourcing and technology transfer enable collaboration between organizations, accelerating the development of new drugs. Moreover, the use of novel drug delivery systems, such as targeted drug delivery and drug formulation, enhances the therapeutic potential of small molecules.

Personalized medicine and analytical services tailor treatments to individual patients, improving outcomes and reducing side effects. The integration of machine learning (ML) and artificial intelligence (AI) in pharmaceutical research and preclinical development expedites the discovery and development of new drugs. In conclusion, the small molecule drug market is experiencing significant growth due to their numerous benefits and increasing applications in the treatment of chronic diseases. Advancements in technology, integration of biotechnology services, and collaboration between organizations are driving the market forward. The use of novel drug delivery systems, personalized medicine, and AI in drug discovery and development are further expanding the potential of small molecule drugs.

The Small molecules segment was valued at USD 56.70 billion in 2019 and showed a gradual increase during the forecast period.

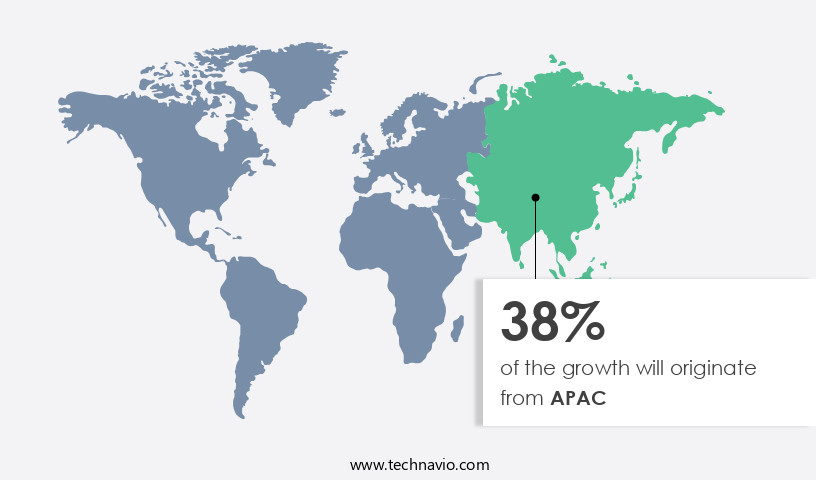

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American contract development and manufacturing organization (CDMO) outsourcing market is experiencing growth due to the rising prevalence of chronic diseases in the US and Canada. Chronic diseases, including Type 2 diabetes, obesity, hypertension, and cardiovascular diseases, are on the rise as a result of poor lifestyle choices such as overconsumption of alcohol, smoking, lack of physical activity, poor diet, and inadequate stress relief. These conditions necessitate the development and manufacturing of various pharmaceutical products, leading to increased demand for CDMO services. CDMOs offer a range of services, from drug substance production and novel drug delivery systems to project management, regulatory affairs, gene therapy, and API synthesis.

Pharmaceutical packaging, process automation, and supply chain management are also critical aspects of CDMO operations. Digitalization in pharma, including data analytics and machine learning, is increasingly important for process optimization and commercialization support. Biotechnology services, such as cell therapy and gene therapy, are gaining popularity due to their potential to treat previously untreatable conditions. Personalized medicine, another emerging trend, requires specialized CDMO capabilities in drug discovery, formulation, and manufacturing. Regulatory compliance, including GMP manufacturing, scale-up manufacturing, sterile manufacturing, and process development, is essential for CDMOs to meet the stringent requirements of regulatory agencies. Clinical trial management, stability testing, and pharmaceutical development services are also crucial components of CDMO offerings.

The CDMO market is evolving, with trends towards single-use technology, continuous manufacturing, and virtual drug development. Biopharmaceutical manufacturing, validation services, and quality control are also essential aspects of CDMO operations. As the pharmaceutical industry continues to innovate, CDMOs must adapt to meet the changing needs of their clients.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive landscape of the contract development and manufacturing organization (CDMO) outsourcing market, pharmaceutical and biotech companies turn to specialized CDMOs for their research and development (R&D) and manufacturing needs. These CDMOs offer innovative solutions, from early-stage R&D and clinical trials to commercial manufacturing and packaging. By leveraging advanced technologies such as continuous manufacturing, automation, and digitalization, CDMOs ensure regulatory compliance, cost savings, and faster time-to-market. Their expertise in various therapeutic areas, including oncology, rare diseases, and vaccines, adds value to the outsourcing partnership. CDMOs also provide flexibility in capacity, enabling clients to scale up or down based on demand. Collaborative partnerships between CDMOs and their clients drive success in the CDMO outsourcing market.

What are the key market drivers leading to the rise in the adoption of Contract Development And Manufacturing Organization Outsourcing Industry?

- The pharmaceutical industry's continued growth serves as the primary catalyst for market expansion.

- The pharmaceutical industry is experiencing significant growth due to demographic shifts and the rise in chronic diseases. By 2025, it is projected that approximately 18.6% of the US population will be aged 65 and above, up from 17.7% in 2024. This trend is expected to continue, with the demographic comprising one in five Americans by 2030. The increase in the aging population is driven by the baby boomer generation, who are more susceptible to chronic diseases such as diabetes and obesity. Moreover, digitalization in pharma is transforming the industry by improving supply chain management, process development, and clinical trial management.

- GMP manufacturing, scale-up manufacturing, sterile manufacturing, drug product development, and cell therapy are key areas benefiting from digitalization. Inventory management is also becoming more efficient with the implementation of advanced technologies. The pharmaceutical industry is also witnessing the growth of contract development and manufacturing organizations (CDMOs) that offer services such as process development, manufacturing, and testing to reduce costs and improve time-to-market for drug formulation and drug product development. This outsourcing trend is expected to continue as the industry focuses on bringing innovative drugs to market quickly and cost-effectively. In conclusion, the pharmaceutical industry is experiencing significant growth due to demographic shifts and the rise in chronic diseases.

- Digitalization in pharma is transforming the industry by improving various processes, and CDMO outsourcing is becoming increasingly popular to reduce costs and improve time-to-market.

What are the market trends shaping the Contract Development And Manufacturing Organization Outsourcing Industry?

- The increasing adoption of analytics by Contract Development and Manufacturing Organizations (CDMOs) represents a significant market trend. This shift towards data-driven insights is essential for enhancing operational efficiency and improving product quality.

- CDMOs (Contract Development and Manufacturing Organizations) employ various analytical tools and techniques to enhance productivity and efficiency in drug discovery, pharmaceutical development services, biotechnology services, and drug delivery systems. These analytics include forecast analytics, charts, percentage change analytics, and numerical analytics, which help enterprises discover meaningful patterns in data. The application of analytics in CDMOs is a complex process that requires real-time execution and a dynamic framework. By utilizing analytics, CDMOs can streamline their development processes and offer customers improved solutions. Furthermore, analytics plays a crucial role in quality assurance (QA), stability testing, and personalized medicine. Single-use technology and continuous manufacturing are also areas where analytics can make a significant impact.

- CDMOs are increasingly adopting these advanced technologies to provide more effective and efficient services to their clients in the pharmaceutical outsourcing industry. Analytical services are a critical component of the CDMO landscape, enabling organizations to make informed decisions and optimize their operations.

What challenges does the Contract Development And Manufacturing Organization Outsourcing Industry face during its growth?

- The infringement of intellectual property (IP) rights poses a significant challenge to industry growth, necessitating vigilance and proactive measures to protect valuable intellectual assets and maintain a competitive edge.

- In the realm of pharmaceutical research, the protection of intellectual property (IP) is a crucial concern for the success of pharma and biotech enterprises. The development of a new drug or medicine is a lengthy and costly process, taking approximately 13.5 years and exceeding USD700 million from laboratory research to market availability. Out of the 7,500 compounds tested by these enterprises, only one will successfully pass clinical trials. To streamline this process, various strategies have emerged, including contract development and manufacturing organizations (CDMOs) outsourcing. CDMOs offer expertise in technology transfer, virtual drug development, machine learning (ML), preclinical development, artificial intelligence (AI), biopharmaceutical manufacturing, validation services, and quality control (QC).

- These services enable process optimization and reduce the overall development time and costs. Moreover, the integration of ML and AI in drug discovery and development has revolutionized the industry. These advanced technologies facilitate the analysis of vast amounts of data, enabling faster and more accurate predictions of drug efficacy and potential side effects. CDMOs specializing in these technologies can provide valuable insights and collaborations for pharma and biotech enterprises, ultimately contributing to the success of their IP and new drug launches.

Exclusive Customer Landscape

The contract development and manufacturing organization outsourcing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the contract development and manufacturing organization outsourcing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, contract development and manufacturing organization outsourcing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aenova Holding GmbH - The company boasts an extensive network of pharmaceutical manufacturing facilities, encompassing a comprehensive range of capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aenova Holding GmbH

- Alcami Corp.

- Almac Group Ltd.

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Celonic AG

- Corden Pharma International GmbH

- Curia Global Inc.

- Eurofins Scientific SE

- FAMAR Health Care Services

- FUJIFILM Holdings Corp.

- Laboratory Corp. of America Holdings

- Lonza Group Ltd.

- NextPharma GmbH

- Piramal Enterprises Ltd.

- Recipharm AB

- Siegfried Holding AG

- The Lubrizol Corp.

- Thermo Fisher Scientific Inc.

- Vetter Pharma Fertigung GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Contract Development And Manufacturing Organization Outsourcing Market

- In January 2024, Lonza, a leading Contract Development and Manufacturing Organization (CDMO), announced the expansion of its manufacturing capacity for small molecules at its Visp, Switzerland site. This expansion was in response to increasing demand from biotech and pharmaceutical companies for outsourced manufacturing services (Lonza Press Release, 2024).

- In March 2024, Thermo Fisher Scientific and Patheon, a leading CDMO, entered into a strategic partnership to offer integrated drug development and manufacturing services. This collaboration aimed to provide customers with a seamless solution from research to commercial manufacturing (Thermo Fisher Scientific Press Release, 2024).

- In May 2024, Catalent, a global CDMO, completed the acquisition of Paragon Bioservices, a gene therapy and viral vector CDMO. This acquisition expanded Catalent's capabilities in gene therapy and viral vector manufacturing, positioning the company as a leading player in this growing market segment (Catalent Press Release, 2024).

- In February 2025, WuXi AppTec, a leading CDMO, announced the successful deployment of its new continuous manufacturing technology for small molecules. This technological advancement is expected to reduce production timelines and improve overall efficiency for its clients (WuXi AppTec Press Release, 2025).

Research Analyst Overview

- The contract development and manufacturing organization (CDMO) outsourcing market encompasses various pharmaceutical processes, including clinical trial design, protein purification, and pharmacodynamic (PD) studies. This sector experiences continuous evolution, with a focus on sustainability in pharma and change management. CDMOs employ techniques such as six sigma, lean manufacturing, and green chemistry to optimize operations. Bioavailability studies, product lifecycle management, and cryogenic storage are integral parts of the CDMO landscape. Aseptic processing, GMP compliance, and analytical method development are essential for ensuring regulatory submissions adhere to EMA and FDA guidelines. Pharmacokinetic (PK) studies, post-marketing surveillance, and quality risk management are crucial for understanding drug safety and efficacy throughout the product lifecycle.

- Advanced technologies like cleanroom technology, process validation, downstream processing, and drug formulation development enable CDMOs to cater to diverse client needs. Bioreactor technology and regulatory submissions play a significant role in the CDMO market, with ICH guidelines driving standardization and innovation. CDMOs employing cell culture and bioreactor technology can produce large quantities of proteins and cells for therapeutic applications. In the realm of CDMO outsourcing, GMP compliance, process validation, and downstream processing are essential for ensuring the highest quality in drug manufacturing. Regulatory agencies' stringent requirements necessitate the implementation of cleanroom technology, quality risk management, and change management strategies.

- Sustainability is a growing concern in the pharma industry, leading CDMOs to adopt green chemistry and lean manufacturing practices. Cryogenic storage and aseptic processing are critical for maintaining the integrity of sensitive biologics. Pharmacodynamic and pharmacokinetic studies are essential for understanding drug action and safety. In the CDMO market, innovation and regulatory compliance go hand in hand. Technologies like bioreactor technology, process validation, and analytical method development are driving advancements in drug development and manufacturing. Regulatory submissions must adhere to stringent EMA and FDA guidelines, necessitating a strong focus on GMP compliance, cleanroom technology, and quality risk management.

- The CDMO market is characterized by continuous innovation and regulatory compliance. Technologies like bioreactor technology, process validation, and analytical method development are driving advancements in drug development and manufacturing. Pharmacodynamic and pharmacokinetic studies are essential for understanding drug action and safety. CDMOs must maintain GMP compliance, employ cleanroom technology, and implement quality risk management strategies to ensure regulatory submissions meet EMA and FDA guidelines.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Contract Development And Manufacturing Organization Outsourcing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.5% |

|

Market growth 2025-2029 |

USD 186.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.8 |

|

Key countries |

US, China, Germany, Canada, Switzerland, India, France, South Korea, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Contract Development And Manufacturing Organization Outsourcing Market Research and Growth Report?

- CAGR of the Contract Development And Manufacturing Organization Outsourcing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the contract development and manufacturing organization outsourcing market growth of industry companies

We can help! Our analysts can customize this contract development and manufacturing organization outsourcing market research report to meet your requirements.