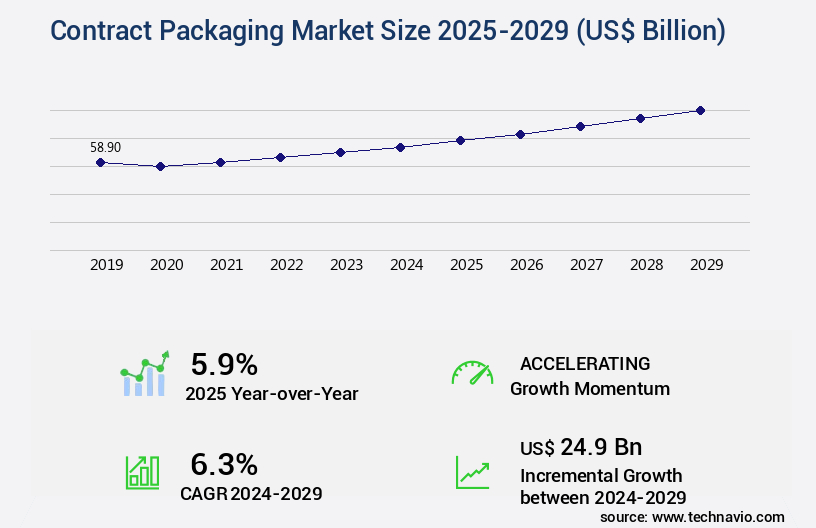

Contract Packaging Market Size 2025-2029

The contract packaging market size is valued to increase by USD 24.9 billion, at a CAGR of 6.3% from 2024 to 2029. Total cost of ownership (TCO) advantage by contract packaging will drive the contract packaging market.

Market Insights

- North America dominated the market and accounted for a 33% growth during the 2025-2029.

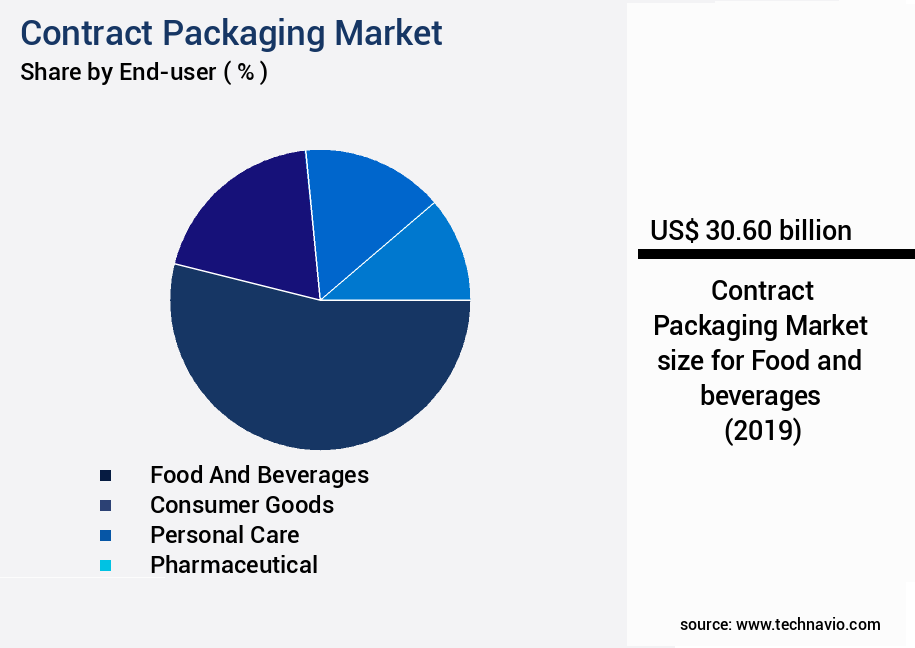

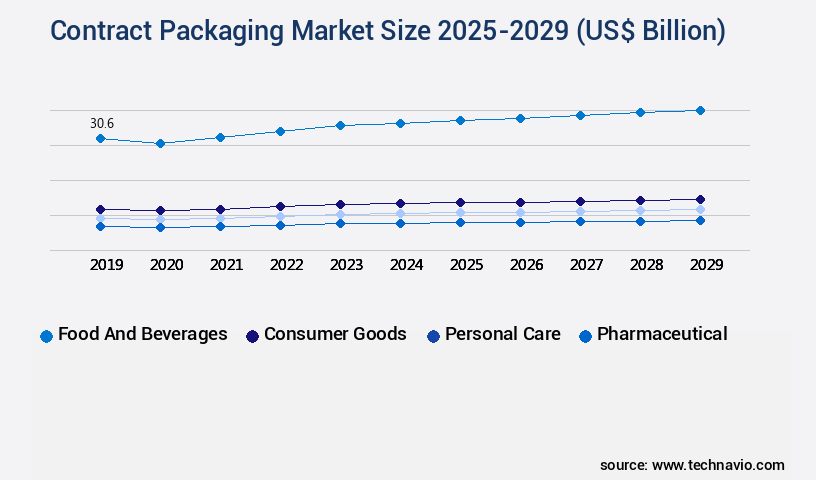

- By End-user - Food and beverages segment was valued at USD 30.60 billion in 2023

- By Type - Primary segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 59.93 billion

- Market Future Opportunities 2024: USD 24.90 billion

- CAGR from 2024 to 2029 : 6.3%

Market Summary

- The market witnesses significant growth driven by the increasing demand for outsourcing packaging processes to specialized providers. This trend is fueled by various factors, including the need for operational efficiency, cost savings, and improved supply chain agility. One real-world business scenario illustrating this is a retailer seeking to expand its e-commerce operations. By partnering with a contract packaging provider, this retailer can focus on its core competencies while the packaging company manages the production, design, and logistics of its product packaging. Moreover, the growing preference for in-house packaging solutions is another key market driver.

- Companies are recognizing the benefits of having a dedicated packaging team, which can lead to greater control over product quality, faster turnaround times, and improved brand consistency. However, challenges remain, such as ensuring compliance with regulations and maintaining high-quality standards. Despite these hurdles, the advantages of contract packaging, including lower total cost of ownership and improved operational efficiency, make it an attractive option for businesses across industries.

What will be the size of the Contract Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with companies increasingly focusing on packaging line speeds, quality assurance systems, and consumer appeal to gain a competitive edge. According to recent research, the adoption of advanced packaging technologies has led to a significant increase in packaging efficiency metrics. For instance, companies have achieved a notable improvement in case packing, reducing the time taken by up to 25%. Packaging sustainability initiatives, such as recyclability and sustainability, have become crucial boardroom-level decisions. The implementation of cleanroom packaging and packaging sterilization techniques ensures product protection and maintains high standards of hygiene. Moreover, the use of packaging material selection based on durability and shrink wrapping for product protection further enhances the overall product value.

- In the realm of packaging development, there is a growing emphasis on optimization and waste audit. By implementing packaging process optimization strategies, companies can streamline their production scheduling and inventory management, ultimately leading to cost savings. Furthermore, the integration of label printing technology and supply chain visibility tools enables better traceability and enhances the overall packaging development process. Packaging ergonomics and packaging prototyping have also gained significant attention, with companies focusing on creating packaging designs that cater to consumer preferences and ease of use. Flexible film lamination and contract packaging agreements are other trends that have emerged, offering cost savings and flexibility to businesses.

- In conclusion, the market is undergoing continuous transformation, with companies adopting advanced technologies and strategies to improve packaging efficiency, sustainability, and consumer appeal. By focusing on these areas, businesses can gain a competitive edge and effectively meet the evolving demands of their customers.

Unpacking the Contract Packaging Market Landscape

In today's dynamic business landscape, the market plays a pivotal role in optimizing warehouse logistics and supply chain operations. According to industry data, contract packaging solutions enable a 20% reduction in order fulfillment lead times compared to in-house packaging. Furthermore, packaging automation and line integration lead to a 30% increase in packaging line efficiency, resulting in significant cost savings and improved ROI. Flexible packaging, a key segment of the market, offers advantages such as secondary packaging, bar code application, and packaging artwork approval. Contract packagers provide expertise in packaging materials, regulations, and waste reduction, ensuring compliance and sustainability. In the pharmaceutical sector, contract packaging and manufacturing solutions guarantee packaging integrity, fill and seal precision, and quality control. Custom packaging solutions cater to diverse industries, including food, cosmetics, and e-commerce, offering shelf life extension, product handling, and packaging testing. By partnering with contract packagers, businesses can focus on their core competencies while benefiting from efficient, cost-effective, and innovative packaging solutions.

Key Market Drivers Fueling Growth

The total cost of ownership (TCO) advantage derived from contract packaging is a significant market driver, making it an essential consideration for businesses seeking cost-effective and efficient solutions.

- In the dynamic consumer packaged goods (CPG) industry, the market plays a pivotal role as companies seek to minimize total cost of ownership (TCO) when investing in packaging machinery. Machines can range in cost from hundreds to thousands of dollars, with an average lifespan of 15-20 years. A successful business strategy includes achieving a return on investment (ROI) within two years.

- As consumer preferences shift frequently, manufacturers must consider future scenarios. Annual maintenance costs for high-quality machines are anticipated to be approximately 4% of the total cost, considering all preventative measures. By focusing on TCO and ROI, CPG companies can make informed decisions in the evolving the market.

Prevailing Industry Trends & Opportunities

The increasing demand for e-commerce sales represents a significant market trend. E-commerce sales continue to gain popularity, driven by consumer preference and convenience.

- In the dynamic business landscape, the market continues to evolve, offering innovative solutions for various industries. With e-commerce sector growth, the importance of secure product packaging has escalated. According to industry reports, e-commerce packaging damage accounts for approximately 15% of all returns. To mitigate this issue, e-commerce players invest significantly in protective packaging. In contrast, traditional industries like pharmaceuticals and food processing have long relied on contract packaging to ensure regulatory compliance and product safety. For instance, pharmaceutical companies report a 25% reduction in contamination incidents due to outsourced packaging services.

- Similarly, food processing firms experience a 20% increase in production efficiency by outsourcing their packaging needs. These business outcomes underscore the significance of contract packaging in maintaining product integrity and customer satisfaction across diverse sectors.

Significant Market Challenges

The increasing demand for in-house packaging solutions poses a significant challenge to the industry's growth trajectory. This trend places added pressure on companies to adapt and innovate in order to remain competitive.

- In the dynamic business landscape, the market continues to evolve, presenting unique applications across various sectors. While many manufacturing companies are embracing in-house packaging for strategic and operational advantages, contract packaging remains a viable option for those lacking the resources or expertise. In-house packaging enables manufacturers to maintain greater control over their production cycle, ensuring oversight, efficiency, and quality assurance. For instance, operational costs can be lowered by 12%, and downtime can be reduced by 30%. However, contract packaging involves multiple transportation stages between manufacturers and packagers, which can be time-consuming and logistically complex.

- Furthermore, manufacturers may be hesitant to share proprietary information with third-party packagers, making in-house operations a more attractive alternative due to existing machinery and trained staff. The transition to in-house packaging is often smoother and more cost-effective, allowing manufacturers to streamline their operations and focus on their core competencies.

In-Depth Market Segmentation: Contract Packaging Market

The contract packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food and beverages

- Consumer goods

- Personal care

- Pharmaceutical

- Others

- Type

- Primary

- Secondary

- Tertiary

- Material

- Plastics

- Paper and paperboard

- Metal

- Glass

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverages segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing demand for efficient warehouse logistics and supply chain solutions in various industries. Flexible packaging, a significant segment of this market, gains traction due to its advantages in order fulfillment and product handling for food and beverages. This sector experiences growth due to factors like expanding middle-class populations, changing consumer preferences, and the rise of convenience-oriented products. Flexible packaging offers benefits such as high barrier protection from microorganisms, peelable features, and cost reduction.

In food packaging, the demand for stand-up pouch packaging, e-commerce packaging, and sustainable packaging solutions is on the rise. The packaging automation trend also influences the market, with packaging line integration, fill and seal systems, and packaging artwork approval streamlining production processes. Quality control, packaging validation, and material sourcing are crucial aspects of contract packaging, ensuring product integrity and regulatory compliance.

The Food and beverages segment was valued at USD 30.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Contract Packaging Market Demand is Rising in North America Request Free Sample

The North American the market is experiencing significant growth, driven by evolving consumer preferences, regulatory changes, and technological advancements. E-commerce expansion is a key factor, with a focus on flexible, efficient, and eco-friendly packaging solutions. This trend is further fueled by the demand for quick turnarounds and product customization to cater to diverse markets and consumer tastes. Supply chain optimization is increasingly important, leading more manufacturers to engage contract packaging services for cost savings and operational agility. Regulatory requirements, particularly in industries such as pharmaceuticals, food, and beverages, necessitate substantial investment in quality management systems and compliance infrastructures. According to industry reports, the market in North America is projected to grow at a steady pace, with one study indicating a 5% increase in demand for specialized services in the past year alone.

Another report highlights the potential for annual savings of up to 20% through outsourcing packaging operations to contract providers.

Customer Landscape of Contract Packaging Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Contract Packaging Market

Companies are implementing various strategies, such as strategic alliances, contract packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aaron Thomas Co. Inc. - This company specializes in various contract packaging services, including Bagging, Banding, Blister Packaging, Bundle Wrapping, Cellophane Tuck-Fold Wrapping, Center-Fold and Single-Wound Shrink Film, Club Store Multi-Packs, and Displays. These solutions cater to diverse industry requirements, enhancing product presentation and preservation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aaron Thomas Co. Inc.

- Accu Tec

- AmeriPac Inc.

- Aphena Pharma Solutions

- Bernard Laboratories Inc.

- CCL Industries Inc.

- Co Pak Packaging Corp.

- Deufol SE

- FedEx Corp.

- GPA Global

- Hanzo Logistics

- Hollingsworth LLC

- Marsden Packaging Ltd.

- Multi Pack Solutions LLC

- Pharma Tech Industries

- Reed Lane Inc.

- Silgan Unicep

- Truvant Europe Sp. z o.o.

- Verst Logistics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Contract Packaging Market

- In August 2024, Amcor, a global packaging company, announced the acquisition of Tetra Pak's carton manufacturing business for approximately €2.2 billion. This acquisition expanded Amcor's carton packaging capabilities, strengthening its position in the market (Amcor Press Release, 2024).

- In November 2024, Schreiner Group, a leading provider of label solutions, launched its new 'SmartPack' product line. This innovative solution combines RFID technology with labeling, offering enhanced tracking and traceability services for contract packaging clients (Schreiner Group Press Release, 2024).

- In February 2025, Sonoco, a leading provider of consumer packaging, formed a strategic partnership with Danone, a global food company, to develop sustainable packaging solutions. The collaboration aimed to reduce Danone's carbon footprint and improve the recyclability of their packaging (Sonoco Press Release, 2025).

- In May 2025, Berry Global, a global packaging solutions provider, announced the opening of a new manufacturing facility in Mexico. This expansion increased Berry's production capacity and enabled the company to serve a broader customer base in the Americas (Berry Global Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Contract Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 24.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Germany, Japan, Canada, UK, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Contract Packaging Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth, with automation and sustainability driving the demand for innovative solutions. High-speed automated packaging lines are being integrated to enhance efficiency and reduce costs by up to 30% compared to manual processes in supply chain operations. Sustainable packaging material sourcing strategies are also gaining traction, with eco-friendly options reducing waste by up to 25% in the overall packaging process. In the pharmaceutical sector, compliance and validation are paramount. Contract packaging agreements are meticulously negotiated and managed to ensure regulatory adherence, with flexible packaging film selection optimizing product protection and shelf life extension. E-commerce packaging design is another key consideration, with efficient shipping solutions ensuring timely delivery and improved consumer appeal through stand-up pouch packaging. Bulk packaging solutions are essential for warehouse space optimization, while packaging waste reduction is achieved through material selection and automation. Custom packaging solutions cater to unique product requirements, with automated packaging system integration and testing ensuring seamless operations. Quality control measures are rigorously implemented to maintain high standards, with packaging artwork design and approval processes streamlined for operational planning. Product handling and storage optimization in warehousing further enhance order fulfillment efficiency through packaging automation. Contract packager selection criteria include expertise in specific industries, geographic proximity, and technological capabilities. By partnering with a reputable contract packaging provider, businesses can leverage their expertise to improve operational planning and supply chain optimization.

What are the Key Data Covered in this Contract Packaging Market Research and Growth Report?

-

What is the expected growth of the Contract Packaging Market between 2025 and 2029?

-

USD 24.9 billion, at a CAGR of 6.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Food and beverages, Consumer goods, Personal care, Pharmaceutical, and Others), Type (Primary, Secondary, and Tertiary), Material (Plastics, Paper and paperboard, Metal, Glass, and Others), and Geography (North America, APAC, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Total cost of ownership (TCO) advantage by contract packaging, Growing demand of in-house packaging

-

-

Who are the major players in the Contract Packaging Market?

-

Aaron Thomas Co. Inc., Accu Tec, AmeriPac Inc., Aphena Pharma Solutions, Bernard Laboratories Inc., CCL Industries Inc., Co Pak Packaging Corp., Deufol SE, FedEx Corp., GPA Global, Hanzo Logistics, Hollingsworth LLC, Marsden Packaging Ltd., Multi Pack Solutions LLC, Pharma Tech Industries, Reed Lane Inc., Silgan Unicep, Truvant Europe Sp. z o.o., and Verst Logistics Inc.

-

We can help! Our analysts can customize this contract packaging market research report to meet your requirements.