Cosmetic Packaging Market Size 2025-2029

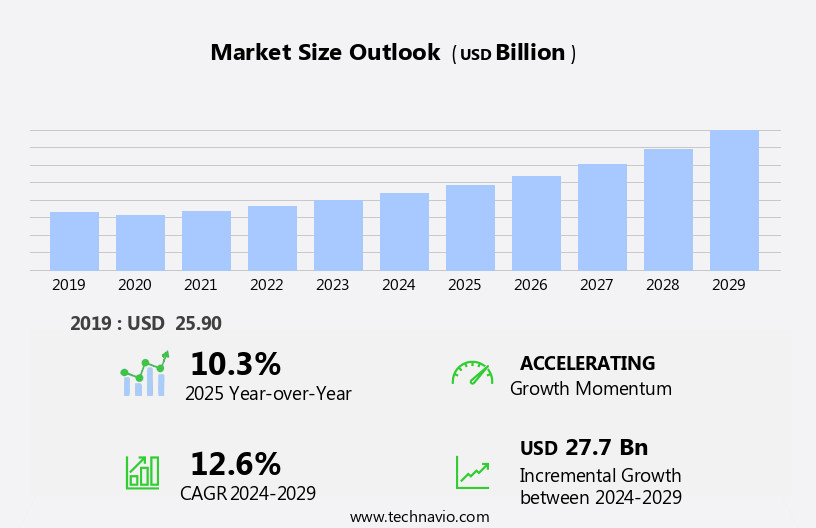

The cosmetic packaging market size is forecast to increase by USD 27.7 billion, at a CAGR of 12.6% between 2024 and 2029.

- The market is witnessing significant shifts driven by the surge in e-commerce sales and the integration of advanced technologies. The rise of e-commerce platforms has led to an increase in demand for packaging solutions that cater to the unique requirements of online sales, such as tamper-evident seals and protective materials. Furthermore, the incorporation of QR codes with augmented reality (AR) technology in cosmetic packaging is revolutionizing consumer engagement and product differentiation. However, this market faces challenges as well. The proliferation of counterfeit cosmetic packaging products poses a significant threat to both brands and consumers, necessitating robust anti-counterfeit measures.

- Companies must navigate these dynamics to capitalize on opportunities and mitigate risks. Strategic investments in e-commerce-friendly packaging designs and technologies, coupled with effective anti-counterfeit strategies, will be crucial for market success.

What will be the Size of the Cosmetic Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by dynamic market trends and advancements in technology. Personal care packaging, a significant segment, integrates various elements such as e-commerce packaging, fragrance packaging, and skincare packaging. Sustainability initiatives, including post-consumer recycled content and biodegradable plastics, are shaping the industry. Evolving packaging applications encompass pump dispensers, aerosol cans, and aluminum tubes, each requiring unique polymer chemistry and printing techniques. Packaging machinery, from labeling machines to filling machines, plays a crucial role in ensuring product quality and shelf life. Ink formulations and labeling systems adapt to meet regulatory requirements and consumer preferences.

Recyclable materials, such as carton packaging and barrier films, are gaining traction in the circular economy. The ongoing unfolding of market activities includes compression testing, drop testing, and tamper-evident seals for safety and consumer protection. Packaging design innovations, from digital printing to color matching, cater to mass-market and luxury segments. Supply chain management and recycling infrastructure improvements are essential for efficient distribution channels. Product labeling regulations and packaging standards continue to evolve, reflecting the industry's commitment to sustainability and innovation. The market's continuous dynamism is further highlighted by the emergence of new packaging types, such as spray bottles, glass jars, and roll-on applicators, and protective coatings for enhanced product preservation.

Material science and printing techniques continue to advance, ensuring packaging remains an integral part of the cosmetic industry's growth and evolution.

How is this Cosmetic Packaging Industry segmented?

The cosmetic packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Skin care

- Hair care

- Makeup

- Nail care

- Material

- Glass

- Metal

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

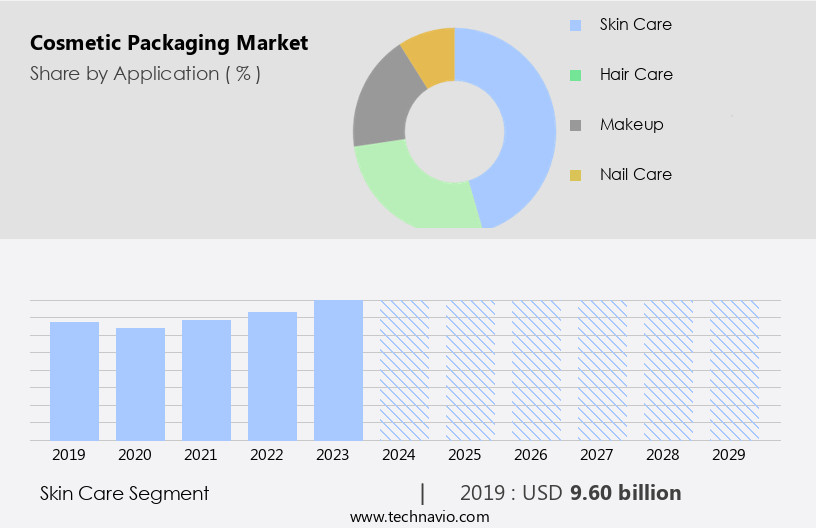

By Application Insights

The skin care segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth and innovation, driven by consumer preferences for eco-friendly solutions and the rise of e-commerce. Sustainability initiatives are at the forefront of this evolution, with an increasing demand for post-consumer recycled content and biodegradable plastics. Pump dispensers and aerosol cans continue to dominate the market, while packaging machinery and materials adapt to meet the unique requirements of various cosmetic categories. Shelf life testing, ink formulations, and labeling systems are crucial aspects of packaging design, ensuring product quality and regulatory compliance. Makeup packaging, skincare packaging, and haircare packaging each present distinct challenges, necessitating specialized solutions.

Sustainable packaging, such as aluminum tubes and carton packaging, is gaining popularity, as companies prioritize circular economy principles. Packaging machinery and materials continue to advance, with digital printing, compression testing, and tamper-evident seals enhancing product safety and shelf appeal. Product labeling regulations and color matching are essential considerations for cosmetic brands, while supply chain management and recycling infrastructure ensure efficient distribution and waste management. Innovations in packaging technology include drop testing for durability, child-resistant packaging for safety, and protective coatings for enhanced product preservation. Barrier films, plastic bottles, and cosmetic tubes are common packaging formats, with each offering unique benefits for various cosmetic applications.

E-commerce packaging requires special attention, as it must protect products during shipping and provide an attractive unboxing experience. Spray bottles, glass jars, and filling machines cater to the unique needs of fragrance packaging, while capping machines and labeling machines streamline production processes. Material science and packaging design continue to play essential roles in the market, as companies strive to create visually appealing, functional, and sustainable packaging solutions that resonate with consumers.

The Skin care segment was valued at USD 9.60 billion in 2019 and showed a gradual increase during the forecast period.

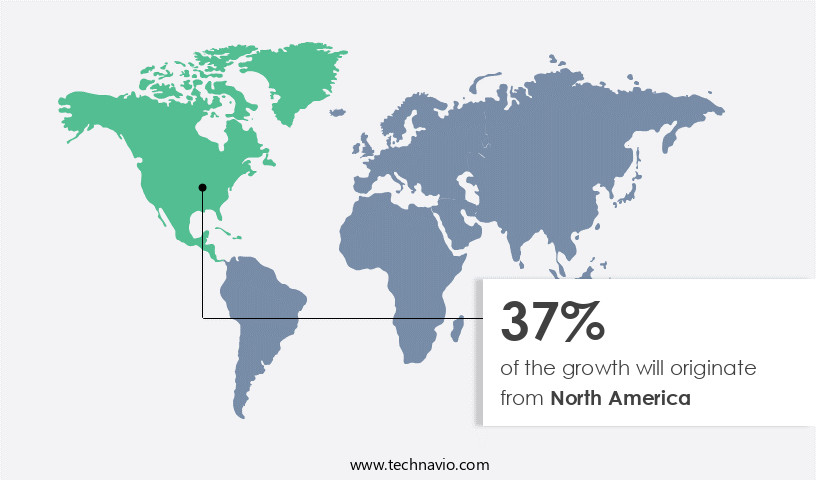

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is thriving due to technological innovations, consumer preferences, and sustainability initiatives. With a robust cosmetics industry in the US and Canada, there is a significant demand for premium quality and advanced packaging solutions. This region is witnessing a shift towards eco-friendliness and sustainability, leading to the adoption of recyclable materials and biodegradable plastics. For example, Berry, a US-based company, recently collaborated with Koa to launch 100% recycled plastic bottles for body cleansers and moisturizers, reflecting a commitment to sustainability. Advancements in polymer chemistry and printing techniques, such as offset printing, digital printing, and flexographic printing, are enhancing the visual appeal and functionality of packaging.

Packaging machinery, including filling machines, capping machines, and labeling machines, are essential for the production and customization of various packaging types, including pump dispensers, aerosol cans, cosmetic tubes, and spray bottles. Shelf life testing, compression testing, drop testing, and tamper-evident seals ensure the quality and safety of cosmetic products. Sustainability initiatives, such as circular economy principles and recycling infrastructure, are influencing the design and production of packaging materials, including barrier films, carton packaging, and aluminum tubes. Packaging waste management and product labeling regulations are crucial aspects of the market, with regulations varying by country and distribution channel.

E-commerce packaging and skincare packaging are growing segments, driven by the convenience and personalization they offer. The market also caters to mass-market and luxury packaging, with a focus on protective coatings and ink formulations for unique branding and labeling systems. In conclusion, the market in North America is driven by technological advancements, consumer preferences, and sustainability initiatives. The region's emphasis on eco-friendliness and premium quality is leading to the adoption of recyclable materials and innovative packaging designs. Companies are investing in research and development to create functional, visually appealing, and sustainable packaging solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative cosmetic industry, the packaging segment plays a pivotal role in capturing consumer attention and ensuring product protection. The market is driven by various trends, including sustainable materials, eco-friendly designs, and interactive elements. Consumers increasingly demand visually appealing, functional, and travel-friendly packaging. Brands leverage materials like glass, plastic, metal, and paper to cater to diverse product types and consumer preferences. Sustainability is a significant concern, with biodegradable, recycled, and refillable packaging gaining traction. Digital technologies, such as QR codes and augmented reality, enhance consumer engagement and provide valuable product information. The market is a competitive landscape, with players continually innovating to meet evolving consumer demands and expectations.

What are the key market drivers leading to the rise in the adoption of Cosmetic Packaging Industry?

- E-commerce and social media marketing play a pivotal role in driving market growth, with an increasing number of businesses leveraging these channels to engage customers and expand their reach.

- The market is experiencing significant growth due to the increasing popularity of online shopping and the resulting demand for innovative packaging solutions. Consumers are increasingly turning to e-commerce platforms for their cosmetic needs, with major players like Amazon, Nykaa, Myntra, and Flipkart offering easy delivery and return services. This trend is driving the sales of cosmetic products, subsequently expanding the market. companies in the cosmetic industry are responding to this demand by investing in sustainability initiatives. They are using post-consumer recycled content and biodegradable plastics in their packaging materials. Pump dispensers and aerosol cans are being replaced with more eco-friendly alternatives.

- In the realm of polymer chemistry, offset printing is being used to reduce the environmental impact of packaging production. Shelf life testing and the use of packaging inks that comply with cosmetic regulations are essential considerations for cosmetic packaging. Packaging machinery and materials are being optimized to improve supply chain management and reduce waste. The recycling infrastructure is also being strengthened to facilitate the recycling of cosmetic packaging. In conclusion, the market is being shaped by various factors, including the growth of e-commerce, consumer preferences for sustainability, and advancements in packaging technology. companies are focusing on these trends to meet the evolving needs of consumers and stay competitive in the market.

What are the market trends shaping the Cosmetic Packaging Industry?

- The integration of AR technology with QR codes in cosmetic packaging is an emerging market trend. This innovative approach combines the benefits of quick, contactless product information access through QR codes, with the immersive experience of augmented reality technology.

- The market is witnessing significant advancements, driven by the integration of technology and a focus on sustainability. Packaging standards are evolving to accommodate circular economy principles, with an increasing preference for aluminum tubes and sustainable barrier films. Drop testing and child-resistant packaging continue to prioritize safety, while skincare packaging emphasizes harmonious and immersive designs. Sustainable packaging solutions, such as plastic bottles with recycled content, are gaining popularity. Labeling machines and packaging testing technologies ensure regulatory compliance and product quality.

- A prominent trend is the use of QR codes with Augmented Reality (AR) technology, revolutionizing consumer engagement by offering quick access to digital content and immersive experiences. Companies are innovating with smart and environmentally friendly solutions, digital services, and data-powered diagnostic tools to provide personalized and inclusive beauty experiences.

What challenges does the Cosmetic Packaging Industry face during its growth?

- The proliferation of counterfeit packaging products in the cosmetics industry poses a significant challenge to industry growth, requiring heightened vigilance and authentication measures to safeguard brand reputation and consumer trust.

- The market faces a significant challenge from the proliferation of counterfeit products. With the rise of e-commerce sales, it has become easier for counterfeiters to sell imitation cosmetic items, often disguised as genuine products. These counterfeit items, which may contain inferior ingredients or even harmful substances, pose a risk to consumers' health and safety. To mitigate this issue, cosmetic packaging companies are focusing on implementing robust quality control measures. These include compression testing, tamper-evident seals, and rigorous ink formulation and labeling system checks. Moreover, there is a growing trend towards using recyclable materials and advanced printing techniques in cosmetic packaging.

- Carton packaging, for instance, is increasingly popular due to its sustainability benefits and ability to protect products during transit. Capping machines and digital printing technology are other areas of investment for companies seeking to enhance their offerings and maintain a competitive edge. By focusing on these areas, companies can ensure the authenticity and quality of their packaging, thereby protecting both their brand reputation and consumers' health.

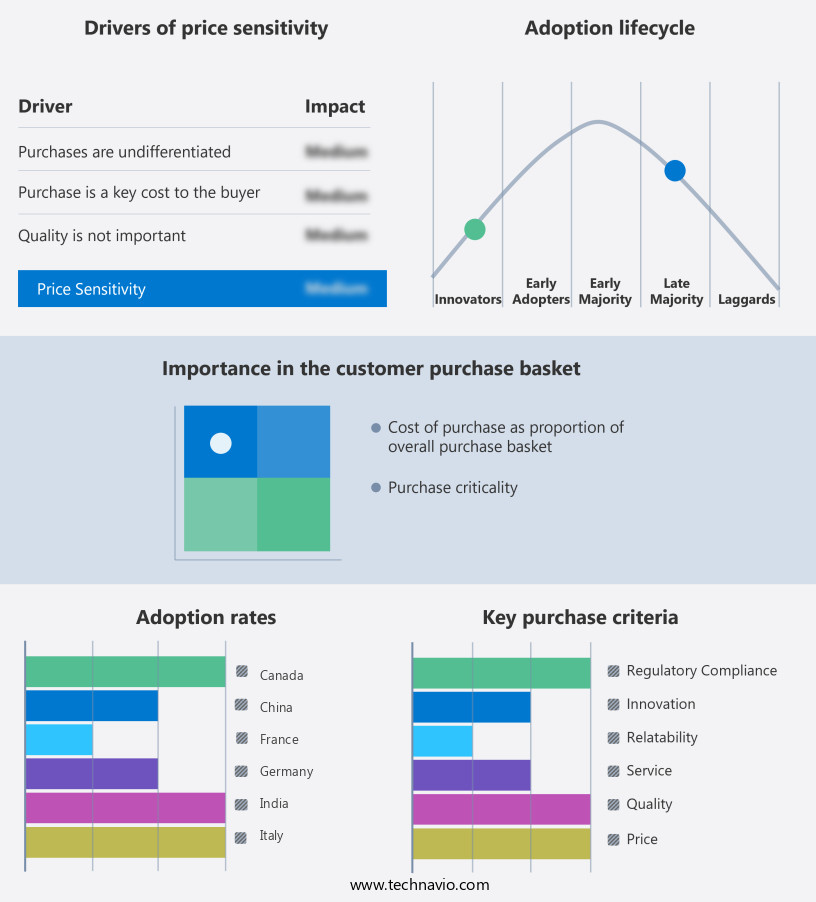

Exclusive Customer Landscape

The cosmetic packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cosmetic packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cosmetic packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AG Poly Packs Pvt. Ltd. - Specializing in innovative cosmetic packaging solutions, we provide a range of offerings including cream jars, HDPE shampoo bottles, pet gel jars, and pet serum bottles, enhancing product presentation and consumer experience. Our high-quality packaging elevates brand image and ensures product preservation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AG Poly Packs Pvt. Ltd.

- Albea Services SAS

- Altium Packaging

- Amcor Plc

- APackaging Group

- AptarGroup Inc.

- Ball Corp.

- Berry Global Inc.

- Cosmopak USA LLC

- DS Smith Plc

- Gerresheimer AG

- Graham Blowpack Pvt. Ltd.

- HCP Packaging UK Ltd.

- Libo Cosmetics

- Quadpack Industries SA

- Silgan Holdings Inc.

- SKS Bottle and Packaging Inc.

- Sulapac Oy

- The Dow Chemical Co.

- TriMas Corp.

- Verescence France

- Vimal Plastics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cosmetic Packaging Market

- In January 2024, L'Oréal, a leading cosmetics company, launched a new line of sustainable packaging for its luxury brand, Lancôme. The innovative packaging, made from recycled glass and sugarcane-derived plastic, was introduced at the Consumer Electronics Show (CES) in Las Vegas (L'Oréal press release, 2024).

- In March 2024, Amcor, a global packaging solutions provider, announced a strategic partnership with Shiseido, a Japanese cosmetics company. The collaboration aimed to develop more sustainable packaging solutions using renewable materials and advanced design techniques (Amcor press release, 2024).

- In May 2024, Berry Global, a multinational plastic packaging manufacturer, acquired RPC Group, a leading European packaging company, for approximately USD6.5 billion. The acquisition expanded Berry Global's European footprint and strengthened its position in the cosmetics packaging market (Berry Global press release, 2024).

- In January 2025, the European Union (EU) introduced new regulations on single-use plastic packaging, banning the production and sale of certain types of packaging from 2026. This initiative is expected to drive demand for alternative, sustainable packaging solutions in the cosmetics industry (European Commission press release, 2025).

Research Analyst Overview

- The market is experiencing significant dynamics and trends, with a focus on enhancing product safety, sustainability, and consumer appeal. Oxygen barrier and moisture barrier properties are essential for maintaining product quality, leading to the adoption of advanced packaging solutions such as hot stamping and UV protection. Packaging optimization and automation are key areas of investment, with automated packaging lines and RFID tags enabling supply chain efficiency. Smart packaging, including augmented reality and inkjet printing, is gaining popularity for brand enhancement and user experience. Sustainability reporting and minimalist packaging are also important trends, with an emphasis on carbon footprint reduction and design for recyclability.

- Quality assurance and regulations compliance are critical factors, with testing procedures and material selection playing crucial roles in ensuring product protection and consumer safety. Shelf impact and packaging ergonomics are also essential considerations for businesses seeking to differentiate their offerings in a competitive market. Packaging innovation continues to drive the industry, with lightweight packaging and secondary and tertiary packaging solutions offering cost reduction opportunities while maintaining product protection. UV curing and foil stamping are popular decoration techniques, providing an additional layer of brand enhancement. In summary, the market is undergoing transformative changes, with a focus on product safety, sustainability, and consumer experience.

- Companies must navigate these trends while ensuring regulatory compliance and optimizing their packaging supply chain for efficiency and cost savings.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cosmetic Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.6% |

|

Market growth 2025-2029 |

USD 27.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.3 |

|

Key countries |

US, Canada, Germany, China, UK, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cosmetic Packaging Market Research and Growth Report?

- CAGR of the Cosmetic Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cosmetic packaging market growth of industry companies

We can help! Our analysts can customize this cosmetic packaging market research report to meet your requirements.