Cotton Harvester Market Size 2024-2028

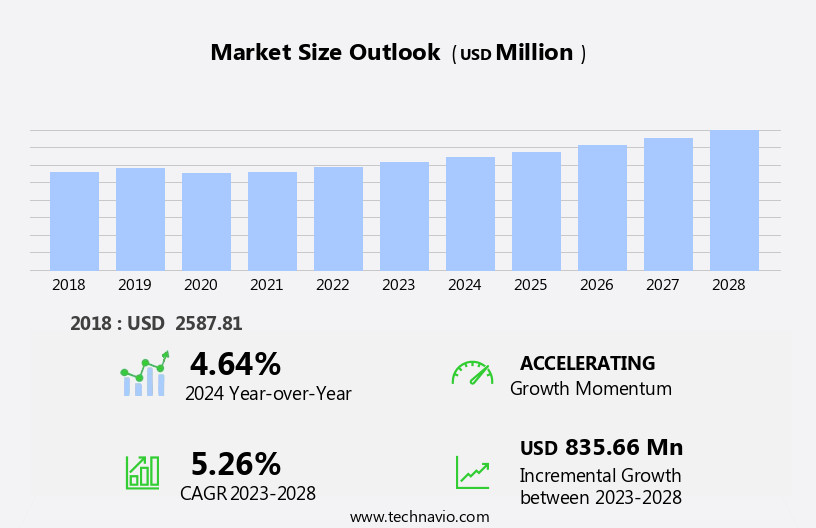

The cotton harvester market size is forecast to increase by USD 835.66 million at a CAGR of 5.26% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing consumption of cotton products worldwide. The integration of advanced technologies, such as GPS mapping, autonomous driving, and precision farming, into cotton harvesters is also driving market growth. However, the market faces challenges due to limitations with climate conditions for cotton harvesters, particularly in regions with extreme temperatures and moisture levels. Additionally, the high initial investment required for cotton harvesters and the availability of alternative farming methods pose significant challenges to market growth. Overall, the market is expected to continue expanding as the demand for efficient and technologically advanced cotton harvesters increases.

What will be the Size of the Cotton Harvester Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for mechanized agricultural systems in cotton production. Traditional methods of cotton picking, such as using labor-intensive strippers and pickers, have given way to advanced mechanical cotton harvesters. These modern harvesters employ sensors, GPS, and monitoring systems to optimize crop yield and improve efficiency. Eco-friendly products and sustainable farming practices are also driving market growth, as consumers and regulators demand more environmentally-friendly cotton picker technology. The integration of AI, IoT, and blockchain in cotton harvesters is revolutionizing the industry, enabling real-time data analysis and streamlined supply chain management.

- Additionally, the rise of ecommerce and health and wellness trends has increased the demand for high-quality cotton, further boosting market growth. Overall, the market is poised for continued expansion as it adapts to evolving consumer preferences and technological advancements.

How is this Cotton Harvester Industry segmented and which is the largest segment?

The cotton harvester industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Cotton picker

- Cotton stripper

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Product Insights

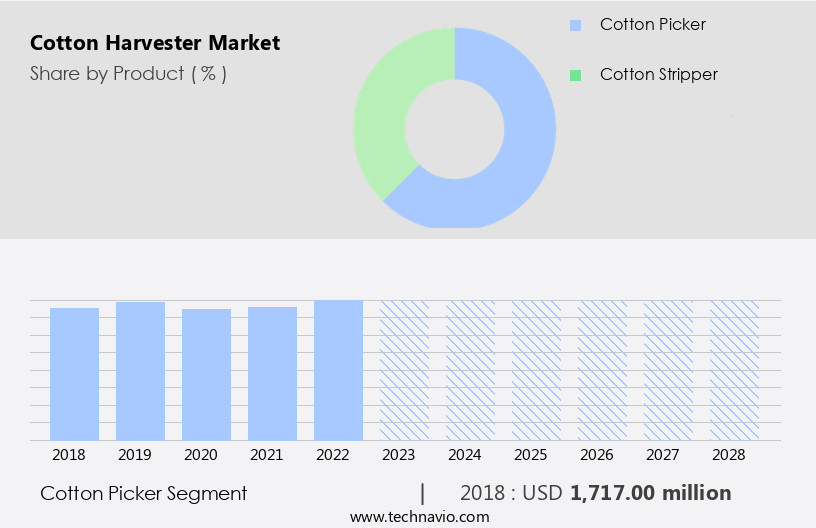

- The cotton picker segment is estimated to witness significant growth during the forecast period.

Cotton pickers are essential agricultural devices used in cotton production, featuring rotating spindles or prongs that extract cotton from open bolls without damaging unopened ones or the plants. These machines come in various types, including handheld and larger, machine-driven versions. Handheld pickers, which run on battery or solar energy, are lightweight and suitable for small-scale farming. Mechanized cotton pickers, on the other hand, are adjustable in height to accommodate both long and short cotton plant varieties. These advanced agricultural systems employ sensors, GPS, and monitoring systems to optimize cotton selection performance, increase yield, and minimize logistic costs. The cotton industry continues to evolve with innovations in technology, such as cutting-edge materials and cotton picker industry advancements, including sorting heads, rotating blades, brushes, conveyor systems, cleaning machines, and impurity removal systems.

The rise of organic textiles and e-commerce platforms offering discounts on organic cotton textiles has fueled the demand for cotton pickers. However, challenges such as labor shortages, water scarcity problems, and the need for eco-friendly products necessitate ongoing modernization and industrialization In the cotton industry. AI, IoT, blockchain, and e-commerce are transforming the cotton sector, offering increased productivity and convenience for farmers and consumers alike.

Get a glance at the Cotton Harvester Industry report of share of various segments Request Free Sample

The Cotton picker segment was valued at USD 1717.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

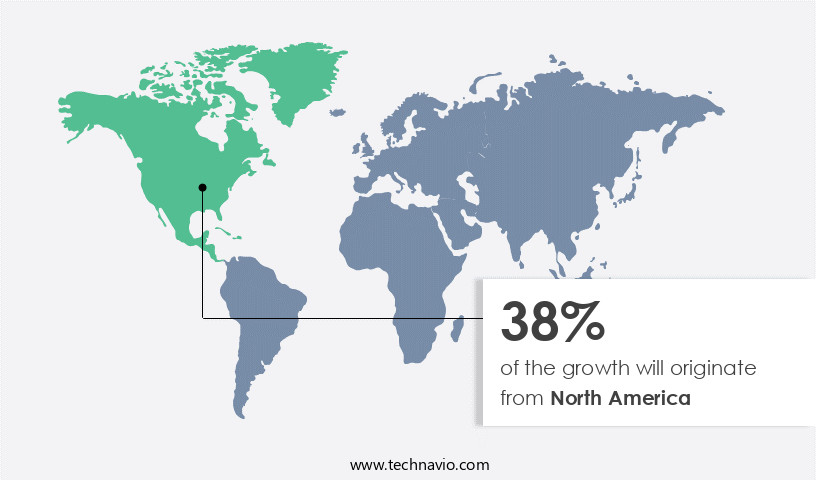

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in select countries, including China, India, and Pakistan, has witnessed a rise in mechanization due to government subsidies encouraging farmers to invest in agricultural equipment. In Uzbekistan, the government is promoting mechanized cotton harvesting to reduce reliance on manual labor, which has been a health concern for women and children. In March 2020, the Uzbekistan government renewed a billion-dollar contract with the US government to procure cotton harvesters from CNH Industrial's Case IH, New Holland, and John Deere's subsidiaries. Advanced agricultural systems, including sensors, GPS, and monitoring systems, are integrated into modern cotton picker technology, enhancing productivity and reducing labor shortages.

The adoption of cotton harvesters contributes to increased yield in cotton fields, benefiting the cotton textiles industry, e-commerce platforms, and organic textiles. The rise of e-commerce, online ordering, and lifestyle organic garments, fueled by celebrities and the post-pandemic economy, further boosts the demand for cotton harvesters. The cotton picker industry continues to innovate with cutting-edge agricultural devices, such as sorting heads, rotating blades, brushes, conveyor systems, and cleaning machines, to improve cotton fiber quality and reduce impurities like dust. The implementation of advanced agricultural systems, urbanization, and industrialization contribute to the modernization of the cotton industry, emphasizing automation, fiber preferences, and mechanical harvesting for enhanced productivity and cotton picking speed.

AI, IoT, blockchain, and ecommerce are transforming the cotton industry, ensuring health and wellness naturally while addressing challenges like water scarcity problems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cotton Harvester Industry?

Increasing consumption of cotton-related products globally is the key driver of the market.

- The global cotton market is experiencing growth due to several factors, including the decline in cotton fiber prices and the rising preference for cotton textiles over synthetic alternatives in textile mills, particularly in major consuming countries like China, Vietnam, Bangladesh, India, and the US. According to the United States Department of Agriculture (USDA), global cotton consumption increased by around 6% in 2021 to reach approximately 25.9 million metric tons, compared to 20.2 million metric tons in 2020. This trend, coupled with the increasing purchasing power of consumers worldwide, is expected to fuel the demand for cotton and its derived products.

- Cotton is widely used in various applications, including apparel such as T-shirts, shirts, trousers, dresses, and innerwear. The rise of lifestyle organic garments and the growing popularity of eco-friendly products among consumers, particularly celebrities, have led to an increase in demand for organic cotton textiles. Modernization and urbanization have also contributed to the growth of the cotton market, with the adoption of cutting-edge agricultural systems, advanced cotton picker technology, and innovative materials. However, challenges such as labor shortages, logistic costs, water scarcity problems, and the need for preserving field health and minimizing impurities, such as dust, remain significant concerns for the cotton industry.

- To address these challenges, the cotton picker industry has embraced automation and mechanical harvesting, which has led to increased productivity and cotton picking speed. Furthermore, the integration of AI, IoT, blockchain, and e-commerce platforms has streamlined the cotton supply chain and facilitated online ordering, discounts, and shipping. The Organic Trade Association reports that organic cotton production has also increased significantly, with fiber volume growing by 13% in 2020. In conclusion, the cotton market is experiencing growth due to various factors, including the increasing demand for cotton textiles, the rise of eco-friendly and organic cotton, and the adoption of advanced agricultural systems and cotton picker technology.

- Despite challenges such as labor shortages and water scarcity, the industry continues to innovate and modernize to meet the evolving needs of consumers and textile mills. The future of the cotton market looks promising, with continued investment in research and development, automation, and e-commerce platforms expected to drive growth and efficiency.

What are the market trends shaping the Cotton Harvester Industry?

Integration of latest technologies in cotton harvesters is the upcoming market trend.

- Commercial cotton harvesters have been in use since the 1980s, with John Deere leading the mass production of these agricultural devices. The introduction of four-row and six-row pickers In the eighties and nineties, respectively, marked a significant advancement in cotton harvesting technology. Today, innovative technologies continue to shape the market. For example, Deere and Company's Precision Cotton Harvesting technology enables real-time monitoring of fiber volume, moisture content, and other essential parameters during the harvest season. This technology not only enhances productivity but also helps preserve the quality of harvested cotton by pausing the harvesting process when high moisture content is detected in bolls.

- Advanced agricultural systems, such as sensors, GPS, and monitoring systems, have become increasingly popular In the cotton harvester industry. These eco-friendly solutions help address water scarcity problems and contribute to the production of organic textiles. The organic cotton textiles market has experienced a post-pandemic rise, with increased demand for lifestyle organic garments from celebrities and consumers. E-commerce platforms and online ordering have significantly impacted the cotton textiles industry, offering discounts and convenient shipping options. The Organic Trade Association reports that organic cotton production has increased by 25% In the last decade. The cotton picker technology industry continues to evolve, with a focus on automation, sorting heads, rotating blades, brushes, conveyor systems, cleaning machines, and other advanced features to improve cotton selecting performance and mechanical harvesting speed.

- The cotton mill sector has embraced the use of AI, IoT, blockchain, and ecommerce to streamline operations and cater to health and wellness-conscious consumers. Industrialization and urbanization have led to fiber preferences shifting towards high-performance, sustainable, and eco-friendly products. In conclusion, the market is driven by technological advancements, increasing demand for organic cotton, and the evolving needs of consumers and businesses.

What challenges does the Cotton Harvester Industry face during its growth?

Limitations with climate conditions for cotton harvesters is a key challenge affecting the industry growth.

- Cotton harvesters play a crucial role In the production of cotton textiles, which include yarn, cotton balls, and various subsidiary products. These harvesters are classified into two types: pickers and strippers. Cotton pickers, an essential agricultural device, are designed to remove open cotton bolls from the plants, while strippers are used to separate the stems from the harvested crop. The cotton industry has seen increased yield due to advanced agricultural systems, modernization, and urbanization. These systems incorporate cutting-edge technologies such as sensors, GPS, and monitoring systems, ensuring eco-friendly production and preserving the field's health. The cotton picker industry has evolved with innovative materials and technology, including sorting heads, rotating blades, brushes, conveyor systems, and cleaning machines, which help in removing impurities like dust and improving cotton picking speed and productivity.

- The cotton mill processes the harvested cotton into fibers, which are then used to manufacture cotton textiles. The fiber volume In the cotton textiles market has grown significantly due to the post-pandemic rise in e-commerce, online ordering, and lifestyle organic garments endorsed by celebrities. The organic textiles segment has experienced substantial growth due to consumer preferences for health and wellness, and the Organic Trade Association reports a 25% increase in organic cotton production In the US in 2020. Logistic costs and labor shortage are challenges faced by the cotton industry. To address these issues, the industry is adopting automation, AI, IoT, blockchain, and e-commerce platforms to streamline operations, offer discounts, and improve cotton selecting performance.

- The shipping platforms are also investing in advanced agricultural systems to increase productivity and minimize water scarcity problems. In conclusion, the market is a dynamic and evolving industry that is adapting to changing consumer preferences and technological advancements. The focus on eco-friendly products and automation is driving innovation In the cotton picker industry, ensuring a sustainable and productive future for cotton production.

Exclusive Customer Landscape

The cotton harvester market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cotton harvester market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cotton harvester market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Barnhardt Manufacturing Co. - The company specializes in producing and supplying high-purity cotton fiber for various industries, including medical, pharmaceutical, health, personal care, and home applications. This is accomplished through the utilization of advanced cotton harvester machines. The resulting fiber offers superior quality and consistency, making it an ideal choice for these sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barnhardt Manufacturing Co.

- Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

- CNH Industrial NV

- Deere and Co.

- Gomselmash India Pvt Ltd.

- Hubei Fotma Machinery Co. Ltd.

- Rana Group of Companies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and distribution of agricultural devices specifically designed for the efficient and effective harvesting of cotton fibers. This market is driven by various factors, including the increasing demand for cotton textiles and subsidiary products, modernization of agricultural systems, and the trend towards automation and eco-friendly practices. Cotton fibers are a vital component of the textile industry, with a wide range of applications in clothing, upholstery, and various industrial uses. As such, the demand for cotton harvesters is closely tied to the overall demand for cotton fibers. The global textile industry is experiencing significant growth, driven by increasing urbanization and the rising popularity of e-commerce platforms.

This trend is leading to an increased demand for cotton textiles and, in turn, a greater need for efficient and productive cotton harvesters. Modernization of agricultural systems is another key factor driving the market. The adoption of cutting-edge agricultural technologies, such as sensors, GPS monitoring systems, and advanced cleaning machines, is transforming the way cotton is harvested. These technologies help to improve productivity, reduce labor costs, and minimize the impact of water scarcity problems. Eco-friendly practices are also becoming increasingly important In the market. The demand for organic cotton textiles is on the rise, driven by consumer preferences for healthier and more sustainable products.

This trend is leading to the development of innovative materials and technologies that can help to minimize the use of harmful chemicals in cotton production. The cotton picker industry is undergoing significant change, with a focus on automation and mechanical harvesting. The use of AI and IoT technologies is becoming more common, allowing for greater precision and efficiency in cotton picking. Blockchain technology is also being explored as a way to improve supply chain transparency and traceability, which is important for both producers and consumers. Despite these advancements, the market faces several challenges. Labor shortages and rising logistic costs are major concerns for producers, particularly in regions where manual labor is still the primary method of cotton harvesting.

The use of advanced agricultural systems and automation is helping to mitigate these challenges, but the transition can be costly and time-consuming. In conclusion, the market is driven by the increasing demand for cotton textiles and the trend towards automation and eco-friendly practices. The adoption of cutting-edge agricultural technologies is transforming the way cotton is harvested, but the industry faces challenges related to labor shortages and logistic costs. Despite these challenges, the future of the market looks bright, with continued innovation and modernization expected to drive growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.26% |

|

Market growth 2024-2028 |

USD 835.66 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.64 |

|

Key countries |

US, China, Australia, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cotton Harvester Market Research and Growth Report?

- CAGR of the Cotton Harvester industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cotton harvester market growth of industry companies

We can help! Our analysts can customize this cotton harvester market research report to meet your requirements.