Data Center Liquid Immersion Cooling Market Size 2024-2028

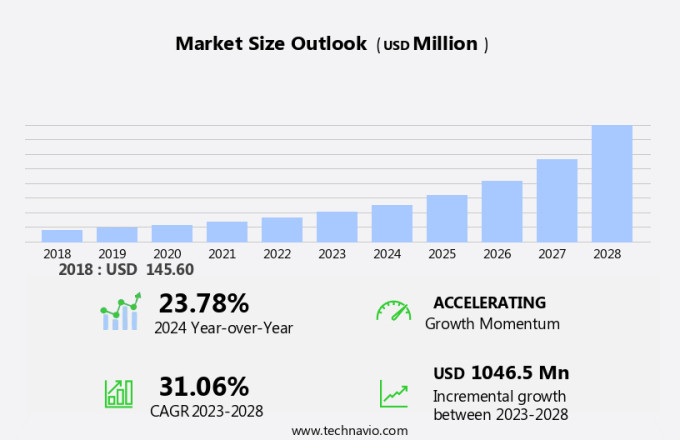

The data center liquid immersion cooling market size is forecast to increase by USD 1.05 billion, at a CAGR of 31.06% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing construction of data centers worldwide. This trend is fueled by the ever-expanding digital economy and the resulting demand for more data processing capacity. A key factor propelling market expansion is the growing need to reduce carbon footprint. Traditional air cooling methods contribute significantly to greenhouse gas emissions, making liquid immersion cooling an attractive alternative. This technology submerges servers in non-conductive liquid, allowing for more efficient cooling and increased power density. However, challenges remain. Implementing liquid immersion cooling requires substantial upfront investment and specialized expertise.

- Additionally, potential issues such as contamination risks and the need for regular maintenance must be addressed. Despite these obstacles, the availability of alternative cooling methods offers potential solutions, including the use of biocides and advanced filtration systems. Companies seeking to capitalize on this market's opportunities must navigate these challenges effectively, ensuring they have the necessary resources and expertise to deploy and maintain liquid immersion cooling systems. By doing so, they can reap the rewards of increased energy efficiency, reduced carbon emissions, and enhanced data center performance.

What will be the Size of the Data Center Liquid Immersion Cooling Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for more efficient and sustainable cooling solutions. Modular design and edge computing are key trends shaping the market, enabling better thermal management and reducing water consumption. Leak detection and pumping systems ensure safety and reliability, while dielectric fluids offer superior heat transfer capabilities. Liquid immersion cooling's integration with data center infrastructure, including server cooling, heat exchangers, and network infrastructure, enhances data center efficiency and reduces energy consumption. The application of machine learning and artificial intelligence (AI) in cooling system design further optimizes cooling performance and lowers operational costs.

However, the market's dynamics are not without challenges. Carbon footprint and environmental impact remain critical concerns, necessitating the use of eco-friendly immersion cooling fluids. The ongoing research and development in two-phase cooling, direct-to-chip cooling, and single-phase immersion cooling aim to address these concerns while maintaining high-performance computing (HPC) capabilities. The market's evolution is also influenced by IT infrastructure demands in various sectors, including big data, cloud computing, and high-performance computing. As the market unfolds, the focus on thermal management and capital expenditure (capex) vs. Operating expenditure (opex) continues to shape the competitive landscape. The integration of liquid immersion cooling into data center infrastructure is an ongoing process, with continuous innovation and advancements in fluid dynamics, heat transfer, and safety systems shaping the future of this dynamic market.

How is this Data Center Liquid Immersion Cooling Industry segmented?

The data center liquid immersion cooling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Large data centers

- Small and mid-sized data centers

- Component

- Solution

- Services

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

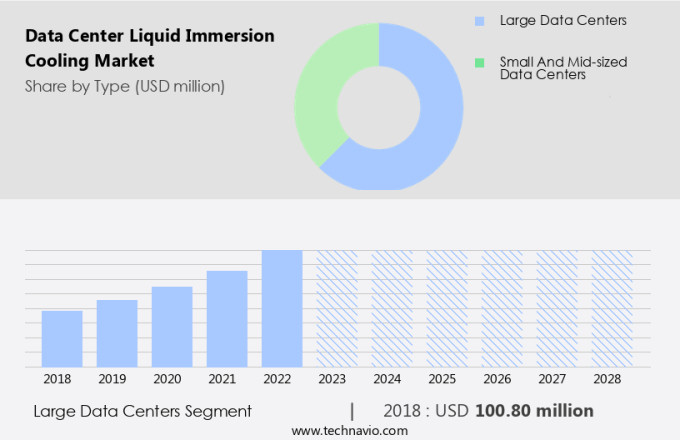

The large data centers segment is estimated to witness significant growth during the forecast period.

In the realm of data center cooling, liquid immersion cooling has emerged as an innovative solution for large-scale facilities and hyperscale data centers. This approach involves submerging servers and other IT components in dielectric fluids for cooling, offering advantages such as increased data center efficiency and reduced water consumption. Liquid immersion cooling systems utilize pumping systems and heat exchangers for heat transfer, ensuring optimal thermal management. Modular designs enable easy implementation and maintenance of these systems, while edge computing enhances their efficiency by bringing processing closer to the data source. Leak detection systems ensure safety, and artificial intelligence and machine learning optimize fluid dynamics for maximum performance.

However, the use of dielectric fluids raises environmental concerns, necessitating careful consideration of their carbon footprint. Operational costs, including capital expenditure and operating expenditure, are crucial factors in the adoption of liquid immersion cooling. Cooling system design and safety systems are essential components of these installations, with the former focusing on heat transfer and the latter ensuring the safety of personnel and equipment. Two-phase cooling and direct-to-chip cooling are alternative immersion cooling methods, while single-phase immersion cooling is an evolving trend. Data centers are increasingly adopting liquid immersion cooling for high-performance computing, big data, and cloud computing applications, as it offers significant improvements in server cooling and data center cooling.

In the context of large data centers, liquid immersion cooling represents a significant advancement in thermal management, offering enhanced efficiency, lower water consumption, and reduced energy consumption. As the market for data center infrastructure continues to evolve, liquid immersion cooling is poised to play a crucial role in the future of data center design and operation.

The Large data centers segment was valued at USD 100.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

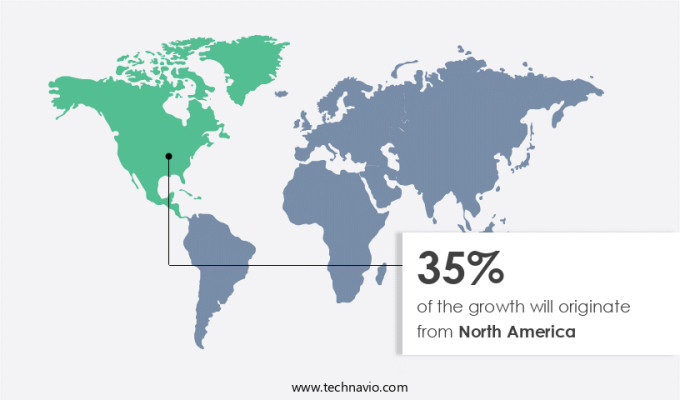

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth as companies and distributors form strategic partnerships to provide efficient solutions. companies are expanding their product offerings and enhancing their competitive edge by collaborating with industry players. This intense competition necessitates continuous growth through strategic alliances to expand market reach and customer base. These partnerships are increasing market awareness and driving adoption of data center liquid immersion cooling solutions. Edge computing, a key trend in the industry, is integrating immersion cooling for improved efficiency and reduced energy consumption. Leak detection systems, pumping systems, and safety systems are crucial components of immersion cooling, ensuring operational costs remain competitive.

Dielectric fluids, heat exchangers, and fluid dynamics play a significant role in heat transfer and thermal management. Machine learning and artificial intelligence are revolutionizing cooling system design, while single-phase immersion cooling and direct-to-chip cooling offer alternatives to traditional methods. Data centers, IT infrastructure, high-performance computing, and cloud computing are major sectors benefiting from these advancements. Despite the environmental impact and carbon footprint concerns, the market's growth is fueled by the need for more efficient and cost-effective cooling solutions. Water consumption reduction and rack-level cooling are essential considerations for data center infrastructure. Overall, the market is evolving, with innovative technologies and strategic partnerships shaping its future.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Data Center Liquid Immersion Cooling Industry?

- The construction of data centers is the primary factor fueling market growth, with an increasing number of organizations investing in advanced technology infrastructure to support their digital transformation initiatives.

- Data center liquid immersion cooling has emerged as an efficient solution for managing the increasing heat generated by high-performance computing systems. This cooling technology, which involves submerging servers in dielectric fluids, offers several advantages, including higher data center efficiency and reduced operational costs. The modular design of immersion cooling systems enables easier installation and maintenance, making them an attractive option for organizations. Edge computing, which involves processing data closer to the source, is also driving the adoption of data center liquid immersion cooling. This is because edge data centers often have limited space and power resources, making traditional air cooling less effective.

- Immersion cooling, on the other hand, allows for denser server deployments and reduces the need for large cooling systems. Leak detection and pumping systems are crucial components of data center liquid immersion cooling systems. These systems ensure the safety and reliability of the cooling process by continuously monitoring the fluid levels and detecting any leaks. Artificial intelligence (AI) and machine learning algorithms are increasingly being used to optimize these systems and improve overall data center performance. Despite the benefits, data center liquid immersion cooling also raises concerns regarding environmental impact. The use of dielectric fluids, which are often synthetic, can have negative effects on the environment if not disposed of properly.

- However, efforts are being made to develop eco-friendly fluids and improve recycling processes to mitigate these concerns. In conclusion, data center liquid immersion cooling is a promising technology that offers several advantages, including increased efficiency, reduced operational costs, and the ability to support edge computing. However, it also presents challenges related to leak detection, pumping systems, and environmental impact. Ongoing research and innovation in these areas will help address these challenges and drive the growth of the market.

What are the market trends shaping the Data Center Liquid Immersion Cooling Industry?

- The increasing awareness of the necessity to decrease carbon emissions is a prevailing market trend. It is essential for both individuals and businesses to adopt sustainable practices to minimize their carbon footprint.

- In the data center sector, carbon emissions have become a pressing concern due to the significant energy consumption required to power IT servers, generators, and building infrastructure. Data centers account for 2.5% to 4.5% of the global power generation and emit 1.5% to 2.5% of greenhouse gases annually. With the increasing demand for data centers to support business operations, there is a growing need for energy-efficient cooling solutions. Liquid immersion cooling is an innovative approach that can help reduce power consumption and carbon emissions in data centers. This cooling system design uses non-conductive fluids to absorb heat directly from the IT components, eliminating the need for traditional air-based cooling systems and their associated energy losses.

- The fluid dynamics of liquid immersion cooling are optimized through advanced heat exchangers and safety systems to ensure harmonious operation. Machine learning algorithms can also be employed to optimize the cooling process further, leading to increased efficiency and cost savings. By adopting liquid immersion cooling, organizations can significantly reduce their carbon footprint and contribute to a more sustainable data center ecosystem.

What challenges does the Data Center Liquid Immersion Cooling Industry face during its growth?

- The growth of the industry is significantly influenced by the limited availability of effective alternative cooling methods.

- Data centers are facing a significant challenge with increasing power consumption, leading operators to explore more efficient cooling solutions. Traditional air-based cooling methods, such as airside and waterside economizers, have been effective in maintaining a Power Usage Effectiveness (PUE) of 1. However, for high-performance computing (HPC) environments, where computing requirements exceed those of large data centers, two-phase liquid immersion cooling is gaining popularity. This cooling method, which involves immersing computer components in a dielectric fluid for heat transfer, offers several advantages, including higher cooling capacity and energy efficiency. The market for data center liquid immersion cooling is growing as more organizations seek to reduce water consumption and improve network infrastructure performance.

- Direct-to-chip cooling, a variant of liquid immersion cooling, is also gaining traction due to its ability to cool individual chips directly, further enhancing cooling efficiency. Overall, the adoption of liquid immersion cooling is a harmonious response to the need for more efficient and high-performance data center infrastructure.

Exclusive Customer Landscape

The data center liquid immersion cooling market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center liquid immersion cooling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data center liquid immersion cooling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aecorsis BV - This company specializes in the development and distribution of innovative sports products, catering to diverse consumer needs and preferences in the global market. Their offerings span various categories, including equipment, apparel, and nutrition, all aimed at enhancing athletic performance and promoting active lifestyles. The company's research and development team continually explores cutting-edge technologies and trends to deliver high-quality, differentiated solutions to consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aecorsis BV

- Chilldyne

- Coolit Systems

- DCX The Liquid Cooling Co.

- DUG Technology Ltd.

- Engineered Fluids Inc.

- ExaScaler Inc.

- Fujitsu General Ltd.

- Green Revolution Cooling Inc.

- Iceotope Technologies Ltd.

- LiquidCool Solutions

- LiquidStack B.V.

- Midas Immersion Cooling

- Rittal GmbH and Co. KG

- STULZ GmbH

- Submer Technologies SL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Liquid Immersion Cooling Market

- In January 2024, Intel Corporation announced the successful deployment of its first large-scale liquid immersion cooling system for data centers at its Oregon facility. This marks a significant technological advancement in the data center cooling market, as Intel aims to reduce water usage and improve energy efficiency (Intel Press Release, 2024).

- In March 2024, Schneider Electric and Green Revolution Cooling (GRC) entered into a strategic partnership to integrate GRC's immersion cooling technology into Schneider Electric's EcoStruxure IT architecture. This collaboration is expected to accelerate the adoption of immersion cooling in data centers worldwide (Schneider Electric Press Release, 2024).

- In May 2024, Vertiv, a global provider of critical infrastructure solutions, acquired LeChasseur, a leading manufacturer of liquid cooling solutions for data centers. This acquisition strengthens Vertiv's position in the data center cooling market and expands its product portfolio (Vertiv Press Release, 2024).

- In February 2025, Microsoft announced the completion of its hyperscale data center in Arizona, which utilizes liquid immersion cooling technology for its servers. This project marks the largest deployment of immersion cooling technology in a single data center, showcasing Microsoft's commitment to reducing its carbon footprint and improving energy efficiency (Microsoft Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant growth as organizations seek more sustainable and energy-efficient solutions for their IT infrastructure. Green data centers, which prioritize sustainability metrics and compliance with industry regulations, are increasingly adopting this technology to reduce their carbon footprint and optimize capacity planning. Predictive modeling and data analytics play crucial roles in ensuring the reliability and safety of these systems. IoT sensors monitor electrostatic discharge (ESD) levels, temperature, and pressure to prevent potential risks and ensure standards compliance. Materials science advances, such as the development of vapor chambers and cold plates, enhance the efficiency of liquid cooling systems.

- Hybrid cooling solutions, which combine liquid immersion and traditional air or water cooling, offer flexibility and improved energy efficiency. Renewable energy integration and lifecycle analysis are essential considerations for organizations implementing these systems. Failure analysis and quality control processes ensure the longevity and safety of liquid cooling components, including heat pipes and fluid compatibility. Remote monitoring and risk assessment are essential for maintaining optimal system performance and ensuring safety standards. The market for liquid immersion cooling is expected to continue growing as organizations prioritize energy efficiency, sustainability, and compliance in their data center operations.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Liquid Immersion Cooling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.06% |

|

Market growth 2024-2028 |

USD 1046.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

23.78 |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Center Liquid Immersion Cooling Market Research and Growth Report?

- CAGR of the Data Center Liquid Immersion Cooling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data center liquid immersion cooling market growth of industry companies

We can help! Our analysts can customize this data center liquid immersion cooling market research report to meet your requirements.