Data Center Rack PDU Market Size 2024-2028

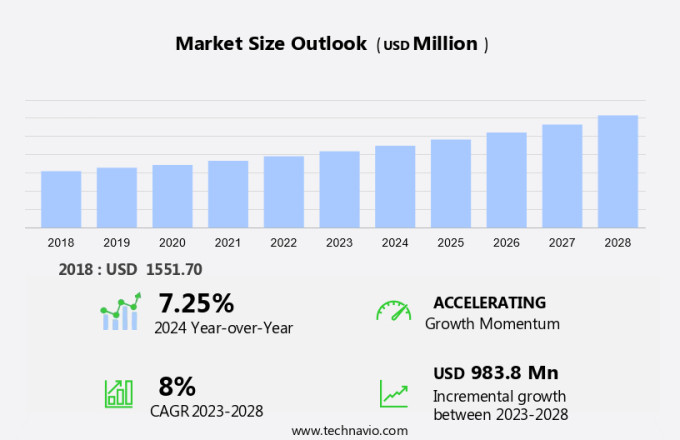

The data center rack PDU market size is forecast to increase by USD 983.8 million at a CAGR of 8% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The increasing demand for edge data centers, which require efficient power management solutions, is one such factor. Additionally, the wave in mobile data traffic and the resulting need for more data consumption capacity is driving the market. The Internet of Things (IoT) platforms and the proliferation of smart electric devices are also contributing to increased power usage in server rooms. To address these challenges, advanced Smart PDUs are gaining popularity due to their ability to monitor and manage power consumption in real-time. The proliferation of data-driven applications, cloud microservices, and IoT platforms is driving the need for edge data centers, which require PDUs that can efficiently manage power distribution and cooling systems. These devices offer precise power distribution and energy efficiency, making them an essential component of modern data center infrastructure. Overall, the market is expected to continue growing as businesses seek to optimize their power usage and reduce costs.

The market is evolving rapidly with the rise of digital traffic and data-driven applications. Modern data centers require reliable power distribution and efficient equipment cooling solutions to handle increasing bandwidth demands. Cloud based services and IoT integration have driven the adoption of smart PDUs, which offer real-time monitoring and advanced control over power usage, ensuring optimal performance and reducing energy consumption. Fiber optic lines and copper wires are essential for high-speed data transmission, while electric devices within server rooms require constant monitoring and protection. With application dominance in sectors like cloud computing and e-commerce, the need for strong PDUs, capable of managing power distribution and cooling effectively, has never been greater. A Smart PDU in a server room, integrated with cloud-based services and IoT (Internet of Things), enables real time monitoring of electric device, optimizing energy usage and supporting data driven applications for efficient power management.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Non-intelligent rack PDU

- Intelligent rack PDU

- Type

- Colocation

- Hosting

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- Italy

- South America

- Middle East and Africa

- North America

By Product Insights

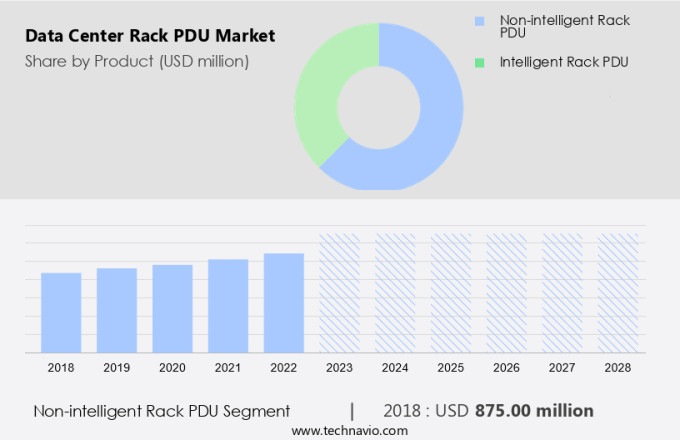

The non-intelligent rack PDU segment is estimated to witness significant growth during the forecast period. The market is experiencing a decline, but the demand for rack-mounted PDUs continues to rise. This trend is driven by the advantages they offer, including efficient use of space and cost-effective power distribution to network switches, servers, and other electronic devices.

The increasing adoption of cloud computing by Small and Medium Enterprises (SMEs) is leading to the proliferation of mini data centers, where basic PDUs are commonly utilized for power management. However, the market share of basic PDUs lags behind that of intelligent PDUs due to their limitations, such as the lack of remote access and monitoring capabilities. Despite this, the cost-effectiveness of basic PDUs makes them a popular choice for many organizations seeking to optimize their IT services.

Get a glance at the market share of various segments Request Free Sample

The non-intelligent rack PDU segment accounted for USD 875.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

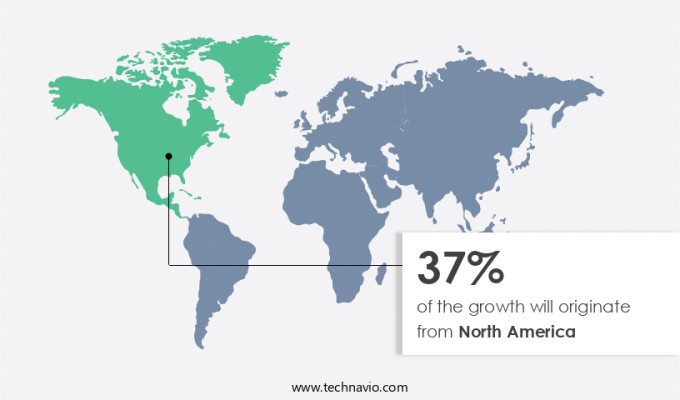

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the expansion of data centers is on the rise, fueled by substantial investments from cloud service providers, colocation companies, and businesses seeking to enhance their IT infrastructure. Edge computing, 5G, multi-cloud services, data analytics, and the Internet of Things (IoT) are key drivers of this growth. The US, as a leading data center hub in North America, hosts major data center markets in cities such as Atlanta, Northern Virginia, Chicago, Dallas/Ft. Worth, and Silicon Valley. Notable companies have announced their plans to expand, further boosting the server market in the region. The increasing need for 5G-enabled IoT solutions and industries requiring high connectivity with minimal latency are significant factors contributing to the overflow in demand for data center solutions across North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing investments in data center construction is the key driver of the market. Data centers play a crucial role in the digital transformation of businesses, particularly those with data-driven applications. The proliferation of cloud computing and the increasing adoption of digital technologies are driving the demand for reliable and efficient data center infrastructure. With this addition, NTT now operates over 12 data center locations across the country, offering enhanced capacity and energy efficiency. As companies continue to invest in digitalization, real-time monitoring and remote management of data centers have become essential for optimizing energy usage and ensuring cost savings.

Moreover, the increasing use of data-driven applications and the growing importance of energy efficiency are expected to fuel the growth of the market. Remote management and real-time monitoring capabilities of these PDUs are particularly valuable in the context of cloud computing, where scalability and flexibility are key requirements. By providing accurate and timely information on power usage and enabling automated responses to power demand, data center PDUs help ensure the optimal performance of cloud services and applications. In summary, the growing importance of cloud computing, digitalization, and data-driven applications is driving the demand for efficient and reliable data center infrastructure. Advanced PDUs, with their real-time monitoring and energy efficiency features, are well-positioned to meet this demand and contribute to cost savings for businesses.

Market Trends

Growing investments in hyper-scale data centers by colocation providers is the upcoming trend in the market. The proliferation of edge data centers is fueling the growth of the data center PDUs market in the United States. The ripple in mobile data traffic and the increasing consumption of data by IoT platforms necessitate the need for advanced electric devices to manage and distribute power efficiently in server rooms. Smart PDUs have emerged as a viable solution to address these challenges.

These companies are investing heavily to meet the increasing data requirements of businesses and individuals. The Smart Revolution, which encompasses the development of smart cities, grids, and homes, is generating massive amounts of data. Processing this data is becoming a critical priority, leading to an uptick in the number of hyper-scale data centers. In conclusion, the data center colocation market in the US is poised for significant growth due to the increasing demand for advanced electric devices, such as Smart PDUs, to manage and distribute power efficiently in edge data centers.

Market Challenge

Increased power consumption in racks is a key challenge affecting the market growth. Data centers are essential for the smooth functioning of online communication services and IT infrastructure by housing servers and storage devices. Powering these facilities is a significant expense for operators, with costs encompassing energy consumption, establishing efficient power distribution systems, and routine maintenance. The power demand from data centers is substantial, contributing to a sizeable carbon footprint, particularly in countries like the US, the UK, and Germany, which host a large number of data centers. The trend of utilizing shared resources and hardware in these facilities further amplifies the power consumption. Globally, data center growth is accelerating, necessitating advanced power management solutions.

Intelligent Power Distribution Units (PDUs) are gaining popularity due to their energy efficiency and ability to monitor power usage and set alarm thresholds. These PDUs offer cost savings by reducing energy waste and improving overall power management.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

DigiPower Manufacturing Inc: The company offers Delta rack power distribution units that provide optimal power distribution for devices inside a rack.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Black Box Ltd.

- Chatsworth Products Inc.

- Cisco Systems Inc.

- Cyber Power Systems Inc.

- Dell Technologies Inc.

- Delta Electronics Inc.

- Eaton Corp. Plc

- Friedhelm Loh Stiftung and Co. KG

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Legrand SA

- Leviton Manufacturing Co. Inc.

- nVent Electric Plc

- Panduit Corp.

- Schleifenbauer Products BV

- Schneider Electric SE

- Siemens AG

- Toshiba Corp.

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for cloud-based services, digitalization, and remote access. With the rise of agile data centers and cloud computing, there is a growing need for power distribution units (PDUs) that offer monitoring capabilities, energy efficiency, and cost savings. These intelligent PDUs enable real-time monitoring of power consumption, alarm thresholds, and input load monitoring, ensuring optimal operation of electronic devices such as servers, network switches, and other IT infrastructure.

Additionally, mobile data traffic and data consumption are also fueling the demand for PDUs that can support high-speed networks and distributed IT architecture. Energy efficiency is a key consideration for data centers, and PDUs play a crucial role in reducing hardware costs by minimizing power waste and ensuring that equipment is operating at peak efficiency. Cooling systems are another critical component of data centers, and PDUs with advanced cooling capabilities help maintain optimal temperatures for optimal performance. In industries such as financial services, healthcare, and industrial use applications, the need for reliable and efficient power distribution is paramount. PDUs are essential for ensuring the optimal operation of IT services and online communication services, as well as for powering cyberpower systems and other electronic devices in household and commercial development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market Growth 2024-2028 |

USD 983.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.25 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, China, Canada, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Black Box Ltd., Chatsworth Products Inc., Cisco Systems Inc., Cyber Power Systems Inc., Dell Technologies Inc., Delta Electronics Inc., DigiPower Manufacturing Inc., Eaton Corp. Plc, Friedhelm Loh Stiftung and Co. KG, Fujitsu Ltd., Hewlett Packard Enterprise Co., Legrand SA, Leviton Manufacturing Co. Inc., nVent Electric Plc, Panduit Corp., Schleifenbauer Products BV, Schneider Electric SE, Siemens AG, Toshiba Corp., and Vertiv Holdings Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch