Cloud Microservices Market Size 2024-2028

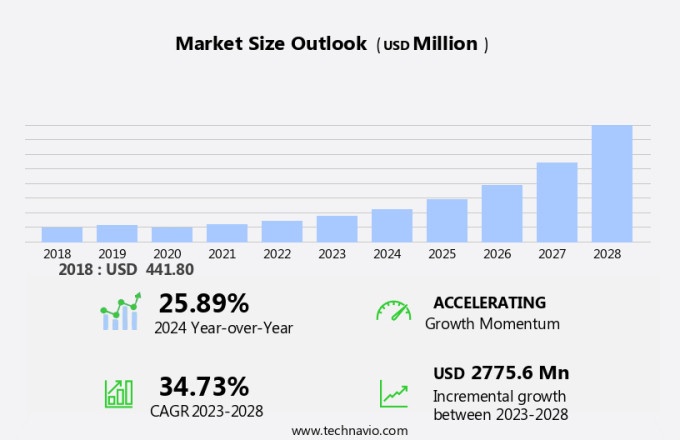

The cloud microservices market size is forecast to increase by USD 2.78 billion at a CAGR of 34.73% between 2023 and 2028. The market is experiencing significant growth, particularly in sectors such as healthcare, driven by the increasing use of mobile devices like smartphones and tablets for accessing mobile apps. This trend is being fueled by the cloud microservices architecture, which enables faster and more efficient development and deployment of applications. However, the adoption of cloud microservices also presents challenges, particularly for organizations in managing and integrating these services. The report on market trends and analysis highlights the growth factor of digital transformations and identifies the manufacturing sector as a key area of expansion. Despite these opportunities, there are organizational challenges that must be addressed to effectively manage microservices in a DevOps environment.

What will be the Size of the Market During the Forecast Period?

Cloud microservices architecture has emerged as a game-changer in the IT landscape, offering numerous benefits such as scalability, flexibility, and faster time-to-market. This architecture is revolutionizing the way businesses operate, particularly in sectors like telecommunications, consumer goods, healthcare, and IT. Microservices, a design approach where applications are built as a collection of small, independent services, are becoming increasingly popular. These services communicate with each other using well-defined programming interfaces, enabling seamless integration and efficient communication. Service meshes, a component of microservices architecture, further enhance communication between services, ensuring reliable and secure interactions. The adoption of cloud microservices architecture is not limited to large enterprises. Developing economies are also embracing this technology, as digitalization continues to penetrate various industries. The shift from monolithic applications to microservices is a significant step towards modernizing IT infrastructure. Cloud microservices are making a significant impact on various sectors. In telecommunications, they are being used to improve network performance and reduce operational costs.

Further, in consumer goods, they help companies deliver personalized experiences to customers through mobile apps on smartphones and tablets. The healthcare industry, in particular, is expected to benefit significantly from cloud microservices, as it can help streamline processes, improve patient care, and ensure data security and privacy. Consulting services and integration services play a crucial role in the adoption and implementation of cloud microservices architecture. They provide expertise and guidance to businesses looking to transition from traditional IT infrastructure to microservices. These services ensure a smooth transition, minimizing disruptions and maximizing the benefits of this technology. In conclusion, cloud microservices architecture is transforming the IT landscape by offering scalability, flexibility, and faster time-to-market. Its adoption is widespread across various industries, from telecommunications to healthcare, and its benefits are driving digitalization efforts in developing economies.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Platform

- Services

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Component Insights

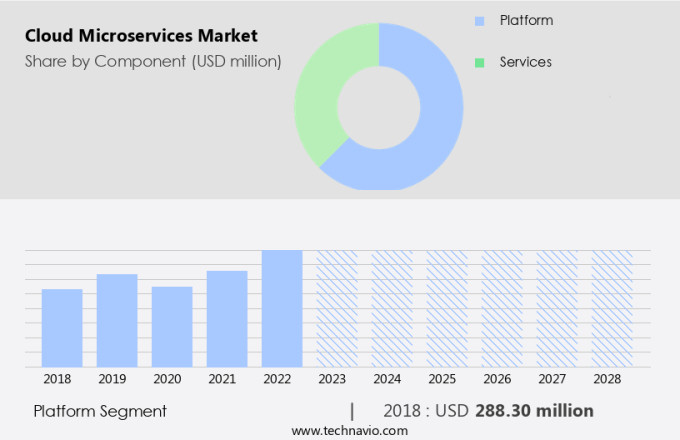

The platform segment is estimated to witness significant growth during the forecast period. In the United States, the market is experiencing significant growth, particularly in sectors such as healthcare, retail, and manufacturing. The adoption of mobile-based technologies, including smartphones and tablets, has led to an increase in the use of mobile apps, which in turn has fueled the demand for cloud microservices architecture. Cloud microservices platforms have become essential for businesses seeking to enhance productivity, improve employee satisfaction, and reduce operational costs.

Overall, the market is poised for continued growth, driven by the increasing adoption of digital transformation initiatives and the need for agile and scalable IT infrastructure. From a business perspective, implementing cloud microservices can lead to faster time-to-market, greater flexibility, and improved customer experience.

Get a glance at the market share of various segments Request Free Sample

The platform segment was valued at USD 288.30 million in 2018 and showed a gradual increase during the forecast period.

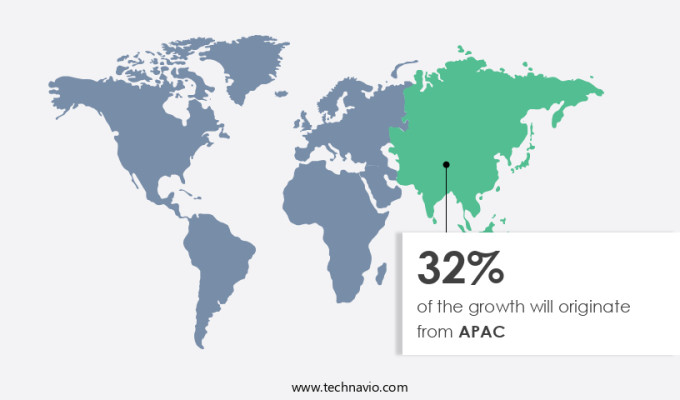

Regional Insights

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the adoption of cloud microservices is on the rise due to the increasing demand from businesses for advanced IT infrastructure solutions. Microservices architecture, which includes DevOps toolchains and cloud-native technologies like Kubernetes clusters, is particularly popular in industries such as finance, e-commerce, and travel. This architecture allows for cost-effective data storage and retrieval, increased agility, efficiency, and scalability. According to the International Telecommunication Union (ITU), digital transformation technologies and services spending in Canada is projected to surpass USD16 billion by 2027. This significant investment in emerging technologies, including artificial intelligence (AI) systems, the Internet of Things (IoT), next-generation security, augmented reality or virtual reality, 3D printing, and robotics, is driving the growth of cloud microservices in the region during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising digital transformations are the key drivers of the market. In today's business landscape, digital solutions, connected devices, and advanced IT systems are increasingly being adopted by organizations to enhance customer engagement and streamline operations. The rapid integration of these technologies has fueled the growth of digital transformation, leading businesses to seek agile environments for deploying new applications. Microservices architecture offers a solution by enabling enterprises to develop and release business applications quickly while ensuring optimal security, performance, and cost-effectiveness. Integration services play a crucial role in enabling seamless communication between various microservices. As the adoption of microservices continues to expand across industries such as ecommerce, entertainment, transportation, and logistics, the demand for reliable integration services is on the rise.

Optimize images with descriptive alt tags and file names. Use schema markup to provide additional information to search engines. Regularly update and add new content to keep your website fresh and engaging. Monitor and analyze your website's performance using tools like Google Analytics to identify areas for improvement.

Market Trends

The manufacturing sector is expected to register significant growth in the upcoming trend in the market. The manufacturing industry's shift towards intelligent technology is driving the adoption of microservices in the cloud. Traditional automation systems come with significant installation costs and maintenance challenges. In response, IT services in manufacturing are transitioning to service-oriented and app-oriented models. For instance, Amazon Web Services (AWS) offers "on-demand microservices and serverless computing models," enabling manufacturers to run connected plants or smart product programs with minimal upfront investment and flexible capacity. Cloud network manufacturing is also transforming the business landscape for manufacturing companies. With increasing competition, IT and computer-aided capabilities have become essential. Microservices in the cloud offer a cost-effective and scalable solution for manufacturers to stay competitive.

By utilizing these services, companies can streamline their operations, reduce costs, and improve efficiency. The future of manufacturing lies in leveraging the power of cloud microservices to drive innovation and growth.

Market Challenge

Organizational challenges while managing microservices are key challenges affecting the market growth. In today's business landscape, the adoption of cloud microservices is becoming increasingly popular across various industries, including Manufacturing and Telecommunication. However, managing these microservices can be complex due to their modular nature. As the number of microservices grows, it becomes essential to plan for their management from the outset or during development. Monitoring is a significant challenge when implementing cloud microservices. Traditional monitoring and diagnostic methods may not be effective due to multiple services contributing to the same functionality, each with its unique performance metrics. Embracing DevOps culture, ensuring fault-tolerance, and rigorous testing are other essential considerations to address the intricacies of cloud microservices.

Moreover, integrating advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into cloud microservices can further complicate management. Proper planning and implementation strategies are crucial to mitigate these challenges and reap the benefits of these innovative technologies. To effectively manage cloud microservices, organizations need to adopt a proactive approach. This includes implementing strong monitoring solutions, fostering a DevOps culture, and ensuring fault-tolerance through redundancy and failover mechanisms. Additionally, testing should be a continuous process to ensure the services perform optimally and are free from errors. In conclusion, while cloud microservices offer numerous benefits, their management can be complex.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amazon.com Inc. - The company offers cloud microservices which is an architectural and organizational approach to software development owned by small and self-contained teams.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspire Systems

- Atos SE

- Broadcom Inc.

- Contino Solution Ltd.

- F5 Inc.

- Idexcel Inc.

- Infosys Ltd.

- International Business Machines Corp.

- Macaw Software Inc.

- Marlabs LLC

- Microsoft Corp.

- OPENLEGACY TECHNOLOGIES LTD.

- Oracle Corp.

- RoboMQ

- Salesforce Inc.

- SmartBear Software Inc.

- Tata Consultancy Services Ltd.

- Unifyed

- Weaveworks Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cloud microservices have revolutionized IT infrastructure by enabling businesses to develop and deploy applications as a collection of small, independent services. These services communicate with each other using well-defined programming interfaces, allowing for greater flexibility, scalability, and resilience. Service meshes (SMEs) play a crucial role in managing communication between microservices, providing features like traffic management, security, and observability. The adoption of cloud microservices architecture is widespread across various industries, including telecommunications, consumer goods, healthcare, and manufacturing.

Further, mobile-based applications, such as smartphones and tablets, are particularly well-suited for this architecture due to their need for agility and quick time-to-market. DevOps practices, digitalization, and the shift towards cloud-native technologies have accelerated the adoption of microservices in the IT landscape. Microservices intelligence, DevOps toolchains, and consulting and integration services are essential for businesses embarking on their digital transformation journey. Ecommerce, entertainment, transportation, logistics, and manufacturing industries have all benefited from the adoption of microservices, with artificial intelligence and machine learning playing a key role in enhancing customer experience and optimizing operations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.73% |

|

Market Growth 2024-2028 |

USD 2.78 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

25.89 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amazon.com Inc., Aspire Systems, Atos SE, Broadcom Inc., Contino Solution Ltd., F5 Inc., Idexcel Inc., Infosys Ltd., International Business Machines Corp., Macaw Software Inc., Marlabs LLC, Microsoft Corp., OPENLEGACY TECHNOLOGIES LTD., Oracle Corp., RoboMQ, Salesforce Inc., SmartBear Software Inc., Tata Consultancy Services Ltd., Unifyed, and Weaveworks Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch