Data Warehousing Market Size 2025-2029

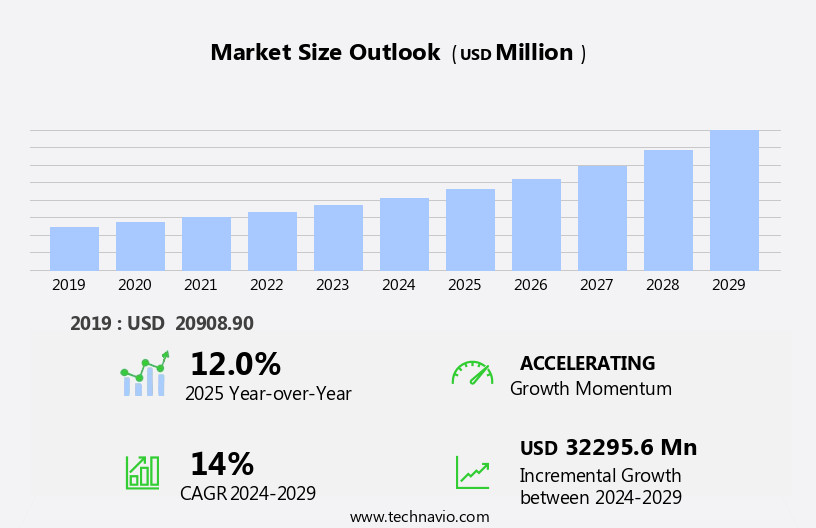

The data warehousing market size is forecast to increase by USD 32.3 billion, at a CAGR of 14% between 2024 and 2029.

- The market is experiencing significant shifts as businesses increasingly adopt cloud-based solutions and advanced storage technologies reshape the competitive landscape. The transition from on-premises to Software-as-a-Service (SaaS) models offers businesses greater flexibility, scalability, and cost savings. Simultaneously, the emergence of advanced storage technologies, such as columnar databases and in-memory storage, enables faster data processing and analysis, enhancing business intelligence capabilities. However, the market faces challenges as well. Data privacy and security risks continue to pose a significant threat, with the increasing volume and complexity of data requiring robust security measures.

- Ensuring data confidentiality, integrity, and availability is crucial for businesses to maintain customer trust and comply with regulatory requirements. Companies must invest in advanced security solutions and adopt best practices to mitigate these risks effectively.

What will be the Size of the Data Warehousing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing volume, variety, and velocity of data. ETL processes play a crucial role in data integration, transforming data from various sources into a consistent format for analysis. On-premise data warehousing and cloud data warehousing solutions offer different advantages, with the former providing greater control and the latter offering flexibility and scalability. Data lakes and data warehouses complement each other, with data lakes serving as a source for raw data and data warehouses providing structured data for analysis. Data warehouse optimization is a continuous process, with data stewardship, data transformation, and data modeling essential for maintaining data quality and ensuring compliance.

Data mining and analytics extract valuable insights from data, while data visualization makes complex data understandable. Data security, encryption, and data governance frameworks are essential for protecting sensitive data. Data warehousing services and consulting offer expertise in implementing and optimizing data platforms. Data integration, masking, and federation enable seamless data access, while data audit and lineage ensure data accuracy and traceability. Data management solutions provide a comprehensive approach to managing data, from data cleansing to monetization. Data warehousing modernization and migration offer opportunities for improving performance and scalability. Business intelligence and data-driven decision making rely on the insights gained from data warehousing.

Hybrid data warehousing offers a flexible approach to data management, combining the benefits of on-premise and cloud solutions. Metadata management and data catalogs facilitate efficient data access and management.

How is this Data Warehousing Industry segmented?

The data warehousing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Hybrid

- Cloud-based

- Type

- Structured and semi-structured data

- Unstructured data

- End-user

- BFSI

- Healthcare

- Retail and e-commerce

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

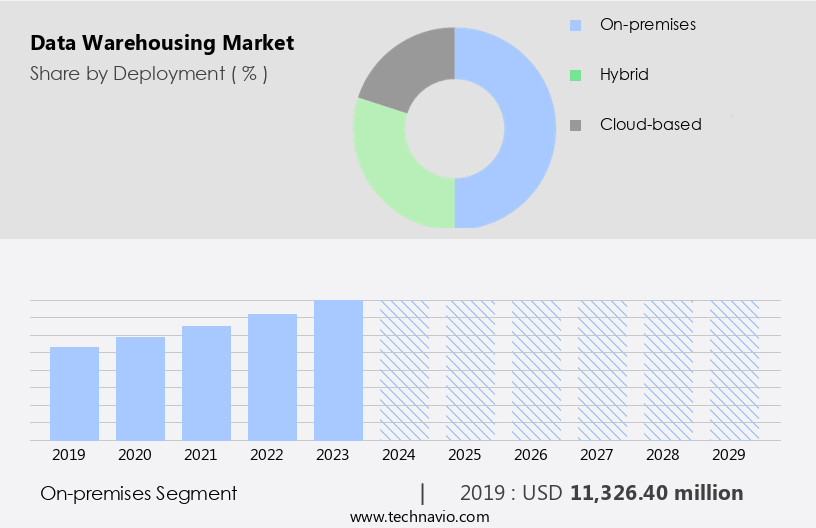

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, on-premise data warehousing solutions continue to be a preferred choice for businesses seeking end-to-end control and enhanced security. These solutions, installed and managed on the user's server, offer benefits such as workflow streamlining, speed, and robust data governance. The high cost of implementation and upgradation, coupled with the need for IT specialists, are factors contributing to the segment's popularity. Data security is a primary concern, with the complete ownership and management of servers ensuring that business data remains secure. ETL processes play a crucial role in data warehousing, facilitating data transformation, integration, and loading.

Data modeling and mining are essential components, enabling businesses to derive valuable insights from their data. Data stewardship ensures data compliance and accuracy, while optimization techniques enhance performance. Data lake, a large storage repository, offers a flexible and cost-effective approach to managing diverse data types. Data warehousing consulting services help businesses navigate the complexities of implementation and migration. Data warehouse modernization and data platform solutions cater to evolving business needs. Data security remains a priority, with encryption, masking, and access control measures essential for safeguarding sensitive information. Cloud data warehousing offers scalability and flexibility, while hybrid solutions strike a balance between on-premises and cloud storage.

Data integration, data pipelines, and data virtualization streamline data access and processing. Data governance frameworks and metadata management solutions ensure data lineage and compliance. Data monetization and data cleansing strategies unlock new revenue streams and improve data quality. Data analytics, business intelligence, and data visualization tools enable data-driven decision making, providing valuable insights for businesses. Data architecture and data warehouse implementation are critical aspects of successful data warehousing projects. Data enrichment and data federation enhance data utility and accessibility. Data warehouse performance and optimization techniques ensure efficient data processing and retrieval. Data warehousing software solutions cater to various business needs, from small to large enterprises.

Data audits and compliance checks ensure regulatory adherence. In conclusion, the market is characterized by continuous innovation and evolution, with a focus on data security, scalability, and flexibility. ETL processes, data modeling, data mining, data transformation, data stewardship, data compliance, data warehousing consulting, data warehouse migration, data quality, data warehouse modernization, data warehousing services, data platforms, data security, data warehousing appliances, data-driven decision making, data warehouse scalability, data warehousing software, data federation, data audit, data analytics, data virtualization, data warehouse performance, data architecture, data enrichment, data warehouse implementation, data visualization, data warehouse security, data encryption, data literacy, data integration, data masking, cloud data warehousing, business intelligence, data governance frameworks, data lineage, data management solutions, data governance, hybrid data warehousing, data catalog, metadata management, data monetization, data cleansing, and data pipelines are key elements shaping the market's dynamics.

The On-premises segment was valued at USD 11.33 billion in 2019 and showed a gradual increase during the forecast period.

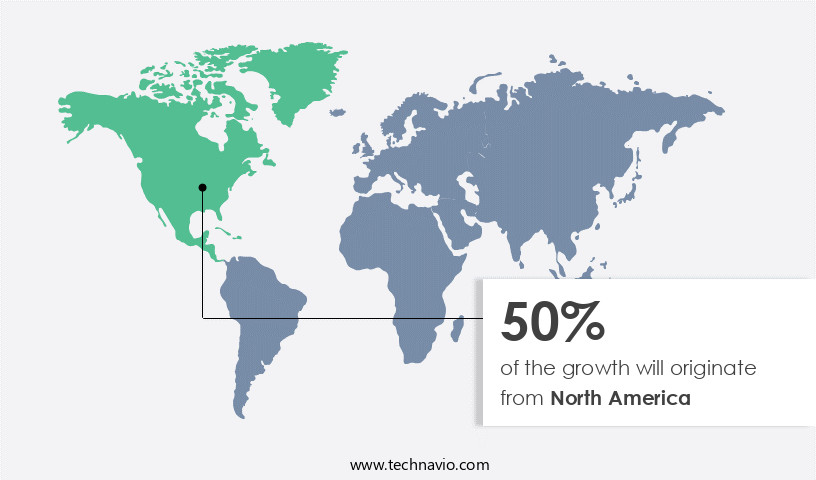

Regional Analysis

North America is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Data warehousing continues to be a significant market in North America, driven by the region's early adoption of advanced technologies in industries such as manufacturing, retail, and BFSI. The presence and penetration of leading companies in the market further fuel its growth. North America's position as home to some of the world's strongest economies increases the necessity for data warehousing, including data processing, outsourcing, and Internet services and infrastructure. Moreover, the integration of cloud-based services, automation solutions, and AI with operational and supply chain processes is propelling the adoption of data warehousing in the region. ETL processes play a crucial role in data warehousing, ensuring data is transformed, cleansed, and loaded into the data warehouse for analysis.

Data lake and on-premise data warehousing solutions offer flexibility and scalability, while data warehouse optimization techniques enhance performance. Data stewardship and data governance frameworks ensure data compliance and security. Data mining and analytics uncover valuable insights, while data modeling and architecture provide structure and organization. Data warehousing consulting and migration services help businesses transition smoothly. Data platforms, security, and encryption safeguard data, while data federation, virtualization, and performance optimization improve access and efficiency. Data integration, masking, and enrichment ensure data accuracy and completeness. Hybrid data warehousing and metadata management facilitate data monetization. Data pipelines and data lineage enable effective data management and compliance.

Data visualization and business intelligence tools enable data-driven decision making. Data warehousing services and software continue to evolve, offering innovative solutions to meet the demands of modern businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Data Warehousing Industry?

- The transition from on-premises to Software-as-a-Service (SaaS) models is a significant market trend, driving growth and innovation within various industries. This shift allows businesses to access software applications over the internet, eliminating the need for on-site infrastructure and maintenance, resulting in cost savings and increased flexibility.

- Data warehousing is undergoing significant transformation as businesses shift from traditional on-premises solutions to cloud-based alternatives. Cloud-based data warehousing services provide user-friendly functionalities, such as drag-and-drop interfaces and mobile accessibility, making them increasingly popular. These solutions cater to businesses of all sizes, offering affordable pricing and quick deployment. The primary advantage of cloud-based data warehousing is the pay-per-use pricing model, which allows clients to pay only for the resources they consume. Flexibility is another key benefit, as clients can customize their cloud infrastructure according to their business needs. Cloud-based infrastructure significantly reduces the total cost of ownership (TCO) by eliminating the need for expensive hardware and software.

- Data security is a crucial concern for businesses, and cloud-based data warehousing platforms prioritize security measures to protect sensitive information. Data quality is also essential, and these platforms offer tools for data auditing and data federation to ensure data accuracy and consistency. Additionally, data analytics capabilities enable data-driven decision making, enhancing business performance and competitiveness. Cloud-based data warehousing solutions offer scalability, allowing businesses to handle growing data volumes and complex analytics requirements. Data warehousing software companies provide various services, including data platform management, data migration, and data integration, to help businesses seamlessly transition to cloud-based infrastructure.

What are the market trends shaping the Data Warehousing Industry?

- Advanced storage technologies are gaining prominence in the current market, with their emergence being a notable trend. This trend is driven by the continuous development of more efficient, high-capacity, and cost-effective storage solutions.

- Data warehousing has emerged as a crucial aspect for businesses aiming to derive valuable insights from their data. The market for data warehousing solutions is witnessing significant growth due to the increasing volume, variety, and velocity of data. To address the challenges of managing and analyzing large volumes of data, advanced data storage technologies and solutions are gaining popularity. One such innovation is data virtualization, which involves creating a virtual model of a database or an entire data warehouse, abstracted from the underlying physical infrastructure. This technology offers high cost-efficiency and resource optimization by enabling the consolidation of data from multiple sources into a single, unified view.

- Another critical aspect of data warehousing is ensuring optimal performance. Data architecture, data integration, and data enrichment are essential components in achieving this goal. Data architecture refers to the design and organization of data within a data warehouse, while data integration deals with the consolidation of data from various sources. Data enrichment, on the other hand, involves adding value to raw data by cleaning, transforming, and enhancing it. Data security is another essential consideration in data warehousing. Solutions such as data encryption, data masking, and data visualization help ensure data privacy and security. Data encryption protects sensitive data by converting it into an unreadable format, while data masking hides sensitive data by replacing it with fictitious data.

- Data visualization, meanwhile, enables users to gain insights from complex data by presenting it in a graphical or pictorial format. Cloud data warehousing is another emerging trend in the market. This model offers the benefits of on-demand infrastructure, reduced costs, and increased scalability. However, it also raises concerns regarding data security and compliance. In conclusion, the market is witnessing significant growth due to the increasing importance of data in business operations. Advanced data storage technologies and solutions, such as data virtualization, data architecture, data integration, data enrichment, data visualization, data encryption, data masking, and cloud data warehousing, are essential in addressing the challenges of managing and analyzing large volumes of data.

- By leveraging these technologies, businesses can gain valuable insights, improve operational efficiency, and make informed decisions.

What challenges does the Data Warehousing Industry face during its growth?

- Data privacy and security risks pose a significant challenge to the growth of industries, as the mishandling of sensitive information can result in reputational damage, legal consequences, and financial losses.

- The market growth is driven by the increasing demand for business intelligence (BI) and data-driven decision making. However, data privacy and security concerns pose significant challenges to the adoption of data warehousing services, particularly in cloud environments. Cloud security management is a complex task for organizations, as they strive to protect their online data from unauthorized access to cloud-based IT infrastructure. Public cloud infrastructure, in particular, faces increased risks due to the potential vulnerabilities in open-source codes that underpin these systems. As multi-tenant environments, public clouds can be susceptible to security breaches that can negatively impact various applications running in the cloud.

- To mitigate these risks, organizations are implementing data governance frameworks, data lineage, metadata management, and data management solutions. Data governance ensures the effective use, protection, and management of data, while data lineage tracks the origin, movement, and transformation of data throughout its lifecycle. Metadata management and data catalogs help maintain accurate and up-to-date information about data, enabling better data monetization and data cleansing. Data pipelines facilitate the efficient movement and transformation of data between various systems and applications. In conclusion, the market is witnessing significant growth due to the increasing importance of data-driven decision making.

- However, data privacy and security concerns, particularly in cloud environments, present significant challenges that organizations must address through the implementation of data governance frameworks, data lineage, metadata management, and data management solutions.

Exclusive Customer Landscape

The data warehousing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data warehousing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data warehousing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alphabet Inc. - This company specializes in data warehousing solutions, specifically utilizing Google Cloud Platform's BigQuery service. By leveraging BigQuery's capabilities, businesses can efficiently analyze and gain insights from large datasets. The platform's scalability and flexibility enable users to perform complex queries and data analysis tasks in seconds. Additionally, BigQuery integrates seamlessly with various data sources and tools, providing a unified and streamlined data management experience. With BigQuery, organizations can make data-driven decisions, optimize operations, and gain a competitive edge in their respective industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Avnet Inc.

- Cloudera Inc.

- Databricks Inc.

- Exasol AG

- Firebolt Analytics Inc.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Ignite Enterprise Software Solutions Inc.

- Infosys Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Nippon Telegraph and Telephone Corp.

- Oracle Corp.

- SAP SE

- SingleStore Inc.

- Snowflake Inc.

- Teradata Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Warehousing Market

- In March 2024, Amazon Web Services (AWS) introduced a new addition to their data warehousing services, AWS Lake Formation, which simplifies and accelerates setting up, securing, and managing a data lake (AWS Press Release, 2024). This development caters to the growing demand for easy-to-use, scalable data warehousing solutions.

- In July 2024, Microsoft and Snowflake, a cloud-based data warehousing platform, announced a strategic partnership to integrate Snowflake's services with Microsoft Azure, allowing seamless migration and usage of Snowflake's data warehousing capabilities within Azure (Microsoft News Center, 2024). This collaboration aims to strengthen both companies' offerings and cater to the increasing need for interoperability between cloud services.

- In October 2025, Google Cloud Platform (GCP) raised the bar in the market by launching BigLake, a multi-cloud, multi-modal data lakehouse platform (Google Cloud Blog, 2025). This new offering allows users to store, process, and analyze data using SQL and machine learning, making it a versatile solution for businesses with diverse data processing needs.

- In December 2025, IBM and Red Hat, an IBM company, announced the general availability of IBM Db2 Warehouse on Red Hat OpenShift, a containerized data warehouse solution (IBM Press Release, 2025). This development marks IBM's commitment to open-source technologies and the growing trend of containerization in the market. These significant developments reflect the increasing competition and innovation in the market, as companies strive to offer more flexible, scalable, and integrated solutions to meet the evolving needs of businesses.

Research Analyst Overview

- The data warehouse industry continues to evolve, with emerging technologies like Data Fabric and Data Lakehouse disrupting traditional relational databases. Data quality tools and Data Governance solutions are essential for maintaining data accuracy and ensuring compliance. Data Mining and Data Analytics tools enable businesses to derive valuable insights from their data. Data Warehouse challenges persist, including data security and integration. NOSQL databases offer scalability and flexibility, while Data Security tools provide an additional layer of protection. Data Warehouse ROI is a key consideration for businesses adopting these solutions. Data Warehouse trends include the adoption of Data Mesh architectures and Data Visualization tools for enhanced data access and analysis.

- Data Warehouse companies offer a range of solutions, from on-premises to cloud-based offerings. Data Integration tools facilitate seamless data flow between systems. Data Warehouse Maturity varies across industries, with some organizations still in the early stages of adoption. The future of Data Warehousing lies in its ability to support real-time analytics and machine learning, enabling businesses to make informed decisions quickly.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Warehousing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14% |

|

Market growth 2025-2029 |

USD 32295.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.0 |

|

Key countries |

US, Germany, Canada, China, UK, Japan, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Warehousing Market Research and Growth Report?

- CAGR of the Data Warehousing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data warehousing market growth of industry companies

We can help! Our analysts can customize this data warehousing market research report to meet your requirements.