Dental Cements Market Size 2024-2028

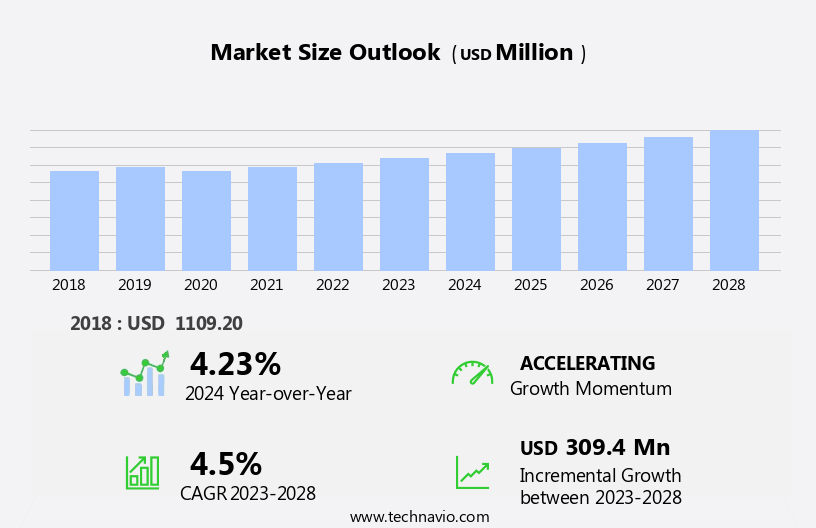

The dental cements market size is forecast to increase by USD 309.4 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the increasing prevalence of oral diseases among the aging population and the growing focus on esthetic restorative techniques. The aging demographic, with its higher susceptibility to dental issues, presents a significant opportunity for market growth. Additionally, the demand for cosmetically appealing dental restorations continues to rise, fueling the market's expansion. However, implant failure caused by dental cements poses a significant challenge. This issue necessitates continuous research and development efforts to create advanced, reliable cement formulations.

- Companies in the market must address this challenge to ensure the longevity and success of dental implants. To capitalize on opportunities and navigate challenges effectively, market participants should focus on innovating cement solutions that provide both functionality and aesthetics, ensuring patient satisfaction and long-term implant success.

What will be the Size of the Dental Cements Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The dental cement market continues to evolve, driven by advancements in technology and research. Luting agents, a crucial component of dental cements, are subject to ongoing innovation. Compressive strength, film thickness, and shelf life are key considerations in the development of new cement formulations. Primer application and adhesive systems play a pivotal role in the success of dental restorations. Clinical trials are an essential part of the process, ensuring the effectiveness and safety of new cement types. Cements dispensing systems aim to streamline the application process, while glass ionomer cements and resin cements offer distinct advantages in terms of tensile strength and dimensional stability.

Composite resins and resin cements are increasingly used in both preventive and restorative dentistry, requiring cement formulations that provide excellent bonding and color matching. Dentin bonding and etching techniques are continually refined to improve the longevity and success of dental restorations. The market for dental cements is diverse, encompassing various types such as polycarboxylate cements, chemical-cure cements, light-cure cements, and self-adhesive cements. Each type offers unique benefits, from improved marginal adaptation to enhanced pulp protection and antibacterial properties. Storage conditions, setting time, and application techniques are essential factors influencing the performance of dental cements. Calcium hydroxide cements and zinc phosphate cements continue to be used in specific applications, while dual-cure cements offer the convenience of both chemical and light activation.

In the realm of dental implants, base materials and bond strength are critical factors, necessitating the development of high-performance cement formulations. Water sorption, flexural strength, and shear strength are also important considerations in the selection of dental cements for various applications. The dental cement market is characterized by continuous innovation and improvement, as researchers and manufacturers strive to meet the evolving needs of dentists and their patients.

How is this Dental Cements Industry segmented?

The dental cements industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Permanent cements

- Temporary cements

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By Product Insights

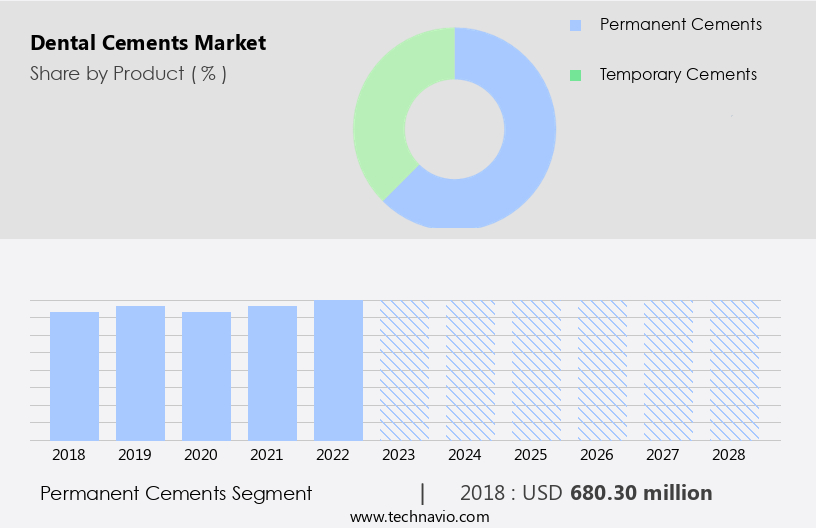

The permanent cements segment is estimated to witness significant growth during the forecast period.

Permanent dental cements play a crucial role in the field of restorative dentistry by providing a reliable bond between dental restorations and the tooth structure. These cements offer several advantages, including superior marginal sealing, resistance to oral fluids, and protection of dental tissues from external stimuli. Zinc phosphate, resin-modified glass ionomer, glass ionomer, and resin cements are the most frequently used permanent cement types. They are primarily employed in the cementation of crowns, orthodontic applications, intraoral splints, partial dentures, and inlays. Advancements in technology have significantly influenced the development of permanent dental cements, leading to improved properties and increased versatility.

The increasing aging population, prone to dental caries, further fuels the demand for these cements. Companies cater to this growing need by offering a wide range of permanent cement options. The cementation process involves the use of luting agents, which ensure a strong bond between the restoration and the tooth structure. The choice of cement depends on factors such as compressive strength, film thickness, and working time. Cement removal techniques are essential to ensure proper cementation and prevent post-operative sensitivity. Polycarboxylate cements, chemical-cure cements, and light-cure cements are alternative cement types, each with unique properties.

Glass ionomer cements, for instance, exhibit excellent bond strength and pulp protection, making them suitable for use in preventive dentistry. Self-adhesive cements eliminate the need for a separate primer application, simplifying the cementation process. Dental implants, base materials, and adhesive systems are other essential components of the dental industry that interact with permanent cements. Clinical trials and research studies are ongoing to improve the properties and performance of these materials, ensuring optimal patient outcomes. Cements dispensing systems facilitate the efficient and accurate dispensing of cement, ensuring consistent results. Flexural strength, tensile strength, and antibacterial properties are critical factors in evaluating the performance of permanent dental cements.

Proper storage conditions are essential to maintain the shelf life and effectiveness of these materials. In summary, permanent dental cements play a vital role in restorative dentistry by providing a strong and reliable bond between dental restorations and tooth structures. Technological advancements, the aging population, and the need for improved cement properties are driving the growth of the permanent dental cement market.

The Permanent cements segment was valued at USD 680.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

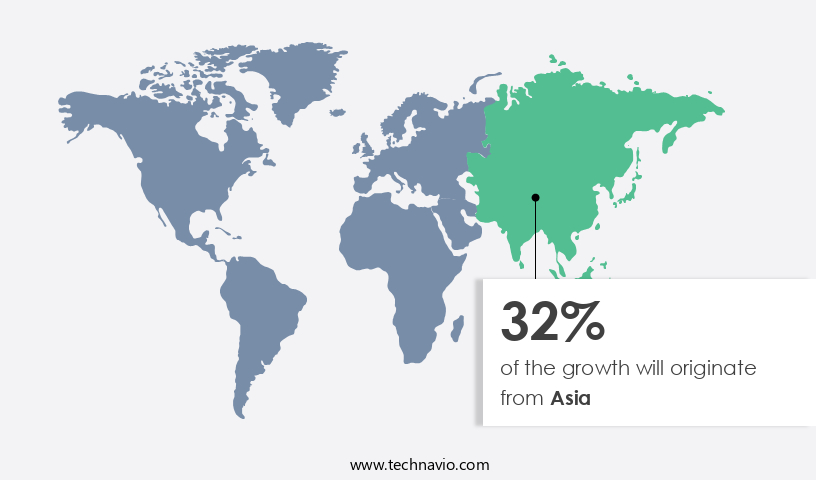

Asia is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, with the US being the major revenue contributor, is driven by the rising prevalence of oral diseases and the increasing demand for esthetic applications among end-users. For instance, approximately 20% of children aged between 5-19 years in the US have untreated dental caries, and 67% of adults aged 65 years and above made dental visits in 2019. This region's market growth is further fueled by the presence of major companies, including Danaher, 3M, and BISCO, and regional players such as Den-Mat, Essential Dental Systems, FGM Dental Products, Medental International, Septodont, SHOFU Dental, and Zimmer Biomet.

In the realm of dental cements, various types cater to diverse applications. Polycarboxylate cements, known for their excellent film thickness and cement removal properties, are widely used for root canal applications. Chemical-cure and light-cure cements offer distinct advantages in terms of setting time and application techniques. Shelf life, shear strength, and working time are crucial factors influencing the choice of cement. Clinical trials play a pivotal role in evaluating the efficacy and safety of dental cements. Adhesive systems, cement dispensing systems, and primers are essential components of the cementation process. Glass ionomer cements, with their antibacterial properties and excellent bond strength, are popular choices for preventive dentistry.

Calcium hydroxide cements offer pulp protection and are often used in restorative dentistry. Composite resins and resin cements are integral to the dental industry, with dentin bonding and etching techniques playing crucial roles in their application. Dual-cure cements offer the benefits of both chemical and light curing, ensuring marginal adaptation and dimensional stability. Self-adhesive cements streamline the cementation process, while storage conditions and application techniques significantly impact the performance of dental cements. Zinc phosphate cements, with their high compressive strength and bond strength, are widely used in dental implants. Flexural strength, water sorption, and color matching are essential factors in the selection of dental cements for various applications.

Base materials and pulp protection are critical considerations in the development and application of dental cements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Dental Cements Industry?

- The increasing prevalence of oral diseases among the aging population serves as the primary market driver. This demographic trend significantly contributes to the growth of the market for oral health solutions and services.

- The market experiences growth due to the increasing prevalence of oral health issues among the aging population. With aging, individuals are more susceptible to oral diseases such as dental caries and periodontal disease. These conditions necessitate dental restoration procedures, driving market expansion. Elderly individuals face unique challenges in maintaining oral health, including atrophy of acinar tissue, xerostomia, oral cancer, degenerative changes in salivary glands, and dry mouth.

- The enhanced quality of life for the elderly population today fuels the demand for dental services aimed at tooth retention and restoration. As the global population ages, the market is poised for continued growth.

What are the market trends shaping the Dental Cements Industry?

- The increasing prioritization of esthetic restorative techniques represents a significant market trend. In the realm of professional services, this emphasis on enhancing the appearance of restorations is a noteworthy development.

- The dental cement market experiences significant growth due to the increasing demand for esthetic dentistry. Patients seek improved appearances through aligned and well-contoured teeth, driving the expansion of the segment. Esthetic dentistry combines smile rehabilitation and material selection. Recent innovations in restorative techniques enable dentists to provide superior treatments. Two primary types of dental cements are polycarboxylate and chemical-cure. Polycarboxylate cements offer excellent film thickness and cement removal properties. In contrast, chemical-cure cements provide high compressive and shear strength. Light-cure cements are essential for cementing ceramic laminates on porcelain veneers. Advancements in glass ionomer formulation have resulted in enhanced properties, such as resin-modified glass ionomers.

- The mixing technique for these cements plays a crucial role in their overall performance. The shelf life and curing process of dental cements are essential factors in their selection. In summary, the dental cement market is fueled by the rising demand for esthetic dentistry and advancements in cement formulations. The choice between polycarboxylate, chemical-cure, and light-cure cements depends on the specific clinical requirements, with each type offering unique advantages. The proper mixing technique and understanding of cement properties are essential for successful dental restorations.

What challenges does the Dental Cements Industry face during its growth?

- Dental cement implant failure poses a significant challenge to the growth of the dental industry, necessitating ongoing research and innovation to address this issue.

- Dental cements play a crucial role in various dental applications, including bridges, crowns, and implant adhesives. These cementitious materials offer advantages over screw-retained restorations, such as improved esthetics and biocompatibility. However, the improper application of dental cements can lead to complications. Excessive cement application and leakage below the crown can result in implant failure, complications during restoration removal, and peri-implantitis infections. Moreover, dental cements can act as a foreign body in the mouth, leading to plaque and calculus accumulation. To mitigate these risks, advancements in dental cement technology include the use of primers for improved bonding and adhesive systems with shorter working times.

- Additionally, clinical trials are underway to evaluate the tensile strength of composite resins and resin cements for dentin bonding, potentially reducing the need for excessive cement application. Cements dispensing systems are also being developed to ensure precise cement application, minimizing the risk of complications.

Exclusive Customer Landscape

The dental cements market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dental cements market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dental cements market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in manufacturing and supplying a range of dental cement types, including resin and veneer cements, as well as conventional glass ionomer varieties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- BISCO Inc.

- Danaher Corp.

- Den Mat Holdings LLC

- Dentsply Sirona Inc.

- DETAX GmbH

- DMG America LLC

- ESSENTIAL DENTAL SYSTEMS INC

- FGM Dental Group

- GC America Inc.

- Henry Schein Inc.

- Ivoclar Vivadent AG

- Kerr Corp.

- Medental International

- SDI Ltd.

- Septodont Inc.

- SHOFU Dental GmbH

- Sun Medical Co. Ltd.

- Tokuyama Dental America

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dental Cements Market

- In January 2024, 3M, a leading healthcare solutions provider, announced the launch of its new glass ionomer dental cement, "Biodentine iQ," which offers improved handling characteristics and enhanced bonding capabilities (3M Press Release, 2024).

- In March 2024, Dentsply Sirona and Ivoclar Vivadent, two major dental suppliers, entered into a strategic partnership to co-develop and commercialize innovative dental materials, including dental cements, aiming to expand their product portfolios and strengthen their market positions (Dentsply Sirona Press Release, 2024).

- In May 2024, Heraeus Holding, a leading specialty materials company, completed the acquisition of Caulk, a prominent dental and medical adhesives manufacturer, significantly expanding its dental business and enhancing its presence in the market (Heraeus Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to GC America, Inc., a subsidiary of GC Corporation, for its new glass ionomer dental cement, "Fuji II LC," featuring superior bonding strength and improved handling properties (GC America Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of materials used in various dental applications, including direct and indirect restorative materials, orthodontic bonding, and root canal obturation. The long-term stability of these cement types relies on their surface tension, elastic modulus, and rheological properties. Direct restorative materials, such as nanohybrid cements, undergo chemical curing and exhibit a high degree of conversion, while indirect restorative materials, like zirconia cements, require precise surface energy and contact angle for successful adhesion. Surface morphology and particle size distribution play crucial roles in cement degradation mechanisms, affecting biomechanical behavior and adhesive failure. Mechanical testing methods, including FTIR spectroscopy and adhesion testing, provide valuable insights into the material characterization of dental cements.

- Polymerization shrinkage and monomer leakage are significant concerns for resin matrix-based cements, necessitating careful consideration of light intensity and filler content. The biomechanical behavior of hybrid cements is influenced by their molar strength and thermal expansion. Ceramic cements, such as flowable and self-etching adhesives, exhibit varying degrees of clinical efficacy due to their unique properties. Understanding the intricacies of dental materials science is essential for optimizing cement selection and application techniques, ultimately improving patient outcomes. Despite advancements in cement technology, challenges persist, including cement degradation mechanisms and adhesive failure. Ongoing research in dental materials science continues to unravel the complex interplay between cement properties and clinical performance.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dental Cements Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 309.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, UK, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dental Cements Market Research and Growth Report?

- CAGR of the Dental Cements industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dental cements market growth of industry companies

We can help! Our analysts can customize this dental cements market research report to meet your requirements.