Dropper Market Size 2025-2029

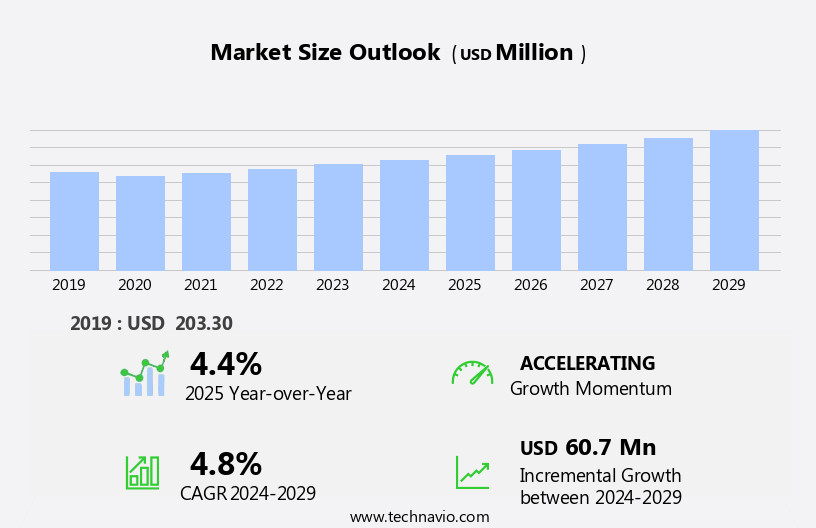

The dropper market size is forecast to increase by USD 60.7 million, at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of droppers in the healthcare industry. The healthcare sector's reliance on droppers for medication dispensing continues to expand, as they offer precise dosage control and ease of use. Additionally, the rising popularity of droppers with caps is contributing to market growth, as these designs provide an extra layer of hygiene and convenience. However, the market faces challenges as well. The increasing generation of waste from disposable droppers and the associated emissions pose environmental concerns. This issue necessitates the development of more sustainable and eco-friendly solutions, such as reusable droppers or those made from biodegradable materials.

- Companies in the market must address these challenges to maintain their competitive edge and meet the evolving demands of consumers and regulatory bodies. By focusing on innovation and sustainability, market participants can capitalize on the opportunities presented by the growing demand for droppers while mitigating potential obstacles.

What will be the Size of the Dropper Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The dropper post market continues to evolve, driven by advancements in technology and shifting consumer preferences. Retail sales of these posts are on the rise, with external routing and preset adjustments gaining popularity. Cable actuation remains common, but pneumatic actuation and hydraulic actuation are increasingly sought after for their faster response and smoother operation. Carbon fiber and aluminum alloy are popular raw materials, each offering unique benefits in terms of weight, strength, and durability. Manufacturing processes are continually improving, with a focus on quality control and efficient supply chain management. Dropper posts come in various travel lengths and are designed to cater to diverse target audiences, from mountain bikers to gravel riders.

Product positioning and marketing strategies are crucial in this competitive market, with infinite adjustment and one-button release features becoming key selling points. Rider feedback and end-user experience are essential factors shaping market dynamics. Online sales are increasingly important, with retailers offering a wide range of options, from budget-friendly to high-end models. Seatpost diameter, clamp diameter, lever position, and sag setting are critical considerations for riders, ensuring a comfortable and efficient riding experience. Manufacturers are continually innovating, with new designs and features, such as bottom-out resistance and return speed adjustments, aiming to meet the evolving needs of consumers.

Distribution channels are expanding, with dropper posts now widely available at both specialty and mass-market retailers. The dropper post market is a dynamic and ever-changing landscape, with ongoing technological advancements and shifting consumer preferences shaping its future.

How is this Dropper Industry segmented?

The dropper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Healthcare

- Personal care

- Home care

- Food and beverage

- Others

- Material

- Glass

- Plastic

- Rubber

- Others

- Variant

- 1-5 ml

- Below 1 ml

- Above 5 ml

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

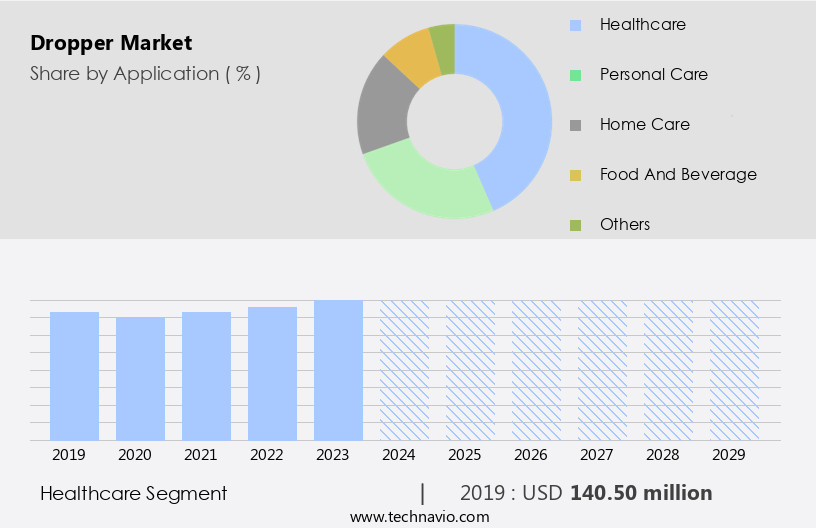

By Application Insights

The healthcare segment is estimated to witness significant growth during the forecast period.

In the precision machining sector, droppers have gained significant traction in various industries, particularly in retail sales for bicycle components. These droppers, which employ cable actuation and external routing, offer preset adjustments and one-button release for seamless use. Carbon fiber and aluminum alloy are popular raw materials for manufacturing these components, ensuring both durability and lightweight design. The retail price of droppers varies based on features such as bottom-out resistance, travel length, and actuation force. The supply chain for these products involves intricate manufacturing processes, including hydraulic or pneumatic actuation and internal or external routing. Product positioning targets cycling enthusiasts and professionals, emphasizing design aesthetics, quality control, and rider feedback.

Distribution channels include online sales and partnerships with bicycle retailers, catering to diverse clamp diameters and seatpost diameters. Technology advancements have led to infinite adjustment and faster return speed, enhancing user experience. Despite the complexities in manufacturing and distribution, the market for droppers continues to evolve, driven by the demand for advanced and efficient seatpost systems.

The Healthcare segment was valued at USD 140.50 million in 2019 and showed a gradual increase during the forecast period.

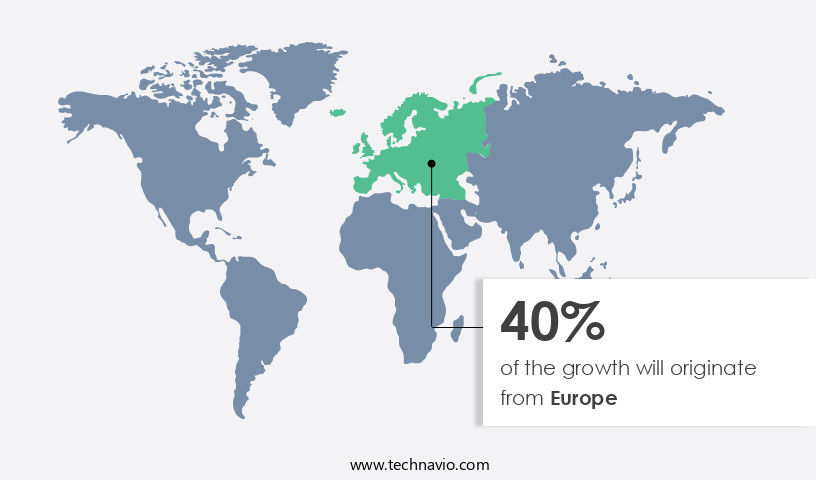

Regional Analysis

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing notable growth due to the expanding applications in various industries, particularly in the medical, pharmaceutical, and cosmetics sectors. The advancement of healthcare infrastructure and the rising demand for sophisticated vaccines and medicines are major factors fueling this growth. Droppers play a crucial role in the accurate administration of medications and the dispensing of liquid solutions, making them indispensable in these industries. The pharmaceutical and healthcare industries' penetration in APAC is escalating, leading pharmaceutical companies to outsource manufacturing to Contract Manufacturing Organizations (CMOs) in the region, attracted by the cost-effective drug development and readily available infrastructure.

The market in APAC is further propelled by technology advancements, such as cable actuation, external routing, preset adjustments, and one-button release mechanisms. Manufacturers employ various materials, including carbon fiber, aluminum alloy, and raw materials, to cater to diverse customer preferences and requirements. The market's distribution channels span from retail sales to online platforms, with bicycle retailers and other industries utilizing droppers for their specific applications. The market's evolution encompasses product positioning, quality control, actuation force, travel length, design aesthetics, and various actuation technologies like hydraulic and pneumatic. The market's product lifecycle is influenced by rider feedback, end-user feedback, and continuous innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Dropper Industry?

- The healthcare industry's growing reliance on droppers is the primary market driver, as these tools enable precise dispensing and administration of medications to ensure accurate dosages and improve patient safety.

- The healthcare and pharmaceutical industries require safe and precise dispensing solutions for various liquid medications, including ear drops, nose drops, eye drops, oils, and tinctures. Adhering to the correct dosages is crucial, as any deviation could potentially harm patients. This need for safety and precision has fueled the demand for droppers in these industries. The manufacturing process of droppers involves careful consideration of drop height and travel length to ensure accurate dispensing. Technology advancements have led to the use of materials like aluminum alloy in dropper post production, enhancing durability and reliability. Remote levers offer added convenience, allowing for easy and controlled dispensing.

- Quality control is paramount in the production of droppers, as they are used in the pharmaceutical and healthcare sectors. Regulatory frameworks and safety standards dictate that packaging solutions must be safe for human consumption. The focus on technology advancements and quality control positions droppers as a valuable investment for industry players seeking to meet the growing demands for safe and precise liquid medication dispensing.

What are the market trends shaping the Dropper Industry?

- The rising preference for droppers with caps is a notable trend in the current market. This trend signifies a shift towards more convenient and hygienic packaging solutions in various industries.

- The market is experiencing growth due to the rising demand for droppers with caps. These droppers offer several advantages, including effective actuation force, internal routing, and infinite adjustment. The caps provide a secure closure, safeguarding the formulations from external elements such as moisture and light. Distribution channels play a crucial role in the market, with companies selling droppers in bulk batches or as part of a package that includes a dropper, a bottle, and a cap. For cosmetic and pharmaceutical companies, the bottle is essential, while medical labs may prioritize the dropper and cap alone.

- The design aesthetics of droppers are also gaining importance, with companies focusing on creating robust, immersive, and harmonious products. Raw materials used in the manufacturing process, such as glass, plastic, or silicone, significantly impact the final product's quality and performance. Hydraulic actuation is another trend in the market, providing an easy-to-use and precise dispensing mechanism. Marketing strategies are essential for companies to reach their target audience effectively. Understanding market dynamics, product lifecycle, and customer preferences are critical to success in this competitive landscape.

What challenges does the Dropper Industry face during its growth?

- The escalating issue of increased waste generation and emissions poses a significant challenge to the industry's growth trajectory.

- The market for dropper systems experiences frequent product replacement due to the short lifecycle and specific requirements of various industries. In healthcare, pharmaceutical, and medical facilities, equipment is changed regularly to ensure hygiene and prevent cross-contamination. Meanwhile, in the cosmetics and home care sectors, consumers typically discard used droppers and containers, contributing significantly to waste. The disposal of these droppers presents challenges, as pharmaceutical waste must be handled carefully to prevent chemical reactions. This waste often ends up in landfills or water bodies, raising environmental concerns. Dropper systems are essential components in various industries, including healthcare, pharmaceuticals, cosmetics, and home care.

- They come in different seatpost diameters and are actuated pneumatically for precise control. End-users value the return speed and lever position, which can be easily adjusted for optimal sag setting. Bicycle retailers also stock a range of droppers catering to diverse customer preferences. Despite their importance, the disposal of used droppers generates substantial waste, posing environmental and health challenges.

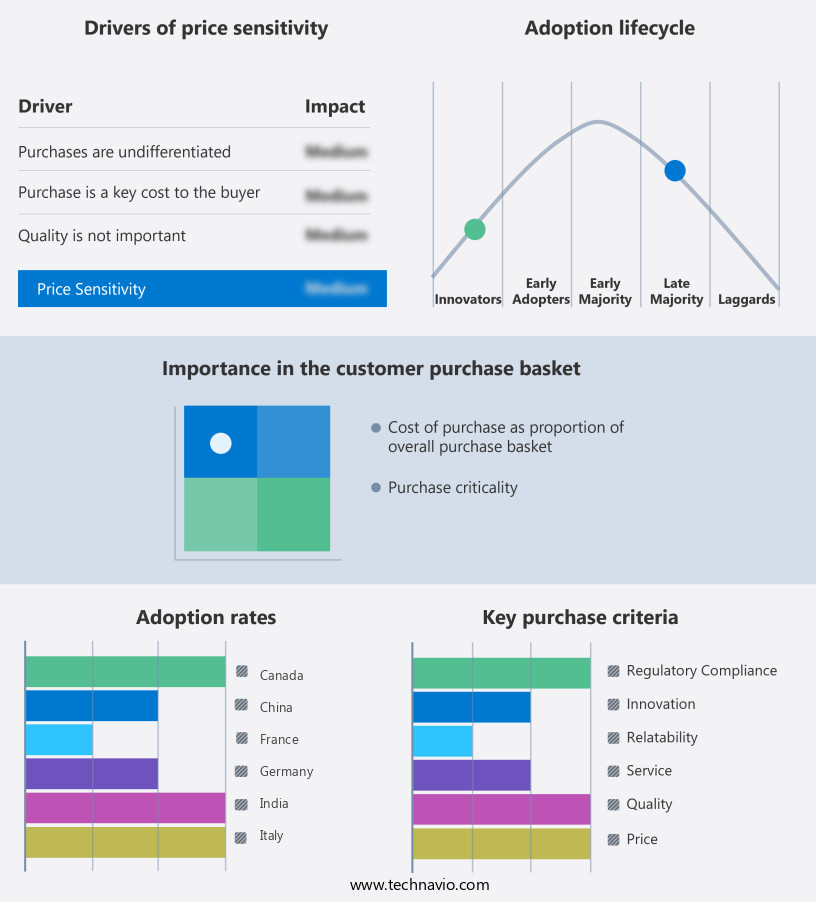

Exclusive Customer Landscape

The dropper market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dropper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dropper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adelphi Healthcare Packaging - The company specializes in manufacturing and supplying droppers with integrated screw cap, teat, and pipette components.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adelphi Healthcare Packaging

- Biocorp

- Bormioli Pharma Spa

- CannaCarton

- Carow Packaging Inc.

- Comar LLC

- CONSOLE INDUSTRIES

- Gerresheimer AG

- Neville and More

- Pacific Vial Manufacturing Inc.

- Paramark Corp.

- Stoelzle Oberglas GmbH

- The Plasticoid Co.

- Usha Poly Crafts Pvt. Ltd.

- Virospack SLU

- Williamson Manufacturing Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dropper Market

- In January 2024, Dropper, a leading provider of drop shipping solutions, announced the launch of its new AI-driven product recommendation engine, "SmartRecommend," at the National Retail Federation (NRF) conference. This innovation aimed to enhance the accuracy and efficiency of product suggestions for e-commerce businesses, significantly improving customer satisfaction and sales (Dropper Press Release, 2024).

- In March 2024, Dropper entered into a strategic partnership with Shopify, a prominent e-commerce platform, to integrate Dropper's services directly into Shopify's App Store. This collaboration enabled thousands of Shopify merchants to easily access Dropper's drop shipping services, expanding Dropper's reach and market presence (Shopify Press Release, 2024).

- In May 2024, Dropper secured a USD 20 million Series C funding round led by Sequoia Capital, bringing the company's total funding to USD 45 million. The investment was earmarked for product development, marketing, and expanding its global footprint (Crunchbase, 2024).

- In February 2025, Dropper obtained a major regulatory approval from the European Union's e-Privacy Directive, enabling the company to process customer data for targeted advertising and personalized product recommendations in the EU market. This approval marked a significant milestone in Dropper's international growth strategy (Dropper Press Release, 2025).

Research Analyst Overview

- In the dynamic dropper post market, seating position plays a crucial role in enhancing user experience for both gravel and road cycling enthusiasts. Computer-aided manufacturing (CAM) and computer-aided design (CAD) enable manufacturers to create corrosion-resistant frames with optimal head angles, ensuring regulatory compliance and fatigue resistance. Additive manufacturing technologies contribute to design optimization, allowing for component compatibility and frame compatibility. Pricing strategies and inventory management are essential elements in this market, with warranty claims and supply chain disruptions impacting sales forecasting. Finite element analysis and surface treatment are essential in addressing manufacturing defects and ensuring safety standards.

- Materials science advances continue to drive performance testing and improve return rate. Riding style and user experience are critical factors influencing customer satisfaction in the dropper post market. Regulatory compliance, supply chain management, and post length are essential considerations for manufacturers. Component compatibility and safety standards are crucial aspects of the design process, ensuring a seamless integration of dropper posts into various cycling applications. In the realm of computer-aided manufacturing and design, manufacturers leverage advanced technologies to create frames with optimal head angles, ensuring regulatory compliance and enhancing user experience. Additive manufacturing and design optimization enable the production of corrosion-resistant frames, addressing the need for durability and longevity.

- The dropper post market is driven by the increasing demand for enhanced user experience and improved performance in various cycling applications. Regulatory compliance, supply chain management, and pricing strategies are essential considerations for manufacturers. Materials science advances and design optimization contribute to the development of corrosion-resistant frames, addressing the need for durability and longevity. Incorporating CAD and CAM technologies into the manufacturing process, manufacturers ensure optimal head angles and frame compatibility, enhancing user experience and safety standards. Additive manufacturing and design optimization enable the production of frames with improved fatigue resistance and component compatibility, addressing the needs of gravel and road cycling enthusiasts.

- The dropper post market is characterized by its focus on user experience and performance, with regulatory compliance and safety standards playing a crucial role in the design process. Manufacturers leverage advanced technologies, such as CAD and CAM, to create frames with optimal head angles and improved fatigue resistance. Additive manufacturing and design optimization enable the production of corrosion-resistant frames, ensuring a seamless integration into various cycling applications. In the competitive dropper post market, manufacturers prioritize user experience, regulatory compliance, and safety standards to differentiate their products. CAD and CAM technologies are employed to optimize head angles and frame compatibility, while additive manufacturing and design optimization address the need for durability and improved performance.

- The dropper post market is shaped by its focus on user experience, regulatory compliance, and safety standards. Manufacturers leverage advanced technologies, such as CAD and CAM, to optimize head angles and frame compatibility, ensuring a seamless integration into various cycling applications. Additive manufacturing and design optimization enable the production of corrosion-resistant frames, addressing the needs of gravel and road cycling enthusiasts for enhanced durability and performance. In the evolving dropper post market, manufacturers prioritize user experience, regulatory compliance, and safety standards to meet the demands of gravel and road cycling enthusiasts. CAD and CAM technologies are employed to optimize head angles and frame compatibility, ensuring a seamless integration into various cycling applications.

- Additive manufacturing and design optimization enable the production of corrosion-resistant frames, addressing the need for durability and improved performance. In the dynamic dropper post market, manufacturers prioritize user experience, regulatory compliance, and safety standards to cater to the demands of gravel and road cycling enthusiasts. CAD and CAM technologies are employed to optimize head angles and frame compatibility, ensuring a seamless integration into various cycling applications. Additive manufacturing and design optimization enable the production of corrosion-resistant frames, addressing the need for durability and improved performance. In the dropper post market, manufacturers prioritize user experience, regulatory compliance, and safety standards to meet the evolving demands of gravel and road cycling enthusiasts.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dropper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 60.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dropper Market Research and Growth Report?

- CAGR of the Dropper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dropper market growth of industry companies

We can help! Our analysts can customize this dropper market research report to meet your requirements.