Europe E-Books Market Size 2024-2028

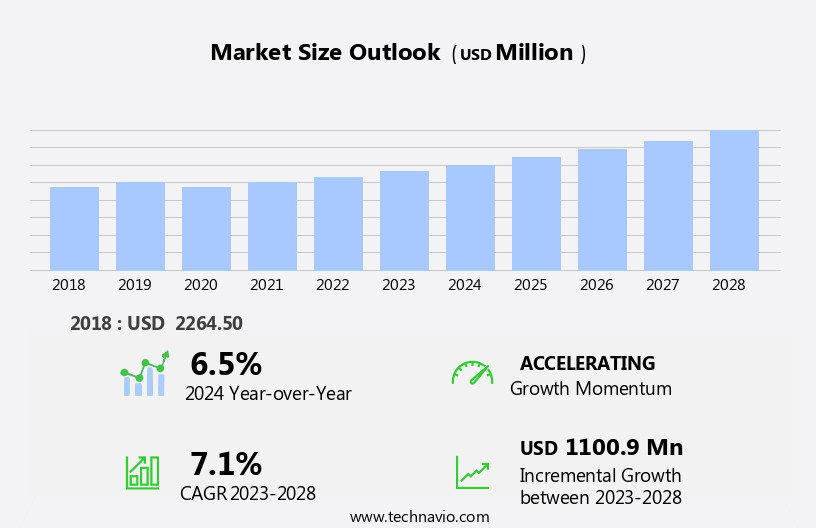

The Europe e-books market size is forecast to increase by USD 1.1 billion at a CAGR of 7.1% between 2023 and 2028.

- The Europe e-books market is experiencing significant growth, primarily driven by the high prices of printed books, which are encouraging more readers to turn to digital alternatives. E-books offer a more affordable and convenient way for readers to access literature, contributing to the market's expansion.

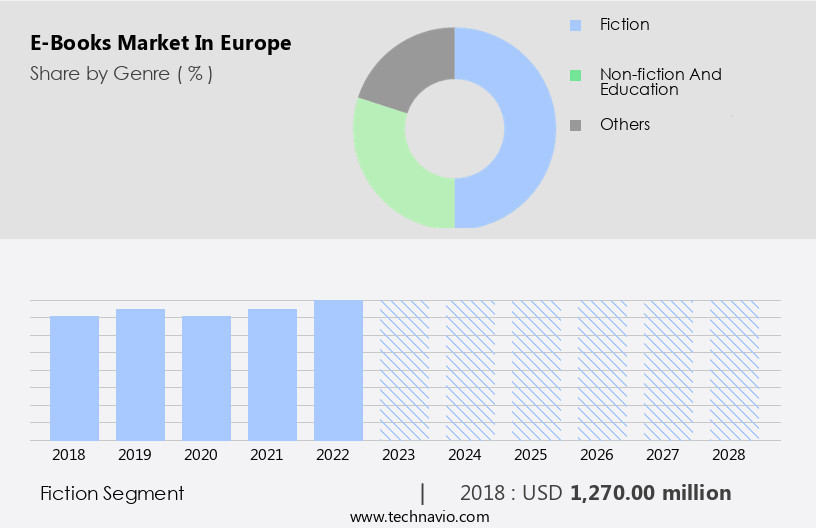

- Among the various genres, the fiction segment is expected to witness notable growth during the forecast period. With the increasing popularity of e-readers and digital platforms, fiction lovers are increasingly opting for e-books due to their easy accessibility, lower cost, and the ability to store large collections of books in one device. This trend highlights the growing shift toward digital reading in Europe.

What will be the size of the Europe E-Books Market during the forecast period?

- E-books are also cloud-based, allowing users to access their library from anywhere, and are lightweight and storage-efficient compared to print books. Despite these advantages, some users still prefer the tactile experience and authenticity of print books, including paper comic books. The European e-books market is expected to continue growing as technology advances and digital users seek more convenient, functional, and shareable content.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Genre

- Fiction

- Non-fiction and education

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Genre Insights

- The fiction segment is estimated to witness significant growth during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Fiction segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

The European e-books market is experiencing significant growth as tech-savvy consumers and educational institutions increasingly embrace digital books. The debate between printed and digital books continues, with digital books offering convenience, portability, and offline accessibility. Schools and corporate organizations are adopting digital publishing for training purposes, while print publishers adapt to the digital era by offering both print versions and digital versions of content. Authenticity and functional shareability are key considerations for digital users, leading to the development of augmented reality experiences, read-aloud features, and interactive elements.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe E-Books Market?

High prices of printed books is the key driver of the market.

- In Europe's publishing industry, the shift from printed books to electronic books (e-books) continues to gain momentum. The high cost of printed books, particularly for higher education segments, has driven consumers towards more affordable digital alternatives. E-books offer numerous advantages, including convenience, portability, and offline accessibility. With a single digital device, users can store thousands of e-books, eliminating the need for physical storage space. Digitizing services have become increasingly functional, with e-books offering shareable content, read-aloud features, and interactive elements. Schools and corporate organizations are embracing digital publishing for training purposes, as e-books offer flexibility and ease of use.

- The digital era has transformed the way we read, with e-books accessible on computers, e-book readers, tablets, smartphones, and even CDs and websites. E-books offer authenticity, with numbered pages and high-quality photographs and graphics. However, concerns regarding authenticity and the user experience are being addressed through advanced technology, such as augmented reality (AR) experiences and immersive environments. AR can provide a 3D image, enhancing the user experience and offering a more engaging reading experience. E-books offer self-assessments, quizzes, and exercises, making them ideal for assessment purposes. Sustainability is another advantage of e-books, as they do not require the manufacturing and publishing of print versions, reducing the carbon footprint.

- In conclusion, the European e-books market is thriving, with e-books offering numerous advantages over traditional printed books. Whether you're a student, professional, or avid reader, e-books offer a convenient, affordable, and functional alternative to printed books.

What are the market trends shaping the Europe E-Books Market?

Emerging formats for publishing e-books is the upcoming trend In the market.

- The European e-books market is witnessing substantial growth as the preference for digital books continues to rise. Tech-savvy digital users increasingly favor e-books for their portability, lightweight design, and offline accessibility. Schools and corporate organizations are adopting digital publishing for training purposes, leading to a shift from print versions to digital versions. The debate over authenticity between print books and electronic books persists, but e-books offer functional advantages such as shareable content, read-aloud features, and interactive elements. In the digital era, e-books are accessible via computers, e-book readers, tablets, smartphones, and other digital devices. Digital versions can be downloaded as files, accessed through websites or the Internet, and read on various digital devices.

- Advanced e-books offer augmented reality experiences, immersive environments, and 3D images, enhancing the user experience. EPUB2 and EPUB3 formats are gaining popularity among digital publishers due to their advanced features, including pre-recorded audio narration and web standards such as CSS 3 and XHTML 5. E-books can be accessed without an Internet connection, making them convenient for travel and other situations where a print book may not be practical. E-books offer self-assessments, quizzes, and exercises, making them ideal for online learning and mobile device usage. Sustainability is another advantage of e-books, as they do not require paper or ink, reducing their environmental impact.

- Cloud-based storage and cloud-based reading apps allow users to store vast collections of e-books, making them a practical and efficient solution for avid readers.

What challenges does Europe E-Books Market face during the growth?

High competition from free content is a key challenge affecting the market growth.

- The European e-books market faces intense competition from an abundance of free digital content. Open-access platforms, public domain resources, self-published e-books, and free content from libraries, blogs, and educational websites have significantly increased the availability of no-cost digital books. This reduction In the incentive to purchase paid e-books, particularly among price-sensitive readers, poses a considerable challenge to the market. Digital users, including tech-savvy individuals, schools, corporate organizations, and those using e-books for training purposes, seek authenticity, functionality, and shareable content In their reading materials. Digital publishing offers the convenience of reading on various digital devices such as computers, e-book readers, tablets, and smartphones.

- However, the debate surrounding the authenticity of e-books compared to print versions continues. In the digital era, e-books provide interactive elements like read-aloud features, augmented reality experiences, and quizzes, making them more engaging for users. Portable, lightweight, and offering offline accessibility, e-books cater to the needs of the modern reader. Cloud-based digital versions allow for easy access and storage, while print books maintaIn their traditional appeal for those who prefer numbered pages, photographs, and graphics. Sustainability is another factor driving the shift towards digital publishing. However, concerns regarding storage space and the need for an internet connection can limit the appeal of e-books for some users.

- The user experience of technology-based reading devices, such as e-readers and tablets, continues to evolve, offering immersive environments with 3D images, user experience enhancements, and assessments through self-assessments and quizzes. In conclusion, the European e-books market faces competition from an abundance of free digital content. Despite this challenge, the convenience, functionality, and interactive features of e-books continue to attract users. The market's growth is influenced by factors such as the user experience, sustainability, and the availability of technology-based reading devices.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Barnes and Noble Booksellers Inc.

- Bertelsmann SE and Co. KGaA

- Ebooks.com Pty Ltd.

- EBSCO Information Services

- Georg von Holtzbrinck GmbH and Co. KG

- Hachette Livre

- Informa PLC

- McGraw Hill

- News Corp.

- Pearson Plc

- Rakuten Group Inc.

- UCL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The European e-books market is experiencing significant growth as the region transitions into the digital era of publishing. This shift is driven by several factors, including the convenience and portability of digital books, the functional benefits they offer, and the increasing preference for shareable content among digital users. E-books offer a level of convenience that is unmatched by their print counterparts. They can be accessed from various digital devices such as computers, e-book readers, tablets, and smartphones, making them ideal for individuals with busy schedules or those who travel frequently. Moreover, e-books do not have the same storage limitations as print books, allowing users to carry an extensive library with them at all times.

The digital nature of e-books also enables interactive elements that enhance the user experience. For instance, some e-books offer read-aloud features, allowing users to listen to the text instead of reading it. Others include augmented reality (AR) experiences, providing an immersive environment that brings the content to life. These features are particularly useful for educational purposes, where students can benefit from self-assessments, quizzes, and exercises to reinforce their learning. The shift towards digital publishing is not without challenges, however. Authenticity and functional aspects are critical considerations for both publishers and users. Publishers must ensure that their digital versions maintaIn the same quality as print books, while users require offline accessibility to ensure they can access their content even without an internet connection.

Moreover, the market is evolving rapidly, with new technologies and trends emerging constantly. Cloud-based e-books, for example, offer the advantage of accessing content from anywhere, while the use of technology-based reading devices continues to grow. The integration of AR technology in e-books is another trend that is gaining traction, offering users a more engaging and interactive reading experience. The European e-books market is also influenced by broader market dynamics, such as changing consumer preferences and the increasing adoption of technology in various sectors. Schools and corporate organizations, for instance, are increasingly turning to digital versions for training purposes, as they offer cost savings and greater flexibility.

The European e-books market is experiencing significant growth as the region transitions into the digital era of publishing. The convenience, portability, and functional benefits of e-books, combined with the emergence of new technologies and trends, make them an attractive alternative to print books. However, challenges related to authenticity, offline accessibility, and user experience remain, and publishers and technology providers must address these to ensure the continued growth and success of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2024-2028 |

USD 1100.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch