E-Passport Market Size 2025-2029

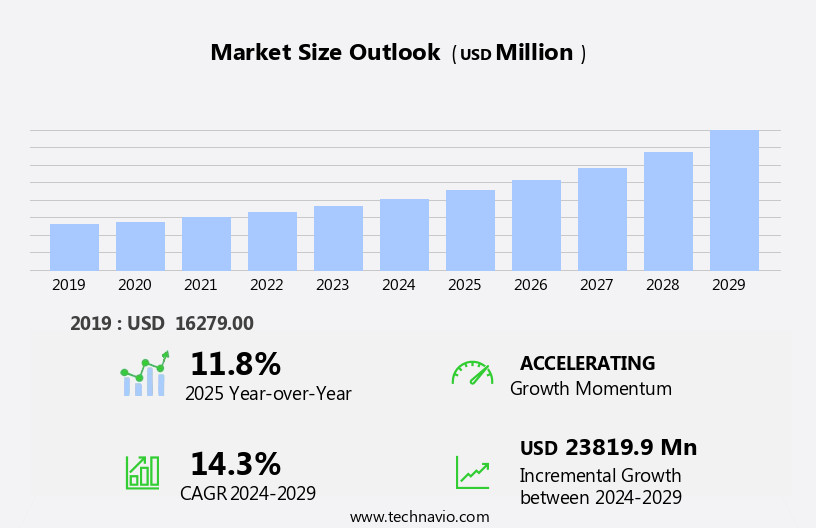

The e-passport market size is forecast to increase by USD 23.82 billion, at a CAGR of 14.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing security concerns and the widespread adoption of electronic passports. With traditional passports susceptible to identity fraud and forgery, the shift towards E-Passports, which incorporate advanced security features such as biometric data and electronic chips, is gaining momentum. However, high initial investment costs pose a challenge for market entrants. Governments and issuing authorities must invest in the necessary infrastructure and technology to produce and issue these secure documents. This includes upgrading production facilities, training staff, and implementing secure communication channels.

- Despite this obstacle, the potential benefits of enhanced security and streamlined travel processes make the market an attractive proposition for stakeholders. Companies seeking to capitalize on this market's opportunities should focus on innovation, cost-effective solutions, and collaboration with governments and industry partners to overcome the initial investment hurdle.

What will be the Size of the E-Passport Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, integrating advanced technologies and adapting to shifting market dynamics. Entities involved in this sector are focusing on image processing to enhance document authenticity and forgery detection. Privacy regulations are a significant consideration, with biometric databases and optical sensors being used to ensure identity verification. Biometric sensors, such as vein recognition and facial recognition, are becoming increasingly common for authentication factors. Digital signatures and multi-factor authentication provide additional security measures. Data breaches remain a concern, leading to a heightened emphasis on data security and encryption. Security audits and vulnerability management are essential components of the market, with secure communication channels and secure elements ensuring data integrity.

Biometric matching and signal processing are critical for efficient verification processes. Contactless communication and data analytics enable seamless travel and border control. Privacy concerns persist, with personal data protection regulations shaping the market. Biometric enrollment devices and antifraud measures are being developed to mitigate identity theft and document forgery. Threat modeling and risk assessment are crucial for cybersecurity threats, with machine learning and artificial intelligence being utilized for threat detection and incident response. The market is characterized by continuous innovation and integration of technologies such as NFC technology, iris scanning, and voice recognition. Authorization mechanisms and access control systems are also being integrated to ensure secure e-passport issuance and identity management. The market's evolving nature underscores the importance of staying informed about the latest trends and developments.

How is this E-Passport Industry segmented?

The e-passport industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Leisure travel

- Business travel

- Component

- Software

- Hardware

- Services

- Technology

- Radio frequency identification

- Biometric

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

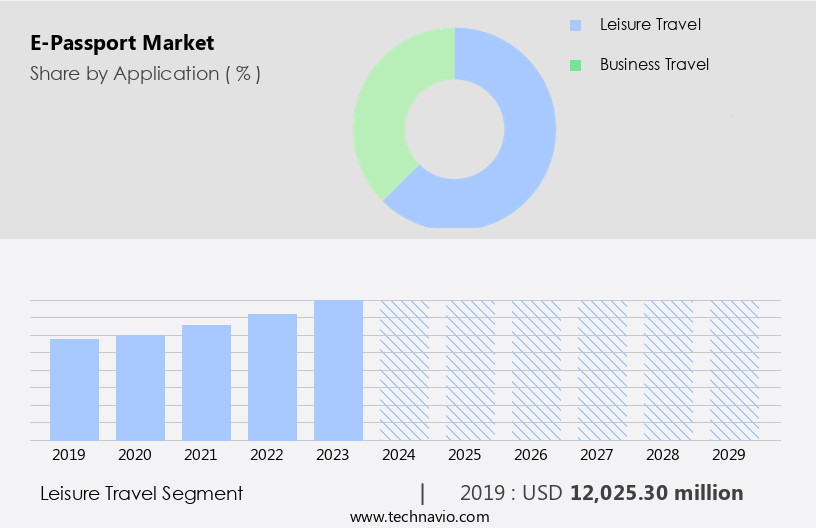

The leisure travel segment is estimated to witness significant growth during the forecast period.

The market has experienced notable growth, driven by the rising demand for secure and efficient travel documents. E-passports are increasingly popular for leisure travel as the global middle-class population expands and disposable income increases. For instance, India's per capita Net National Income (NNI) has grown from USD1,311 (Rs. 108,786) in 2023-24 to an estimated USD 2,477 (Rs. 205,579) in 2024-25. E-passports offer several advantages, including eliminating the need for physical visas and reducing wait times at airports through contactless communication and biometric verification devices. Security is a top priority in the market. Cloud computing and edge computing ensure data is encrypted and transmitted securely.

Signature recognition and biometric enrollment devices prevent identity theft and document forgery. Threat modeling, vulnerability management, and cybersecurity threats are addressed through robust authentication protocols and secure communication channels. Data mining and pattern recognition help in risk assessment and identity management. Biometric sensors, including fingerprint scanning, facial recognition, iris scanning, and vein recognition, are used for verification and biometric matching. Spoof detection and liveness detection ensure the authenticity of the biometric data. Data storage and database management are crucial for maintaining the integrity of the biometric databases. ICAO standards ensure compliance with international regulations. Machine learning and artificial intelligence are used for predictive analytics and incident response, enhancing security and improving the efficiency of the e-passport issuance process.

E-passports are also used for immigration control and authorization mechanisms. NFC technology and RFID enable border control and access control systems. Behavioral biometrics and presentation attack detection provide additional layers of security. In conclusion, the market is dynamic and evolving, with a focus on security, efficiency, and convenience. E-passports offer a secure and convenient way for travelers to cross international borders, addressing the needs of a growing global population and increasing travel demand.

The Leisure travel segment was valued at USD 12.03 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing notable growth as governments prioritize security and efficiency in border control processes. The European Union aims for all member states to issue biometric passports, containing digital chips with personal data and photos. Countries like Germany, France, and the UK have already implemented E-passport programs, bolstering border security and streamlining immigration. This surge in demand for E-passports extends beyond government initiatives, as European travelers appreciate the convenience and enhanced security features. Biometric systems and passport readers are among the related technologies in high demand. Cloud computing facilitates data storage and access, while encryption ensures data security.

Threat modeling and vulnerability management mitigate cybersecurity risks. Compliance with regulations, such as ICAO standards, is crucial. NFC technology enables contactless communication, and data analytics offers valuable insights. Behavioral biometrics, facial recognition, and other biometric verification devices ensure identity verification. Data breaches and document forgery are combated with robust authentication protocols and presentation attack detection. Machine learning and artificial intelligence are integral to improving the identification process and incident response. The market's evolution reflects the integration of various advanced technologies, including data mining, signature recognition, and template protection, to create a secure and efficient E-passport system.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic world of travel documentation, the market continues to gain momentum. This market encompasses advanced electronic passports, incorporating microprocessors and contactless chips, enabling secure data storage and communication. Biometric technology, including facial recognition and fingerprint scanning, enhances identity verification, ensuring authenticity and reducing identity theft. E-passports offer numerous benefits, including faster border control processing, extended passport validity periods, and improved data security. The market is driven by increasing global travel, stringent security regulations, and technological advancements. Additionally, governments worldwide invest in e-passport infrastructure, further fueling market growth. The market is a fusion of innovation, security, and convenience, shaping the future of travel documentation.

What are the key market drivers leading to the rise in the adoption of E-Passport Industry?

- The heightened emphasis on security is the primary factor fueling market growth. E-passports represent the future of travel documentation, offering enhanced security features and streamlined processes. Equipped with advanced technologies like fingerprint scanning, thermal sensors, and ultrasonic sensors, these documents ensure secure identity verification. Data storage is encrypted, and communication channels are secure, minimizing the risk of identity theft and cybersecurity threats. Big data and pattern recognition enable real-time fraud prevention and vulnerability management. E-passports integrate seamlessly with various government systems and databases, facilitating efficient border control procedures. They also adhere to ICAO standards for digital identity and database management, ensuring interoperability and information security.

- Behavioral biometrics further strengthen security by recognizing individual traveler patterns. These features not only provide a more reliable and secure travel experience but also contribute to improved overall travel security. By prioritizing personal data protection and secure communication channels, e-passports offer peace of mind for travelers and governments alike.

What are the market trends shaping the E-Passport Industry?

- E-passports, also known as electronic passports, are becoming increasingly common in the global travel industry. The adoption of these advanced travel documents is a notable market trend, offering enhanced security features and easier data processing.

- The market has experienced significant growth over the past decade due to increasing security concerns in the travel industry. E-passports provide enhanced security features, including biometric data and encryption technology, making it challenging for fraudsters to create counterfeit documents. This is crucial in addressing issues such as identity theft, terrorism, and document forgery. Moreover, governments are encouraged to adopt E-passports to facilitate the seamless and secure movement of their citizens, fostering trade and tourism. The push toward digitization and automation in various sectors, including travel, further propels the adoption of E-passports. These advanced travel documents utilize biometric sensors, such as facial recognition and vein recognition, for authentication factors and digital signatures.

- Biometric matching through image processing and signal processing ensures accurate verification. Data security is prioritized through biometric databases, contactless communication, and data analytics. Security audits and secure elements further fortify data protection. Despite these advantages, data breaches remain a concern, necessitating ongoing efforts to strengthen data security measures.

What challenges does the E-Passport Industry face during its growth?

- The high initial investment costs represent a significant challenge impeding the growth of the industry. The market experiences substantial investment requirements for its implementation, posing a significant challenge. The development and deployment of E-passports necessitate substantial investments in technology, infrastructure, and personnel training. Biometric verification devices, such as iris scanning and voice recognition, are integral components of E-passports, adding to the cost. Governments and organizations must invest in designing, testing, and deploying systems and infrastructure to support E-passport functionality, including encryption and authentication protocols, presentation attack detection, and access control systems. These systems must adhere to international standards and employ advanced technologies like artificial intelligence, machine learning, and predictive analytics for identity verification and incident response.

- Despite the high initial investment costs, the benefits of E-passports, including enhanced security and streamlined immigration control, make them a valuable investment for many countries. However, smaller and less affluent nations may find it challenging to participate in the market due to the significant upfront costs.

Exclusive Customer Landscape

The e-passport market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-passport market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-passport market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in E-Passport solutions, including the 3M CR100 Document Passport Reader Scanner MRZ MRTDS USB and 3M QS1000 Full Page Passport Scanner, utilizing advanced technology for efficient and accurate authentication. Our offerings enhance security and streamline identity verification processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Aion Tech Solutions Ltd.

- ASSA ABLOY AB

- AUSTRIACARD AG

- CardLogix Corp.

- De La Rue PLC

- DERMALOG Identification Systems GmbH

- Entrust Corp.

- GET Group Holdings Ltd.

- Giesecke Devrient GmbH

- HID Global Corp.

- IDEMIA France SAS

- IN Groupe

- Intel Corp.

- Keyfactor

- M2SYS

- Muhlbauer GmbH and Co. KG

- NXP Semiconductors NV

- Panasonic Holdings Corp.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Passport Market

- In January 2024, IDEMIA, a global leader in Augmented Identity, announced the launch of its MorphoWave Compact ePassport reader, enabling contactless ePassport processing with a single wave of a passport (IDEMIA press release).

- In March 2024, the European Union Agency for Criminal Justice Cooperation (Europol) and IDEMIA signed a strategic partnership to enhance secure identity management and border control systems using ePassports and biometric technologies (Europol press release).

- In April 2024, Gemalto, another major player in digital security, completed the acquisition of 3M's Identity Management business, significantly expanding its ePassport and biometric solutions portfolio (Gemalto press release).

- In May 2025, the International Civil Aviation Organization (ICAO) announced the successful implementation of its e-GATE project in 10 major airports worldwide, enabling contactless ePassport processing and biometric identification for faster and more secure travel (ICAO press release).

- These developments demonstrate the growing importance of ePassports and biometric technologies in secure identity management and travel processes. Companies like IDEMIA and Gemalto are leading the market with innovative solutions, strategic partnerships, and acquisitions to meet the increasing demand for secure and efficient identity verification systems.

Research Analyst Overview

- The market is experiencing significant advancements in identity verification and access control technologies. Self-sovereign identity and decentralized identity solutions are gaining traction, enabling users to control their biometric data and audit trails. Online banking and mobile payments are driving the adoption of biometric time clocks, performance evaluation, and error rate reduction through self-service kiosks. Data anonymization and data lifecycle management are essential for ensuring ethical considerations in biometric data storage and usage. Biometric encryption, homomorphic encryption, and zero-knowledge proofs are enhancing security and privacy in digital wallets and electronic signatures. Usability testing and user experience (UX) design are crucial in implementing biometric standardization and logical access control.

- Law enforcement applications and healthcare access control are benefiting from time-stamp authentication and biometric tokenization. Federated learning and blockchain technology are revolutionizing access logging and data retention policies, providing secure and efficient data sharing and processing. Biometric payment systems and physical access control are becoming more sophisticated, integrating biometric data and logical access control for improved security and convenience. Error rates and performance evaluation are critical in ensuring the reliability and accuracy of biometric systems, while ethical considerations and data minimization are essential in maintaining user trust and privacy. The market is continually evolving, with ongoing research and development in biometric performance, data security, and user experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Passport Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.3% |

|

Market growth 2025-2029 |

USD 23819.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.8 |

|

Key countries |

US, China, UK, Germany, Japan, France, India, Brazil, Canada, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Passport Market Research and Growth Report?

- CAGR of the E-Passport industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-passport market growth of industry companies

We can help! Our analysts can customize this e-passport market research report to meet your requirements.