Electric Air Taxi Market Size 2024-2028

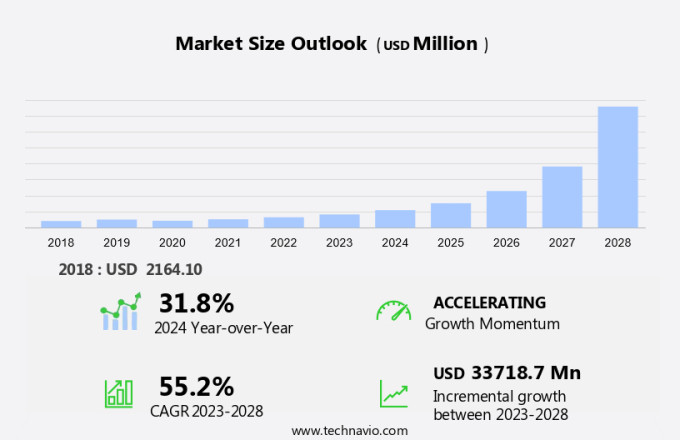

The electric air taxi market size is forecast to increase by USD 33.72 billion at a CAGR of 55.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for efficient and eco-friendly transportation solutions, particularly for short-distance travel. Aviation is increasingly being recognized as a viable alternative to ground transportation, especially in urban areas plagued by traffic congestion. However, the development of electric air taxis faces challenges, including the complex aviation licensing process and the need for advanced aerospace technology from leading firms. The use of fuel cell-powered propulsion is a promising solution to address the challenges of electric air taxi development, as it offers clean, quiet, and efficient power. This trend is expected to drive market growth in the coming years. The market is poised for expansion, with the potential to revolutionize urban transportation and reduce reliance on traditional ground transportation methods.

What will be the Size of the Market During the Forecast Period?

- The market is poised to revolutionize urban mobility and provide an efficient solution to the persistent issue of traffic congestion. With the increasing demand for short-distance travel and the need for sustainable transportation alternatives, aviation is emerging as a viable option for urban transportation. Traffic congestion is a significant challenge in many cities, leading to inefficiencies, wasted time, and increased stress for commuters. Traditional transportation systems, such as cars and buses, are often the primary contributors to road congestion. In this context, electric air taxis offer a promising solution, providing an alternative to ground transportation and reducing the burden on road infrastructure.

- Furthermore, the aviation industry is at the forefront of this innovation, with aerospace firms investing heavily in the development of electric vertical takeoff and landing (eVTOL) technology. These aircraft, also known as flying taxis, are designed for piloted, short-distance air transportation. To facilitate the operation of electric air taxis, infrastructure such as vertiports and charging stations is being developed. Vertiports are vertical takeoff and landing facilities, providing a hub for electric air taxi services. Charging stations enable the recharging of eVTOL aircraft batteries, ensuring they remain operational and ready for service. Air traffic management systems are also being adapted to accommodate the integration of electric air taxis into the transportation landscape.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Two-seat aircraft

- Four-seat aircraft

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

- The two-seat aircraft segment is estimated to witness significant growth during the forecast period.

The market is gaining traction as a viable solution for short-distance travel, addressing the issue of traffic congestion in transportation systems. With the rise of vehicles on the road and subsequent increase in traffic, there is a growing demand for more efficient transportation methods. Air taxis, using two-seater electric aircraft, offer an efficient solution for this issue. Several companies in the aviation and transportation industries are investing in the development of air taxis worldwide. For instance, Archer Aviation, a US-based startup, unveiled a new two-passenger electric aircraft in June 2021, marking the beginning of a potential future fleet of air taxis. This trend is expected to continue as the demand for more efficient transportation solutions increases. Aviation licensing and regulations are also being addressed by aerospace firms to facilitate the commercialization of electric air taxis.

Get a glance at the market report of share of various segments Request Free Sample

The two-seat aircraft segment was valued at USD 1.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 65% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is anticipated to lead the global industry during the forecast period. This dominance is primarily attributed to the region's early adoption of electric air taxi technology and ongoing eVTOL projects. North America's reputation as a pioneer in advanced technology implementation makes it an alluring market for electric air taxi providers. Urbanization in North American cities has resulted in the exploration of innovative solutions for urban mobility, including electric air taxis. Major players in the electric air taxi industry are based in North America, contributing to the market's growth in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Electric Air Taxi Market?

Increasing need for clean and quiet aircraft is the key driver of the market.

- The aviation sector accounted for approximately 2.5% of the world's total CO2 emissions in 2023, a figure projected to increase substantially with the expansion of the global aircraft fleet and the rise in air travel. To mitigate the industry's carbon footprint, there is a growing preference for electric air taxis over traditional fossil fuel-powered aircraft. Authorities such as the International Civil Aviation Organization, the US Federal Aviation Administration, and the European Union Aviation Safety Agency advocate for sustainable fuel alternatives. By 2050, they estimate that aircraft emissions will have tripled. Propulsion through electric means, such as multicopters and quadcopters, is a promising solution.

- Moreover, advanced battery technology and electric propulsion systems are key components of these electric aircraft. The adoption of electric air taxis is expected to significantly decrease aviation's carbon emissions, making it an essential part of the industry's transition towards sustainability. Key players in this market include Propulsion, Aircraft manufacturers, and Battery technology providers.

What are the market trends shaping the Electric Air Taxi Market?

Challenges in developing electric air taxis is the upcoming trend in the market.

- Fuel cells serve as an on-demand energy solution, offering financial profitability, adaptability, and efficient energy transfer. Their ability to operate using various hydrocarbons makes fuel cell systems a promising propulsion technology for aviation. Air Taxis, equipped with electric motors and fuel cells, are gaining traction as an alternate transportation solution in US traffic patterns. These vehicles, featuring a two-blade propeller and hydrogen fuel supply, provide a quieter and cleaner transportation alternative. Transportation analytics reveal that Air Taxi Range and taxi platform services are expected to witness significant growth, driven by the integration of fuel cell technology. Automated automobiles, including Air Taxis, are poised to revolutionize the transportation industry.

- Moreover, charging stations are being installed at strategic locations to ensure seamless refueling for these vehicles. Air traffic control systems are also being updated to accommodate the integration of Air Taxis into the national airspace system. Innovations in fuel cell membranes, electrodes, and electrolytes are anticipated to lead to more affordable and lightweight Air Taxi designs. This technological advancement will contribute to the expansion of the Air Taxi market in the US. Fuel cell technology's integration into Air Taxis is expected to lead to a more sustainable and efficient transportation system.

What challenges does Electric Air Taxi Market face during the growth?

Use of fuel cell-powered propulsion is a key challenge affecting the market growth.

- Electric air taxis, also known as eVTOL (electric vertical takeoff and landing) aircraft, are gaining attention as a potential solution to address the issues of noise pollution and heavy traffic volumes in urban areas. These flying taxis are expected to offer efficient shuttle services, reducing the need for cars and thereby minimizing road congestion. However, the development of electric air taxis is a complex process, requiring advanced technologies such as flight simulators for testing and refining the design. The air taxi market is still in its infancy, with most startups relying on digital animations rather than actual flying prototypes. The adoption of electric power in these aircraft necessitates more powerful electrical systems, which require effective cooling and dynamic control over power generation and conversion.

- In addition, despite the potential benefits, the maturity of the associated technologies is not yet sufficient to meet the performance benchmarks required for commercial use.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Airstream A.S

- Archer Aviation Inc

- EHang Holdings Ltd.

- Honeywell International Inc.

- Joby Aviation Inc.

- Karem Aircraft Inc.

- Kitty Hawk Corp.

- Lilium GmbH

- Neva Aerospace Ltd.

- Nurol Holding Inc.

- Rolls Royce Holdings Plc

- Skyway Air Taxi LLC

- Talkeetna Air Taxi

- The Boeing Co.

- Urban Aeronautics

- Volocopter GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric air taxi market is experiencing significant growth due to the increasing demand for efficient and eco-friendly transportation solutions in the face of traffic congestion. Aviation technology is at the forefront of this trend, with electric air taxis gaining popularity as a viable alternative to traditional ground transportation. These piloted aircrafts, also known as electric-based air taxis or eVTOL (electric vertical takeoff and landing) technology, offer short-distance travel solutions for urban mobility. Aviation licensing and infrastructure development are crucial components of the air taxi market. Aerospace firms are investing in the development of air taxi infrastructure, including vertiports and charging stations, to support the growing demand for air taxi services.

Furthermore, air traffic management systems are also being integrated to ensure safe and efficient operation of electric air taxis. The electric propulsion and battery technology used in electric air taxis contribute to zero emissions and reduced noise pollution, making them an attractive option for urban transportation. The air taxi market is expected to expand as part of smart city projects, offering shuttle services and alternate transportation solutions to combat traffic congestion and traffic patterns. With advancements in propulsion technology and the development of flight simulators, the range and passenger capacity of electric air taxis are continually increasing. The air taxi market is poised for growth as a key player in urban transportation, offering a solution to road congestion and offering passengers a unique and innovative travel experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 55.2% |

|

Market growth 2024-2028 |

USD 33.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

31.8 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch