Electric Massager Market Size 2025-2029

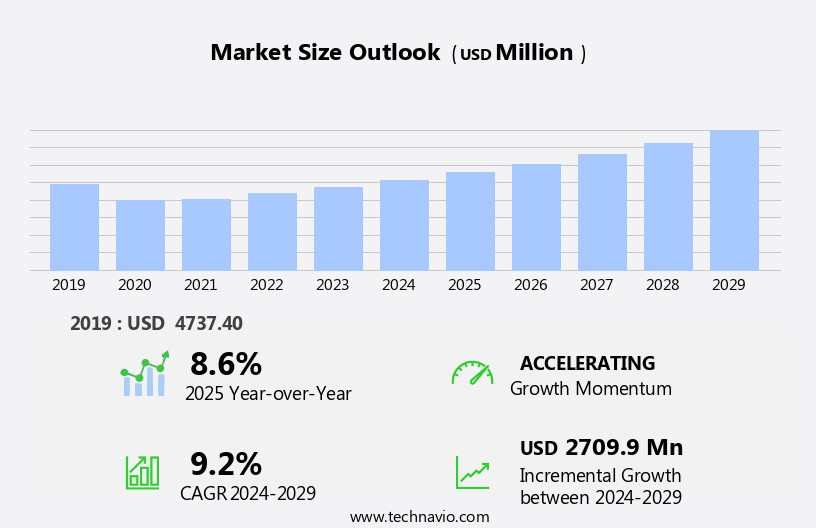

The electric massager market size is forecast to increase by USD 2.71 billion at a CAGR of 9.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by rising stress levels and increasing health consciousness among consumers worldwide. The market is benefiting from the leveraging of the internet platform to create awareness and make these products more accessible. Geared motor mechanisms and vibration motors power these devices, offering various intensity levels to cater to individual preferences. Additionally, the penetration into emerging economies presents a vast opportunity for market expansion. The market dynamics are influenced by factors such as technological advancements leading to innovative product offerings, increasing disposable income, and a growing preference for non-invasive pain relief solutions. Electric massagers, available as handheld electronic devices or massage chairs, offer advanced technology for pain management and muscle recovery. Companies seeking to capitalize on these opportunities should focus on product innovation, expanding their reach in emerging markets, and leveraging digital marketing strategies to increase brand awareness.

- Navigating challenges such as regulatory compliance and price competition will require strategic partnerships and a focus on delivering value to customers. Overall, the market is poised for robust growth, offering significant opportunities for companies to establish a strong market presence and capture a share of this expanding market.

What will be the Size of the Electric Massager Market during the forecast period?

- The market encompasses a range of health activities centered around massage therapy, providing an alternative to traditional hands-on techniques. This market caters to the growing demand for improved blood circulation, muscle relaxation, and overall physical wellbeing. With the increasing recognition of health benefits, such as lower blood pressure, enhanced sleep, potential weight loss, and stress relief, the market has gained significant traction. Spa parlors continue to offer massage services, but the convenience and affordability of electric massagers have made them a popular choice for middle class households.

- The internet penetration has been instrumental in driving the market's growth, enabling consumers to purchase electric massagers from retail players and web-based retail stores. Personal care expenditures have risen as consumers prioritize self-care and wellness. The market is poised for continued expansion, offering a compelling value proposition for those seeking to maintain their health and enhance their personal care routine.

How is this Electric Massager Industry segmented?

The electric massager industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Massage chairs

- Back massagers

- Neck and shoulder massagers

- Others

- End-user

- Commercial

- Residential

- Distribution Channel

- Online

- Offline

- Product Type

- Cordless

- Corded

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

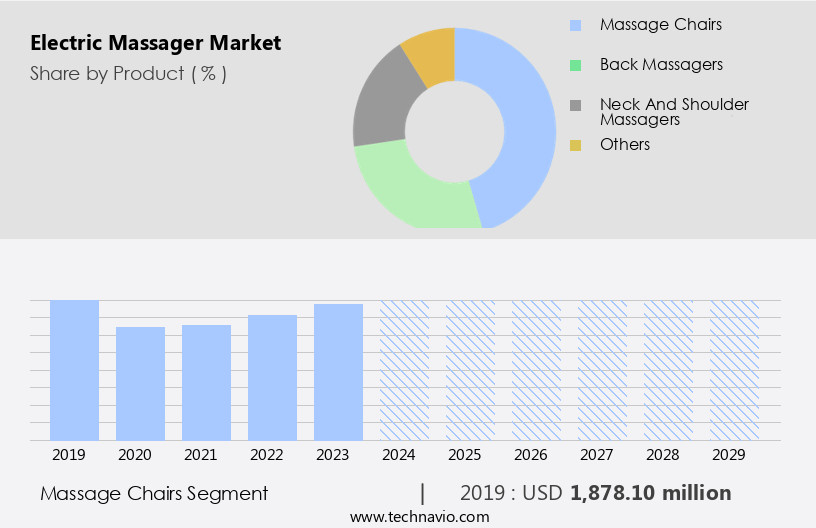

The massage chairs segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing popularity of massage therapy for health and wellness. Massage therapy, which includes hands-on techniques, promotes blood circulation, muscle relaxation, and stress relief. These devices provide various treatments such as percussive and vibration, targeting different physical benefits. Smart devices with features like energy consumption control, smart temperature control, and motion control are gaining traction among consumers. The market caters to various segments, including corded and cordless battery types, commercial segments, and online retail.

The market is driven by factors such as the rise in stress-related medical cases, leisure activities such as golf matches, and daily life demands leading to physical deconditioning and muscle weakness. Consumers, particularly middle-class households, are increasingly investing in personal care expenditures for health benefits and environmental concerns. The beauty devices market, including electric massagers, is expected to grow in tandem with the increasing internet penetration and generational trend towards physical wellbeing. The market is competitive, with multinational brands and local players offering a range of products, from handheld massagers to massage chairs, catering to diverse customer needs and preferences.

Get a glance at the market report of share of various segments Request Free Sample

The Massage chairs segment was valued at USD 1.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

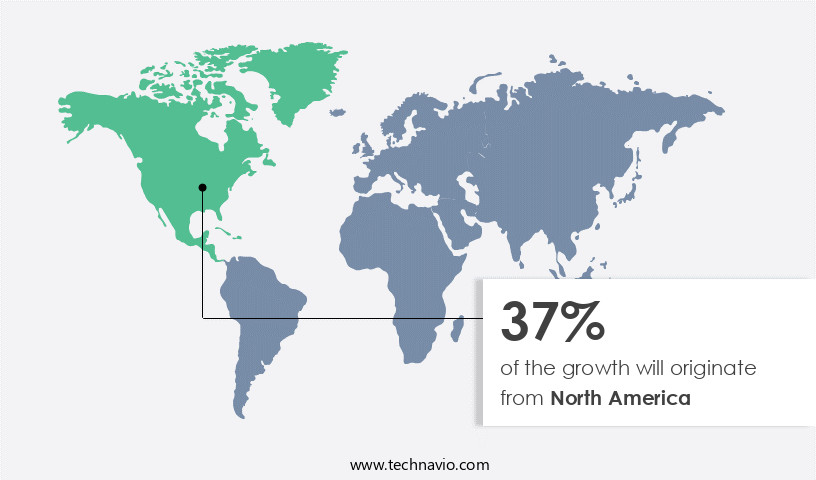

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing notable growth, driven by several key factors. Urbanization, with 83% of the population in the US and 82% in Canada living in urban areas in 2023 (The World Bank Group), increases the demand for electric massagers for stress relief, chronic pain alleviation, and muscle relaxation. Additionally, rising disposable income and an aging population contribute to the market's expansion. The availability of electric massagers through online retail channels, such as e-commerce sites and web-based retail stores, enhances accessibility. Furthermore, prominent companies in the region offer advanced technology, including smart devices with app connectivity, energy consumption management, and smart temperature control.

The market's growth is also influenced by the health benefits of electric massagers, including improved blood circulation, muscle relaxation, and potential weight loss. As consumers become more environmentally conscious, the market is shifting towards energy-efficient, lightweight, and eco-friendly products. The market caters to various segments, including massage chairs, handheld massagers, and commercial segments, with corded and cordless battery types. The beauty devices market, middle class households, and spa parlors are significant consumers. The market is expected to continue growing, driven by increasing health awareness, physical wellbeing, and the convenience of electric massagers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electric Massager Industry?

- Rising stress-related cases globally is the key driver of the market. Stress has become a significant concern for individuals in today's fast-paced world. Factors such as workload, economic conditions, peer pressure, and socio-cultural norms can lead to stress, which, if left untreated, can result in various health issues. These include anxiety, irritability, anger, lack of motivation or focus, restlessness, body pain, sadness, and depression. Untreated stress can also lead to behavioral changes such as angry outbursts, drug or alcohol abuse, overeating or under-eating, social withdrawal, and tobacco use. The impact of stress on an individual's health can be profound, weakening the immune system and exhausting the body both physically and mentally.

- Furthermore, prolonged stress can lead to physical deconditioning and muscle weakening, resulting in back pain. Given the prevalence and potential consequences of stress, there is a growing demand for stress relief solutions. One such solution is the use of electric massagers. These devices provide a non-invasive, drug-free way to alleviate muscle tension and promote relaxation. They can be used at home or in a professional setting, making them a convenient and accessible option for individuals seeking stress relief. The increasing prevalence of stress and its negative impact on health make electric massagers an attractive solution for individuals seeking relief.

- These devices offer a non-invasive, drug-free way to alleviate muscle tension and promote relaxation, making them a valuable addition to any self-care routine.

What are the market trends shaping the Electric Massager Industry?

- Leveraging of Internet platform to create awareness is the upcoming market trend. The digital age has revolutionized the way businesses connect with consumers, particularly in the market. Companies can now showcase their offerings online, enhancing the shopping experience for customers and increasing brand visibility. Websites hosted by either the company or a third-party provider offer various features such as live chat, auto-text reminders, blogs, personal profiles, e-commerce, and streaming. This online presence enables higher revenue generation and expansion of market reach. The convenience of browsing and purchasing from the comfort of one's home is a significant market trend, driving growth in the electric massager industry.

What challenges does the Electric Massager Industry face during its growth?

- Penetration in emerging economies is a key challenge affecting the industry growth. The market penetration is relatively low in developing regions, including South America, Africa, and certain Asian countries, excluding Japan. In the US and other developed nations, the use of electric massagers is increasingly common, yet penetration rates remain limited in emerging economies such as Brazil, India, and Nigeria. This trend is primarily attributed to insufficient awareness, affordability, and reluctance towards adopting such technology. The low Gross Domestic Product (GDP) in these countries restricts the market's expansion. Furthermore, the growth of the market, particularly in developing countries, is impeded by inadequate infrastructure, a shortage of skilled labor, inappropriate facilities, limited investor-friendly policies, bureaucratic hurdles, and the absence of international accreditation. Despite their numerous benefits, the adoption of electric massagers is hindered by these challenges.

Exclusive Customer Landscape

The electric massager market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric massager market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric massager market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Beurer GmbH - The company provides a selection of electric massagers, including infrared, tapping, and mini options, catering to various preferences and needs in the wellness market. These massagers utilize advanced technology to deliver therapeutic benefits, enhancing overall well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beurer GmbH

- Casada International GmbH

- Compass Health Brands

- Deemark Healthcare Pvt. Ltd

- Fysiomed NV

- Hi-Dow International Inc.

- Homedics USA

- JSB Wellness

- Luraco Technologies

- medisana GmbH

- Mettler Electronics Corp.

- OMRON Corp.

- Panasonic Holdings Corp.

- Prospera Corp.

- RoboTouch

- Shenzhen XFT Medical Ltd.

- Thumper Massager Inc.

- Vision Sky Shop

- WelbuTech Co. Ltd.

- Zynex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Electric massagers have gained significant traction in the health activities market as an alternative to traditional hands-on techniques for muscle relaxation and blood circulation enhancement. These handheld electronic devices offer advanced technology that caters to various muscle soreness and tension issues, providing numerous physical benefits. The electric massager industry has seen material advances, with lightweight and energy-efficient products becoming increasingly popular among consumers. The shift towards eco-friendly and environmentally sustainable products has also influenced the market, with manufacturers focusing on producing electric massagers that comply with environmental regulations. Recovery solutions have emerged as a significant commercial segment, with electric massagers offering effective pain relief for individuals dealing with stress-related medical cases and leisure activities.

The growing trend of prioritizing physical wellbeing has led to increased personal care expenditures, making electric massagers an attractive investment for middle-class households. The beauty devices market, including electric massagers, has seen a surge in demand due to the increasing popularity of smart devices and internet penetration. Consumers now have access to a wide range of electric massagers, including gun massagers, shiatsu massagers, acupressure massagers, infrared massagers, ultrasonic massagers, and more, through various online retail channels. Electric massage chairs, offering full body massage experiences, have also gained popularity in commercial segments. These chairs often come with advanced features such as smart temperature control, speed control, and motion control, making them a desirable option for those seeking a more comprehensive massage experience.

The market for electric massagers is diverse, catering to various corded and cordless battery types. The online retail segment has seen substantial growth, with e-commerce sites and web-based retail stores offering a convenient shopping experience. Traditional retail players, including department stores, convenience stores, local shops, and specialty stores, also offer electric massagers. Electric massagers provide numerous health benefits, such as improved blood flow, reduced pain intensity, and enhanced relaxation therapy. They are available in various forms, including head massagers, back massagers, neck massagers, shoulder massagers, handheld massagers, leg massagers, foot massagers, eye massagers, and more. The market for electric massagers is continually evolving, with new technologies and features being introduced regularly.

Some electric massagers offer voice control features, while others come with app connectivity for customized massage experiences. Infrared heat, multiple heads, tapping or percussion, cold therapy, and massage rollers are some of the advanced features that have gained popularity in recent years. Electric massagers are an essential self-care tool for individuals seeking pain relief, muscle relaxation, and stress relief. They offer a convenient and effective solution for those with busy schedules, making them a valuable addition to daily activities and leisure time. As the market continues to grow, we can expect to see further innovations and advancements in electric massager technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.2% |

|

Market growth 2025-2029 |

USD 2.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, Germany, UK, China, France, Canada, Italy, Japan, Spain, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Massager Market Research and Growth Report?

- CAGR of the Electric Massager industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric massager market growth of industry companies

We can help! Our analysts can customize this electric massager market research report to meet your requirements.