Golf Tourism Market Size 2025-2029

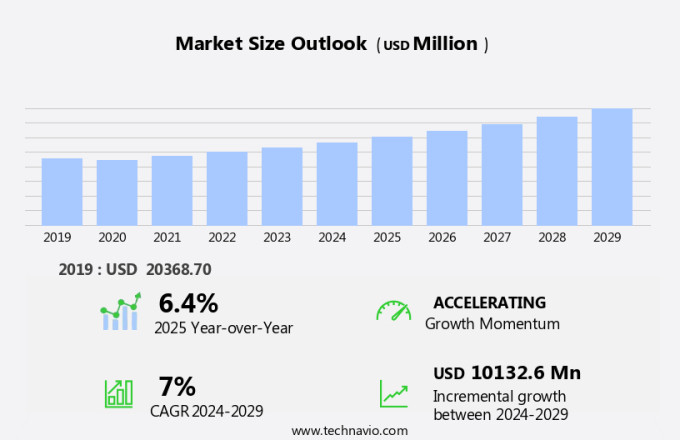

The golf tourism market size is forecast to increase by USD 10.13 billion at a CAGR of 7% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing emphasis on golf infrastructure development worldwide. This trend is driven by the growing popularity of golf as a recreational activity and the expansion of golf courses in various regions. Another key factor fueling market growth is the advent of integrated mobile solutions in golf clubs and other equipment, which enhances the overall golfing experience for players. However, the market faces challenges from the increasing threat of fantasy sports, which offer similar entertainment value and convenience to golf enthusiasts. Despite these challenges, the golf tourism industry is expected to continue its growth trajectory, driven by the ongoing investment in golf infrastructure and the adoption of technology to enhance the golfing experience.

What will be the Size of the Golf Tourism Market During the Forecast Period?

- The golf sport continues to be a significant contributor to the global tourism industry, with golf tourism representing a substantial segment. The market is driven by various factors, including the availability of high-quality sporting infrastructure, such as golf courses, and the hosting of international sporting events, like the RBC Canadian Open and the Aramco Team Series. Economies of various destinations invest in golf courses and related facilities to attract domestic and international tourists. Local governments and tourism boards collaborate to offer accommodation, dining, and leisure activities catering to golf enthusiasts. Female golfers constitute a growing demographic in this market. Golf Saudi, for instance, has made strides in promoting the sport among women.

- Moreover, corporate golf events also contribute to the market's growth. An effective inventory management system is crucial for golf businesses to meet the demands of this dynamic market. Golf tourism continues to be a vital sector In the sport tourism industry, offering unique experiences for travelers and contributing to economic growth.

How is this Golf Tourism Industry segmented and which is the largest segment?

The golf tourism industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Male

- Female

- Type

- Domestic

- International

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- Spain

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

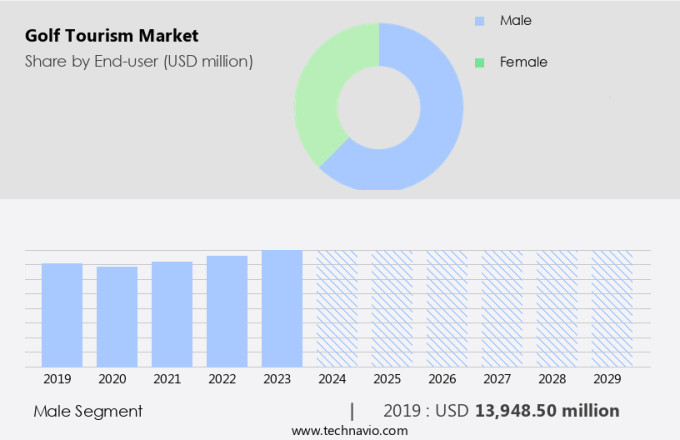

- The male segment is estimated to witness significant growth during the forecast period.

Golf tourism caters to a demographic of predominantly middle-aged males and spectators, driven by an increased interest in golf and enhanced living standards. The market's expansion is significant, with growth expected to continue due to the increasing number of golf destinations. This sector encompasses golf enthusiasts traveling for sports events, nostalgia, and active participation. The global golf market's growth is fueled by factors such as improved sports infrastructure and a growing male interest in golf. World-class golf courses, top-notch facilities, and personalized experiences attract discerning travelers. Corporate groups, retreats, conferences, and team-building activities also contribute to the market's growth. Golf tourism encompasses various segments, including domestic and international applications.

Get a glance at the Golf Tourism Industry report of share of various segments Request Free Sample

The male segment was valued at USD 13.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

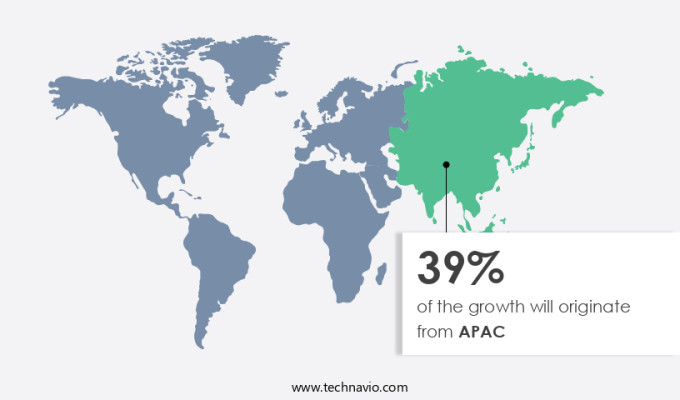

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, specifically In the US and Canada, holds a significant market share. South America's golf tourism sector exhibits promising growth due to strong economies, suitable weather conditions, diverse terrains, and extensive golf media exposure. Although golf participation rates remain stable, the number of rounds played and golfers has risen over the past few years. This growth in golfer activity positively impacts the golf industry and, in turn, the market. Golf tourism caters to discerning travelers seeking world-class courses, top-notch facilities, and personalized experiences. Renowned architects design courses to cater to various preferences, from corporate groups to retreats, conferences, and team-building activities.

Market Dynamics

Our golf tourism market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Golf Tourism Industry?

Growing emphasis on golf infrastructure worldwide is the key driver of the market.

- The market encompasses the provision of golfing products and services to discerning travelers seeking world-class facilities and personalized experiences. With over 38,000 golf courses globally in 2024, the market caters to a diverse range of preferences, from corporate groups to retreats, conferences, and team-building activities. North America, home to around 19,000 golf courses, dominates the global golf course supply, followed by Europe and Asia. Golf tourism extends beyond the sport itself, offering accommodation, dining, and leisure activities at top-notch facilities. Female golfers, in particular, are a growing segment, with initiatives like the Aramco Team Series and the LPGA Tour driving participation.

- In addition, the RBC Canadian Open and the DP World Tour attract international business travelers and enthusiasts alike, contributing significantly to the economies of host destinations. The golfing products market includes golf equipment and apparel, with brands like Callaway Golf and Topgolf leading the inventory management system. Sustainability practices and eco-friendly initiatives, such as water conservation, habitat preservation, and wellness integration, are increasingly important to golf tourism. Spa treatments, yoga classes, healthy dining options, and guided tours of museums, landmarks, natural landscapes, and wildlife habitats offer holistic wellness experiences for golfers. Local governments and tourism boards collaborate to develop golfing infrastructure, ensuring the highest course quality and personalized experiences for travelers.

What are the market trends shaping the Golf Tourism Industry?

Advent of integrated mobile solutions in golf clubs and other equipment is the upcoming market trend.

- The market has experienced fluctuations in recent years, with approximately 26 million golfers In the US currently engaging In the sport. As consumer expectations rise, golf clubs are responding by integrating advanced mobile solutions to enhance the golfing experience. These mobile solutions offer extensive services, acting as valuable upselling and cross-selling tools for golf clubs. Golf tourism extends beyond domestic applications, with the international segment also contributing significantly to the market's growth. Notable entities like Golf Saudi, Aramco Team Series, DP World Tour, and the RBC Canadian Open have bolstered the golf tourism industry by attracting discerning travelers from around the world.

- Moreover, golf courses remain a focal point for golf tourism, with world-class facilities and top-notch services catering to preferences of both corporate groups and enthusiasts. Renowned architects continue to design exceptional courses, ensuring course quality remains a priority. Personalized experiences, sustainability practices, and eco-friendly initiatives are increasingly important to golfers, with many seeking out golfing products and accommodations that align with their values. Local governments and tourism boards collaborate to promote golf destinations, offering a range of leisure activities, dining options, and cultural experiences. Wellness integration, spa treatments, yoga classes, and healthy dining options are popular choices for golfers seeking holistic wellness experiences.

What challenges does the Golf Tourism Industry face during its growth?

Increasing threat from fantasy sports is a key challenge affecting the industry growth.

- The market has experienced notable growth in recent years, driven by the enduring appeal of the golf sport and the expansion of sporting infrastructure. The Canadian Federal Government, through initiatives like the RBC Canadian Open, has played a pivotal role in promoting golf tourism domestically. Internationally, events such as the Aramco Team Series on the DP World Tour have attracted discerning travelers to destinations with world-class golf courses and top-notch facilities. Female golfers represent a significant segment of the market, with an increasing preference for personalized experiences tailored to their preferences. Corporate groups, retreats, conferences, and team-building activities also contribute significantly to the market, catering to business travelers.

- Moreover, sustainability practices, environmental conservation, and eco-friendly initiatives have become essential elements of golf tourism. Wellness integration, including spa treatments, yoga classes, and healthy dining options, further enhances the holistic wellness experiences offered to golfers. Golfing products, from Golf Saudi to Callaway Golf and Topgolf, continue to innovate and cater to the evolving needs of golfers. The golf outfit market also thrives, with domestic golfers and international travelers seeking the latest trends. Local governments and tourism boards collaborate to provide accommodation, dining, and leisure activities that complement the golfing experience. Renowned architects design courses that prioritize course quality and offer unique challenges for enthusiasts.

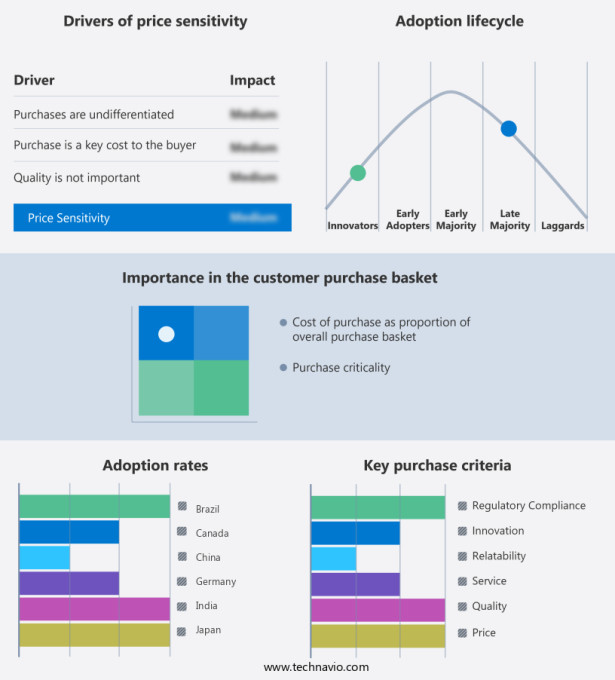

Exclusive Customer Landscape

The golf tourism market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the golf tourism market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, golf tourism market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Ananta Group Pvt. Ltd. - The company offers golf tourism packages which are designed by the various tour operators in such a way that the enthusiasts are comfortably able to make the best out of their trips.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ascot Tours

- Carr Golf and Corporate Travel Ltd.

- Duffers Golf Travel

- Fairway Golf Tours

- GARMANY GOLF and TRAVEL LLC

- Go Golfing

- Golf and Tours Pty Ltd.

- Golf Tourism Australia

- Golf Tours International Ltd.

- Golf Tours Worldwide

- Grasshopper Golf Tour

- Indian Holiday Pvt. Ltd.

- Liberty Travel and Tours M Sdn Bhd

- Palatinate Group Ltd.

- Perry Travel Inc.

- Pioneer Golf Inc.

- Scottish Golf Holidays Inc.

- The Golf Travel Group.

- Travel Impresarios

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment withIn the broader sport tourism industry. This market encompasses various facets, including golfing infrastructure, courses, accommodations, dining, and leisure activities. These elements cater to the preferences of discerning travelers seeking world-class facilities and personalized experiences. Golf tourism is driven by several factors. The allure of top-notch facilities and services attracts both enthusiasts and business travelers. Corporate groups often utilize golf courses for retreats, conferences, and team-building activities. Furthermore, golf tourism plays a crucial role In the economies of various destinations. Golf courses are the cornerstone of golf tourism. Local governments and tourism boards invest In these facilities to attract visitors.

Moreover, renowned architects design courses that offer unique challenges and breathtaking landscapes. Course quality is paramount, ensuring a memorable experience for golfers. Personalized experiences are essential in golf tourism. From customized packages to tailored services, accommodations cater to individual preferences. Golfing products, such as clubs and apparel, are often included In these offerings. Sustainability practices have gained prominence in golf tourism. Eco-friendly initiatives, water conservation, habitat preservation, and wellness integration are increasingly prioritized. Spa treatments, yoga classes, and healthy dining options contribute to holistic wellness experiences. Guided tours, museums, landmarks, natural landscapes, and wildlife habitats offer additional attractions for golfers.

Furthermore, outdoor exploration and guided nature walks provide opportunities for birdwatching tours and wildlife encounters. Renowned chefs, local farms, wineries, and culinary events contribute to farm-to-table dining and wine tastings. Golf tourism extends beyond domestic trips. International trips and international sporting events, such as the DP World Tour, attract golfers from around the world. Corporate golf events also play a role in this market, with inventory management systems streamlining logistics and operations. Therefore, the market is a dynamic and diverse sector within the sport tourism industry. It offers unique experiences for golfers, catering to their preferences and prioritizing sustainability. Golf courses, accommodations, dining, and leisure activities contribute to the economic growth of various destinations and provide opportunities for personal and professional development.

|

Golf Tourism Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 10.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Japan, Canada, South Korea, China, India, UK, Spain, Brazil, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Golf Tourism Market Research and Growth Report?

- CAGR of the Golf Tourism industry during the forecast period

- Detailed information on factors that will drive the Golf Tourism growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the golf tourism market growth of industry companies

We can help! Our analysts can customize this golf tourism market research report to meet your requirements.