Electric Vehicle Adhesives And Sealants Market Size 2025-2029

The electric vehicle adhesives and sealants market size is forecast to increase by USD 1.99 million at a CAGR of 18.4% between 2024 and 2029.

- The electric vehicle (EV) adhesives and sealants market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) worldwide. Key factors driving market growth include the rising demand for lightweight and fuel-efficient vehicles, new product launches by companies, and regulatory compliance. The adoption of EVs is on the rise due to increasing environmental concerns and government initiatives to reduce carbon emissions.

- This trend is leading to an increased demand for adhesives and sealants used in the manufacturing of EV batteries, electric motors, and other components. Additionally, companies are investing in research and development to launch new products that cater to the specific requirements of the EV industry. Regulatory compliance is another major factor driving market growth, as governments worldwide are implementing stringent regulations to ensure the safety and reliability of EV components. Overall, the market is expected to grow steadily over the next few years, driven by these key trends and growth factors.

What will be the Size of the Market During the Forecast Period?

- The electric vehicle (EV) industry's shift towards green automotive solutions has led to an increased focus on component integration, thermal management, and battery pack design. Adhesives and sealants play a crucial role in ensuring the integrity and performance of these systems. Safety is a paramount concern in the EV market, with a growing emphasis on battery pack performance and thermal management. Advanced technology adhesives and sealants are employed to ensure structural bonding and heat dissipation, contributing to the overall safety and efficiency of the battery pack. Sustainability is another key factor driving the adoption of EVs, and the use of sustainable materials in adhesives and sealants aligns with this trend.

- Moreover, material science innovations continue to push the boundaries of lightweight design and sustainable manufacturing, making production more efficient and environmentally friendly. Battery pack assembly requires precision and reliability, with component assembly and battery bonding relying on high-performance adhesives and sealants. Additives for adhesives and sealants can enhance their properties, improving battery safety standards and collision safety. Charging solutions and infrastructure also necessitate the use of advanced adhesives and sealants, ensuring the longevity and integrity of these systems. Lightweight design and renewable energy are further areas where these materials can contribute to the overall sustainability of EVs. The EV market's continued growth and innovation necessitate the development of new and advanced adhesives and sealants. Regulatory compliance and safety regulations require stringent testing and certification, making it essential to work with trusted suppliers and partners in the industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Adhesives

- Sealants

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Two-wheelers

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

- The adhesives segment is estimated to witness significant growth during the forecast period.

Adhesives play a crucial role in the electric vehicle (EV) industry, replacing traditional mechanical fasteners to reduce vehicle weight and enhance structural integrity. Structural adhesives, a type of high-performance adhesives, are used for bonding vehicle body panels, battery enclosures, and lightweight materials like aluminum and composites. These adhesives provide robust bonding, contributing significantly to the vehicle's durability and safety.

Thermally conductive adhesives facilitate heat dissipation in batteries and electronic components, ensuring optimal performance and thermal connection. Incentives from governments and organizations to promote the adoption of EVs further boost the demand for these adhesives in the industry. Substrates used in EV manufacturing, such as metals and plastics, also require specialized adhesives for bonding and sealing purposes. Adhesives and sealants are essential for maintaining the integrity of EVs, making them an indispensable component in the manufacturing process.

Get a glance at the market report of share of various segments Request Free Sample

The adhesives segment was valued at USD 656.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

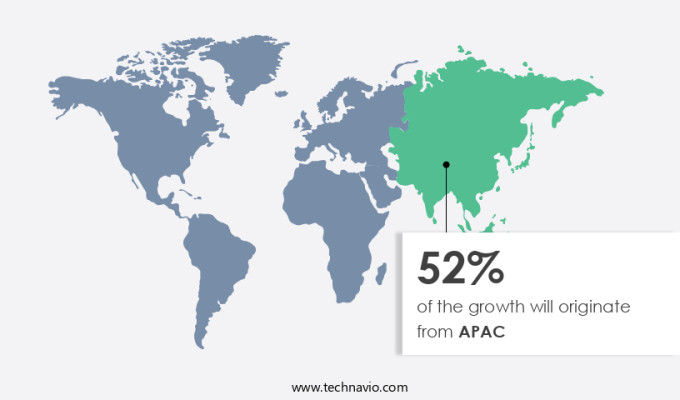

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is a significant contributor to the global electric vehicle (EV) adhesives and sealants market due to the rapid expansion of EV manufacturing in countries like China, Japan, and South Korea, and emerging markets such as India. The region's dominance is driven by robust production capabilities, supportive government policies, and substantial investments in EV infrastructure.

China, in particular, is a leader in both EV production and consumption, fueled by strong government incentives and major industry players like BYD and NIO. In 2023, China registered over 8.1 million new electric cars, marking a 35% increase from the previous year. Key components of EVs, including additives for batteries, polycarbonate for body parts, and acrylonitrile butadiene styrene (ABS) for superstructures, are essential for the market's growth. Venture capital investments and advancements in technologies like ADAS, battery capacity, and superchargers further boost market expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Electric Vehicle Adhesives And Sealants Market?

Rising adoption of electric vehicles is the key driver of the market.

- The electric vehicle (EV) market's expansion is significantly fueled by the increasing adoption of electric mobility solutions. In 2023, approximately 14 million new electric cars were registered globally, bringing the total number of EVs on the road to 40 million. This growth is in line with the projections in the 2023 Global EV Outlook report. The sales increase of 3.5 million units compared to 2022 represents a 35% year-on-year growth rate. This significant rise is over six times higher than the sales figures from just five years ago in 2018. Electric vehicle manufacturing requires various adhesives and sealants for battery encapsulation, battery pack assembly, structural bonding, thermal interface bonding, and insulation.

- Additionally, these materials ensure mechanical rigidity, thermal connection, and integrity in EVs. Structural adhesives, such as polycarbonate, polypropylene, acrylonitrile butadiene styrene, and polyamide, are used for bonding battery packs and chassis components. Flexibility and process optimization are essential factors in the selection of adhesives for EV manufacturing. Thermal conductivity, battery capacity, and charging technology are critical considerations for battery cell encapsulation. Sealants play a vital role in battery thermal management, ensuring proper venting and preventing gas leakage. Lightweight adhesives and defoamers, rheology modifiers, and leveling agents are used to optimize the manufacturing process. The EV market's growth is influenced by incentives, autonomous driving technologies, charging infrastructure, and emissions regulations.

- In conclusion, the market's value chain includes suppliers of adhesives, sealants, batteries, charging technology, and venture capital firms. The increasing demand for clean energy, interior components, and lightweight materials is driving innovation in EV adhesives and sealants. Carbon emissions reduction, driving range, and crashworthiness are essential factors for automakers in the development of electric vehicles. Thermal management, sensors, and charging standards are critical technologies for the EV ecosystem. The market's growth is also influenced by the integration of advanced driver-assistance systems (ADAS), radars, superchargers, and charging loads. The EV industry's future relies on the optimization of supply chains, advancements in charging technology, and the availability of critical minerals for battery production.

What are the market trends shaping the Electric Vehicle Adhesives And Sealants Market?

New launches by vendors are the upcoming trends in the market.

- The Electric Vehicle (EV) adhesives and sealants market is experiencing substantial growth due to advancements in EV technology. companies are introducing innovative solutions to address critical challenges in EV manufacturing, including thermal management, structural bonding, and sustainability. For instance, Henkel Adhesive Technologies launched Loctite TLB 9300 APSi, an injectable thermally conductive adhesive for EV battery systems. This groundbreaking product combines structural bonding with high thermal conductivity, simplifying manufacturing processes and effectively managing thermal challenges. With a thermal conductivity of 3 W/mK, electrical insulation properties, and high bonding performance, Loctite TLB 9300 APSi is already being adopted by a major global EV battery manufacturer.

- Moreover, other advancements include the use of lightweight adhesives and sealants, which contribute to the overall weight reduction of EVs, enhancing driving range and reducing carbon emissions. Additionally, the integration of adhesives and sealants in battery cell encapsulation, battery packs, and chassis ensures mechanical rigidity, process optimization, and crashworthiness. The market is further driven by incentives for clean energy adoption, advancements in charging technology and charging standards, and the increasing popularity of hybrid, plugin hybrid, and light commercial vehicles. Furthermore, the integration of adhesives and sealants in electric car interior components, such as sensors, radars, and self-parking systems, is expected to boost market growth.

- The market is also witnessing significant advancements in battery capacity, fuel cell technology, and thermal connection integrity, as well as the development of additives like defoamers, rheology modifiers, and leveling agents to improve the performance of EV adhesives and sealants. The market is expected to continue growing due to emissions regulations, the increasing popularity of autonomous vehicles, and the expansion of EV charging infrastructure.

What challenges does Electric Vehicle Adhesives And Sealants Market face during the growth?

Regulatory compliance is a key challenge affecting market growth.

- In the electric mobility sector, electric vehicle (EV) adhesives and sealants play a crucial role in ensuring the structural integrity and thermal management of battery cell encapsulation, battery packs, and other critical components. These materials are essential for achieving mechanical rigidity, thermal connection, and crashworthiness in EVs, as well as insulation and moisture protection. Regulatory compliance is a significant challenge in the global EV adhesives and sealants market. Strict regulations, such as the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, govern the safe use of chemicals in these products. REACH mandates that adhesives and sealants meet low volatile organic compound (VOC) requirements, encouraging the development of eco-friendly formulations.

- In the United States, the Environmental Protection Agency (EPA) enforces rules under the Clean Air Act that restrict VOC emissions. Moreover, the increasing demand for lightweight EVs and the integration of advanced driver-assistance systems (ADAS), fuel cells, and charging technology require the use of lightweight adhesives, adhesion promoters, defoamers, rheology modifiers, and other additives. The market is also witnessing the adoption of new technologies, such as thermal interface bonding, surface modifiers, dispersants, and leveling agents, for battery thermal management and interior component bonding. The market dynamics are further influenced by incentives for reducing carbon emissions, increasing driving range, and improving the charging infrastructure for electric and hybrid vehicles.

- In conclusion, the integration of sensors, radars, superchargers, and charging standards in EVs is also driving the demand for advanced adhesives and sealants. In conclusion, the EV adhesives and sealants market is expected to grow significantly due to the increasing demand for clean energy, lightweight vehicles, and advanced technologies in the electric mobility sector. The market is subject to regulatory compliance, process optimization, and supply chain challenges, necessitating the development of innovative and eco-friendly formulations.

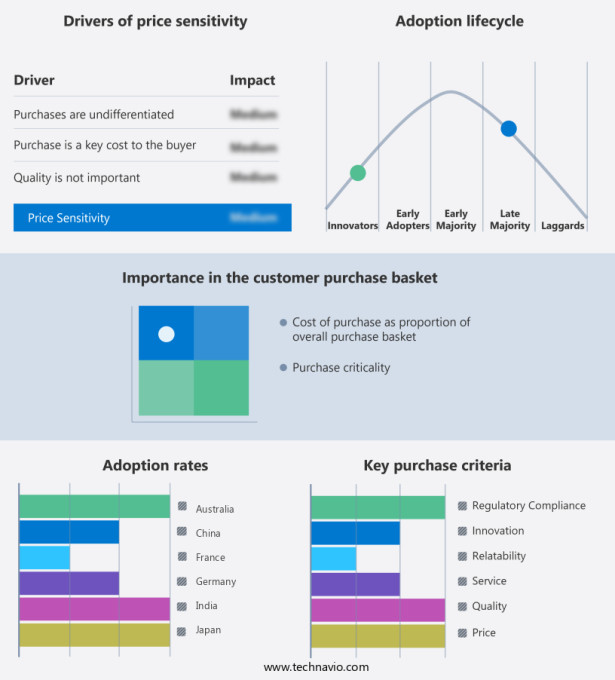

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - This company offers electric vehicle adhesives and sealants designed for battery assembly, thermal management, and structural bonding.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema

- Ashland Inc.

- Bostik Ltd.

- Dymax Corp.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- ITW Performance Polymers

- Jowat SE

- L and L Products Inc.

- Parker Hannifin Corp.

- Permabond LLC

- PPG Industries Inc.

- Sika AG

- Uniseal Inc.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric vehicle (EV) market is experiencing unprecedented growth, driven by increasing consumer demand for clean energy solutions and stringent emissions regulations. This shift towards electric mobility is leading to significant advancements in battery technology, charging infrastructure, and vehicle design. One critical component that plays a pivotal role in the development of EVs is the use of adhesives and sealants. Adhesives and sealants are essential in the manufacturing process of electric vehicles, ensuring the structural integrity and functionality of various components.

Additionally, these materials offer flexibility, thermal connection, and mechanical rigidity, which are crucial for battery cell encapsulation, battery pack assembly, and thermal interface bonding. Battery cell encapsulation is a vital process that protects the battery cells from external factors, such as moisture, dust, and other contaminants. Structural adhesives and sealants are employed to seal the battery cells and provide mechanical strength to the battery pack. The use of lightweight adhesives and sealants further enhances the overall weight reduction of the vehicle, contributing to improved driving range. Thermal management is another critical aspect of EV technology, as batteries generate heat during operation.

In conclusion, thermal interface bonding using high thermal conductivity adhesives and sealants ensures efficient heat transfer, maintaining optimal battery performance and longevity. Crashworthiness is another essential consideration in EV design. Adhesives and sealants play a crucial role in maintaining the structural integrity of the vehicle during collisions. These materials offer the flexibility required to absorb energy during an impact, ensuring the safety of occupants. Insulation is another application where adhesives and sealants excel. These materials are used to insulate interior components, such as wiring and electrical systems, from external temperatures and moisture. This insulation ensures optimal performance and longevity of the electrical components. The use of metal fasteners is being gradually replaced by adhesives and sealants due to their advantages in weight reduction and process optimization. Adhesives and sealants offer the added benefit of eliminating the need for drilling and welding, reducing production time and costs. The EV market is not limited to passenger cars but also includes electric buses, trucks, and light commercial vehicles. Adhesives and sealants play a crucial role in the design and manufacturing of these vehicles, ensuring their structural integrity and functionality. Fuel cell technology is another area where adhesives and sealants are essential. These materials are used to bond fuel cell components, ensuring optimal performance and durability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.4% |

|

Market growth 2025-2029 |

USD 1.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.0 |

|

Key countries |

US, China, Germany, France, Japan, UK, The Netherlands, South Korea, Australia, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch