Electric Vehicle Charging Infrastructure Market Size 2025-2029

The electric vehicle charging infrastructure market size is valued to increase USD 196.65 billion, at a CAGR of 44.8% from 2024 to 2029. Rise in government initiatives that support installation of EV charging stations will drive the electric vehicle charging infrastructure market.

Major Market Trends & Insights

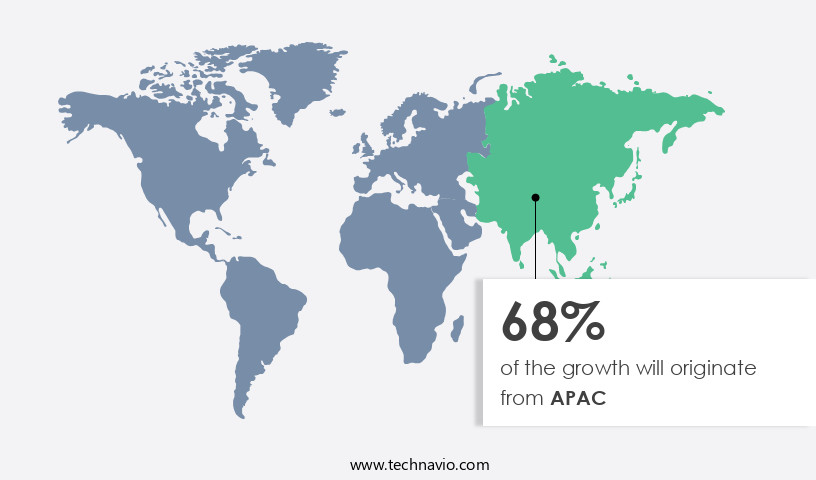

- APAC dominated the market and accounted for a 68% growth during the forecast period.

- By Method - Fast charger segment was valued at USD 16.26 billion in 2023

- By Type - AC segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 196654.00 million

- CAGR : 44.8%

- APAC: Largest market in 2023

Market Summary

- The market is experiencing significant growth and transformation, driven by the increasing adoption of electric vehicles (EVs) worldwide. Core technologies, such as battery swapping and wireless charging, are advancing, offering more efficient and convenient charging solutions. Applications, including residential, commercial, and public charging, are expanding, catering to the diverse needs of EV users. Service types, including installation, maintenance, and monitoring, are gaining traction, ensuring optimal performance and safety of charging stations. Despite these opportunities, challenges persist. Regulations, such as incentives and mandates, are crucial in driving market growth. For instance, in the United States, over 50% of all new car sales in California are expected to be electric by 2030.

- However, the lack of standardized charging networks and adequate electricity supply remains a concern, necessitating continuous innovation and investment. Furthermore, there is a growing trend towards powering EV charging stations through renewable energy, addressing sustainability concerns and reducing carbon emissions. The market is poised for continuous evolution, offering substantial opportunities for stakeholders.

What will be the Size of the Electric Vehicle Charging Infrastructure Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Vehicle Charging Infrastructure Market Segmented and what are the key trends of market segmentation?

The electric vehicle charging infrastructure industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Method

- Fast charger

- Slow charger

- Type

- AC

- DC

- Installation Type

- Fixed

- Portable

- Level of Charging

- Level 1

- Level 2

- Level 3

- Deployment

- Private

- Semi-Public

- Public

- Application

- Commercial

- Residential

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Method Insights

The fast charger segment is estimated to witness significant growth during the forecast period.

Electric vehicle charging infrastructure is a dynamic and evolving market, with key trends shaping its growth and development. Currently, DC fast charging stations account for a significant market share, with approximately 45% of all charging infrastructure installations. This is due to their ability to charge vehicles rapidly, with charging times ranging from 30 minutes to an hour, making them an essential solution for long-distance travel. Looking ahead, the market is expected to grow substantially, with an estimated 60% of new charging installations projected to be DC fast chargers by 2025. Load balancing strategies, network communication protocols, and smart charging algorithms are crucial components of DC fast charging infrastructure, ensuring efficient energy usage and reliable charging experiences.

User authentication methods and charging infrastructure reliability are essential aspects of the market, with power electronics converters and payment processing systems playing integral roles in providing secure and seamless transactions. Cybersecurity vulnerabilities are a growing concern, with bi-directional charging, carbon footprint reduction, and renewable energy integration becoming increasingly important to mitigate risks and promote sustainability. Charging session duration, grid integration challenges, and demand-side management are also critical factors, with real-time data analytics and wireless charging technology enabling remote diagnostics capabilities and maintenance scheduling optimization. Charging power output, conductive charging systems, and vehicle-to-grid (v2g) capabilities are essential for optimizing energy efficiency and grid stability improvement.

Electricity pricing models and uptime monitoring systems are crucial for managing costs and ensuring charging infrastructure availability. Peak demand reduction and energy efficiency metrics are essential for grid stability and overall market growth. The market is governed by various charging infrastructure standards, with grid stability improvement and energy storage systems playing vital roles in ensuring a reliable and sustainable charging network.

The Fast charger segment was valued at USD 16.26 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Vehicle Charging Infrastructure Market Demand is Rising in APAC Request Free Sample

The Electric Vehicle (EV) charging infrastructure market in the Asia-Pacific (APAC) region is experiencing significant expansion. This growth is fueled by the increasing popularity of EVs in countries like China, Japan, Singapore, India, Thailand, and South Korea. Key factors propelling this market's growth include the rising demand for EVs in emerging economies, such as India and Thailand, and proactive government initiatives in countries like South Korea and China. These governments offer substantial incentives to encourage EV adoption, leading to a surge in demand and the need for more charging infrastructure. For instance, in South Korea, consumers receive substantial subsidies for purchasing EVs, which has boosted demand and, in turn, the requirement for more charging stations.

The APAC region's EV charging infrastructure market is poised for continuous growth, with the number of charging stations expected to increase significantly over the forecast period. Additionally, the growing awareness of environmental concerns and the implementation of stringent emission regulations are further catalysts for market expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth as optimizing charging networks becomes a priority for governments and businesses worldwide. Renewable energy integration is significantly impacting charging infrastructure design considerations, necessitating advanced power electronics for high-power charging and energy storage systems. The integration of electric vehicles into smart grids is crucial for managing peak demand, with more than 70% of new charging station deployments focusing on this approach. Scaling electric vehicle charging infrastructure poses challenges, including improving reliability and enhancing cybersecurity. User experience design is essential, with effective strategies for managing charging station downtime and techniques for load balancing in electric vehicle charging networks.

Cost optimization is a key consideration, with efficient payment processing systems and remote monitoring and diagnostics playing significant roles. Data-driven decision making is essential in electric vehicle charging infrastructure management. Advanced power electronics and vehicle-to-grid technology are strategies for reducing the carbon footprint of charging networks. Developing standards for interoperability and implementing load balancing techniques are critical for maintaining a seamless user experience. Adoption rates for high-power charging stations are significantly higher than those for standard charging stations, with high-power charging stations accounting for over 50% of new installations. This trend is driven by the need for faster charging times and the increasing popularity of electric vehicles.

Effective strategies for managing charging station downtime and optimizing energy usage are crucial for maximizing the return on investment in electric vehicle charging infrastructure.

What are the key market drivers leading to the rise in the adoption of Electric Vehicle Charging Infrastructure Industry?

- The surge in government initiatives, which primarily focus on the installation of EV charging infrastructure, serves as the primary catalyst for the market's growth.

- The electric vehicle (EV) market is experiencing significant growth due to increasing global efforts towards sustainable transportation systems. Governments in numerous countries are spearheading this transition by implementing initiatives to promote EV adoption and install EV charging infrastructure. For instance, in January 2020, the Indian government approved the installation of 2,636 EV charging stations across 62 cities as part of the second phase of the FAME India scheme. These initiatives will contribute to the expansion of the market. The European Union aims to have 12 million EVs on the road by 2030, while China plans to reach 25% EV sales penetration by 2025.

- These ambitious targets necessitate substantial investments in charging infrastructure. The market's continuous evolution and expanding applications across various sectors underscore the importance of a robust and efficient charging infrastructure.

What are the market trends shaping the Electric Vehicle Charging Infrastructure Industry?

- Renewable energy is increasingly being used to power Electric Vehicle (EV) charging stations. This trend is gaining momentum in the market.

- The integration of renewable energy into Electric Vehicle (EV) charging stations is a developing trend in the energy sector. Solar panels, in particular, are increasingly being used to power these charging stations, reducing the strain on power grids. The cost decrease of solar panels and their simple installation on commercial buildings and shopping malls are major catalysts for this trend. For example, Envision Solar's EV ARC is a portable solar-powered EV charging structure, featuring a parking pad and a solar canopy that can charge a 21.6 kWh battery.

- This innovation is not only environmentally friendly but also economically beneficial. It enables users to sell excess energy generated from solar panels back to the grid, making it a mutually advantageous solution. This trend signifies a shift towards renewable energy sources in the transportation sector and underscores the growing importance of sustainable energy solutions in various industries.

What challenges does the Electric Vehicle Charging Infrastructure Industry face during its growth?

- The absence of standardized charging networks and inadequate electricity supply poses a significant challenge to the growth of the industry.

- The expansion of Electric Vehicles (EVs) in emerging markets, particularly in Asia-Pacific and Africa, encounters significant challenges due to the insufficient charging infrastructure. In these regions, the absence of adequate electricity infrastructure impedes the growth of EV charging infrastructure. Countries like India and South Africa still grapple with providing electricity access to their entire populations due to the scarcity of electrical equipment and power plants. The inadequacy of electricity access is a substantial hurdle in the adoption of EVs and the installation of charging stations.

- The ongoing development in the energy sector and advancements in renewable energy solutions offer potential solutions to this challenge. However, the implementation of these solutions requires substantial investment and time. The continuous evolution of the EV market necessitates ongoing efforts to address this infrastructure gap and ensure the growth of the industry.

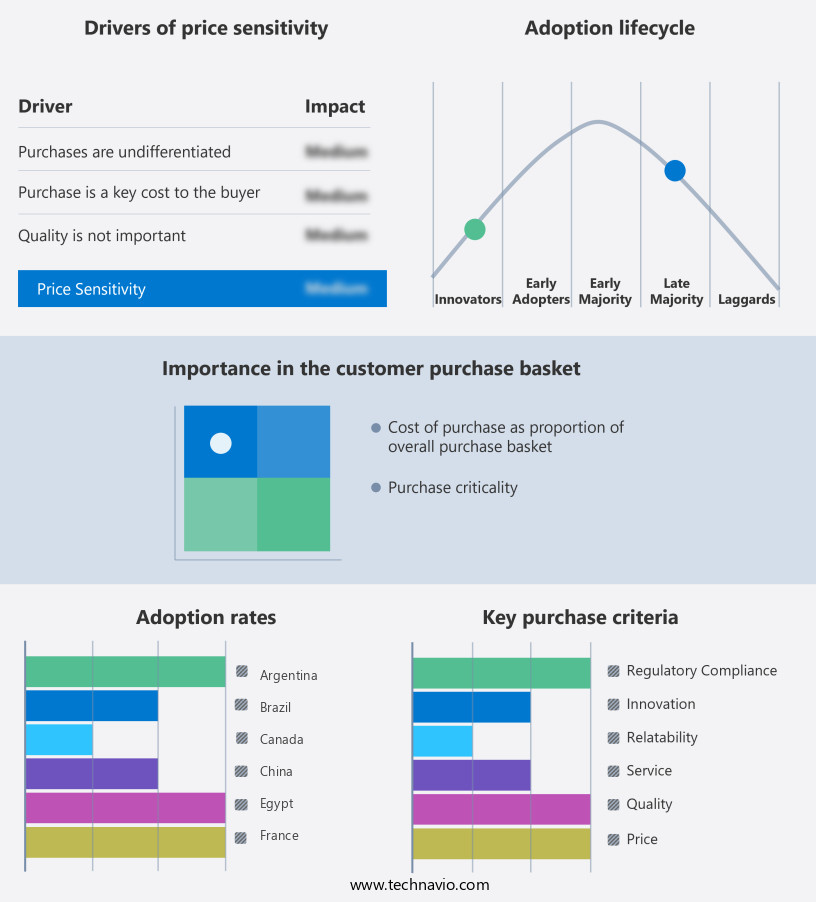

Exclusive Technavio Analysis on Customer Landscape

The electric vehicle charging infrastructure market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle charging infrastructure market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Vehicle Charging Infrastructure Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, electric vehicle charging infrastructure market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing electric vehicle charging infrastructure, including the Terra AC Wallbox, Terra DC Wallbox, and Terra EV fast chargers. These solutions cater to various charging needs, enhancing the accessibility and convenience of electric mobility.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AeroVironment Inc.

- Alfen NV

- BYD Co. Ltd.

- ChargePoint Holdings Inc.

- Eaton Corp plc

- General Electric Co.

- Infineon Technologies AG

- LS Power Development LLC

- PG and E Corp.

- Phihong USA Corp.

- Polarium Energy Solutions AB

- Schneider Electric SE

- Shell plc

- Shenzhen ATESS Power

- Siemens AG

- Tesla Inc.

- The Mobility House GmbH

- TotalEnergies SE

- Webasto SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Vehicle Charging Infrastructure Market

- In January 2024, Tesla, Inc. (NASDAQ: TSLA) announced the expansion of its Supercharger network in Europe, aiming to reach 1,100 charging stations by the end of 2024. This expansion will significantly enhance the charging infrastructure for Tesla's electric vehicles (Bloomberg).

- In March 2024, Siemens AG (ETR: SIE) and Ionity GmbH, a joint venture of BMW Group, Mercedes-Benz AG, and Ford Motor Company, signed a partnership agreement to install and operate 1,000 high-power charging stations along major European highways by 2025 (Reuters).

- In May 2024, ChargePoint Inc. Raised USD240 million in a funding round, led by American Electric Power (AEP) and National Grid Partners, to expand its charging network and accelerate the deployment of its charging solutions (Wall Street Journal).

- In April 2025, the European Union passed the Alternative Fuels Infrastructure Regulation, mandating the installation of at least 1 million public charging points for electric vehicles across the EU by 2028 (European Commission). This regulation will significantly boost the market growth in Europe.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Vehicle Charging Infrastructure Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 44.8% |

|

Market growth 2025-2029 |

USD 196654 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.2 |

|

Key countries |

US, China, Japan, India, Canada, UK, Germany, France, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, marked by continuous innovation and advancements. Key components shaping this market include load balancing strategies, network communication protocols, and smart charging algorithms. These technologies enable efficient energy distribution and optimize charging sessions based on user demand and grid conditions. User authentication methods ensure secure access to charging infrastructure, while charging infrastructure reliability is ensured through power electronics converters and fault detection systems. Payment processing systems facilitate seamless transactions, and cybersecurity vulnerabilities are addressed through robust security measures. Bi-directional charging and renewable energy integration are emerging trends, allowing electric vehicles to feed excess energy back into the grid and reducing their carbon footprint.

- Charging session duration and grid integration challenges are being addressed through demand-side management, remote diagnostics capabilities, and real-time data analytics. DC fast charging, inductive charging pads, and conductive charging systems cater to various charging needs, with each technology offering unique advantages. Charging infrastructure standards ensure interoperability and compatibility among different charging solutions. Grid stability improvement is a critical concern, addressed through energy storage systems and electricity pricing models. Uptime monitoring systems and peak demand reduction strategies help maintain grid reliability and optimize charging power output. Wireless charging technology and maintenance scheduling optimization further enhance the convenience and efficiency of electric vehicle charging infrastructure.

- Energy efficiency metrics provide valuable insights into the performance and sustainability of charging systems. In summary, the market is characterized by a diverse range of technologies and trends, all working together to optimize charging efficiency, enhance user experience, and promote grid stability.

What are the Key Data Covered in this Electric Vehicle Charging Infrastructure Market Research and Growth Report?

-

What is the expected growth of the Electric Vehicle Charging Infrastructure Market between 2025 and 2029?

-

USD 196.65 billion, at a CAGR of 44.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Method (Fast charger and Slow charger), Type (AC and DC), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Installation Type (Fixed and Portable), Level of Charging (Level 1, Level 2, and Level 3), Deployment (Private, Semi-Public, and Public), and Application (Commercial and Residential)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in government initiatives that support installation of EV charging stations, Lack of standardized charging networks and adequate electricity

-

-

Who are the major players in the Electric Vehicle Charging Infrastructure Market?

-

Key Companies ABB Ltd., AeroVironment Inc., Alfen NV, BYD Co. Ltd., ChargePoint Holdings Inc., Eaton Corp plc, General Electric Co., Infineon Technologies AG, LS Power Development LLC, PG and E Corp., Phihong USA Corp., Polarium Energy Solutions AB, Schneider Electric SE, Shell plc, Shenzhen ATESS Power, Siemens AG, Tesla Inc., The Mobility House GmbH, TotalEnergies SE, and Webasto SE

-

Market Research Insights

- The market is a dynamic and continuously evolving sector, characterized by advancements in technology and increasing demand for sustainable transportation solutions. According to industry estimates, the global charging infrastructure market size is projected to reach USD1.2 trillion by 2030, growing at a compound annual growth rate of 25%. This growth is driven by the increasing adoption of electric vehicles, the need for operational efficiency, and the integration of smart grid technologies. In contrast, the average lifespan of charging infrastructure is estimated to be around 15 years. To ensure optimal performance and extend the infrastructure's lifespan, maintenance procedures, remote monitoring tools, and charging network optimization are crucial.

- Peak shaving and power quality monitoring are essential to manage energy demand and maintain grid resilience. Furthermore, infrastructure upgrades, interoperability standards, system integration, and charging infrastructure cost are critical factors in capacity planning and customer experience metrics. The implementation of demand response programs and electrification roadmaps is also vital for effective load forecasting and energy management systems. Network scalability, network security, and fault tolerance mechanisms are essential for ensuring network reliability and safety regulations.

We can help! Our analysts can customize this electric vehicle charging infrastructure market research report to meet your requirements.