Electronic Hookah Market Size 2024-2028

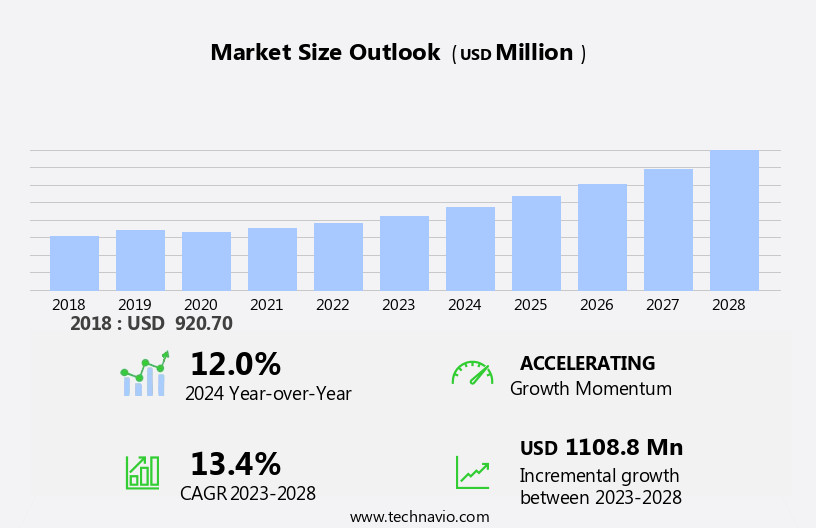

The electronic hookah market size is forecast to increase by USD 1.11 billion at a CAGR of 13.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One major driver is the increasing disposable income among consumers, enabling them to spend on premium and innovative smoking alternatives. Another trend influencing the market is the rising adoption of electronic hookahs among millennials, who prefer modern and healthier alternatives to traditional hookahs.

- Public health considerations surrounding Indoor and Outdoor Smoking in social gatherings, nightclubs, and other public spaces continue to fuel debates. However, there are challenges associated with the use of electronic hookahs, such as potential health risks and regulatory issues, which may hinder market growth. Despite these challenges, the market is expected to continue expanding, driven by technological advancements and evolving consumer preferences.

What will be the Size of the Electronic Hookah Market During the Forecast Period?

- The market, also known as e-hookahs or mechanical ecigarettes with RNV designs and Timesvape being notable players, has gained significant traction as a modern smoking alternative to traditional hookahs. These rechargeable electronic devices heat e-liquids, providing users with various flavor selections and nicotine concentrations, eliminating the need for charcoal and tobacco. While vaping culture continues to evolve, health concerns persist, with debates surrounding the potential health hazards of e-hookahs compared to traditional smoking.

- Retail channels and online platforms offer diverse e-hookah designs, with disposable options also available. E-commerce has facilitated easy access to these non-traditional tobacco products, fueling innovation in flavor offerings, including dessert flavors. Public health considerations remain a crucial aspect of the market's development, with ongoing discussions surrounding the long-term effects of e-hookah use.

How is this Electronic Hookah Industry segmented and which is the largest segment?

The electronic hookah industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Disposable

- Rechargeable

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Type Insights

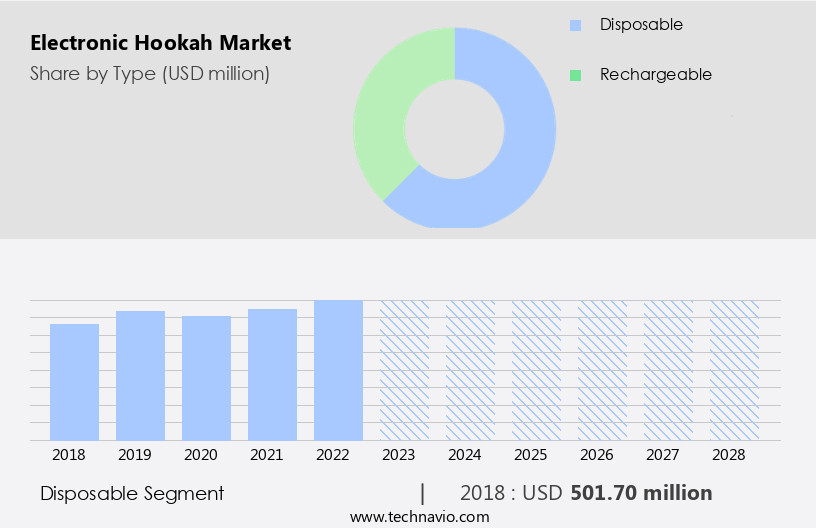

The disposable segment is estimated to witness significant growth during the forecast period. The disposable segment is experiencing notable growth within the market. These devices cater to consumers desiring a hassle-free and user-friendly vaping experience, devoid of the complexities linked to traditional hookahs or reusable electronic hookahs. Disposable electronic hookahs are designed for ease of use, making them an appealing choice for both novice and experienced users. Pre-filled with e-liquids and ready-to-use, they eliminate the need for users to refill e-liquids or charge batteries, offering a convenient plug-and-play solution. This feature appeals to individuals seeking a hassle-free vaping experience and those who engage in travel and require a portable option.

Get a glance at the share of various segments. Request Free Sample

The disposable segment was valued at USD 501.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

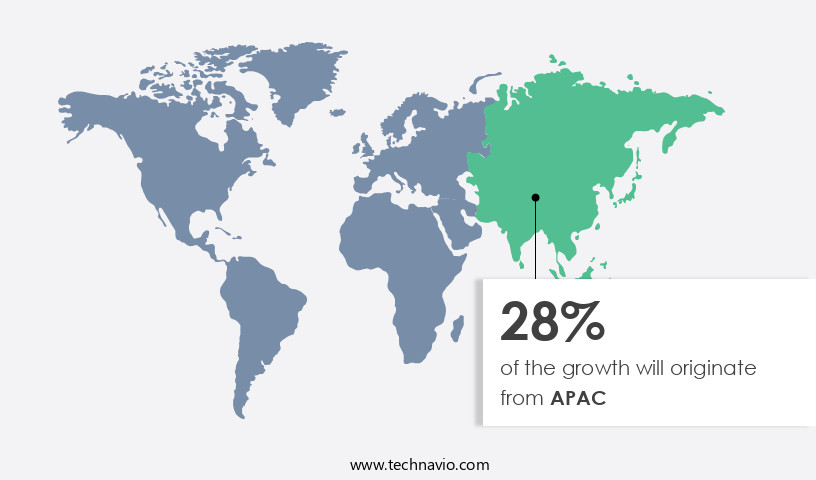

APAC is estimated to contribute 28% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is witnessing notable expansion due to technological innovations and evolving consumer preferences. Factors fueling this growth include demographic trends, product developments, and regulatory influences. Companies that successfully cater to the youth demographic and navigate regulatory challenges will thrive in this expanding industry. In a significant move, Ispire Technology Inc., a prominent vaping technology and precision dosing company, announced a five-year exclusive global manufacturing and distribution agreement with BrkFst, a lifestyle brand co-created by a GRAMMY-Award winner and his team of young entrepreneurs. This strategic partnership underscores the market's potential for collaboration and growth.

Market Dynamics

Our electronic hookah market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electronic Hookah Industry?

Growing disposable income among consumers is the key driver of the market.

- The Electronic Hookah (E-Hookah) market is experiencing substantial growth due to the rising preference for modern smoking alternatives among consumers seeking a healthier lifestyle. Mechanical e-cigarettes, also known as Mods, have gained popularity as rechargeable Electronic Hookahs offer a more cost-effective and customizable vaping experience. Leading brands are innovating the E-Hookah design, providing a wide range of Flavor Selections, including dessert and candy flavors, to cater to diverse consumer preferences. Despite the allure of E-Hookahs, health concerns remain a significant factor In the market.

- However, the integration of Smart Technology and the availability of Nicotine substitutes have mitigated some health hazards associated with Traditional Smoking. The E-Hookah market encompasses various product categories, including Rechargeable, Disposable, Portable, and LED E-Hookahs. Retail Channels and Online Sales Channels have emerged as key distribution channels, offering convenience and accessibility to consumers. As the vaping culture continues to evolve, the market is expected to expand further, driven by ongoing flavor innovation and the growing acceptance of e-Hookahs as a viable alternative to traditional hookahs and cigarettes.

What are the market trends shaping the Electronic Hookah Industry?

The rise in adoption of electronic hookah among millennials is the upcoming market trend.

- The market, also known as E-Hookahs or Mechanical E-cigarettes (Mods), is experiencing notable growth In the US market, particularly among the millennial demographic. This trend is influenced by shifting cultural norms and the desire for modern smoking alternatives that offer a healthier lifestyle. E-Hookahs provide an array of flavor selections, including dessert and candy flavors, which deviate from traditional tobacco products. These rechargeable devices offer a more convenient and portable smoking experience compared to traditional hookahs. E-Hookahs come in various designs, such as LED, disposable, and portable options, catering to diverse consumer preferences. While e-Hookahs offer potential health benefits compared to traditional smoking, they are not without health concerns.

- The E-Hookah market is expanding through multiple retail and online channels. Indoor and outdoor smoking environments, social gatherings, nightclubs, and other settings are increasingly adopting E-Hookahs as a smoking alternative. Smart technology integration, such as temperature control and flavor customization, enhances the user experience. E-commerce platforms have become significant sales channels for E-Hookahs, offering convenience and a wider range of flavor options. Nicotine substitutes and e-liquids with various nicotine concentrations cater to diverse consumer needs. The E-Hookah market's growth is driven by increasing consumer awareness, changing social norms, and the desire for a more health-conscious smoking alternative. However, public health considerations and ongoing research on the long-term health effects of E-Hookahs remain crucial.

What challenges does the Electronic Hookah Industry face during its growth?

Health issues associated with the use of electronic hookahs is a key challenge affecting the industry growth.

- The market is experiencing growth due to the increasing popularity of modern smoking alternatives among consumers seeking a healthier lifestyle. Electronic hookahs, also known as EHookahs or mechanical e-cigarettes (mods), offer a rechargeable and customizable vaping experience that deviates from traditional smoking methods. Brands provide various e-hookah designs, flavor selections, and nicotine concentrations, catering to diverse consumer preferences. Despite the potential benefits of electronic hookahs, such as reduced exposure to harmful chemicals compared to traditional smoking, health hazards remain a concern. Users may inhale nicotine and potentially harmful flavoring agents, even when using nicotine-free e-liquids.

- Long-term health effects, particularly on respiratory and cardiovascular health, are not yet fully understood. Elevated systemic markers of inflammation, such as high-sensitivity C-reactive protein, fibrinogen, and tumor have been linked to electronic hookah use and may indicate an increased risk of chronic diseases. Retail and online channels have emerged as key distribution channels for electronic hookahs, providing consumers with various options for purchasing rechargeable, disposable, portable, LED, and other types of e-hookahs. Vaping culture continues to evolve, with flavor innovation and dessert and candy flavors gaining popularity. As the market expands, smart technology integration and online sales channels are expected to play a significant role in shaping the future of electronic hookahs. However, public health considerations and ongoing research into the long-term health effects of electronic hookah use remain important factors to consider.

Exclusive Customer Landscape

The electronic hookah market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electronic hookah market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electronic hookah market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspire Vape Co.

- Eleaf Group

- GD SIGELEI Electronic Tech Co. Ltd.

- Geekvape

- IJOY Group

- Innokin Technology Ltd.

- Joyetech Electronics Co Ltd.

- JWell

- LOSTVAPE

- Rincoe Technology Co. Ltd .

- Shenzhen dovpo Technology Co. Ltd.

- Shenzhen Electronic Technology Co Ltd.

- Shenzhen FreeMax Technology Co. Ltd.

- Shenzhen Hellvape Technology Co. Ltd.

- Shenzhen IVPS Technology Co Ltd.

- Shenzhen Kanger Technology Co. Ltd.

- Shenzhen Smoore Technology Ltd

- Shenzhen UWELL Technology Co. Ltd.

- Stefen Zhang and Vandy Vape Technology Co. Ltd.

- VOOPOO

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of modern smoking alternatives, with electronic hookahs, also known as mechanical e-cigarettes or mods, gaining significant popularity in recent years. These devices offer a unique experience, merging the traditional hookah culture with advanced technology. Electronic hookahs differ from their traditional counterparts in several ways. Instead of burning charcoal and tobacco, they utilize battery-powered heating elements to vaporize e-liquids. This process results in smoother, more consistent draws and eliminates the need for constant refueling. The design of electronic hookahs varies, with rechargeable and disposable options available. Rechargeable e-hookahs offer the convenience of being refillable and reusable, while disposable e-hookahs provide a more convenient and portable solution.

Moreover, portable e-hookahs, including LED and compact models, cater to those who enjoy smoking on-the-go. Flavor selections for electronic hookahs are vast and diverse, ranging from traditional tobacco flavors to more exotic options like dessert and candy flavors. This versatility caters to a wide range of preferences and allows users to experiment with various tastes. Despite the growing popularity of electronic hookahs, there are health concerns associated with their use. While they are generally considered less harmful than traditional smoking methods, they still contain nicotine and other potentially harmful chemicals. Public health considerations are a crucial aspect of the market, with ongoing research focusing on the long-term effects of e-hookah use.

Furthermore, retail channels and online sales platforms play a significant role In the market. Brick-and-mortar stores offer the advantage of allowing customers to try before they buy, while online channels provide a more convenient and accessible shopping experience. The rise of e-commerce has led to an increase In the availability and variety of electronic hookahs and e-liquids. The integration of smart technology into electronic hookahs is a growing trend. This includes features like temperature control, adjustable airflow, and compatibility with various e-liquid atomizers. These advancements enhance the user experience and cater to those seeking a more customizable smoking alternative.

|

Electronic Hookah Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market Growth 2024-2028 |

USD 1.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.0 |

|

Key countries |

US, China, Canada, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electronic Hookah Market Research and Growth Report?

- CAGR of the Electronic Hookah industry during the forecast period

- Detailed information on factors that will drive the Electronic Hookah growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electronic hookah market growth of industry companies

We can help! Our analysts can customize this electronic hookah market research report to meet your requirements.