Electronically Commutated Motor (ECM) Market Size 2025-2029

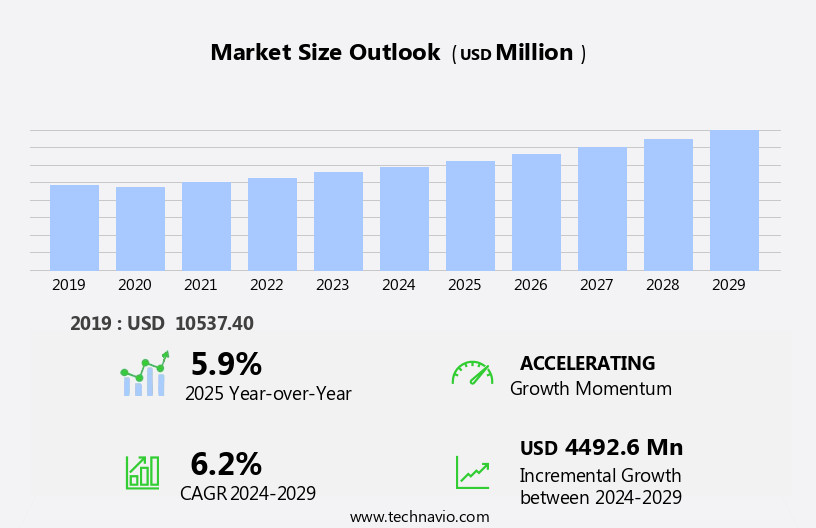

The electronically commutated motor (ECM) market size is forecast to increase by USD 4.49 billion at a CAGR of 6.2% between 2024 and 2029.

- The market experiences significant growth, driven primarily by the increasing demand for energy-efficient solutions in various industries, particularly in the heating, ventilation, and air conditioning (HVAC) sector. Technological advancements in ECMs, such as improved efficiency, longer lifespan, and smart control capabilities, further fuel market expansion. The global shift towards electric vehicles and the integration of automation systems in various industries are major catalysts for this trend. However, the market faces challenges, including regulatory hurdles impacting adoption due to safety and environmental concerns, as well as complexities involved in integrating ECMs into existing systems.

- Effective collaboration between stakeholders, including manufacturers, regulators, and system integrators, is crucial to overcome these challenges and capitalize on the market's growth potential. Companies seeking to capitalize on these opportunities should focus on developing innovative solutions, ensuring regulatory compliance, and providing robust integration support to their customers.

What will be the Size of the Electronically Commutated Motor (ECM) Market during the forecast period?

- The market is witnessing significant growth, driven by the increasing demand for energy-efficient and high-performance motors. ECM motors, which utilize sensorless commutation for motor control, offer several advantages over traditional AC motors, including improved efficiency, reduced maintenance requirements, and enhanced reliability. ECM motor drives, a critical component of these motors, are subject to stringent standards and certification processes to ensure safety and performance. ECM motor design continues to evolve, with a focus on increasing efficiency and reducing costs. ECM motor applications span various industries, including automotive, HVAC, and industrial automation. In these sectors, ECM motors are increasingly being integrated into systems for their energy savings and performance benefits. Electric motors are an integral part of HVAC systems, which are widely used in commercial and residential buildings to maintain comfortable temperatures.

- ECM motor maintenance is a crucial consideration for businesses, with regular testing and monitoring essential to ensure optimal performance and longevity. ECM motor efficiency, a key factor in energy savings, is a major focus of research and development efforts. High-performance ECM motors are gaining popularity due to their ability to deliver increased power density and torque. ECM motor certification, a necessary step for market entry, involves rigorous testing and compliance with industry standards. The ECM motor market is dynamic and evolving, with a focus on improving efficiency, reliability, and cost-effectiveness. ECM motor drives, applications, maintenance, integration, sensorless commutation, testing, efficiency, design, and certification are all critical aspects of this market.

How is this Electronically Commutated Motor (ECM) Industry segmented?

The electronically commutated motor (ECM) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Brushless DC motors

- Permanent magnet AC motors

- Switched reluctance motors

- Product

- Constant air flow

- Constant speed

- Constant torque

- Technology

- Air-cooled ECM motors

- Water-cooled ECM motors

- Application

- Automotive

- Industrial

- Consumer electronics

- Aerospace and defense

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

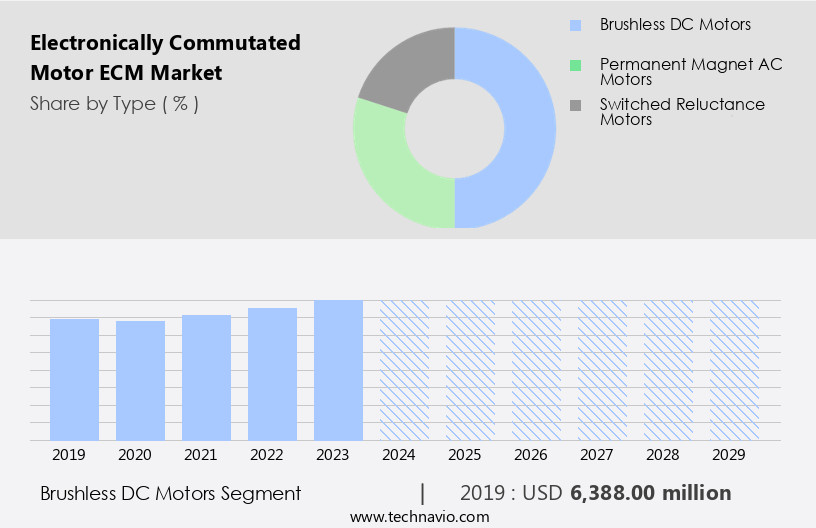

The brushless DC motors segment is estimated to witness significant growth during the forecast period. Brushless DC (BLDC) motors, a type of Electronically Commutated Motor (ECM), are gaining significant traction in various industries due to their advantages over traditional motors. BLDC motors offer enhanced energy efficiency, reliability, and precise control, making them a popular choice for numerous applications. In the realm of electric vehicles (EVs) and hybrid electric vehicles (HEVs), BLDC motors are increasingly utilized for propulsion, power steering, and cooling systems, fueling their demand in the automotive sector. Their higher energy efficiency, stemming from the absence of friction and reduced heat loss, leads to lower energy consumption and carbon emissions, aligning with global sustainability initiatives. Permanent magnet and non-permanent magnet are the two main types of DC motors. The market for electric motors is witnessing significant innovation, with the development of smart motor technologies. These advanced motor systems incorporate sensors and control systems to optimize performance and energy efficiency.

The Brushless DC motors segment was valued at USD 6.39 billion in 2019 and showed a gradual increase during the forecast period. Furthermore, BLDC motors' compact design, fault diagnosis capabilities, and integration with smart grids, motor drivers, predictive maintenance systems, and digital signal processors, contribute to their widespread adoption in home appliances, consumer electronics, renewable energy systems, material handling, electric power generation, and industrial automation. The integration of sensorless control, vector control, and direct torque control technologies, as well as the use of advanced manufacturing techniques, ensures a long lifespan and minimal vibration. BLDC motors are also employed in wind turbines, digital twins, embedded systems, solar power, medical devices, and electric power tools, underscoring their versatility and broad market applicability. Electric motors play a significant role in various industries, including fans, pumps, compressors, machine tools, consumer electronics, electric vehicles (EVs), heating, ventilation, and air conditioning (HVAC) applications, power tools, and automated robotics.

Regional Analysis

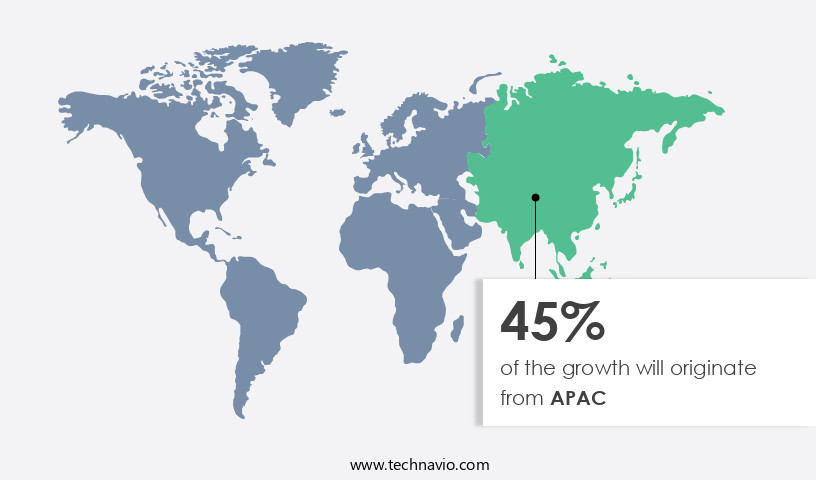

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the global push towards energy efficiency and reliability in various industries. ECMs, which include brushless DC motors, synchronous motors, and permanent magnet motors, among others, are increasingly being adopted for their compact design, high power density, and advanced control features. In the field of pumping systems, ECMs offer energy savings and long lifespan, making them a preferred choice. ECMs are also gaining popularity in industries such as home appliances and consumer electronics for their sensorless control and vector control capabilities. In the renewable energy sector, ECMs are integral to wind turbines and solar power systems due to their high torque, low vibration, and electronic commutation.

The integration of ECMs in electric vehicles and industrial automation systems is further driving market growth. The adoption of ECMs in advanced manufacturing and material handling industries is also on the rise due to their predictive maintenance capabilities and digital signal processors. ECMs are also being used in medical devices and energy storage systems for their high reliability and low noise operation. The integration of ECMs in smart grid technologies is another major trend, enabling grid integration and providing real-time data analytics for efficient energy management. With the increasing focus on energy efficiency and the growing demand for electric power generation, the market for ECMs is expected to continue its upward trajectory.

ECMs are also being used in power tools and motor control applications, providing precise speed control and torque control. The use of ECMs in digital twins and embedded systems is further expanding their applications in various industries. Overall, the ECM market is witnessing robust growth due to its ability to offer energy savings, high performance, and advanced control features across various industries and applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Electronically Commutated Motor (ECM) market drivers leading to the rise in the adoption of Industry?

- The HVAC industry's increase in demand for Energy Management Control Systems (ECMs) serves as the primary market driver. The market experiences robust growth due to the increasing adoption of ECMs in various industries, particularly in electric power generation, HVAC systems, power tools, solar power, medical devices, and more. ECMs offer numerous advantages, such as energy efficiency, high torque, wireless communication, and precise speed control, which make them an attractive alternative to traditional synchronous and permanent magnet motors. Power electronics play a crucial role in the operation of ECMs, enabling variable speed control and efficient energy conversion. Hall effect sensors are essential components of ECMs, providing accurate position feedback for optimal motor performance. The integration of software development and advanced control systems further enhances the capabilities of ECMs, enabling better system integration and improved operational efficiency.

- Regulations promoting energy efficiency and sustainability, coupled with the growing demand for eco-friendly solutions, are driving the market growth. For instance, in the HVAC industry, ECMs offer significant energy savings and reduced operational costs, making them an ideal choice for building owners seeking to meet sustainability goals and comply with energy efficiency regulations. ECM technology also finds extensive applications in power tools, solar power systems, and medical devices, where precise control, energy efficiency, and high power density are essential. The integration of wireless communication capabilities in ECMs further enhances their versatility and applicability in various industries. The global ECM market is poised for continued growth due to the increasing demand for energy-efficient and high-performance motor solutions across various industries. The integration of advanced technologies, such as power electronics, software development, and wireless communication, further enhances the capabilities of ECMs, making them an attractive alternative to traditional motors.

What are the Electronically Commutated Motor (ECM) market trends shaping the Industry?

- The trend in electronic document management systems (ECMs) is being driven by technological advancements. These innovations are shaping the market and setting new standards for efficiency and productivity. The market experiences significant growth due to technological advancements in motor design, control systems, and materials science. Companies such as Nidec Corporation and Regal Beloit Corporation lead the way in innovation, investing heavily in research and development to improve motor efficiency, performance, and compatibility with smart control systems. These advancements result in ECMs offering superior energy efficiency, minimal vibration, and precise speed and torque control. Furthermore, ECMs are integrated with energy storage systems, remote monitoring capabilities, and data analytics to optimize industrial automation processes.

- Brushless DC motors, a type of ECM, are increasingly popular due to their long lifespan and high power density. The integration of ECMs into advanced manufacturing processes enables increased productivity and cost savings, making them a preferred choice for various industries.

How does Electronically Commutated Motor (ECM) market faces challenges face during its growth?

- The integration of Enterprise Content Management Systems (ECMs) presents complex challenges that significantly impact the industry's growth trajectory. The market faces complexity as integrating these motors into existing systems is a significant challenge. Unlike traditional motors with standardized interfaces and operating characteristics, ECMs require specialized control systems and infrastructure for optimal performance. This complexity can deter end-users, particularly those with limited technical expertise or resources for system integration. Compatibility between ECMs and existing equipment and control systems is a key challenge. Retrofitting or replacing conventional motors with ECMs may necessitate modifications to mechanical and electrical components, as well as adjustments to software and control algorithms.

- Digital signal processors play a crucial role in managing the intricacies of ECMs, enabling efficient motor control and improved system performance. However, the intricacies of integrating ECMs into existing systems may hinder market growth during the forecast period.

Exclusive Customer Landscape

The electronically commutated motor (ECM) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electronically commutated motor (ECM) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electronically commutated motor (ECM) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company showcases an advanced electronically commutated motor, embodying BaldorReliance EC Titanium technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AEROVENT

- AMETEK Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- East West Manufacturing

- ebm papst Mulfingen GmbH and Co. KG

- Infinitum

- Johnson Electric Holdings Ltd.

- LG Corp.

- maxon

- Nidec Corp.

- O Dell HVAC Group Inc

- Oriental Motor Co. Ltd.

- Parker Hannifin Corp.

- Regal Rexnord Corp.

- Rosenberg Ventilatoren GmbH

- WEG S.A

- Wolong Electric Group Co. Ltd.

- ZIEHL ABEGG SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electronically Commutated Motor (ECM) Market

- In January 2024, Schneider Electric, a global energy management and automation company, announced the launch of its new line of energy-efficient ECMs, the EcoStruxure Motion E3, designed for industrial applications. These motors offer up to 15% energy savings compared to conventional motors, according to Schneider Electric's press release (Schneider Electric, 2024).

- In March 2025, Siemens and ABB, two leading technology companies, formed a strategic partnership to jointly develop and market advanced ECMs for various industries. The collaboration aims to combine Siemens' expertise in industrial automation and ABB's knowledge in electrification technology, as stated in ABB's press release (ABB, 2025).

- In June 2024, Danfoss, a Danish engineering company, completed the acquisition of Eaton's hydraulics business, which included a significant portfolio of ECMs for mobile and industrial applications. The acquisition expanded Danfoss's product offerings and strengthened its position in the global ECM market, as reported in Danfoss's press release (Danfoss, 2024).

- In October 2025, the European Union passed new regulations mandating the use of ECMs in specific industrial applications to reduce energy consumption and greenhouse gas emissions. The regulation is expected to drive the demand for ECMs in Europe, as stated in the European Commission's press release (European Commission, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in power electronics, motor control, and digital signal processing. These technologies enable compact designs, high reliability, and efficient motor operation across various sectors. ECMs are integrated into pumping systems, home appliances, consumer electronics, renewable energy, and industrial automation, among others. Field oriented control, sensorless control, vector control, and direct torque control are some of the evolving control algorithms that enhance motor performance. These technologies enable grid integration, predictive maintenance, and energy efficiency. ECMs are also used in electric vehicles, wind turbines, and solar power systems, contributing to the transition towards sustainable energy.

ECMs are integrated with digital twins, embedded systems, and software development to optimize motor performance and enable remote monitoring. Motor drivers, power electronics, and power tools also benefit from the use of ECMs. The integration of Hall effect sensors and back EMF detection further enhances motor control and fault diagnosis capabilities. ECMs are known for their low noise, long lifespan, and high power density. They are used in material handling, electric power generation, and advanced manufacturing applications, where precise torque control and speed regulation are essential. Wireless communication and low vibration are additional features that make ECMs a preferred choice for various industries.

The ongoing development of ECMs and their integration into various applications underscores the continuous dynamism of the market. Digital signal processors play a crucial role in optimizing motor performance, enabling real-time monitoring, and enhancing energy efficiency. The integration of these technologies into ECMs is a key driver of innovation and growth in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electronically Commutated Motor (ECM) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

251 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 4.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, India, Germany, Japan, UK, South Korea, Canada, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electronically Commutated Motor (ECM) Market Research and Growth Report?

- CAGR of the Electronically Commutated Motor (ECM) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electronically commutated motor (ECM) market growth of industry companies

We can help! Our analysts can customize this electronically commutated motor (ECM) market research report to meet your requirements.