Electrophysiology Catheters Market Size 2024-2028

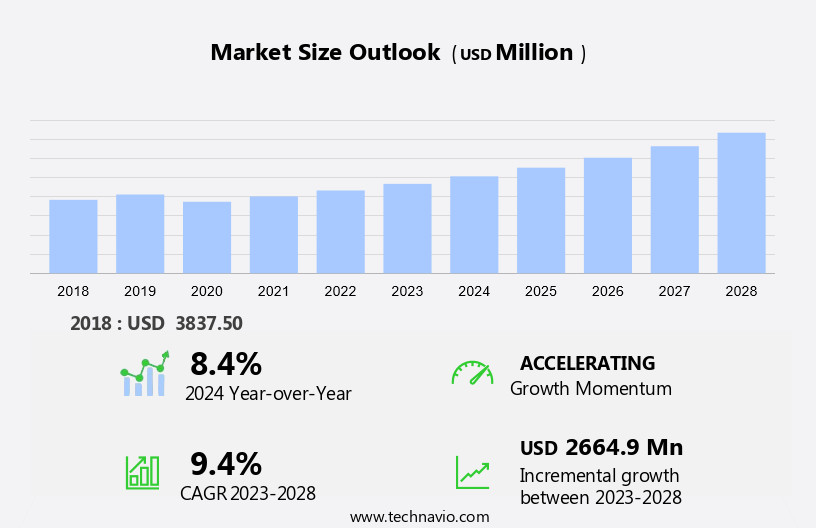

The electrophysiology catheters market size is forecast to increase by USD 2.66 billion, at a CAGR of 9.4% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising incidence of cardiac diseases and the expansion of insurance providers' coverage for electrophysiology procedures. This increasing demand presents a lucrative opportunity for market participants. However, the market is not without challenges. The scarcity of trained electrophysiologists and cardiac surgeons poses a significant obstacle to market growth. To overcome this hurdle, companies can invest in training programs or collaborate with medical institutions to address the shortage.

- Additionally, strategic alliances between market companies are on the rise, intensifying competition and necessitating continuous innovation to maintain a competitive edge. Companies must stay informed of the latest technological advancements and market trends to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Electrophysiology Catheters Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The electrophysiology catheter market is characterized by continuous innovation and evolution, driven by advancements in technology and growing applications across various sectors. RF ablation catheters, which utilize radiofrequency energy to create lesions for the treatment of cardiac arrhythmias, are a significant segment of this market. These catheters incorporate intricately designed electrode configurations, dipole densities, and temperature sensors, enabling precise lesion creation and improved patient outcomes. Pacing catheters, another essential component of the market, employ advanced electrode materials and signal processing techniques to deliver electrical impulses for heart rhythm regulation. Data acquisition systems, integral to both RF ablation and pacing catheters, facilitate real-time monitoring and analysis of electrical activity.

Catheter shafts, engineered for flexibility and durability, ensure smooth navigation through complex cardiac structures. Signal processing algorithms, an essential aspect of electrophysiology studies, enhance arrhythmia detection and electrical impedance analysis, contributing to accurate diagnosis and treatment. The ongoing development of catheter design, including contact force sensing and 3D mapping technologies, enhances catheter navigation and tissue characterization. Ultrasound imaging and fluoroscopy guidance further facilitate accurate catheter placement and lesion creation. Intracardiac catheters, including diagnostic and irrigation catheters, play crucial roles in electrophysiology studies, offering valuable insights into heart rhythm and tissue properties. The integration of pressure sensors and tissue impedance monitoring systems in these catheters expands their diagnostic capabilities.

As the electrophysiology catheter market continues to unfold, new trends and patterns emerge, shaping the future of cardiac care.

How is this Electrophysiology Catheters Industry segmented?

The electrophysiology catheters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and cardiac centers

- ASCs

- Product

- Ablation catheters

- Diagnostic catheters

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

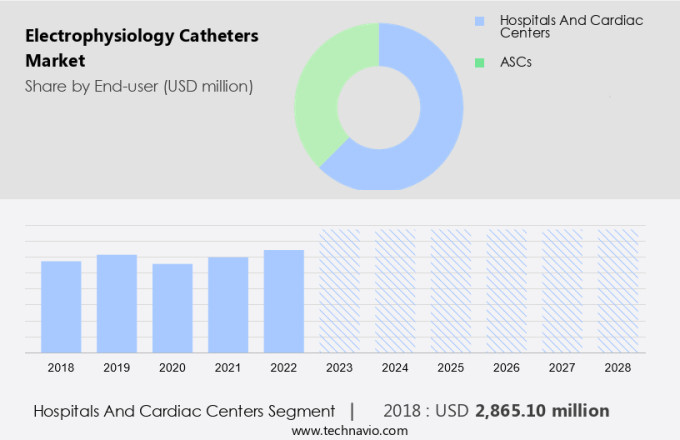

The hospitals and cardiac centers segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing prevalence of heart diseases and the expansion of digital catheterization laboratories in hospitals and cardiac centers. Hospitals and cardiac centers are expected to dominate the market, driven by the rising incidence of coronary heart disease and the presence of major players. However, the preference for non-invasive angiography may hinder market growth. The number of catheterization laboratories worldwide has increased substantially, leading to market expansion. The demand for electrophysiology catheters in hospitals and cardiac centers is high due to the superior patient care they provide.

Ultrasound imaging, dipole density, tissue characterization, catheter ablation, temperature sensors, and electrical impedance are essential features of these catheters. The market also includes pacing catheters, electrode materials, data acquisition, catheter shaft, signal processing, arrhythmia detection, lesion creation, pressure sensors, tissue impedance, irrigation catheters, electrophysiology studies, diagnostic catheters, electrogram analysis, 3D mapping, ablation catheters, contact force sensing, heart rhythm, intracardiac catheters, catheter design, fluoroscopy guidance, mapping catheters, electrical conductivity, and catheter navigation. These advanced features enable accurate diagnosis and treatment of heart rhythm disorders. The market's growth is further fueled by advancements in technology, such as RF ablation, activation mapping, and contact force sensing.

The market's future looks promising as these technologies continue to evolve, improving patient outcomes and increasing the efficiency of electrophysiology procedures.

The Hospitals and cardiac centers segment was valued at USD 2.87 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

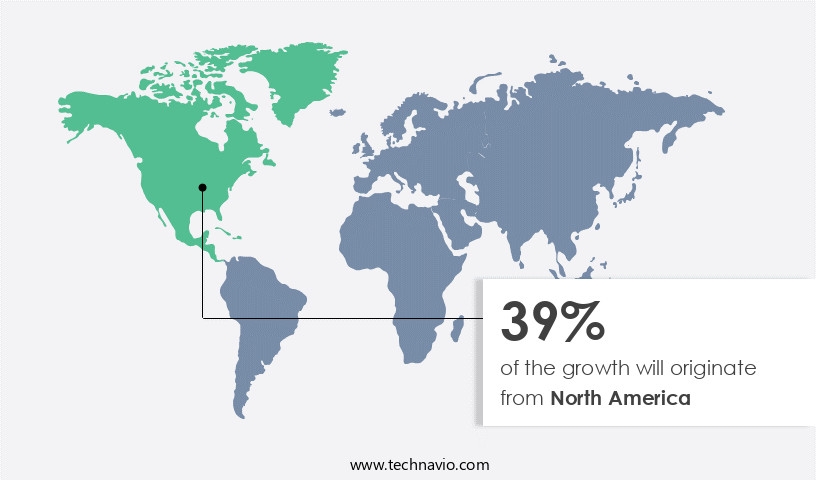

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The electrophysiology catheter market in North America is witnessing growth due to the increasing number of interventional cardiovascular procedures aimed at minimizing the risks of cardiovascular diseases (CVDs). Advanced healthcare facilities in the region, particularly in the US and Canada, are driving the demand for electrophysiology catheters, specifically balloon catheters and cardiac ablation catheters. These medical centers utilize technologically advanced balloon catheters in drug-eluting balloon (DEB) angioplasty to enhance patient care, improve quality of life, and reduce hospital stays. The availability of advanced healthcare infrastructure enables these procedures to be carried out in outpatient settings such as hospitals, ambulatory surgical centers (ASCs), and digital catheterization laboratories.

Ultrasound imaging and 3D mapping technologies are integrated into these catheters to ensure precise tissue characterization and lesion creation. Electrode configurations, activation mapping, and rf ablation facilitate efficient electrogram analysis and arrhythmia detection. Temperature sensors and pressure sensors monitor electrical impedance and tissue impedance during catheter navigation and lesion creation. Irrigation catheters are used to maintain optimal contact force sensing between the catheter and heart tissue during electrophysiology studies and diagnostic procedures. Catheter design, signal processing, and fluoroscopy guidance are crucial factors in ensuring the effectiveness and safety of these catheters. Electrical conductivity and catheter navigation are essential features that enable efficient and accurate cardiac mapping and pacing.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electrophysiology Catheters Industry?

- The surge in the prevalence of cardiac diseases and the expansion of insurance providers serve as the primary drivers for market growth in this sector.

- The market is poised for growth due to the increasing prevalence of heart diseases, particularly in the aging population. According to the National Institutes of Health (NIH), approximately 10% of the global population aged 75 years and above were diagnosed with degenerative abnormalities associated with severe aortic stenosis, mitral and tricuspid regurgitation in 2022. With increasing life expectancy worldwide, the incidence of heart valve diseases is expected to rise, leading to a higher demand for electrophysiology catheters. These advanced medical devices enable cardiac mapping, electrode configuration, activation mapping, temperature sensing, and ultrasound imaging for catheter ablation procedures.

- The dipole density and tissue characterization features of stimulation catheters are crucial for accurate diagnosis and treatment of cardiac arrhythmias. The market growth is further driven by advancements in technology, such as immersive and harmonious electrode configurations, which provide more precise and effective ablation outcomes. Electrophysiology catheters play a vital role in the diagnosis and treatment of various cardiac conditions, including atrial fibrillation, atrial flutter, and ventricular tachycardia. The market's growth is expected to be sustained by the increasing focus on minimally invasive procedures and the development of more advanced catheter designs with enhanced functionality.

What are the market trends shaping the Electrophysiology Catheters Industry?

- The formation of increasing strategic alliances among market companies represents a significant market trend. This business strategy is becoming increasingly common as companies seek to expand their reach and enhance their competitive position.

- Strategic alliances play a pivotal role in the growth of the healthcare equipment market, particularly in the electrophysiology catheters segment. These collaborations enable medical equipment companies to expand their product offerings and reach new markets without incurring significant financial risk. For instance, Boston Scientific Corporation's acquisition of Baylis Medical Company Inc. In February 2022 expanded the former's trans-septal solutions for catheter-based procedures in the heart's left ventricles. Similarly, Medtronic Plc's Freezor and Freezor Xtra cardiac cryoablation focal catheters received US FDA approval in February 2022 for treating Atrioventricular Nodal Reentrant Tachycardia (AVNRT) in pediatric patients, extending the company's product line in the arrhythmia detection and lesion creation space.

- Advancements in technology, such as RF ablation, pacing catheters with advanced electrode materials, and data acquisition systems with improved signal processing capabilities, are driving the demand for electrophysiology catheters. These technologies enable more precise and effective ablation procedures, leading to better patient outcomes. Electrical impedance mapping systems and other advanced imaging technologies are also contributing to the growth of the market by providing real-time visualization of the heart's electrical activity during ablation procedures. These technologies aid in the accurate detection and treatment of complex arrhythmias, further increasing the market's potential. In summary, the market is experiencing significant growth due to technological advancements, increasing demand for minimally invasive procedures, and strategic alliances that expand product lines and geographical reach.

What challenges does the Electrophysiology Catheters Industry face during its growth?

- The scarcity of adequately trained electrophysiologists and cardiac surgeons poses a significant challenge to the expansion of the industry.

- The electrophysiology catheter market is experiencing significant shifts due to several factors influencing the demand for these medical devices. One factor is the declining number of electrophysiology studies performed, as indicated by a 28% decrease in coronary artery bypass grafting (CABG) operations between 2018 and 2022. Conversely, there was a 120% increase in claims for cardiac stent placements during the same period, a procedure typically performed by cardiologists rather than cardiac surgeons. The scarcity of cardiologists, with only 5,500 cardiologists available in India, a country with a population of 1.3 billion, further exacerbates the situation. This translates to a ratio of one cardiologist for every 30,000 people.

- These factors contribute to fewer medical students opting for cardiology as a specialty, resulting in unfilled seats for this specialty. In the realm of electrophysiology catheters, advancements in technology continue to shape the market. Pressure sensors, tissue impedance, irrigation catheters, diagnostic catheters, electrogram analysis, 3D mapping, ablation catheters, and contact force sensing are some of the key technologies driving innovation in this space. These technologies enable improved accuracy and efficiency in electrophysiology studies, making them indispensable tools for healthcare professionals. As the market evolves, it is essential to stay informed about the latest trends and developments to ensure the best possible patient outcomes.

Exclusive Customer Landscape

The electrophysiology catheters market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electrophysiology catheters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electrophysiology catheters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in electrophysiology catheters, including the advanced Advisor HD grid sensor mapping catheter, which enables precise and comprehensive cardiac arrhythmia diagnosis and ablation procedures for healthcare professionals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Acutus Medical Inc.

- AngioDynamics Inc.

- APT Medical

- AtriCure Inc.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- CardioFocus Inc.

- CathRx Pty Ltd.

- Japan Lifeline Co. Ltd.

- Johnson and Johnson Services Inc.

- Koninklijke Philips N.V.

- Medtronic Plc

- Merit Medical Systems Inc.

- MicroPort Scientific Corp.

- Millar Inc.

- Nihon Kohden Corp.

- Siemens Healthineers AG

- Stereotaxis Inc.

- Stryker Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electrophysiology Catheters Market

- In January 2024, Medtronic plc, a global leader in medical technology, solutions, and services, announced the US Food and Drug Administration (FDA) approval of its new Harmony Elite Ablation System for the treatment of atrial fibrillation. This innovative catheter system combines both ablation and mapping capabilities in a single device (Medtronic Press Release, 2024).

- In March 2024, Abbott Laboratories, through its subsidiary St. Jude Medical, entered into a strategic collaboration with the University of California, San Francisco (UCSF) to develop and commercialize a new generation of electrophysiology catheters. This partnership aimed to improve the diagnosis and treatment of complex cardiac arrhythmias (Abbott Press Release, 2024).

- In May 2024, Boston Scientific Corporation completed the acquisition of Mapmyheart, a UK-based digital health company specializing in mobile ECG solutions. This acquisition was expected to expand Boston Scientific's remote monitoring capabilities and enhance its electrophysiology product offerings (Boston Scientific Press Release, 2024).

- In April 2025, Siemens Healthineers received FDA approval for its new Magnetom Free.Max 1.5T MRI system, which includes advanced features for electrophysiology procedures. This system is designed to improve the accuracy and efficiency of cardiac arrhythmia diagnosis and treatment (Siemens Healthineers Press Release, 2025).

Research Analyst Overview

- In the dynamic electrophysiology market, advancements in catheter technology continue to shape clinical outcomes for cardiac electrophysiology procedures. Lesion volume and ablation efficacy are key considerations, with improvements in pacemaker lead design and electrical insulation leading to more precise and effective ablation. Clinical trial data underscores the importance of device sterilization and biocompatibility testing in ensuring patient safety. Remote monitoring and ep lab navigation systems enhance procedural success and data interpretation. Electrode array design and signal fidelity are crucial for defibrillation threshold testing and managing conditions like atrial fibrillation.

- Catheter durability and safety profile are essential, with ongoing research focusing on reducing thrombogenicity risk and improving catheter tracking. Electrical stimulation and radiofrequency energy applications are driving innovation, with a focus on enhancing clinical outcomes and improving patient care in electrophysiology labs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electrophysiology Catheters Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2024-2028 |

USD 2664.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.4 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electrophysiology Catheters Market Research and Growth Report?

- CAGR of the Electrophysiology Catheters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electrophysiology catheters market growth of industry companies

We can help! Our analysts can customize this electrophysiology catheters market research report to meet your requirements.