Elevator Control Market Size 2024-2028

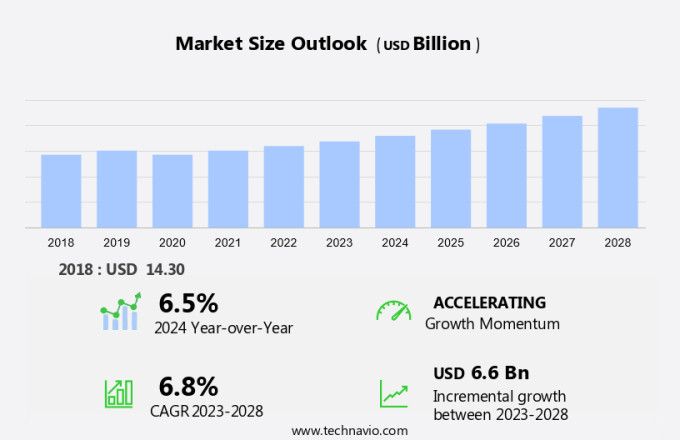

The elevator control market size is forecast to increase by USD 6.6 billion at a CAGR of 6.8% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing construction of high-rise buildings equipped with intelligent vertical transportation systems. This trend is driven by the demand for smart buildings that offer efficient traffic management, building access, and intelligent entry systems. Additionally, the integration of door phones and remote monitoring systems enhances security and convenience for occupants.

- Energy efficiency is another key factor, as infrastructure investments prioritize sustainable solutions. However, the market faces challenges, including cybersecurity risks associated with IoT-enabled elevator controls. Smart cities are also investing in advanced elevator technologies to improve urban mobility and reduce energy consumption. Overall, the market is poised for continued expansion as the demand for smart, secure, and energy-efficient vertical transportation solutions grows.

What will be the Size of the Market During the Forecast Period?

- Elevator control systems have become an essential component of modern infrastructure, particularly in high-height buildings. These systems ensure efficient traffic management, safety, and energy consumption in both residential and commercial structures. The integration of cutting-edge technology, such as artificial intelligence (AI), smart sensors, and the Internet of Things (IoT), has significantly enhanced the functionality and performance of elevator control systems. In the context of high-height buildings, elevator control systems play a crucial role in optimizing building operations and enhancing user experience. These systems enable seamless traffic flow, reduce wait times, and improve overall building access.

- Moreover, the integration of door phones, intelligent building entry, and touchless technologies further enhances the convenience and safety of elevator usage. Elevator control systems have become increasingly important as infrastructure spending on high-rise constructions continues to grow. The integration of smart technologies and automated solutions, such as machine learning and touchless technology, allows for more efficient and effective management of elevator traffic. Safety remains a top priority in the design and implementation of elevator control systems. Advanced safety features, such as traffic control and energy management, ensure the safe and efficient operation of elevators in high-height buildings. Furthermore, touchless technologies have gained significant attention due to their ability to minimize physical contact and promote a healthier environment.

- Furthermore, the integration of AI and machine learning algorithms in elevator control systems allows for predictive maintenance and real-time optimization of elevator performance. This results in reduced downtime, increased reliability, and improved overall efficiency. Additionally, the integration of smart sensors and IoT technologies enables remote monitoring and real-time data analysis, allowing for proactive maintenance and troubleshooting. In conclusion, the market in high-height buildings is driven by the need for efficient traffic management, safety, and energy consumption. The integration of cutting-edge technologies, such as AI, smart sensors, and IoT, has significantly enhanced the functionality and performance of elevator control systems. As infrastructure spending on high-rise constructions continues to grow, the demand for advanced elevator control systems is expected to increase.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Residential

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- North America

- US

- South America

- APAC

By Application Insights

- The commercial segment is estimated to witness significant growth during the forecast period.

Elevator control systems have become essential components in commercial buildings such as offices, hospitals, schools, retail stores, and malls, given their large traffic volume and the convenience they offer to occupants and visitors. The demand for elevator control extends beyond developed countries and is increasingly gaining traction in developing economies like China and India due to the surge in commercial construction. For instance, the burgeoning IT, telecommunications, and business process outsourcing sectors in India are driving the demand for office space in major cities like Bengaluru and Delhi. Smart buildings are a significant trend in the commercial real estate sector, and elevator control plays a crucial role in managing traffic and ensuring efficient building access.

Moreover, door phones and intelligent building entry systems are integral components of smart buildings, and their integration with elevator control systems enables remote monitoring and energy efficiency. Infrastructure investment in smart cities is another factor fueling the growth of the market. These cities prioritize the use of technology to enhance the quality of life for their residents and visitors, making smart buildings and efficient elevator control systems a priority. Elevator control systems offer numerous benefits, including improved safety, energy savings, and enhanced user experience. As a result, commercial building owners and managers are investing in these systems to meet the growing demand for efficient and convenient building access. The market is expected to grow steadfastly during the forecast period, driven by the increasing adoption of smart buildings and the need for energy efficiency.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 9.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

For more insights on the market share of various regions Request Free Sample

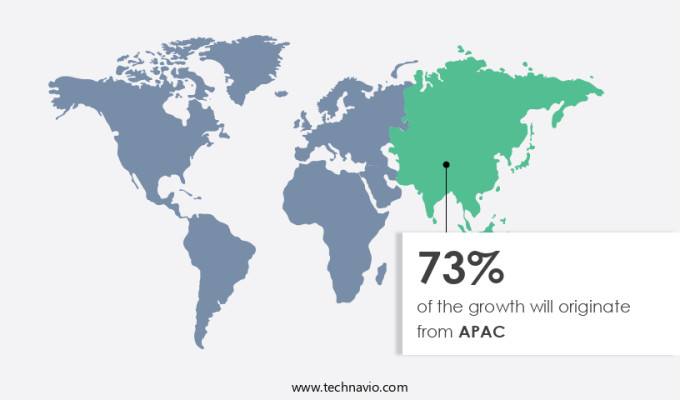

The market holds significant potential, particularly in the APAC region, where it captured the largest market share in 2023. This region's growth can be attributed to the infrastructure spending in multi-storey buildings and residential apartments, creating a high demand for efficient elevator control systems. companies in the market are capitalizing on this trend by expanding their presence in APAC countries, such as India, Malaysia, and China, to meet the increasing demand. Moreover, the emergence of new economies like Indonesia and the focus on industrialization throughout the region have led to an influx of urban populations in search of better job opportunities.

To cater to this growing market, companies are incorporating advanced technologies like touchless elevators, artificial intelligence, and smart sensors to enhance safety and reduce energy consumption. These innovations not only improve the user experience but also contribute to the overall sustainability of buildings. As the market continues to evolve, it is essential for businesses to stay informed about the latest trends and developments to remain competitive. In conclusion, the market in the APAC region is poised for significant growth due to the increasing demand for efficient and sustainable elevator systems in multi-storey buildings and residential apartments. companies are responding to this trend by incorporating advanced technologies and expanding their presence in the region to meet the growing demand.

By staying informed about the latest market trends and innovations, businesses can position themselves for success in this dynamic market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Elevator Control Market?

Rise in construction of high-rise buildings with smart vertical transportation systems is the key driver of the market.

- In the coming years, urbanization is anticipated to accelerate significantly, with the global urban population projected to reach 68% by 2050, according to the UN Department of Economic and Social Affairs. This trend is particularly prominent in Asia, Africa, and the Middle East, where a large number of people are moving from rural areas to cities. As a result, there is a growing need for infrastructure development, including the construction of commercial spaces and residential buildings, particularly in the form of high-rise structures in megacities. To efficiently manage the increasing traffic in these structures, elevator control systems have become essential mobility solutions.

These smart technologies enable seamless movement within commercial and residential buildings, ensuring the safety and convenience of occupants. As the demand for eco-efficient and sustainable societies continues to rise, the market for elevator control systems is poised for significant growth.

What are the market trends shaping the Elevator Control Market?

Increasing investment in building infrastructure is the upcoming trend in the market.

- Elevator control systems have experienced significant advancements, adapting to the increasing construction of tall buildings in the US. Innovative technologies are being integrated into these systems, leading to market expansion. AI, smart sensors, and IoT are among the technologies revolutionizing elevator operations. These technologies contribute to energy savings, enhanced safety, and efficient traffic management. The surge in infrastructure investments in energy-efficient elevators and green construction is a major trend, driven by the growing urbanization in the US. By implementing these modern technologies, the elevator industry is addressing sustainability concerns and improving overall building efficiency.

What challenges does Elevator Control Market face during the growth?

Cybersecurity risks with IoT-enabled elevator controls is a key challenge affecting the market growth.

- Elevator control systems have become more advanced with the integration of Automated Technologies and IoT, allowing for real-time monitoring, predictive maintenance, and remote management in both residential and commercial applications. However, these smart building innovations come with cybersecurity risks. With the increasing use of Machine Learning and touchless technology, elevator control systems are connected to the Internet, making them susceptible to hacking, unauthorized access, and data breaches. These vulnerabilities can result in disruptions, operational failures, or even compromise passenger safety. Given the critical role elevators play in high-rise buildings, hotels, hospitals, and office complexes, securing these systems against cyber threats is essential for both safety and liability reasons.

As the adoption of IoT-enabled elevator controls continues to grow, it is crucial for industry players to prioritize Cybersecurity to mitigate these risks.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd. - The company provides advanced elevator control systems, including the FI Series group control technology, ensuring efficient and reliable elevator operations in various buildings across the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Doorking Inc.

- Elevator Systems Inc.

- Fujitec Co. Ltd.

- GAL Manufacturing Company LLC

- Green Field Control System India Pvt. Ltd.

- Hitachi Ltd.

- Honeywell International Inc.

- Hyundai Elevator Co. Ltd.

- KONE Corp.

- Mitsubishi Electric Corp.

- Motion Control Engineering Inc.

- Nidec Corp.

- Otis Worldwide Corp.

- Schindler Holding Ltd.

- SICK AG

- Thames Valley Controls Ltd.

- TK Elevator GmbH

- Toshiba Corp.

- VRS Elevators Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing construction of high-height buildings and the integration of cutting-edge technology. Artificial intelligence, smart sensors, and the Internet of Things (IoT) are transforming elevator systems, making them more energy-efficient and safer. These advanced technologies enable real-time traffic management and remote monitoring, ensuring smooth elevator operations in smart buildings. Elevator control systems are no longer just a means of transportation between floors. They are becoming integral parts of smart buildings, offering door phones, building access, and intelligent building entry. Touchless elevators and energy-saving infrastructure are becoming essential components of modern living and commercial spaces.

Infrastructure investment in megacities and the digital transformation of urban areas are driving the demand for smart city technologies, including smart transportation services and green infrastructure standards. Elevator control systems play a crucial role in these initiatives, offering energy efficiency and traffic control solutions. Residential apartments, multi-storey buildings, commercial spaces, skyscrapers, and commercial buildings all benefit from the integration of automated technologies, machine learning, and touchless technology into elevator control systems. These advancements contribute to the overall infrastructure spending and the development of smart technologies in various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 6.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

China, India, Germany, Japan, South Korea, UK, Australia, France, Italy, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, Middle East and Africa, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch