Embedded Hypervisor Software Market Size 2024-2028

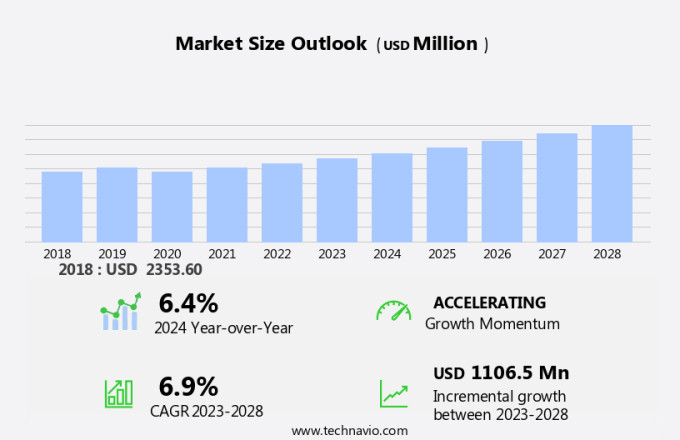

The embedded hypervisor software market size is forecast to increase by USD 1.11 billion at a CAGR of 6.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of embedded software in various industries, particularly in wearable technology. This trend is driven by the need for enhanced security and compartmentalization in these applications. Bare metal hypervisors, a type of embedded hypervisor, are gaining popularity due to their ability to provide a high level of security and real-time performance. Malware detection is another crucial factor driving the market, as non-real-time embedded systems are increasingly vulnerable to cyber threats. Certification is also a major concern, as these systems are often used in safety-critical applications where failure can have serious consequences. Efficiency is another key consideration, as embedded hypervisors must be able to run efficiently on limited hardware resources. Overall, the market for embedded hypervisor software is expected to continue growing as the demand for secure and efficient embedded systems increases.

What will the size of the market be during the forecast period?

- Embedded hypervisor software is a type of virtualization technology designed specifically for embedded systems. This software allows multiple operating systems (OS) or virtual machines (VM) to run on a single hardware platform, providing compartmentalization and enhanced security. Hardware platforms used in embedded systems require a high level of security due to their critical nature in various industries. Embedded hypervisor software plays a crucial role in securing these systems by creating virtual environments for each OS or application. This isolation ensures that any potential malware or cyberattacks are contained, reducing the risk of system failure or data breaches.

- Virtualization technology, including embedded hypervisors, offers increased efficiency by enabling multiple workloads to run on a single hardware platform. This is particularly beneficial for industries with real-time performance requirements, such as the medical industry or industrial automation, where downtime can result in significant financial and operational consequences. Certification is essential for embedded systems, especially those used in safety-critical applications. Embedded hypervisor software can help meet certification requirements by providing a secure and isolated environment for each application. This ensures that functional safety is maintained, even in the presence of multiple OS or applications. Processor architecture is an essential consideration when selecting an embedded hypervisor.

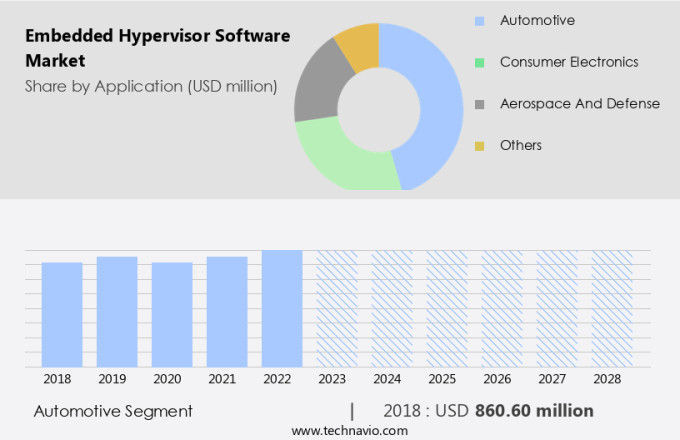

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Consumer electronics

- Aerospace and defense

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

Embedded hypervisor software is a vital technology in the virtualization of systems, particularly in the automotive sector. This software enables compartmentalization and security in embedded systems, ensuring real-time performance for both non-real-time and time-critical applications. The increasing demand for advanced technology in automobiles, such as IoT, AI, and others, has led to a rise in the adoption of embedded hypervisors in the automotive industry. The mid-size passenger car segment is a significant market for embedded hypervisor software due to the growing number of customers in the early majority category. These consumers are always on the lookout for the latest technologies that enhance comfort, convenience, and safety in their vehicles.

Furthermore, the use of a bare metal hypervisor provides an additional layer of security, as it runs directly on the hardware without requiring an underlying operating system. Furthermore, malware detection and certification are essential features for automotive applications, making embedded hypervisor software an indispensable component in the development of next-generation vehicles.

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 860.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

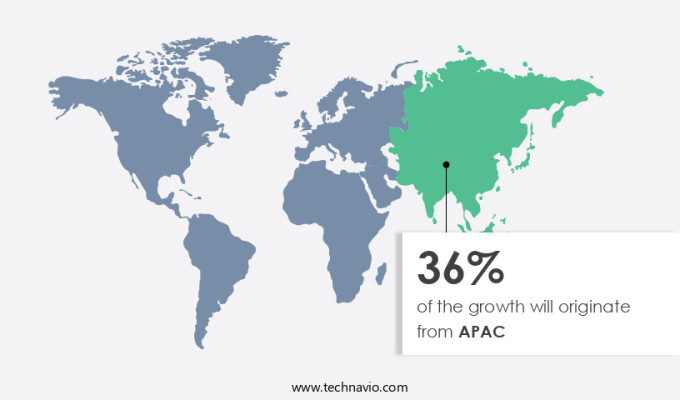

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Another region offering significant growth opportunities to vendors is North America. In North America, the market is experiencing significant growth due to several key factors. The demand for faster time-to-market and cost reduction in manufacturing processes is driving the adoption of virtualization technology in various industries. Virtual machines (VMs) enable the efficient management of resources and offer isolated environments for data replication and cloning. These benefits are particularly valuable in complex hardware control systems. Moreover, the increasing use of tablets and netbooks in the industrial sector is adding impetus to market growth.

The automotive, electronics, and electrical industries are leading the way in the adoption of embedded software in North America. Storage-based replication is another trend gaining traction in the North American market, as it offers a cost-effective solution for data backup and disaster recovery. The growth of these industries and the resulting demand for advanced software solutions are expected to continue fueling the growth of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Embedded Hypervisor Software Market?

High adoption of embedded software across the end-user industry is the key driver of the market.

- Embedded hypervisor software plays a crucial role in the semiconductor sector by creating a hardware-agnostic virtual computing environment for various operating systems (OS) on embedded hardware. In the burgeoning consumer electronics market, expected to dominate the semiconductor industry in 2023, this software offers significant advantages. By consolidating multiple OS and applications with varying reliability, safety, and security requirements onto a single System-on-Chip (SoC), embedded hypervisor software reduces hardware costs, size, weight, and power consumption.

- Moreover, it enhances resource utilization and improves test environments for industrial control automation and desktop virtualization applications. Hosted hypervisors, in particular, enable the creation of graphical dashboards for monitoring and managing virtual machines, offering increased flexibility and control. These benefits make embedded hypervisor software an indispensable tool for enterprises, application developers, and electronics manufacturers.

What are the market trends shaping the Embedded Hypervisor Software Market?

The use of embedded software in wearable technology is the upcoming trend in the market.

- Embedded hypervisors refer to software that enables virtualization on embedded systems, allowing multiple operating systems (OS) to run on a single hardware platform. Virtualization through embedded hypervisors enables the creation and management of virtual machines (VM), each running its OS. This technology is essential for hardware platforms that require multiple OS environments, such as automotive, healthcare, and industrial automation systems.

- The market is anticipated to expand significantly due to the increasing adoption of virtualization in various industries. Wearable technology, including smartwatches and fitness-tracking devices, is a growing market that will benefit from embedded hypervisors. Consumer expenditure on wearables is projected to increase at a substantial rate due to the rising awareness of health and fitness. This trend will fuel the demand for embedded hypervisor software in the wearable technology market during the forecast period.

What challenges does the Embedded Hypervisor Software Market face during the growth?

Data security and privacy issues is a key challenge affecting the market growth.

- Embedded hypervisor software plays a crucial role in the digital transformation of businesses, particularly in the context of intelligent edge systems. With the increasing adoption of hardware virtualization, the need for low latency and minimal memory footprint hypervisors is escalating. The interoperation of hypervisors is essential for efficient host and guest management, ensuring secure and reliable execution of applications. companies in the market cater to industries handling sensitive client information and financial data, necessitating stringent security measures.

- Direct communication among systems without human intervention increases the risk of potential data breaches. Therefore, the demand for hypervisors that offer strong memory management and protection against unauthorized access is on the rise. Companies are prioritizing the implementation of embedded hypervisor software to mitigate risks associated with data privacy, security, liability, and intellectual property protection.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- acontis technologies GmbH

- AspenCore

- BlackBerry Ltd.

- Citrix Systems Inc.

- Enea AB

- ERTIS

- Green Hills Software LLC

- International Business Machines Corp.

- KRONO SAFE

- Lynx Software Technologies

- Microsoft Corp.

- OpenSynergy GmbH

- Oracle Corp.

- Red Hat Inc.

- Siemens AG

- Sierraware LLC.

- SYSGO GmbH

- TenAsys Corp.

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Embedded hypervisor software is a type of virtualization technology designed for use in embedded systems. It allows for the creation of virtual machines (VMs) on a single hardware platform, providing compartmentalization and enhanced security. The software functions as a mediator between the hardware and the operating system (OS), enabling multiple isolated environments to run on a single hardware platform. Virtualization technology, including embedded hypervisors, offers benefits such as resource management, improved efficiency, and real-time performance for both real-time and non-real-time applications. The hardware-neutral nature of embedded hypervisors enables consolidating servers and reducing the overall hardware requirements. Security is a primary concern in industries such as medical and industrial uses, where data protection and functional safety are crucial.

Furthermore, embedded hypervisors offer features like malware detection, resource usage limits, and memory footprint optimization to mitigate cyberattacks. Virtualization technology also enables the creation of test environments, graphical dashboards, and intelligent edge systems, making it an essential component in industrial control automation and desktop virtualization. Hypervisor interoperation and low-latency communication further enhance the functionality of embedded hypervisors. Bare metal hypervisors, also known as Type 1 hypervisors, offer a minimal memory footprint and are suitable for use in applications where low latency and high performance are essential. The software's ability to run directly on the hardware, bypassing the need for an underlying OS, makes it an attractive option for various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market Growth 2024-2028 |

USD 1.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch