Energy Trading And Risk Management (ETRM) Market Size 2025-2029

The energy trading and risk management market size is forecast to increase by USD 457.2 million at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for smart grids worldwide. Smart grids enable two-way communication between electricity suppliers and trading and consumers, leading to more efficient energy management and consumption. This trend is particularly prominent in regions with high energy demand and a focus on renewable energy sources. Another key driver for the ETRM market is the adoption of cloud-based energy trading and risk management software. Cloud solutions offer increased flexibility, scalability, and cost savings, making them an attractive option for energy traders and risk managers. However, this shift towards cloud-based systems also brings new challenges, including energy data security concerns.

- With the increasing volume and complexity of energy data being generated and transmitted, ensuring its security is paramount for market participants. Companies seeking to capitalize on the opportunities presented by the ETRM market must stay abreast of these trends and proactively address the associated challenges to effectively manage risk, optimize energy trading, and ultimately, drive business growth.

What will be the Size of the Energy Trading And Risk Management (ETRM) Market during the forecast period?

- The market is a dynamic and complex ecosystem that facilitates the buying, selling, and managing of energy commodities. This market encompasses various components, including data governance, cloud-based ETRM, regulatory compliance solutions, and trade lifecycle management. Cloud-based/ Cloud Compution ETRM solutions enable energy traders to manage their operations more efficiently, while regulatory compliance solutions ensure adherence to industry standards. The energy trading ecosystem is evolving, with AI-powered ETRM systems and energy trading strategies becoming increasingly prevalent. Position reconciliation, market data analytics, and data security standards are crucial elements of an effective ETRM system. Energy trading platforms provide access to real-time energy price forecasting, carbon emissions reduction, and energy security.

How is this Energy Trading And Risk Management (ETRM) Industry segmented?

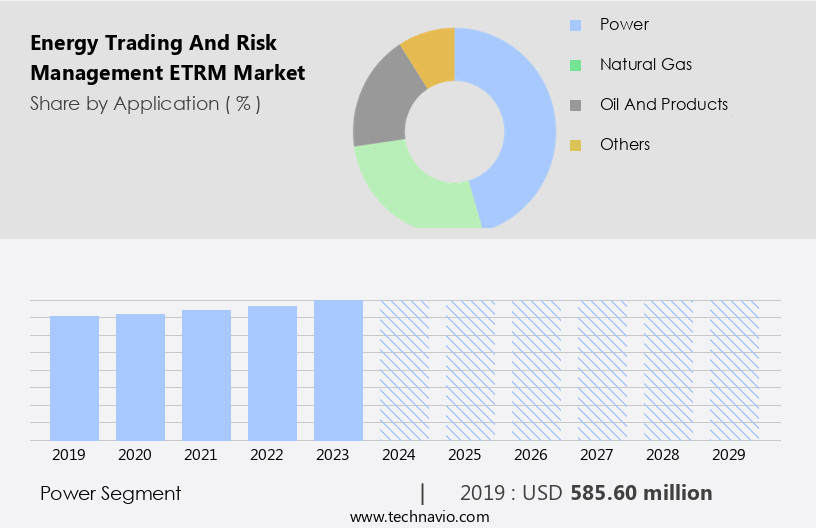

The energy trading and risk management (etrm) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commodity Trading

- Portfolio Management

- Compliance

- Type

- Software

- Service

- Deployment

- SaaS or hosted service

- license

- Product Type

- Front office

- Middle office

- Back office

- Solution Type

- Trading Platforms

- Risk Management Software

- Analytics Tools

- Geography

- North America

- US

- Canada

- Mexico

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- Spain

- UK

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Application Insights

The commodity trading segment is estimated to witness significant growth during the forecast period.

In the power segment of the energy market, the primary catalyst for growth is the increasing emphasis on resource management and operational efficiency. Traditional technologies are being replaced with digital solutions to streamline processes and reduce costs. The demand for real-time data, regulatory compliance, and collaboration between internal and external stakeholders is driving the adoption of energy trading and risk management software and services. One significant application of these solutions is the automation of energy generation and management systems. This software empowers users to control their systems effectively and collaborate efficiently with team members. Additionally, it enables operational risk management, market risk mitigation, and contract management, all crucial aspects of the power market.

Financial institutions and energy markets are integrating advanced technologies like machine learning, artificial intelligence, and cloud computing to enhance their operations. These technologies facilitate data security, data management, and regulatory compliance, ensuring seamless trade processing and risk management. The energy transition towards renewables and the emergence of gas and oil markets are also influencing the power grid segment. Energy trading platforms are adapting to these changes by offering solutions for renewable energy markets and emissions trading. The integration of these offerings with enterprise resource planning, customer relationship management, and supply chain management systems further enhances their value proposition.

In , the power segment of the energy market is undergoing digital transformation to meet the demands of operational efficiency, cost reduction, and regulatory compliance. Energy trading and risk management software and services are at the forefront of this transformation, providing solutions for workflow automation, risk management, and data management. The integration of advanced technologies and the adaptation to market trends are essential for these solutions to remain competitive and meet the evolving needs of the power segment.

Get a glance at the market report of share of various segments Request Free Sample

The Commodity Trading segment was valued at USD 585.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the industrially advanced North American region, the market is experiencing significant growth due to the increasing focus on energy efficiency and the need to meet demand through various energy sources. The market's expansion is driven by the adoption of advanced technologies such as Portfolio Management, Back Office, Business Intelligence, Customer Relationship Management, Risk Management, Digital Transformation, and Enterprise Resource Planning. These solutions enable financial institutions to optimize their energy trading operations, manage risk appetite, and ensure regulatory compliance. Moreover, the integration of Machine Learning, Artificial Intelligence, and Cloud Computing in ETRM systems is revolutionizing the market.

The ability to process real-time data and analyze market trends in Energy Markets, Gas Markets, Oil Markets, Power Markets, and Renewables Markets is crucial for effective trade processing and position management. The intensifying competition among industrial enterprises and the increasing importance of Energy Transition are further fueling the market's growth. Commodity Trading, Supply Chain Management, Operational Risk, and Market Risk are some of the critical areas where ETRM systems play a significant role in managing risk and ensuring operational efficiency. The adoption of ETRM systems is also essential for Financial Institutions to meet the demands of various Emissions Markets and comply with regulatory reporting requirements.

Data Security and Data Management are crucial aspects of these systems, ensuring the protection of sensitive information and maintaining regulatory compliance. In , the North American ETRM market is witnessing significant growth due to the increasing focus on energy efficiency, the adoption of advanced technologies, and the need to meet various regulatory requirements. The market's growth is driven by the integration of various software solutions, including Portfolio Management, Back Office, Business Intelligence, Customer Relationship Management, Risk Management, Digital Transformation, and Enterprise Resource Planning, among others.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Renewable energy trading, commodity risk management, and energy infrastructure are also integral parts of the ETRM market. Energy trading regulations, energy analytics, and energy trading optimization contribute to energy market transparency and efficiency. Emerging technologies such as blockchain for energy, business process automation, and cybersecurity for ETRM are shaping the future of the market. Energy storage, energy market simulation, and energy trading community platforms foster collaboration and innovation. Derivatives risk management, energy data management, and risk management solutions provide valuable tools for energy traders. Energy contract optimization and energy trading training enable businesses to maximize their profits and minimize risks.

ETRM market trends 2025-2029 highlight ETRM software for renewable energy and ETRM systems with AI integration. Cost-effective ETRM solutions for SMEs and ETRM software for small businesses drive adoption, per global ETRM market size and forecast. Scalable ETRM software providers and real-time ETRM market insights support ETRM deployment for utilities. ETRM software for commodity trading and ETRM adoption in oil and gas enhance efficiency. AI-driven ETRM software benefits, ETRM systems for risk mitigation, and ETRM market analysis address ETRM market challenges and solutions. Global ETRM market competitive landscape and future of ETRM software 2029 insights fuel ETRM market growth opportunities 2025.

What are the key market drivers leading to the rise in the adoption of Energy Trading And Risk Management (ETRM) Industry?

- Rising demand for smart grids globally is the key driver of the market. The global market for Energy Trading and Risk Management (ETRM) solutions is witnessing significant growth due to the increasing demand for efficient and reliable energy management. With investments in smart grid technology on the rise, economies are enhancing their power systems to meet the growing energy needs. ETRM software and services enable power engineers to analyze real-time data and optimize power system output, ensuring improved energy efficiency and reliability. The Asia Pacific region is expected to lead the market growth due to the increasing demand for power supply and declining transmission losses.

- Moreover, government policies and regulations in North America and APAC are driving the efficiency, quality, dependability, and security of power supply systems in these regions. As a result, the ETRM market is poised for substantial expansion in the coming years.

What are the market trends shaping the Energy Trading And Risk Management (ETRM) Industry?

- Adoption of cloud-based energy trading and risk management software is the upcoming market trend. The market is witnessing significant growth due to the increasing adoption of cloud-based solutions. Cloud-based ETRM software enables users to access the application through web-based browsers, allowing for flexible access and multi-device compatibility. This software often includes mobile apps for enhanced usability on smartphones and tablets. A key advantage of cloud-based ETRM software is its scalability, which enables businesses to easily expand their operations as needed.

- Cloud-based solutions offer organizations the ability to define access levels across the organization and enable users to log in from any Internet-enabled device, providing greater convenience and efficiency.

What challenges does the Energy Trading And Risk Management (ETRM) Industry face during its growth?

- Energy data security-related concerns is a key challenge affecting the industry growth.

- The markets have gained significant importance in the global business landscape due to the increasing focus on energy security and the need to manage risks associated with energy trading. Cybersecurity has emerged as a major concern for energy and utility organizations, as they have become prime targets for hackers and cyber terrorists. These attacks can result in mass disruptions, causing significant financial and operational damage. indicates that cyberattacks on energy service providers and public utilities have primarily been focused on reconnaissance rather than data theft. Hackers aim to identify vulnerabilities and assess the potential impact of an attack.

- In January 2025, Chinese hackers reportedly enhanced their capabilities, shifting from corporate espionage to posing serious threats to energy infrastructure. This underscores the need for cybersecurity measures in the ETRM market to mitigate risks and protect critical infrastructure. ETRM systems play a crucial role in managing risks associated with energy trading, including price risks, operational risks, and market risks. These systems help energy organizations make informed decisions by providing real-time market data, risk analytics, and trading tools. However, the increasing digitization of energy trading and the growing sophistication of cyber threats pose significant challenges to the security of these systems.

Exclusive Customer Landscape

The energy trading and risk management (etrm) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the energy trading and risk management (etrm) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, energy trading and risk management (etrm) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

OpenLink Financial LLC - The company specializes in providing energy trading and risk management solutions through advanced software offerings, including Accenture Energy and Utilities and Accenture Risk and Compliance. These innovative tools enable clients to effectively manage energy markets, mitigate risks, and ensure regulatory compliance. By leveraging cutting-edge technology and industry expertise, the company empowers businesses to optimize their energy strategies and enhance operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- OpenLink Financial LLC

- ION Group

- Allegro Development Corporation

- Eka Software Solutions

- Amphora Inc.

- Triple Point Technology Inc.

- SAP SE

- Hitachi Energy

- Atos SE

- Capgemini SE

- Accenture plc

- CGI Group Inc.

- Fujitsu Limited

- NTT Data Corporation

- Toshiba Energy Systems & Solutions

- Beijing Energy Trading Platform Co. Ltd.

- Shanghai Electric Power Co. Ltd.

- China Huaneng Group

- Kyndryl Holdings Inc.

- Fiserv Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the complex and dynamic world of Energy Trading and Risk Management (ETRM), financial institutions face numerous challenges in optimizing their operations and managing risks. The ETRM market encompasses various functions, including portfolio management, back office, business intelligence, customer relationship management, and enterprise resource planning. Portfolio management plays a crucial role in ETRM, enabling institutions to effectively allocate resources and manage risk exposure. This function is integral to deriving maximum value from their trading activities in energy markets, such as gas, oil, power, emissions, and renewables. The back office is another essential component of ETRM, responsible for trade capture, position management, and regulatory reporting.

These functions are critical in ensuring accurate and timely processing of trades, maintaining proper records, and adhering to regulatory requirements. Business intelligence and data management are essential for gaining insights into market trends and managing risks effectively. The use of advanced technologies, such as machine learning and artificial intelligence, can help institutions analyze vast amounts of data in real-time, enabling them to make informed decisions and respond to market changes swiftly. Digital transformation is a key trend in the ETRM market, with financial institutions increasingly adopting cloud computing and ETRM systems to streamline their operations and improve efficiency. These technologies enable institutions to access real-time data, automate processes, and enhance collaboration between front, middle, and back office functions.

Risk management is a critical aspect of ETRM, with institutions facing various types of risks, including market risk, credit risk, and operational risk. Effective risk management requires a risk management framework, including risk appetite setting, risk identification, assessment, and mitigation strategies. Energy transition and the growing focus on renewable energy sources present new opportunities and challenges for financial institutions in the ETRM market. Managing the risks associated with these emerging markets requires a deep of the unique characteristics and complexities of renewable energy markets. Supply chain management and contract management are also essential functions in ETRM, enabling institutions to manage their relationships with counterparties and ensure the timely and efficient execution of trades.

Effective contract management is crucial in mitigating counterparty risk and ensuring compliance with regulatory requirements. Data security and regulatory compliance are critical concerns for financial institutions in the ETRM market. Ensuring the security and confidentiality of sensitive data is essential in maintaining trust with customers and regulatory authorities. Compliance with regulatory requirements is also crucial in avoiding fines and reputational damage. In , the ETRM market is a complex and dynamic environment, requiring financial institutions to effectively manage risks, optimize operations, and adapt to emerging trends. The use of advanced technologies, such as machine learning and artificial intelligence, can help institutions gain insights into market trends and make informed decisions in real-time.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 457.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Energy Trading And Risk Management (ETRM) Market Research and Growth Report?

- CAGR of the Energy Trading And Risk Management (ETRM) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the energy trading and risk management (etrm) market growth of industry companies

We can help! Our analysts can customize this energy trading and risk management (etrm) market research report to meet your requirements.