Equestrian Equipment Market Size 2024-2028

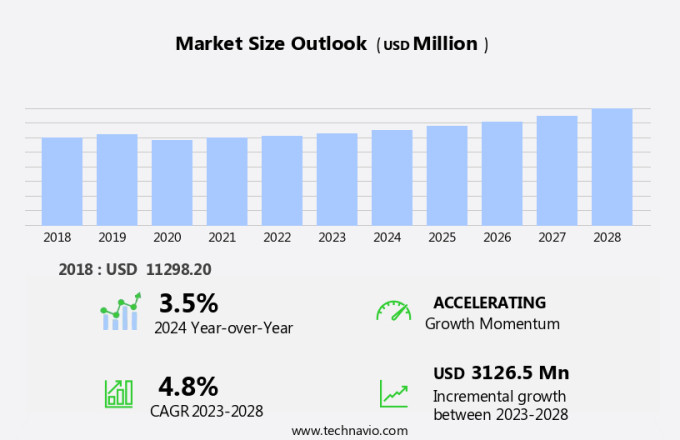

The equestrian equipment market size is forecast to increase by USD 3.13 billion at a CAGR of 4.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing participation in equestrian sports, fueled by the rising popularity of events such as the Olympics and the growth of recreational riding. Another trend is the focus of companies on new product launches, which include advanced technologies and innovative designs to cater to the evolving needs of riders. Additionally, the availability of pre-owned and rented equestrian equipment provides cost-effective solutions for those who may not be able to afford new gear. These factors are expected to continue driving market growth In the coming years. Overall, the market is poised for continued expansion, offering opportunities for companies and suppliers in this dynamic industry.

What will be the Size of the Equestrian Equipment Market During the Forecast Period?

- The market is experiencing strong growth, driven by the increasing popularity of horse riding as a recreational activity and participation in equestrian sports. Safety remains a top priority, with demand for certified helmets, protective vests, and airbag vests continuing to rise. Advanced materials, such as moisture-wicking fabrics, are being used to create tailored riding apparel that enhances both rider comfort and horse comfort. e-commerce platforms have made it easier for consumers to access specialized gear, including saddles, bridles, and accessories, from the convenience of their homes.

- The equestrian community is diverse, encompassing various riding disciplines, from dressage and show jumping to recreational riding. With disposable incomes on the rise, consumers are investing in high-quality, specialized equipment to enhance their equestrian experiences. Communication and innovation are key trends, with new bridle designs and riding apparel offering improved functionality and performance.

How is this Equestrian Equipment Industry segmented and which is the largest segment?

The equestrian equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rider equipment

- Equine equipment

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

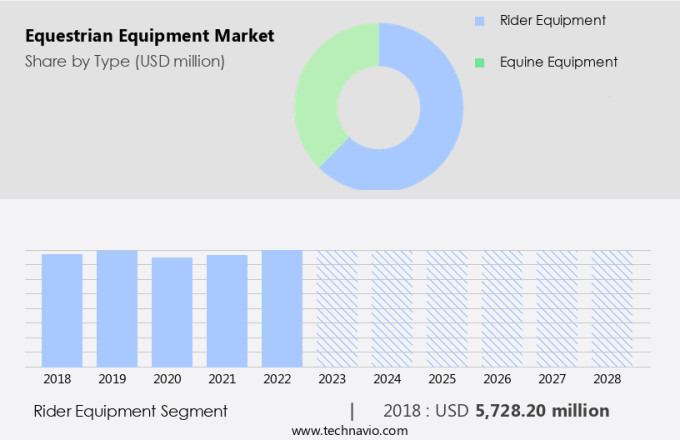

- The rider equipment segment is estimated to witness significant growth during the forecast period.

The market caters to the demand for gear and accessories essential for riders participating in various equestrian activities. This market segment includes helmets, riding apparel, body protectors, and gloves, designed to ensure rider safety, comfort, and optimal performance. Helmets, a crucial safety component, protect against head injuries. The Kylo riding helmet, launched by Charles Owen in 2023, is an innovative example. It offers an affordable option with features such as a wide peak, adjustable precision fit, and a flexible peak. Additionally, the market prioritizes ethical considerations, with offerings of cruelty-free products, recycled plastics, organic cotton, and vegan leather. Transparent supply chains ensure ethical sourcing and production practices.

Get a glance at the Equestrian Equipment Industry report of share of various segments Request Free Sample

The rider equipment segment was valued at USD 5.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

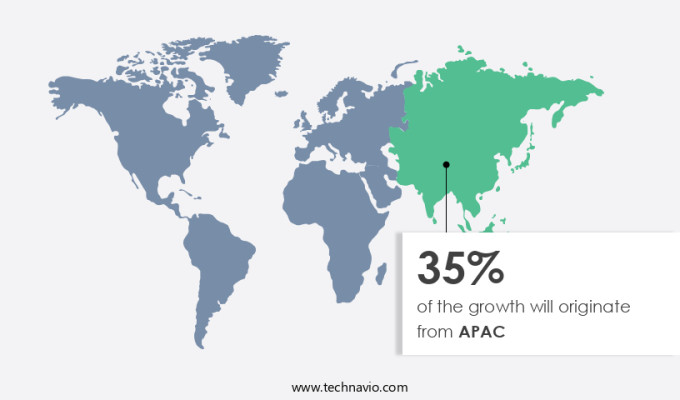

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is driven by the substantial equine population and the large number of horse enthusiasts In the United States. With approximately 6.65 million horses and 10 million horse owners, the demand for equestrian equipment is significant. Annual participation in horse-related activities reaches 25 million people, necessitating the use of high-quality equipment for safety and optimal performance in riding, training, and Olympic-level competitions. Equestrian equipment encompasses various categories, including equine wearables, smart sensors, monitoring devices, horse health products, rider equipment, and performance insights tools. These technologies enhance horse and rider well-being, improve training methods, and provide valuable data for better decision-making.

Market Dynamics

Our equestrian equipment market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Equestrian Equipment Industry?

Increasing participation in equestrian sports is the key driver of the market.

- The market is experiencing growth due to the rising popularity of equestrian sports and recreational riding. According to industry reports, over 480,000 Americans engage in horse riding activities, fueling the demand for a diverse range of equipment. From certified helmets and protective vests to specialized footwear and advanced materials, horse riding equipment is essential for both recreational and competitive riders. Safety gear, such as airbag vests and body protectors, are increasingly in demand as riders prioritize their safety. E-commerce platforms have made it easier for consumers to access specialized equipment from the comfort of their homes.

- Fashion in equestrian is also a significant trend, with a focus on tailored equipment, lightweight fabrics, and cruelty-free products made from recycled plastics, organic cotton, and vegan leather. Equestrian events and tourism have become popular leisure activities, leading to increased sales of riding apparel, gloves, horse boots, blankets, and other accessories. Rider comfort and horse comfort are crucial considerations In the design of saddles and bridle designs. The market for equestrian equipment caters to both individuals and institutions, with offline channels and specialty stores complementing online sales. The equestrian community values safety regulations and transparency In the supply chain.

What are the market trends shaping the Equestrian Equipment Industry?

The increasing focus of companies on new product launches is the upcoming market trend.

- The market is experiencing a notable shift towards advanced and specialized products, prioritizing both rider and horse comfort and safety. Innovative companies are introducing new items to cater to evolving consumer demands and maintain a competitive edge. For instance, WeatherBeeta's Spring 2024 collection, launched on March 7, 2024, showcases various products designed to enhance the equestrian experience. One such offering is the Green-Tec Airflow Mesh Fly Sheet from the WeatherBeeta Fly collection, which focuses on breathable materials and effective insect protection for horse comfort. This trend is driven by the growing popularity of equestrian sports, recreational riding, and equestrian tourism.

- Consumers are increasingly seeking safety gear, such as certified helmets, protective vests, and airbag vests, made from advanced materials like lightweight fabrics and recycled plastics. E-commerce platforms and specialty stores are making these products more accessible, while ensuring transparent supply chains and offering cruelty-free, organic cotton, and vegan leather options. Safety regulations continue to play a significant role In the market, driving the demand for safety equipment. Riding apparel, such as moisture-wicking fabrics, body protectors, and gloves, are essential components of rider safety. Horses' comfort is also a priority, with horse boots, blankets, and saddles being designed to cater to various riding disciplines and bridle designs.

What challenges does the Equestrian Equipment Industry face during its growth?

The availability of pre-owned and rented equestrian equipment is a key challenge affecting the industry growth.

- The market is undergoing a transformation due to shifting consumer preferences towards pre-owned and rented gear. This trend is driven by the increasing availability of platforms dedicated to buying and selling used equestrian equipment, such as Equestrian Closet, LLC and eBay Inc. These marketplaces offer affordable options for budget-conscious riders and those new to the sport, who may be hesitant to invest in expensive new equipment. The rise of pre-owned gear has significant implications for the equestrian industry. On the one hand, it presents opportunities for increased accessibility and affordability, particularly for recreational riders and those participating in leisure activities.

- On the other hand, it poses challenges for manufacturers and retailers of new equipment, who must adapt to changing market dynamics and consumer behavior. Safety remains a top priority In the market, with a focus on certified helmets, protective vests, airbag vests, and other safety gear. Advanced materials, such as lightweight fabrics and recycled plastics, are increasingly being used to create high-performance, comfortable, and sustainable equipment. Specialty stores and e-commerce platforms offer a wide range of tailored equipment for various riding disciplines, including dressage, show jumping, and recreational riding. The equestrian community is also embracing cruelty-free products, with a growing demand for organic cotton, vegan leather, and transparent supply chains.

- Smart sensors and monitoring devices are being integrated into equestrian wearables to provide performance insights and enhance horse health and rider safety. The market is diverse, catering to both individual and institutional buyers, as well as offline channels. Safety regulations continue to evolve, driving the development of innovative safety equipment, such as lightweight materials and smart sensors. The market is expected to grow as disposable incomes increase and equestrian sports continue to gain popularity as recreational and leisure activities.

Exclusive Customer Landscape

The equestrian equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the equestrian equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, equestrian equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Jump

- Ariat International Inc.

- Bates Saddles

- Beval saddlery

- Cavallo GmbH and Co. KG

- Charles Owen

- Devoucoux

- GEMS International

- Hermes International SA

- HKM Sports Equipment GmbH

- Horseware Products Ltd.

- LeMieux Ltd

- Mariam International

- Nunn Finer

- SALEHA INTERNATIONAL

- Sharie International

- Weatherbeeta USA Inc.

- Weaver Equine

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed to enhance the experience of both riders and horses in various equestrian activities. This market caters to the needs of equestrian sports, recreational riding, and equestrian tourism. Equestrian equipment includes certified helmets, protective vests, specialized footwear, saddles, bridles, riding apparel, and accessories. The demand for safety gear is a significant market driver, as rider and horse safety are paramount in equestrian activities. Advanced materials, such as lightweight fabrics and airbag vests, have revolutionized safety equipment, offering superior protection without compromising comfort. E-commerce platforms have made it easier for consumers to access these products, allowing for greater convenience and increased competition among retailers.

Further, rider comfort and horse comfort are essential considerations in equestrian equipment design. Tailored equipment, including body protectors and saddle pads, cater to individual rider and horse needs. Equestrian culture places a high value on safety, performance, and fashion, leading to the development of luxury products and the integration of smart sensors and monitoring devices into equine wearables. The market is influenced by various factors, including raw material prices, rider and horse preferences, and safety regulations. The use of cruelty-free products, recycled plastics, organic cotton, and vegan leather is becoming increasingly popular, reflecting consumers' growing concern for animal welfare and the environment.

Additionally, transparent supply chains are also gaining importance, as consumers demand greater accountability and ethical production practices. Specialty stores and sporting goods retailers cater to the diverse needs of the equestrian community. Riding disciplines, such as dressage, show jumping, and recreational riding, each have unique equipment requirements. Communication between riders, trainers, and equipment manufacturers is essential to ensure the development of specialized gear that meets the demands of each discipline. Equestrian equipment is not only essential for competitive sports but also for leisure activities and outdoor pursuits. The equestrian tourism industry relies heavily on the availability of high-quality, reliable equipment to provide enjoyable experiences for riders and their horses.

|

Equestrian Equipment Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market Growth 2024-2028 |

USD 3.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Key countries |

US, China, Canada, UK, Australia, Germany, Japan, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Equestrian Equipment Market Research and Growth Report?

- CAGR of the Equestrian Equipment industry during the forecast period

- Detailed information on factors that will drive the Equestrian Equipment Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the equestrian equipment market growth of industry companies

We can help! Our analysts can customize this equestrian equipment market research report to meet your requirements.