Equine Healthcare Market Size 2024-2028

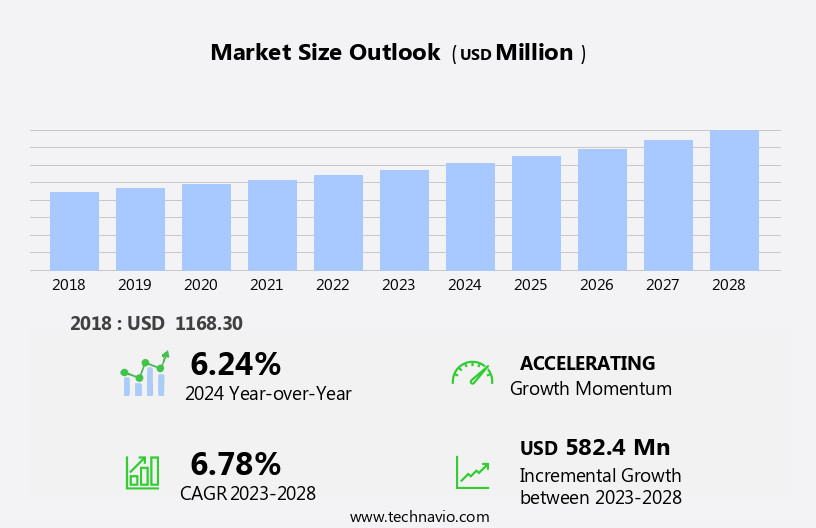

The equine healthcare market size is forecast to increase by USD 582.4 million at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends and factors. The rise in the incidence of zoonotic diseases, which can be transmitted from animals to humans, is a major concern driving market growth. Additionally, the adoption of new technologies, such as telemedicine and electronic health records, is revolutionizing the industry.

- However, high costs associated with equine healthcare remain a challenge in both veterinary telehealth and for horse owners. The implementation of advanced technologies and preventive measures to address the increasing incidence of zoonotic diseases is expected to provide significant opportunities for market growth. Alltech, a leading company, offers equine healthcare such as nutritional supplements and feed additives to support horse health, performance, and digestive health.

What will be the Size of the Equine Healthcare Market During the Forecast Period?

- The market encompasses a range of products and services aimed at preventing and treating diseases in horses. Key diseases of concern include equine infectious anemia, rabies, West Nile fever, and Venezuelan equine encephalomyelitis. Equine industry participants, including equine veterinary practitioners, play a crucial role in managing these health issues. Technologies such as CT systems and vaccines are essential tools in equine healthcare, with vaccination programs a critical component of disease prevention.

- Furthermore, the equine population's size and the need for skilled veterinarians continue to drive market growth. Animal health companies offer various products, including vaccines and health plans, to cater to the industry's needs. The market is subject to ongoing trends, including the development of advanced diagnostic tools and the integration of technology into veterinary practices.

How is this Equine Healthcare Industry segmented and which is the largest segment?

The equine healthcare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Pharmaceuticals

- Vaccines

- Others

- Distribution Channel

- Offline

- Online

- Indication

- Musculoskeletal Disorders

- Parasitic Infections

- Equine Herpes Virus

- Equine Viral Arteritis (EVA)

- Equine Influenza

- West Nile Virus

- Tetanus

- Others

- Activity

- Sports/Racing

- Recreation

- Others

- Geography

- North America

- Mexico

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

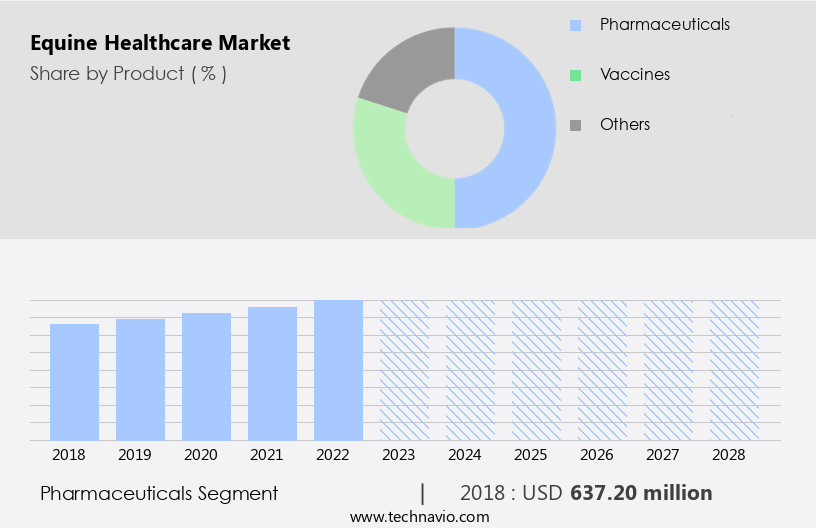

- The pharmaceuticals segment is estimated to witness significant growth during the forecast period.

The market encompasses various sectors, with pharmaceuticals holding the largest share due to the demand for medications and therapies to prevent and treat equine diseases. Pharmaceutical offerings for horses cater to their unique physiological requirements and include anti-inflammatory drugs, antibiotics, dewormers, antiparasitic drugs, antifungal medications, pain relievers, hormonal therapies, and other formulations. Preventive medications are essential for maintaining equine health and preventing diseases, such as tetanus, rabies, equine influenza, equine herpes, equine infectious anemia, equine encephalomyelitis, and West Nile fever.

Furthermore, animal healthcare spending on equine pharmaceuticals also covers vaccines and medicinal feed additives for parasite control. Animal insurance, equine veterinary practitioners, equine care equipment, diagnostics, and e-commerce platforms further contribute to the market. Animal healthcare products and services are essential for horse farms, racing events, and recreational activities, ensuring the well-being of the equine population. Regenerative therapies, such as stem cell therapy, are emerging trends in the industry.

Get a glance at the Equine Healthcare Industry report of share of various segments Request Free Sample

The pharmaceuticals segment was valued at USD 637.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

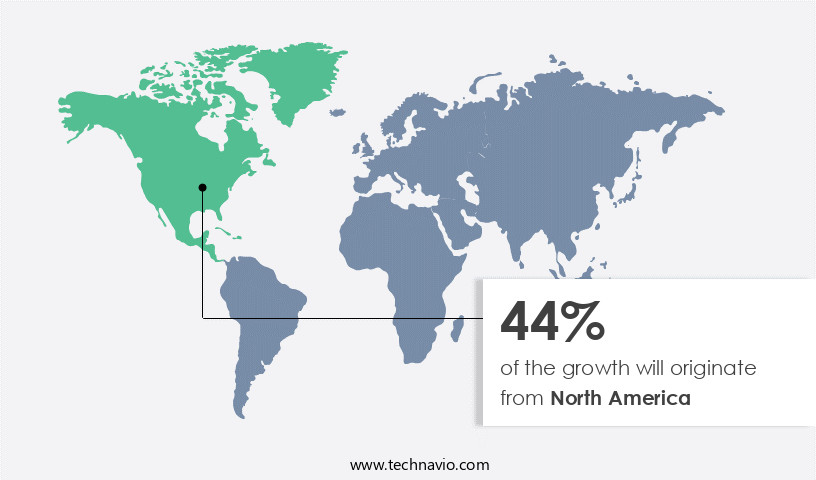

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, primarily driven by the US, is shaped by the presence of leading companies like Zoetis, committed to advancing equine health through innovative products. Government initiatives prioritizing animal health and regulations ensuring product safety contribute significantly to market growth. The US government oversees the safety and efficacy of biologics, feed additives, and pharmaceuticals for horses through two federal agencies. These measures safeguard the health and well-being of horses in the region.

Furthermore, key sectors include equine veterinary practitioners, horse farms, racing events, and recreational activities. Products encompass equine vaccines, analgesics, anti-inflammatory, parasiticides, and medicinal feed additives. Diseases such as equine influenza, tetanus, rabies, equine encephalomyelitis, Venezuelan equine encephalomyelitis, West Nile fever, and equine infectious anemia pose ongoing challenges. Innovations in diagnostics, CT systems, and regenerative therapies, including stem cell therapy, are addressing these challenges. E-commerce platforms facilitate the sale of products, enhancing accessibility.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Equine Healthcare Industry?

The rise in incidences of zoonotic diseases is the key driver of the market.

- The market encompasses a range of products and services aimed at preventing and treating various diseases and conditions affecting horses. Animal healthcare spending in this sector includes expenditures on animal insurance, vaccines, analgesics, anti-inflammatory drugs, parasiticides, and medicinal feed additives. Equine diseases, such as Equine Influenza, Equine Herpes, Equine Encephalomyelitis, Venezuelan Equine Encephalomyelitis, West Nile Fever, Rabies, Tetanus, and Equine Infectious Anemia, pose significant challenges to the equine population. Equine healthcare products and services include diagnostics, such as CT systems and the EquiTrace platform, equine equipment, and regenerative therapies like stem cell therapy.

- Furthermore, horse farms and racing events are major consumers of these products and services due to the large equine populations and high-value animals involved. Parasite control is an essential aspect, with parasiticides used to prevent and treat parasitic infestations. Skilled veterinarians play a crucial role, providing preventative care, diagnosing and treating diseases, and ensuring the overall well-being of horses. E-commerce platforms have made it easier for equine industry participants to access and purchase products, enabling convenient and efficient transactions. The equine industry continues to innovate, with developments in areas such as bio-thermo microchips and advanced diagnostic technologies contributing to improved outcomes.

What are the market trends shaping the Equine Healthcare Industry?

Adoption of new technologies is the upcoming market trend.

- The market is experiencing significant growth due to increasing animal health spending and the adoption of advanced technologies. Animal healthcare, including equine care, is a critical sector with a substantial equine population requiring preventative measures and treatment for various diseases. Equine diseases such as Equine encephalomyelitis, Equine influenza, Equine herpes, Equine infectious anemia, Venezuelan equine encephalomyelitis, West Nile fever, Rabies, and Tetanus continue to pose challenges, necessitating the development of new vaccines, medicinal feed additives, parasiticides, and anti-inflammatory and analgesic drugs. Advancements in diagnostics, including CT systems and the EquiTrace platform, enable early detection and effective treatment. E-commerce platforms facilitate the sale of equine healthcare products, including anti-infectives and regenerative therapies like stem cell therapy.

- Furthermore, horse farms and racing events are significant consumers of equine healthcare products and services. Animal insurance and equine veterinary practitioners play a crucial role in ensuring the well-being of horses. companies in the equine healthcare industry are investing in research and development to introduce innovative solutions. For instance, Arenus Animal Health is focusing on bio-thermo microchips for temperature monitoring and stem cell therapy. IDEXX Laboratories and Zoetis are expanding their diagnostic offerings with AI applications for dermatology and equine fecal analysis. These trends will drive The market during the forecast period.

What challenges does the Equine Healthcare Industry face during its growth?

High costs associated with equine healthcare are key challenges affecting the industry growth.

- The market encompasses a range of products and services designed to maintain the health and wellbeing of horses. Animal healthcare spending in this sector is driven by various factors, including the need for analgesics, animal insurance, animal vaccines, anti-infectives, and anti-inflammatory medications. Horses are prone to several diseases, such as equine encephalomyelitis, equine influenza, equine herpes, tetanus, rabies, West Nile fever, and equine infectious anemia. To ensure effective diagnosis and treatment, equine veterinary practitioners utilize advanced diagnostic tools, such as CT systems and the EquiTrace platform. Equine care also involves parasite control through parasiticides and medicinal feed additives. In addition, regenerative therapies, including stem cell therapy, are gaining popularity in equine healthcare. The high costs associated with equine healthcare are a significant challenge for horse owners.

- Furthermore, veterinary services, which include routine check-ups, vaccinations, and complex surgeries, require specialized expertise and advanced equipment, leading to higher fees. For instance, colic surgery can cost several thousand dollars, including pre-operative evaluations, anesthesia, surgical equipment, and post-operative care. Equine healthcare products, such as vaccines and medications, can also be expensive. For example, equine vaccination programs can cost several hundred dollars per horse annually. Additionally, specialized equine equipment, such as Bio Thermo microchips and Arenus animal health products, can be costly. E-commerce platforms have made it easier for horse owners to access equine healthcare products and services. Horse farms and racing events also play a crucial role in the equine healthcare industry by providing equine healthcare services and promoting preventative care programs. Overall, the market is dynamic, with ongoing research and development in areas such as diagnostics, pharmaceuticals, and equipment.

Exclusive Customer Landscape

The equine healthcare market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the equine healthcare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, equine healthcare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alltech Inc.

- Boehringer Ingelheim International GmbH

- Central Garden and Pet Co.

- Ceva Sante Animale

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc.

- Equine Products UK LTD.

- Esaote Spa

- Forte Healthcare Ltd.

- Hallmarq Veterinary Imaging Ltd.

- IDEXX LABORATORIES INC.

- Jacks Inc.

- Kemin Industries Inc.

- Land O Lakes Inc.

- Merck KGaA

- Peak Equine Health

- Scone Equine Group

- Thermo Fisher Scientific Inc.

- Vetoquinol SA

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of products and services designed to promote the health and well-being of horses. This market is driven by several factors, including the increasing popularity of horses as companions, the growth of the equine industry, and the need to address various health challenges that horses face. One significant trend in the market is the rising demand for preventative care. Horse owners are increasingly recognizing the importance of regular veterinary check-ups, vaccinations, and parasite control measures to maintain the health of their animals. This has led to an increase in demand for vaccines, anti-inflammatory drugs, and other preventative healthcare products. Another trend in the market is the use of advanced diagnostic tools and technologies. Diagnostic tools such as CT systems and imaging technologies are becoming increasingly common in equine healthcare, allowing veterinarians to diagnose conditions more accurately and effectively. Additionally, e-commerce platforms and telemedicine services are making it easier for horse owners to access veterinary care and order healthcare products from the comfort of their own homes. The market is also witnessing the emergence of new technologies and treatments.

For instance, regenerative therapies such as stem cell therapy are gaining popularity for their ability to promote healing and improve the overall health of horses. Medication delivery systems, such as bio-thermo microchips, are also being developed to make medication administration more convenient and effective. Despite these trends, the market faces several challenges. One major challenge is the prevalence of various diseases that affect horses, such as equine encephalomyelitis, equine influenza, and equine herpes. These diseases can have significant economic and health consequences for horse owners and the equine industry as a whole.

Additionally, the high cost of equine healthcare and the need for skilled veterinarians are also major challenges for the market. In summary, the market is a dynamic and evolving industry that is driven by the need to promote the health and well-being of horses. Preventative care, advanced diagnostic tools, and new technologies are key trends in the market, while diseases and the high cost of healthcare remain significant challenges. Skilled veterinarians and equine industry participants play a crucial role in addressing these challenges and ensuring the health and well-being of horses.

|

Equine Healthcare Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 582.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Key countries |

US, China, Mexico, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Equine Healthcare Market Research and Growth Report?

- CAGR of the Equine Healthcare industry during the forecast period

- Detailed information on factors that will drive the Equine Healthcare growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the equine healthcare market growth of industry companies

We can help! Our analysts can customize this equine healthcare market research report to meet your requirements.