ETF Market Size 2025-2029

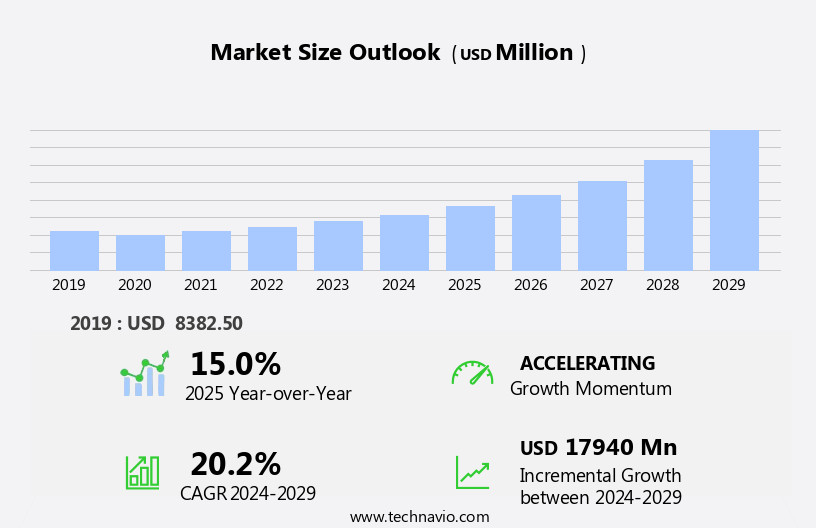

The ETF market size is forecast to increase by USD 17.94 billion at a CAGR of 20.2% between 2024 and 2029.

- The market continues to experience robust growth, with increasing institutional adoption and investor preference for cost-effective, diversified investment solutions. One of the key drivers propelling this market forward is the expansion of bond ETFs, blockchains which now account for over one-third of the total assets under management. This trend is expected to persist, as fixed income securities offer attractive yields in the current low-interest-rate environment. However, the market is not without its challenges. A significant concern is the potential for transaction risks, particularly in illiquid securities. This risk can lead to price discrepancies between the ETF's net asset value and its market price, potentially resulting in losses for investors.

- Additionally, market volatility and sudden price movements can exacerbate these risks, making it crucial for market participants to closely monitor market conditions and adjust their strategies accordingly. Companies seeking to capitalize on the growth opportunities in the market while mitigating transaction risks may consider focusing on liquid securities and implementing robust risk management strategies.

What will be the Size of the ETF Market during the forecast period?

- The exchange-traded fund (ETF) market continues to evolve, integrating advanced technologies and applications across various sectors. Machine learning algorithms enhance the investment process, enabling more precise index construction in fixed income ETFs. Currency ETFs leverage technology to offer real-time exposure to foreign exchange markets. Small businesses benefit from scalability and affordability, with increasing numbers turning to ETFs for diversified investment opportunities. Service providers and financial institutions collaborate to ensure financial market stability, offering innovative solutions for passive investing strategies, including index funds and index mutual funds.

- The integration of artificial intelligence and blockchain technology further enhances ETF offerings, reducing transaction costs and improving security. The ongoing unfolding of market activities reveals evolving patterns in trade finance, international trade, and asset management. ETFs continue to adapt, providing investors with efficient and cost-effective investment vehicles.

How is this ETF Industry segmented?

The etf industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Fixed income ETF

- Equity ETF

- Commodity ETF

- Real estate ETF

- Others

- Product Type

- Large cap ETFs

- Mega cap ETFs

- Mid cap ETFs

- Small cap ETFs

- End-User

- Retail Investors

- Institutional Investors

- Investment Type

- Active

- Passive

- Distribution Channel

- Brokerage Platforms

- Direct Sales

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Switzerland

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

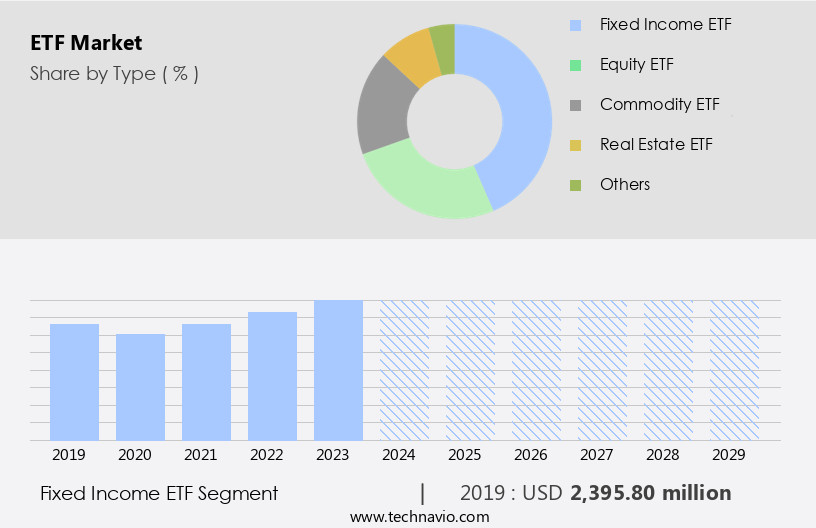

The fixed income etf segment is estimated to witness significant growth during the forecast period.

In the dynamic securities markets of 2024, the fixed income Exchange-traded fund (ETF) emerged as a leading investment choice. This type of ETF, which invests in various fixed-income securities like corporate, municipal, and treasury bonds, is traded on a centralized stock exchange. In contrast, most corporate bonds are sold through bond brokers, limiting bond buyers' exposure to the stock exchange. Fixed income ETFs, however, provide extensive exposure, enabling investors to participate in the stock exchange's activity. These ETFs employ various technologies, such as Optical Character Recognition and Machine Learning, to ensure efficient trade processing and risk management.

Additionally, the integration of Blockchain technology enhances security and transparency. Fixed income ETFs cater to diverse investor needs, including small businesses seeking scalability and financial institutions aiming for financial market stability. The market offers various categories, such as Government Bond ETFs, which invest in government securities, and Currency ETFs, which provide exposure to foreign currencies. Furthermore, Real Estate ETFs, Commodity ETFs, and Alternative Trading Funds expand the investment universe. Service providers play a crucial role in facilitating these investment solutions, ensuring affordability through passive investing strategies and competitive transaction costs. Trade agreements and international trade contribute to the growth of the fixed income the market.

Assets under Management in the sector continue to increase, driven by the participation of Fintech organizations and Financial Institutions. Passive investment strategies, such as Index funds and Index mutual funds, have gained popularity due to their Net Asset Value alignment with the underlying market. Fixed income ETFs' flexibility, affordability, and accessibility make them an essential component of the securities markets.

The Fixed income ETF segment was valued at USD 2.4 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

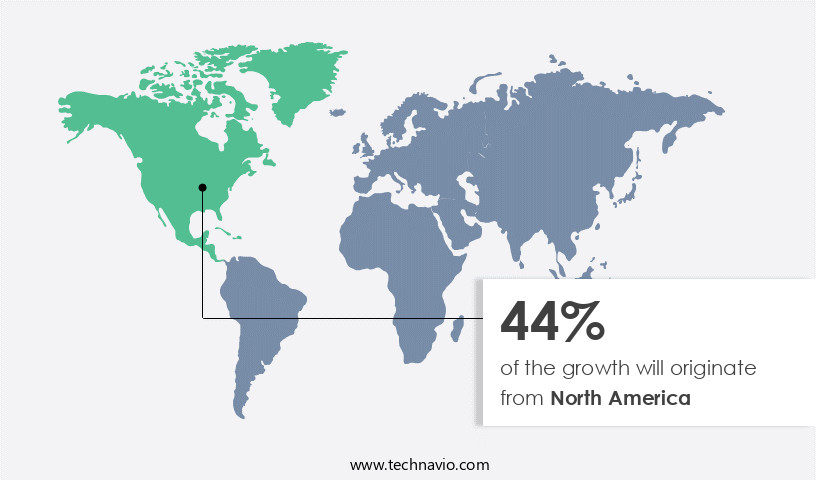

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America has witnessed substantial growth, holding a significant market share in 2024. Assets under management in U.S. Exchange-traded funds (ETFs) surpassed USD10 trillion for the first time, underpinning the increasing investor preference for these securities. This trend is attributed to ETFs' flexibility, cost efficiency, and diverse investment options, including equity, fixed income, commodity, currency, real estate, and alternative trading funds. In 2024, active ETFs accounted for approximately 27% of the industry inflows, totaling USD299 billion, indicating investors' growing interest in actively managed funds that may outperform the market. ETFs' appeal stems from their tax efficiency, transparency, and access to centralized stock exchange platforms.

Key technologies like machine learning, artificial intelligence, blockchain, and optical character recognition have further enhanced ETFs' functionality and investor experience. Moreover, the market caters to various financial institutions, small businesses, and international trade, offering affordable investment opportunities through passive investment strategies, such as index funds and index mutual funds. Government support and trade agreements have also contributed to the market's stability and scalability, making it an attractive investment option for financial institutions and individual investors alike. Fintech organizations have played a crucial role in facilitating ETF trading, reducing transaction costs, and providing real-time Net Asset Value information.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of ETF Industry?

- Market liquidity plays a pivotal role in driving market functionality and efficiency by facilitating the buying and selling of securities in a timely and orderly manner.

- ETFs, or Exchange-Traded Funds, are known for their high liquidity in the global financial market. This ease of buying and selling is due to their composition in large-cap and mega-cap assets, which have substantial trading volumes. The asset class offers investors a diverse range of options, including equities and fixed income, both of which are highly liquid. The liquidity of an ETF is influenced by the trading volume of the underlying stocks. Fintech organizations are increasingly utilizing artificial intelligence and advanced analytics to optimize transaction costs for ETF investors.

- While Index mutual funds continue to be popular, ETFs provide the advantage of trading throughout the day at a price equal to the net asset value. As the asset under management in the market continues to grow, it is essential for investors to consider the liquidity of their chosen ETF to minimize market impact and maximize returns.

What are the market trends shaping the ETF Industry?

- The trend in the financial market is shifting towards the growth of bond exchange-traded funds (ETFs). This development reflects the increasing demand for fixed income investment vehicles that offer both liquidity and diversification benefits.

- The exchange-traded product (ETP) market, specifically bond ETFs, has experienced substantial growth in recent years due to their cost efficiency and diversification benefits. Compared to traditional mutual funds, bond ETFs offer lower expense ratios, making them a more economical choice for investors seeking fixed income exposure. Furthermore, bond ETFs provide diversification by granting access to a broad range of bonds, including government, corporate, and municipal issues. This risk mitigation and stable return profile is especially desirable during market volatility. Advancements in technology, such as big data and computer-built ETFs, have also contributed to the market's expansion.

- Optical Character Recognition (OCR) technology enables automated data processing and analysis, improving operational efficiency and reducing errors. Additionally, alternative trading funds, like bond ETFs, have gained traction due to their ability to offer more flexibility and transparency compared to traditional mutual funds. Innovative technologies, such as blockchain, are expected to further revolutionize the securities markets by enhancing security, reducing counterparty risk, and streamlining trade agreements. Equity ETFs have already adopted these advancements, and bond ETFs are likely to follow suit, further increasing their appeal to investors.

What challenges does the ETF Industry face during its growth?

- Transaction risks pose a significant challenge to the industry's growth, requiring continuous attention and effective risk management strategies to mitigate potential threats and ensure business continuity.

- Exchange-traded funds (ETFs), including those focusing on fixed income and currencies, offer small businesses effective tools for managing transaction risks in today's globalized financial markets. Machine learning algorithms can help identify potential risks and optimize investment strategies in real-time, enhancing financial market stability. Service providers play a crucial role in facilitating the use of ETFs, ensuring security and scalability for businesses. By investing in an ETF, a corporation can hedge against currency fluctuations and reduce the impact of transaction risks on its financial statements.

- The ability to trade ETFs on an exchange, as opposed to over-the-counter markets, adds transparency and liquidity to the investment process. ETFs enable small businesses to efficiently manage transaction risks, allowing them to focus on their core operations while maintaining financial stability.

Exclusive Customer Landscape

The etf market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the etf market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, etf market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allianz SE - This firm specializes in Exchange-Traded Fund (ETF) services, providing investors with tools to mitigate downside portfolio risk. Our offerings include Buffered Outcome ETFs, which enable investors to capitalize on equity growth opportunities while minimizing market volatility. These innovative investment solutions are designed to help manage risk, offering a strategic approach to portfolio diversification. By participating in potential equity gains while safeguarding against potential losses, investors can pursue long-term financial objectives with increased confidence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allianz SE

- Amundi Austria GmbH

- Betterment LLC

- BlackRock Inc.

- Blackstone Inc

- FMR LLC

- Invesco Ltd.

- JPMorgan Chase and Co.

- Mirae Asset Securities Co. Ltd.

- Morgan Stanley

- Morningstar Inc.

- State Street Corp.

- The Bank of New York Mellon Corp.

- The Charles Schwab Corp.

- The Goldman Sachs Group Inc.

- The Vanguard Group Inc.

- UBS Group AG

- Wealthfront Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in ETF Market

- In February 2023, BlackRock, the world's largest asset manager, launched iShares MSCI USA Sustainable Impact ETF, marking a significant expansion of its sustainable investment offerings (BlackRock press release). This ETF aims to provide investors with exposure to U.S. Companies that have a positive impact on the environment and society, while also generating competitive returns.

- In March 2024, Vanguard, another leading player in the ETF industry, announced a strategic partnership with Google Cloud to enhance its digital capabilities and improve the investor experience (Vanguard press release). This collaboration involves integrating Google Cloud's technology into Vanguard's platforms, allowing for more efficient data processing and advanced analytics for its ETF offerings.

- In May 2024, Invesco acquired PowerShares Capital Management, a major ETF provider, from BlackRock for approximately USD1.2 billion (Bloomberg). This acquisition expanded Invesco's ETF offerings and strengthened its position in the competitive the market.

- In November 2025, the European Securities and Markets Authority (ESMA) approved the European the market Infrastructure Regulation (EMIR), which aims to enhance transparency and risk management in the European the market (ESMA press release). The regulation requires ETF issuers to report trades in real-time and disclose additional information about their ETFs, promoting greater market efficiency and investor protection.

Research Analyst Overview

The market continues to evolve, with various types of exchange-traded products gaining traction among institutional and individual investors. Index funds, including real estate and fixed income ETFs, have become popular choices for passive investment strategies due to their affordability and ability to track market indices. Commodity ETFs, representing physical commodities, have seen increased demand as investors seek diversification and hedging opportunities. Currency ETFs provide exposure to foreign currencies, while alternative trading funds and computer-built ETFs offer innovative investment solutions. Transaction costs are a critical consideration for investors, with mutual funds and ETFs offering competitive fees. Government support and financial market stability have also contributed to the growth of investment funds, including ETFs.

Physical ETFs, which hold the underlying assets, have gained favor due to their transparency and potential for tax efficiency. Passive investment strategies, such as index funds and ETFs, have become increasingly prevalent in the financial landscape. Exchange-traded products, including commodity and currency ETFs, provide investors with access to various asset classes, enabling them to manage risk and enhance portfolio diversification. Fixed income ETFs offer investors exposure to the bond market, while passive investment strategies have gained popularity due to their lower transaction costs and ease of use. The market continues to expand, offering investors a wide range of investment opportunities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled ETF Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.2% |

|

Market growth 2025-2029 |

USD 17940 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, Canada, UK, Germany, France, China, The Netherlands, Switzerland, South Korea, Japan, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this ETF Market Research and Growth Report?

- CAGR of the ETF industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the etf market growth of industry companies

We can help! Our analysts can customize this etf market research report to meet your requirements.