Exosome Diagnostics And Therapeutics Market Size 2025-2029

The exosome diagnostics and therapeutics market size is forecast to increase by USD 1.01 billion, at a CAGR of 26.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the advancements in exosome research and technology. Exosomes, small extracellular vesicles, carry bioactive molecules from cells, making them promising diagnostic and therapeutic tools. The collection of exosomes is becoming more sophisticated, with methods such as ultracentrifugation, size exclusion chromatography, and immunoaffinity capture gaining popularity. However, this market faces a substantial challenge in the form of stringent regulatory approval processes for product launches. The regulatory bodies require extensive clinical trials and rigorous testing to ensure the safety and efficacy of exosome-based diagnostics and therapeutics.

- This not only increases the time and cost of bringing these products to market but also poses a significant barrier for new entrants. Companies seeking to capitalize on the opportunities in this market must navigate these challenges effectively by investing in robust research and development programs, collaborating with regulatory agencies, and building strong partnerships with key industry players.

What will be the Size of the Exosome Diagnostics And Therapeutics Market during the forecast period?

The market continues to evolve, driven by advances in technology and research. Exosomes, small extracellular vesicles, play a crucial role in intercellular communication and have emerged as potential diagnostic and therapeutic agents. The market encompasses various sectors, including safety, industry standards, exosome-mediated drug delivery, intellectual property, therapeutics, cancer therapy, regenerative medicine, biocompatibility, RNA sequencing, personalized medicine, gene therapy, characterization, tracking, and targeted drug delivery. Exosome safety and industry standards are paramount, with ongoing efforts to ensure consistency and reliability in production and application. Exosome-mediated drug delivery offers a promising avenue for overcoming challenges in traditional drug delivery methods, while intellectual property protections shape the competitive landscape.

Exosome therapeutics, particularly in cancer and regenerative medicine, are under intensive investigation. Biocompatibility, RNA sequencing, and personalized medicine are key areas of focus for improving efficacy and precision. Exosome-mediated gene therapy holds potential for revolutionary treatments, while characterization and tracking methods enable a better understanding of their role in cell signaling and imaging techniques. Exosome manufacturing, liquid biopsy, data analysis, clinical trials, engineering, microfluidic devices, proteomics, nanomaterials, profiling, diagnostic panels, efficacy, and immunotherapy are all integral components of this dynamic market. The regulatory landscape continues to unfold, shaping the future of exosome-based applications.

How is this Exosome Diagnostics And Therapeutics Industry segmented?

The exosome diagnostics and therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Diagnostic

- Therapeutic

- End-user

- Research and academic institutes

- Pharmaceutical and biotechnology companies

- Commercial

- Hospitals and Clinics

- Diagnostic Centers

- Cancer Institutes

- Other Healthcare Providers

- Product Type

- Instruments

- Reagents/Kits

- Software

- Source

- Stem Cells

- Blood

- Urine

- Technology

- Ultracentrifugation

- Flow Cytometry

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The diagnostic segment is estimated to witness significant growth during the forecast period.

Exosomes, small extracellular vesicles, play a significant role in various physiological and pathological processes, including immunological responses, cancer, cardiovascular disease, and abnormal pregnancies. Early detection and precise diagnosis are crucial for patients with malignancies or precancerous lesions, and non-invasive liquid biopsy using exosomes demonstrates substantial benefits. Exosomes can be isolated from various body fluids, ensuring stability and preserving their unique biomolecular cargo, which includes proteins, lipids, DNA, and RNA. Exosome research tools and technologies, such as mass spectrometry, bioinformatics, and nanomaterials, facilitate characterization, tracking, and targeted drug delivery. Exosomes' diagnostic potential lies in their ability to carry tumor-specific biomarkers, enabling early cancer detection and monitoring disease progression.

Tumor-derived exosomes (TDEs) are crucial for the development of metastatic niches, immune evasion, and tumor growth, suggesting their potential utility in cancer diagnosis and prognosis. Exosome-based diagnostics and therapeutics are gaining momentum in the research community, with a focus on precision medicine, immune modulation, and drug delivery. Exosome-mediated cell communication and gene therapy hold promise for regenerative medicine and cancer therapy. Exosome-based vaccines, therapeutics, and nanomedicine are under development, with the potential to revolutionize healthcare by providing personalized, effective, and safe treatments. Exosome safety, quality control, and industry standards are essential considerations in the development and commercialization of these innovative technologies.

The regulatory landscape for exosome-based products is evolving, with increasing investment and collaboration between academia and industry. Exosome research continues to uncover new insights into their role in various diseases and potential therapeutic applications. The diagnostic segment held the highest market share in 2024, underscoring the importance of early and precise diagnosis in healthcare. The market's activity and evolving patterns reflect the growing recognition of exosomes' potential as valuable tools in personalized medicine, drug development, and disease understanding.

The Diagnostic segment was valued at USD 100.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the rising prevalence of chronic and infectious diseases, particularly cancer. According to the Centers for Disease Control and Prevention (CDC), the number of new cancer cases in the US increased by 24% among men to over 1 million cases between 2010 and 2022. This increasing demand for research and development of new drugs has fueled the need for advanced exosome research products. Factors driving market growth include the growing number of cancer cases, the adoption of technologically advanced biopsy tests, an aging population, high spending on cancer screening, and the increasing number of biotechnology and pharmaceutical companies investing in new cancer treatments.

Exosome research is crucial in the development of personalized medicine, diagnostics, and therapeutics. Exosome toxicology, metabolomics, and genomics are essential in understanding the role of exosomes in disease progression and response to therapy. Isolation, stability, and quality control are critical factors in ensuring accurate and reliable exosome-based diagnostics and therapeutics. Exosome-based precision medicine, vaccines, and immunotherapy are at the forefront of innovative treatments. Exosome research tools, such as mass spectrometry, bioinformatics, and imaging techniques, facilitate the characterization and tracking of exosomes. Exosome-mediated cell communication, drug delivery, and gene therapy hold significant potential in therapeutic applications. Regulatory landscape and safety concerns are crucial in the development and adoption of exosome-based diagnostics and therapeutics.

Exosome nanomedicine, liquid biopsy, and clinical trials are essential in the development of exosome-based therapeutics. Manufacturing, storage, and delivery systems are crucial in ensuring the efficacy and biocompatibility of exosome-based therapeutics. Overall, the market in North America is experiencing significant growth and innovation, driven by the increasing demand for personalized and advanced treatments.

Market Dynamics

The Exosome Diagnostics Market and Exosome Therapeutics Market are rapidly expanding, leveraging the unique capabilities of exosomes. In diagnostics, liquid biopsy exosomes offer a non-invasive approach for conditions like cancer diagnostics exosomes, identifying crucial exosome biomarkers. For therapeutics, engineered exosomes are at the forefront of targeted drug delivery exosomes and regenerative medicine exosomes, holding promise for conditions such as neurodegenerative diseases exosomes and cardiovascular diseases exosomes. Core to this progress are advanced techniques for exosome isolation and exosome characterization, which are vital for developing effective exosome therapeutic products and user-friendly exosome diagnostic kits. The intense exosome research by exosome companies is driven by exosome engineering technology and the pursuit of personalized medicine exosomes, with a focus on achieving scalable exosome production to meet future demands.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Exosome Diagnostics And Therapeutics Industry?

- Exosome therapeutics research is the primary catalyst fueling market growth.

- The market is experiencing significant growth due to the increasing research focus on exosomes for novel treatment methods. Exosomes, which are nanovesicles released by cells, have gained attention in various fields, including cardiovascular diseases (CVDs), exosome biogenesis, and exosome pharmacology. Research institutions worldwide are actively investigating the potential of exosomes in CVDs, such as Shanghai Jiao Tong University and Nanjing Medical University in China. Exosomes hold promise in various applications, including exosome-based vaccines, exosome immune modulation, exosome microenvironment, and exosome-mediated cell communication. Furthermore, the regulatory landscape is evolving to support the development of exosome-based diagnostics, exosome-targeted therapy, and exosome drug development.

- For instance, Beni-Suef University in Egypt is researching the effect of microvesicles and exosome therapy on beta-cell mass in type I diabetes, while Fujian Medical University in China is exploring the potential of MSC-derived exosomes for multiple organ dysfunction. Exosome research tools and exosome storage are essential components of the market, enabling researchers to isolate, characterize, and study exosomes effectively. Additionally, exosome nanomedicine and exosome delivery systems are gaining traction, offering potential solutions for targeted drug delivery and overcoming challenges associated with traditional drug delivery methods. In conclusion, the market is poised for growth, driven by the promising potential of exosomes in various applications and the ongoing research efforts to unlock their full potential.

What are the market trends shaping the Exosome Diagnostics And Therapeutics Industry?

- Advanced technology significantly influences the exosome collection market, with innovations being the current market trend. The use of sophisticated methods for exosome isolation and purification is a key focus in this rapidly advancing field.

- Exosomes, small extracellular vesicles, are gaining significant attention in the diagnostics and therapeutics industry due to their potential in cancer therapy, regenerative medicine, and personalized medicine. The safety and biocompatibility of exosomes are crucial, and industry standards ensure their purity and consistency. Exosome characterization, tracking, and intellectual property protection are essential for their therapeutic applications. Advancements in exosome research include the use of microfluidic technology for more effective exosome isolation. This technology allows for manipulating small fluid volumes through microchannels with dimensions ranging from tens to hundreds of micrometers. The unique functionality of microfluidic devices has not been achievable with traditional methods.

- Another technology, nanoparticle tracking analysis (NTA), is used for exosome tracking in cancer therapy. NTA determines the concentration and size distribution of particles, contributing to the growth of the market. Exosome-mediated drug delivery and gene therapy are promising areas of research. Exosomes can be engineered to carry therapeutic RNA or drugs, allowing for targeted delivery and minimizing side effects. The potential of exosome-based therapies in personalized medicine is immense, as they can be isolated from individual patients and used for disease diagnosis and treatment. In conclusion, The market is expected to grow significantly due to the adoption of advanced technologies for exosome collection and isolation, the potential of exosome-mediated drug delivery and gene therapy, and the increasing demand for personalized medicine.

- The focus on exosome safety, biocompatibility, and characterization will ensure the success of this emerging field.

What challenges does the Exosome Diagnostics And Therapeutics Industry face during its growth?

- The strict regulatory approval process for product launches poses a significant challenge and significantly impacts industry growth.

- Exosomes, small extracellular vesicles, are gaining significant attention in the healthcare industry due to their potential applications in diagnostics and therapeutics. Exosome immunotherapy, a promising area, utilizes exosomes as delivery vehicles for therapeutic agents. However, manufacturing exosomes at a large scale while maintaining their integrity is a challenge. GMP compliance is crucial for exosomes in clinical trials, with key issues being the upstream cell cultivation process, downstream purification process, and exosome quality control. Regulatory approval is a complex and unpredictable process, requiring companies to adhere to stringent regulations and verify safety and efficacy during clinical trials. Exosome data analysis, including proteomics, nanomaterials, and imaging techniques, is essential for understanding their role in cell signaling and disease progression.

- Advancements in exosome engineering, microfluidic devices, and diagnostic panels are enhancing their potential in disease diagnosis and treatment. Despite these challenges, the exosome market is expected to grow due to their potential in various applications, including cancer therapy and neurological disorders.

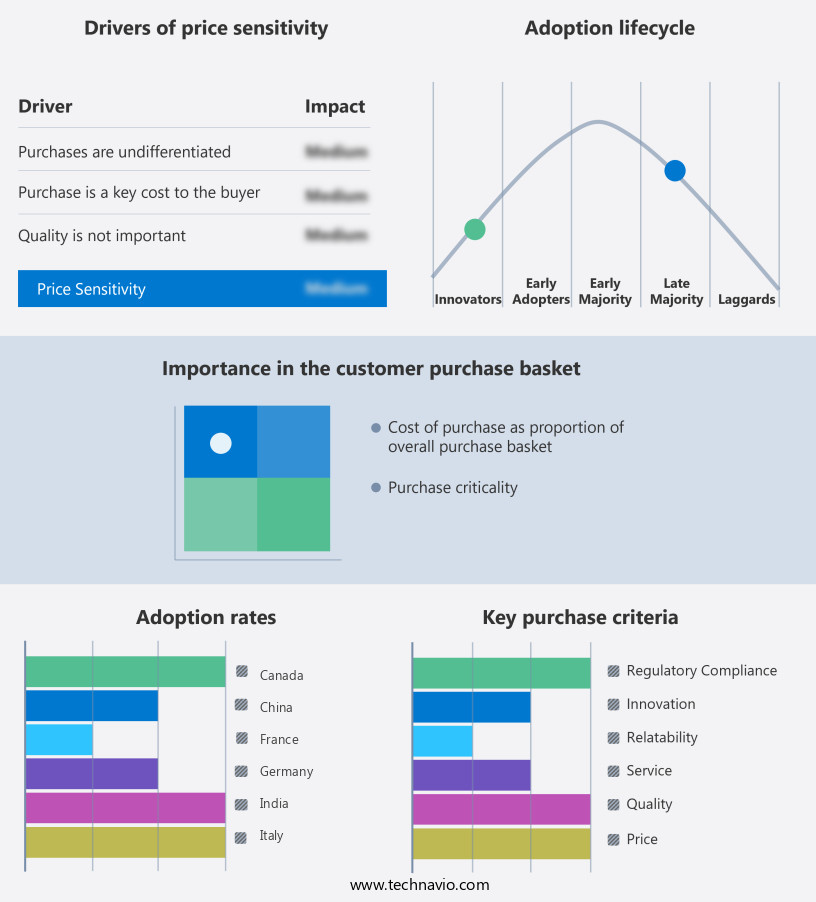

Exclusive Customer Landscape

The exosome diagnostics and therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the exosome diagnostics and therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, exosome diagnostics and therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aegle Therapeutics - The company specializes in the development and application of exosome diagnostics and therapeutics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aegle Therapeutics

- Aethlon Medical Inc.

- Aruna Bio Inc.

- Bio-Techne Corporation

- Capricor Therapeutics Inc.

- Codiak BioSciences

- Evox Therapeutics Ltd.

- Exosome Diagnostics (Bio-Techne)

- Hologic Inc.

- Lonza Group Ltd.

- Miltenyi Biotec

- NanoSomiX

- Norgen Biotek Corp.

- PureTech Health

- Qiagen N.V.

- RoosterBio Inc.

- Sartorius AG

- System Biosciences

- Thermo Fisher Scientific Inc.

- VivaZome Therapeutics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Exosome Diagnostics And Therapeutics Market

- In January 2023, Exosome Diagnostics, a leading company in the exosome diagnostics market, announced the launch of its new liquid biopsy test, ExoDx Prostate IntelliScore (EPI-prostate), which utilizes exosomal RNA biomarkers to aid in the detection and monitoring of prostate cancer. This innovative product marks a significant advancement in the field of liquid biopsy diagnostics (Exosome Diagnostics Press Release, 2023).

- In March 2024, a major strategic collaboration was announced between F. Hoffmann-La Roche Ltd and Exosome Diagnostics. Under this partnership, Roche will integrate Exosome Diagnostics' liquid biopsy tests into its diagnostic portfolio, expanding its offerings in the oncology segment. This collaboration is expected to significantly boost Exosome Diagnostics' market presence (Roche Press Release, 2024).

- In May 2025, Exosome Therapeutics, a subsidiary of Exosome Diagnostics, secured a USD50 million Series C financing round. The funds will be used to advance the development of its exosome-based therapeutics for neurodegenerative diseases and cancer. This substantial investment underscores the growing potential of exosome therapeutics (Exosome Therapeutics Press Release, 2025).

- In October 2024, the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation to Exosome Diagnostics' ExoDx Lung (MUC16) test. This designation accelerates the regulatory review process for this liquid biopsy test, which aims to detect early-stage lung cancer using exosomal biomarkers. The test's potential to improve patient outcomes makes it a significant development in the exosome diagnostics market (FDA Press Release, 2024).

Research Analyst Overview

- The market encompasses a range of applications, from exosome manufacturing and characterization to therapeutic interventions and diagnostics. Exosome genomics and proteomics offer insights into the genetic and protein content of these nanovesicles, enhancing our understanding of their role in intercellular communication and disease progression. Exosome safety, biocompatibility, and stability are critical considerations for their use in various applications, including exosome-mediated drug delivery and exosome-based vaccines. Exosome mass spectrometry and imaging techniques facilitate the identification and quantification of exosome-derived biomarkers, enabling the development of exosome diagnostic panels for disease detection and monitoring. Exosome nanomaterials and microfluidic devices contribute to the advancement of exosome-based personalized medicine and toxicology studies.

- Exosome pharmacology and immunotherapy explore the potential of exosomes as drug delivery vehicles and therapeutic agents, while exosome-mediated gene therapy holds promise for treating genetic disorders. Exosome quality control and efficacy assessment are essential for ensuring the reliability and success of these applications. Overall, the market continues to evolve, driven by advancements in technology and increasing interest in the therapeutic potential of these nanovesicles.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Exosome Diagnostics And Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.5% |

|

Market growth 2025-2029 |

USD 1010.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.4 |

|

Key countries |

US, India, Germany, Canada, UK, China, Japan, South Korea, France, Italy, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Exosome Diagnostics And Therapeutics Market Research and Growth Report?

- CAGR of the Exosome Diagnostics And Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the exosome diagnostics and therapeutics market growth of industry companies

We can help! Our analysts can customize this exosome diagnostics and therapeutics market research report to meet your requirements.