Farm Equipment Rental Market Size 2024-2028

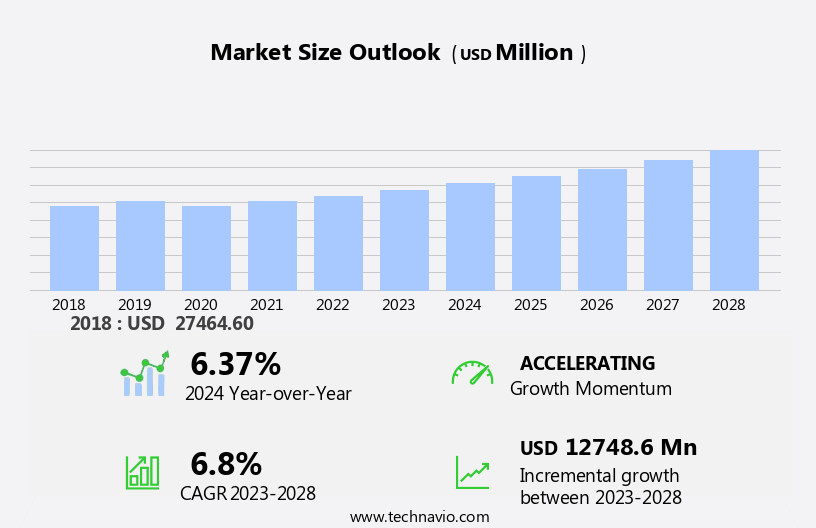

The farm equipment rental market size is forecast to increase by USD 12.75 billion at a CAGR of 6.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. Firstly, farmers are seeking cost-effective solutions to acquire specialized equipment, reducing their financial burden. Secondly, the increasing demand for food products necessitates the adoption of advanced farming techniques, which often require the use of specialized equipment. Furthermore, government initiatives are encouraging farmers to upgrade their equipment, leading to an increase in demand for rental services. Moreover, key capabilities of the farm equipment rental industry include industry-specific templates, quick deployment times, and mobile solutions. Equipment rental companies offer a wide range of assets, including agriculture tractors, harvesters, and planting equipment, to cater to the diverse requirements of farmers. These capabilities enable farmers to easily rent equipment, reducing downtime and increasing operational efficiency. Additionally, security and customer data protection are crucial considerations for rental companies, ensuring that farmers' information is kept confidential and secure. Integrations with other agricultural software and systems are also essential for seamless workflows and improved productivity. Overall, the market is an essential component of the agricultural industry, providing farmers with access to the latest technology and equipment while minimizing their capital expenditures.

What will be the Size of the Farm Equipment Rental Market During the Forecast Period?

- The market is a significant sector within the agricultural industry, providing farmers with access to specialized assets essential for cultivating and harvesting crops. This market caters to the varying needs of farmers, enabling them to rent equipment for short-term use, thereby reducing the burden of purchasing and maintaining expensive machinery. The integration of technology, such as ecommerce platforms and content management systems, has streamlined the rental process, making it more accessible and convenient.

- Furthermore, rental software solutions have become indispensable tools for equipment rental businesses. These systems facilitate equipment booking and reservation, inventory management, maintenance scheduling, purchasing, and rental agreements. The software's scalability ensures that businesses can efficiently manage their operations, regardless of their size. Maintenance services are an integral part of the market. Rental companies offer regular maintenance and repair schedules to ensure the equipment's optimal performance and longevity. This not only benefits the farmers by providing them with well-maintained equipment but also reduces their maintenance burdens. Specialized companies and diversified rental businesses cater to the unique needs of various farming operations.

How is this Farm Equipment Rental Industry segmented and which is the largest segment?

The farm equipment rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Tractors

- Harvesters

- Haying equipment

- Others

- Geography

- APAC

- China

- India

- Europe

- France

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

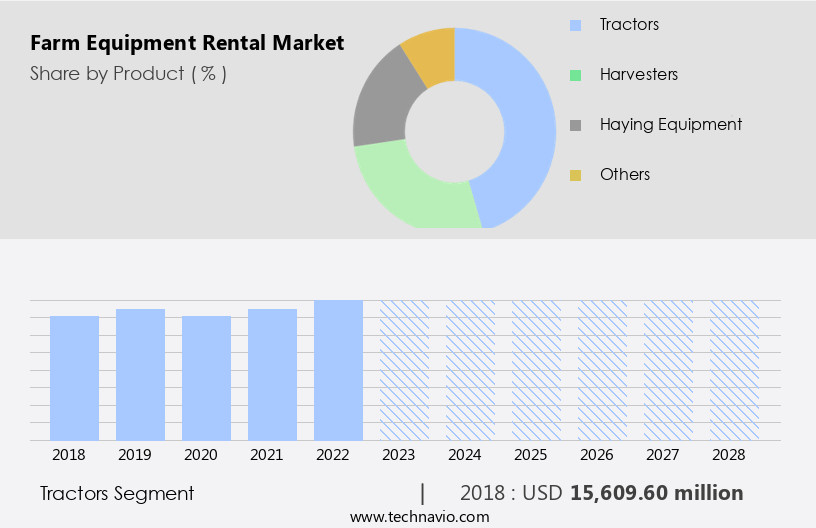

- The tractors segment is estimated to witness significant growth during the forecast period.

The tractor rental segment held a significant share in the market in 2023. The tractor's versatility and extensive usage in agriculture operations make it a popular choice among farmers for renting specialized equipment. With an increasing preference for lower capacity tractors, farm equipment manufacturers are introducing new models and making them available for rental. Mahindra and Mahindra, for instance, offer advanced tractor models through their brand Trringo. The expansion of custom hiring centers (CHCs) for tractors is anticipated to boost the growth of the tractor rental market In the US. These centers provide farmers with easy access to modern and efficient tractor models, enabling them to optimize their farming operations.

Get a glance at the Farm Equipment Rental Industry report of share of various segments Request Free Sample

The tractors segment was valued at USD 15.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, with a higher Compound Annual Growth Rate (CAGR) than the global market during the forecast period. This expansion can be attributed to the large population in countries like China and India, where agriculture is a significant source of livelihood for many. The increasing demand for food products due to population growth is driving the need for more efficient farming methods and the utilization of advanced farm equipment. Manufacturers In the region and local governments are addressing this demand by establishing Custom Hiring Centers (CHCs) to provide farmers with access to modern farm equipment on a rental basis.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Farm Equipment Rental Industry?

Need to reduce financial burden on farmers is the key driver of the market.

- Farming operations can significantly benefit from renting farm equipment, particularly for larger machinery such as agriculture harvesters, forage harvesters, and planting equipment. The expense of purchasing such equipment outright can be substantial, and the time it takes to recoup the investment may be lengthy for smaller farming operations. Instead, farmers can rent these machines at affordable rates, enabling them to focus on their core business activities. For example, Zimmerman Farm Service in Pennsylvania, USA, offers disc mower conditioners for approximately USD10 per acre and USD50 per day. As farm equipment ages, it eventually requires replacement. By renting equipment, farmers can stay updated with the latest technology and ensure their machinery is well-maintained through regular servicing.

- In addition, an app-based system can facilitate the rental process, allowing farmers to easily schedule equipment and receive health alerts or engine warnings. This approach can lead to increased efficiency in land development, sowing, and cultivation processes. Farmers can write off the rental costs against their annual tax returns, making this an economically viable solution for many.

What are the market trends shaping the Farm Equipment Rental Industry?

Growing need to meet rising demand for food products is the upcoming market trend.

- The global farming community has witnessed a significant rise In the consumption of fruits and vegetables in recent times. This trend can be attributed to the increasing number of individuals adopting vegetarian and vegan diets for ethical reasons. In countries like India, where a large portion of the population follows a vegetarian lifestyle, the demand for fruits and vegetables is substantial. In nations such as the United States, Canada, and the UK, the demand for these produce types is high due to the growing vegan population, particularly among the millennial demographic. Farmers In these regions require efficient and effective means to manage their equipment rental businesses to meet the increasing demand.

- Furthermore, equipment rental companies play a crucial role in catering to the farming community's equipment needs. To streamline their operations, these companies are adopting advanced technologies like eCommerce platforms, content management systems, rental software, and inventory management tools. These solutions enable farmers to easily book and reserve equipment online, manage maintenance and repair schedules, and collaborate with sales representatives. By implementing these technologies, rental companies can improve their operational efficiency, enhance customer satisfaction, and expand their market reach.

What challenges does the Farm Equipment Rental Industry face during its growth?

Growing government support for purchase of new farm equipment is a key challenge affecting the industry growth.

- In the agricultural sector, governments worldwide are taking steps to enhance crop production. The cost of fundamental farming tools and the application of technology are crucial factors that influence crop yields. To help farmers optimize their profits, various governments offer subsidies on agricultural machinery. For instance, the Agriculture and Farmers Welfare Department in India subsidizes the purchase of straw management equipment for farmers. Similarly, the Canadian federal and provincial governments grant sales tax relief on farm machinery and parts. Advancements in technology have led to the development of high-tech farm equipment for plant protection, harvesting and threshing, and post-harvest processes.

- Moreover, agro-processing industries have also benefited from these technological advancements, improving efficiency and productivity. However, the technology gap between developed and developing countries remains a challenge. To address this challenge, rental apps have emerged as a cost-effective solution for farmers. These apps offer access to high-tech farm equipment without the need for significant upfront investment. Additionally, tele-customer support services ensure that farmers receive expert advice and maintenance support, ensuring the optimal use of the equipment. By leveraging technology and government subsidies, farmers can increase their yields and remain competitive In the global agricultural market.

Exclusive Customer Landscape

The farm equipment rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the farm equipment rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, farm equipment rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALMACO

- Associated Supply Co. Inc.

- Cedar Street Sales and Rentals

- Deere and Co.

- Escorts Crop Solutions

- Flaman

- German Bliss Equipment Inc.

- Holmes Rental Station

- Mascoutah Equipment Co. Inc.

- Messicks Farm Equipment

- Pacific Ag Rentals

- Sandhills Global Inc.

- Simplex Tool Rental

- The Pape Group Inc.

- TINGA

- Titan Machinery Inc.

- Total Equipment Rental Inc.

- Zimmerman Farm Service Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to farmers' needs for specialized and expensive equipment, providing flexibility and reduced maintenance burdens. Equipment rental companies offer various solutions, including ecommerce platforms and content management systems, enabling farmers to easily book and reserve assets through rental software. Key capabilities include industry-specific templates, short deployment times, and mobile solutions for on-the-go booking. Rental software manages inventory, maintenance, repair schedules, and sales rep interactions, ensuring efficient operations. Customer data security is paramount, with integrations available for various applications. Specialized companies cater to diversified rental businesses, offering a wide range of farm-related machinery such as tractors, rotavators, and agriculture harvesters.

In addition, technological advancements, including app-based systems, monitor engine warnings, vehicle servicing, and health alerts, ensuring optimal farm productivity. Risk mitigation is crucial, with rental agreements and maintenance services ensuring equipment availability and reliability. Scalability is essential for meeting farmers' varying needs, from small farmers to large-scale operations. Environmental concerns are addressed through eco-friendly equipment and practices. Technological innovation reduces rental fees' fluctuations, making high-tech farm equipment accessible to more farmers. Tele-customer support services ensure quick problem resolution, enhancing the rental experience. The technology gap between rental companies and farmers is bridged through continuous technological innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 12.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.37 |

|

Key countries |

US, China, India, France, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Farm Equipment Rental Market Research and Growth Report?

- CAGR of the Farm Equipment Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the farm equipment rental market growth of industry companies

We can help! Our analysts can customize this farm equipment rental market research report to meet your requirements.