Feminine Hygiene Wash Market Size 2025-2029

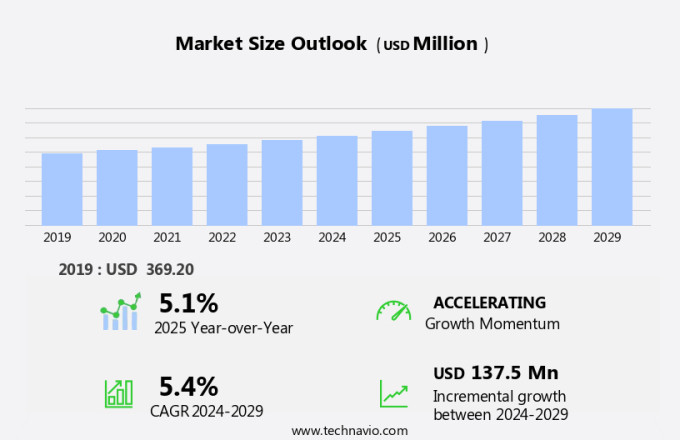

The feminine hygiene wash market size is forecast to increase by USD 137.5 million, at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by effective advertising and promotion strategies for these products. The increasing popularity of e-commerce platforms is also contributing to market expansion. However, there are challenges that the market faces, such as the potential negative consequences of certain feminine washes, including irritation and discomfort, and the presence of colorants, which may raise concerns among consumers. Producers must address these issues to maintain market competitiveness and consumer trust. Advertising efforts and e-commerce growth are key market trends shaping the market while addressing consumer concerns regarding product safety and efficacy remains a crucial challenge.

What will be the Size of the Feminine Hygiene Wash Market During the Forecast Period?

- The market caters to the unique needs of females during menstruation, focusing on security and comfort to ensure improved hygiene and reduce the risk of infections and discomfort. With the increasing female population and higher education levels, there is a growing demand for appropriate products that address the challenges of menstruation, such as leaks and daily activities. Rapid urbanization and open discussions around menstruation are leading to a normalization of the conversation, reducing the culture of shame and silence.

- Sustainability and environmental responsibility are also becoming important considerations In the market, with consumers seeking eco-friendly alternatives to disposable menstrual products, such as reusable menstrual cups. The market dynamics are influenced by factors including the physical and emotional well-being of females, the convenience and effectiveness of products, and the evolving social norms surrounding menstruation.

How is this Feminine Hygiene Wash Industry segmented and which is the largest segment?

The feminine hygiene wash industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Female teenager

- Female adults

- Product Type

- Liquid wash

- Foam wash

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various retail channels, including department stores, supermarkets, hypermarkets, pharmacies, and convenience stores. Companies employ marketing strategies, like branding through signages and promotional discounts, to boost sales. Retailers like Walmart and Walgreens have long been stocking these essential items. Market participants prioritize factors such as geographical reach, efficient inventory management, and seamless transportation for their operations. Female population growth, rapid urbanization, and higher education levels fuel demand for improved feminine hygiene solutions. The shift towards normalizing menstruation and open discussions about menstrual health contributes to the market's expansion.

Sustainability and environmental responsibility are emerging trends, with consumers seeking eco-friendly alternatives like reusable menstrual cups, cloth pads, and biodegradable tampons. The market is poised for growth, addressing the needs of females for security, comfort, and preventing leaks during daily activities. Concerns over health risks, discomfort, and physical and emotional well-being further fuel demand.

Get a glance at the Feminine Hygiene Wash Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 317.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

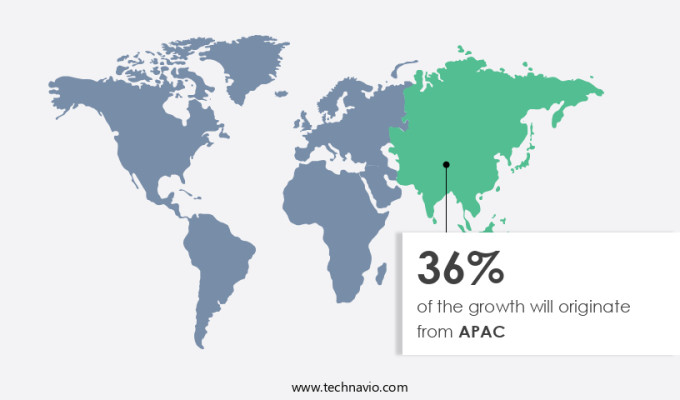

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region leads due to its large consumer base and production of a diverse range of feminine hygiene products. China, as a significant producer, offers affordable feminine hygiene washes. Emerging economies like India and China have a vast population of women with unmet needs for feminine hygiene products, presenting a lucrative market opportunity. Japan, the Philippines, and Indonesia are other major contributors due to increased product availability and strong distribution networks. Feminine hygiene washes are essential for maintaining security, comfort, and improved hygiene during menstruation. The risk of infections and discomfort associated with menstruation necessitates the use of appropriate products.

In addition, the female population, driven by rapid urbanization, higher education levels, and open discussions about menstruation, is increasingly demanding sustainable and eco-friendly alternatives to disposable menstrual products. The shift towards reusable menstrual cups, cloth pads, and biodegradable tampons addresses concerns about the environmental impact of disposable products made from synthetic materials and their contribution to non-biodegradable waste, pollution, and landfills. This trend prioritizes the female population's physical and emotional well-being while minimizing the ecological footprint.

Market Dynamics

Our feminine hygiene wash market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Feminine Hygiene Wash Industry?

Advertising and promotion of feminine hygiene wash products is the key driver of the market.

- The market encompasses a range of items designed to ensure the security and comfort of females during menstruation. These products cater to managing menstrual flow and mitigating leaks, enabling females to participate in daily activities with improved hygiene and reduced risk of infections. However, the use of certain products, such as feminine hygiene washes or douches, has been met with controversy. While manufacturers argue that these products maintain vaginal health, medical research indicates potential harm. The chemicals used In these wash products can lead to vaginal infections and irritation. To counteract this perception, manufacturers must focus on alternative strategies.

- This includes promoting the normalization of menstruation through open discussions and providing females with appropriate products that align with their cultural beliefs and values. Moreover, the growing female population, rapid urbanization, and higher education levels are driving the demand for eco-friendly menstrual products. Sustainability and environmental responsibility are increasingly important considerations for consumers. Reusable menstrual cups, cloth pads, and biodegradable tampons are gaining popularity due to their reduced ecological impact. However, the shift towards more sustainable options also presents challenges. Disposable menstrual products, made from synthetic materials, contribute significantly to non-biodegradable waste, pollution, and the depletion of ecosystems.

What are the market trends shaping the Feminine Hygiene Wash Industry?

The rapid growth of e-commerce is the upcoming market trend.

- The market encompasses a range of items designed to ensure the security and comfort of females during menstruation. These products cater to the needs of women during menstrual flow, addressing concerns of leaks, improved hygiene, and the risk of infections. With the increasing female population, higher education levels, and urbanization, there is a growing demand for these products. However, the cultural stigma surrounding menstruation and silence around open discussions about menstrual health can hinder the market growth. The shift towards sustainability and environmental responsibility is influencing consumer preferences. There is a heightened awareness of the ecological impact of disposable menstrual products, such as sanitary pads/napkins and tampons, made of synthetic materials, which contribute significantly to non-biodegradable waste and pollution.

- In response, reusable menstrual cups, cloth pads, and biodegradable tampons have gained popularity. The convenience of e-commerce platforms has made it easier for customers to access a variety of feminine hygiene products, including feminine hygiene wash, from the comfort of their homes. This not only simplifies daily activities but also allows manufacturers to expand their reach and increase brand visibility. As the market continues to evolve, it is essential to consider the environmental impact and promote the normalization of menstruation discussions to reduce the stigma surrounding menstrual health.

What challenges does the Feminine Hygiene Wash Industry face during its growth?

Negative consequences of feminine washes and presence of colorants is a key challenge affecting the industry growth.

- The market offers a variety of products designed to ensure security and comfort during menstruation. These products cater to the daily activities of females, addressing concerns related to leaks and improved hygiene. However, the use of certain feminine hygiene products, such as disposable menstrual pads and tampons, can pose risks. The synthetic materials and chemicals In these products, including phthalates and parabens, can disrupt the natural pH balance In the vagina and lead to health issues like bacterial vaginosis, pelvic inflammatory disease, and cervical cancer. Moreover, the disposable nature of these products contributes to environmental concerns, with significant waste generated from non-biodegradable materials ending up in landfills and posing a threat to ecosystems and marine life.

- In response to these concerns, there is a growing trend towards sustainable and eco-friendly alternatives, such as reusable menstrual cups, cloth pads, and biodegradable tampons. These products offer a more sustainable solution, reducing the environmental impact and promoting a culture of responsibility. The heightened awareness of the ecological impact of disposable menstrual products and the desire for improved menstrual health and hygiene have led to increased demand for these alternatives. Despite these benefits, there remains a social stigma surrounding menstruation and discussions about menstrual health and hygiene. This culture of silence and shame can prevent females from making informed choices about their menstrual health and the products they use.

Exclusive Customer Landscape

The feminine hygiene wash market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the feminine hygiene wash market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, feminine hygiene wash market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Albaad Deutschland GmbH - The company offers feminine hygiene wash products such as wipes, and maternity wipes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Be Bodywise

- COTTON HIGH TECH SL

- Daio Paper Corp.

- Diva International Inc.

- Edgewell Personal Care Co.

- Essity AB

- Hengan International Group Co. Ltd.

- Johnson and Johnson Services Inc.

- Kao Corp.

- Kimberly Clark Corp.

- Maxim Hygiene Products Inc.

- Nature Abani Biotic Pvt. Ltd.

- Organyc

- The Honest Co. Inc.

- The Procter and Gamble Co.

- TZMO SA

- Unicharm Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the growing demand for effective and eco-friendly solutions that ensure the daily needs of females during menstruation. This market is driven by several factors, including the desire for security, comfort, and improved hygiene. The increasing risk of infections and discomfort associated with menstruation has led to a heightened awareness of the importance of using appropriate products. The female population, particularly those in rapidly urbanizing areas, are becoming more educated about menstruation and the need for open discussions surrounding it. This cultural shift is leading to a normalization of menstruation and a reduction In the stigma surrounding it. Further, the availability of a wide range of products, from disposable menstrual pads and tampons to reusable menstrual cups and cloth pads, is contributing to this trend.

However, concerns regarding the environmental impact of disposable menstrual products are also influencing market dynamics. The use of synthetic materials and non-biodegradable waste, such as plastics and chemicals, in disposable products is leading to an ecological impact, including pollution and harm to marine life. This has resulted in a growing interest in sustainable alternatives, such as biodegradable tampons and reusable menstrual cups. Moreover, the trend towards environmental responsibility and sustainability is driving the adoption of eco-friendly menstrual hygiene products. In addition, the use of ceramics and other natural materials in the production of menstrual hygiene washes is becoming increasingly popular. These products offer a more sustainable alternative to disposable menstrual products and help reduce the amount of non-biodegradable waste that ends up in landfills.

|

Feminine Hygiene Wash Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market Growth 2025-2029 |

USD 137.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, Germany, UK, Canada, India, Brazil, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Feminine Hygiene Wash Market Research and Growth Report?

- CAGR of the Feminine Hygiene Wash industry during the forecast period

- Detailed information on factors that will drive the Feminine Hygiene Wash Market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the feminine hygiene wash market growth of industry companies

We can help! Our analysts can customize this feminine hygiene wash market research report to meet your requirements.