Feminine Probiotic Supplement Market Size 2025-2029

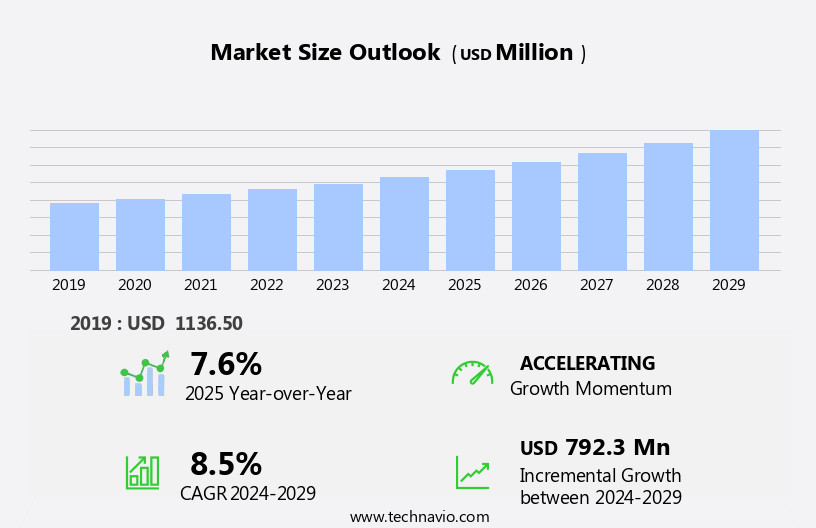

The feminine probiotic supplement market size is forecast to increase by USD 792.3 million at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prevalence of digestive problems among women. This trend is further fueled by the growing emphasis on research and development of feminine probiotic supplements, which cater specifically to the unique health needs of women. However, the market is not without challenges. Stringent government regulations and guidelines for feminine probiotic supplements pose significant hurdles for market entrants. These regulations ensure product safety and efficacy, but they also increase the cost of production and limit the number of players in the market. To capitalize on this opportunity, companies must invest in robust research and development programs to meet regulatory requirements and differentiate their offerings.

- Additionally, strategic partnerships and collaborations with regulatory bodies and research institutions can help companies navigate the regulatory landscape and gain a competitive edge. Overall, the market presents a compelling opportunity for companies seeking to address the unmet health needs of women while navigating the complex regulatory environment.

What will be the Size of the Feminine Probiotic Supplement Market during the forecast period?

- The feminine probiotic supplement market is thriving, propelled by rising consumer awareness and a shift toward holistic health. Probiotics, known as beneficial bacteria, support digestive health, immune modulation, and vaginal flora balance. Online retailers are meeting demand with diverse products like capsules, tablets, and yogurt, while consumers prioritize transparency through third-party testing and product certifications. Sustainable packaging is increasingly vital to minimize environmental impact.

- Innovations such as delayed release and advanced probiotic delivery systems ensure optimal potency, backed by clinical evidence highlighting inflammation reduction and antioxidant properties. Allergen information addresses diverse needs, while enteric coating protects probiotics for effective gut delivery, and prebiotic fiber enhances their growth. Emerging research on the gut-brain connection and probiotic microbiome analysis drives personalized supplement recommendations. Focus on intestinal permeability and probiotic trends underscores their role in immune system support and overall wellness, shaping a promising future.

How is this Feminine Probiotic Supplement Industry segmented?

The feminine probiotic supplement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Tablets

- Capsules

- Oral liquid

- Others

- Application

- Vaginal health

- Urinary tract health

- Bacterial vaginosis prevention

- Digestive health

- Immune support

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market for probiotic supplements, particularly those formulated for vaginal and immune system support, has witnessed notable growth. Traditional sales channels, including offline retailers such as Walmart, Target, Kmart, Walgreens, and CVS Pharmacy, have long been significant revenue generators. These establishments cater to the increasing awareness among women regarding their unique health requirements. Probiotic powders, an integral part of this market, are now commonly found in these stores. The digital landscape has also emerged as a crucial sales avenue. Social media marketing and digital marketing strategies have become essential tools for companies to reach consumers.

Clinical trials and research findings on the benefits of probiotics for vaginal health and immune system support further fuel consumer interest. As a result, companies are investing in these areas to expand their reach and customer base. Organic ingredients, a key trend in the health industry, have also found a place in the probiotic supplement market. Consumers are increasingly seeking natural and organic alternatives to traditional supplements. This trend is expected to continue, further driving market growth. In summary, the market for probiotic supplements, particularly those formulated for women's health and immune system support, is experiencing steady growth.

Traditional retailers and digital marketing channels are key sales avenues, with clinical trials and consumer trends shaping market dynamics. Organic ingredients are also gaining popularity, further expanding the market's reach.

The Offline segment was valued at USD 750.70 million in 2019 and showed a gradual increase during the forecast period.

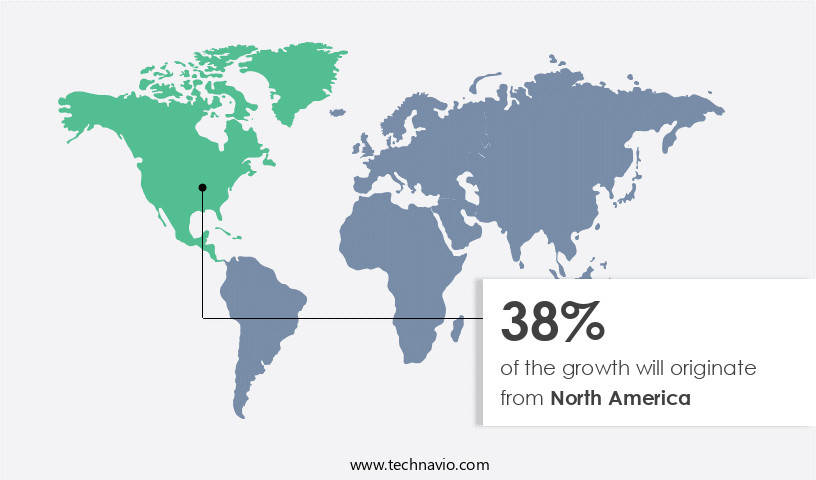

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth due to substantial investments in healthcare research and probiotic development. This region's strong distribution networks in countries like the US and Canada, coupled with the increasing focus of manufacturers on probiotics production, are significant driving factors. Notably, industry leaders such as Bayer AG and DuPont de Nemours Inc., both based in the US, contribute to the expansion of the regional market. Companies with extensive market experience and robust financials offering feminine probiotic supplements are also fueling the demand for these products.

Social media marketing and digital strategies play a crucial role in reaching consumers, particularly women seeking immune system support, organic ingredients, and solutions for vaginal health issues like yeast infections. Clinical trials and ongoing research further validate the efficacy of these supplements, bolstering consumer confidence and market growth.

Market Dynamics

The global women's health probiotic market is expanding, fueled by feminine probiotic supplements like vaginal health probiotics and gut health probiotics for women. Lactobacillus probiotic supplements and synbiotic supplements for women lead innovations, with personalized feminine probiotics and clean-label feminine probiotics gaining popularity. Probiotic gummies for women and probiotic capsules for feminine health ensure convenient delivery, while vegan feminine probiotic supplements cater to plant-based trends. Feminine probiotic supplements for vaginal health and best probiotics for women's digestive health address needs like natural probiotics for bacterial vaginosis prevention and probiotic supplements for women's hormonal balance. Multi-strain probiotics for women's health, delayed-release feminine probiotic capsules, and probiotics for women's immune system support drive the feminine probiotic market growth forecast, with science-backed probiotics for women's health ensuring consumer trust.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Feminine Probiotic Supplement Industry?

- The significant rise in the incidence of digestive issues serves as the primary catalyst for market growth in this sector.

- Probiotic supplements, containing beneficial bacteria strains, have gained significant attention in the health and wellness market due to their role in supporting the immune system. These supplements are particularly important for women's health, as they contribute to vaginal health and help prevent yeast infections. The use of organic ingredients in probiotic supplements adds to their appeal, as consumers increasingly prioritize natural and holistic health solutions. Clinical trials have shown that certain probiotic strains can effectively restore the balance of intestinal bacterial flora, improving digestion and overall health. Probiotic powders, an alternative to capsules, offer convenience and versatility in consumption.

- Social media marketing and digital channels have become essential tools for reaching potential customers and raising awareness about the benefits of probiotic supplements. Brands invest in targeted campaigns and influencer collaborations to engage their audience and build trust. The human microbiome, consisting of trillions of bacteria, plays a crucial role in maintaining a healthy digestive system. An imbalance of the good and bad bacteria can lead to digestive problems and other health issues. Probiotic supplements help restore this balance, making them a valuable addition to a healthy lifestyle.

What are the market trends shaping the Feminine Probiotic Supplement Industry?

- The emerging market trend reflects a significant focus on the research and development of feminine probiotic supplements.

- The market has witnessed notable growth due to the increasing consumer awareness towards holistic health and the importance of maintaining a balanced gut microbiome. Online retailers have made these supplements easily accessible, offering probiotic capsules and tablets as convenient alternatives to probiotic yogurt. The market's expansion is driven by ongoing research and development efforts, which lead to the discovery of new probiotic strains, products, applications, and technology. This investment in innovation ensures the production of high-quality, sustainable supplements that cater to the diverse needs of consumers. As the demand for probiotic supplements continues to rise, the market is expected to grow significantly during the forecast period.

- The focus on preserving the integrity of the microbiome and promoting digestive health has made probiotics an essential component of many health and wellness regimens. Companies are committed to providing eco-friendly, sustainable packaging solutions to minimize their environmental footprint, further increasing the appeal of these supplements.

What challenges does the Feminine Probiotic Supplement Industry face during its growth?

- The feminine probiotic supplement industry faces significant growth constraints due to the stringent government regulations and guidelines governing the production and marketing of such supplements. (Important point: The presence of rigorous government regulations and guidelines is a key challenge for the industry's growth.)

- The global market for feminine probiotic supplements is subject to rigorous regulations imposed by authorities such as the Food and Drug Administration (FDA). These regulations cover various aspects, including permits, entry of new companies, residual management, and expiry dates for probiotic dietary supplements. The FDA plays a significant role in regulating the manufacturing and distribution of these supplements, setting strict guidelines on the types of supplements that can be introduced, the number of ingredients, and labeling requirements. Ensuring compliance with these regulations is essential for companies operating in the market.

- These supplements, as part of functional foods and lifestyle choices, aim to support hormonal balance and feminine hygiene during the menstrual cycle. Subscription services are also emerging as a popular option for consumers seeking regular access to these supplements. Natural ingredients are a key focus for many companies, as consumers increasingly demand products free from artificial additives.

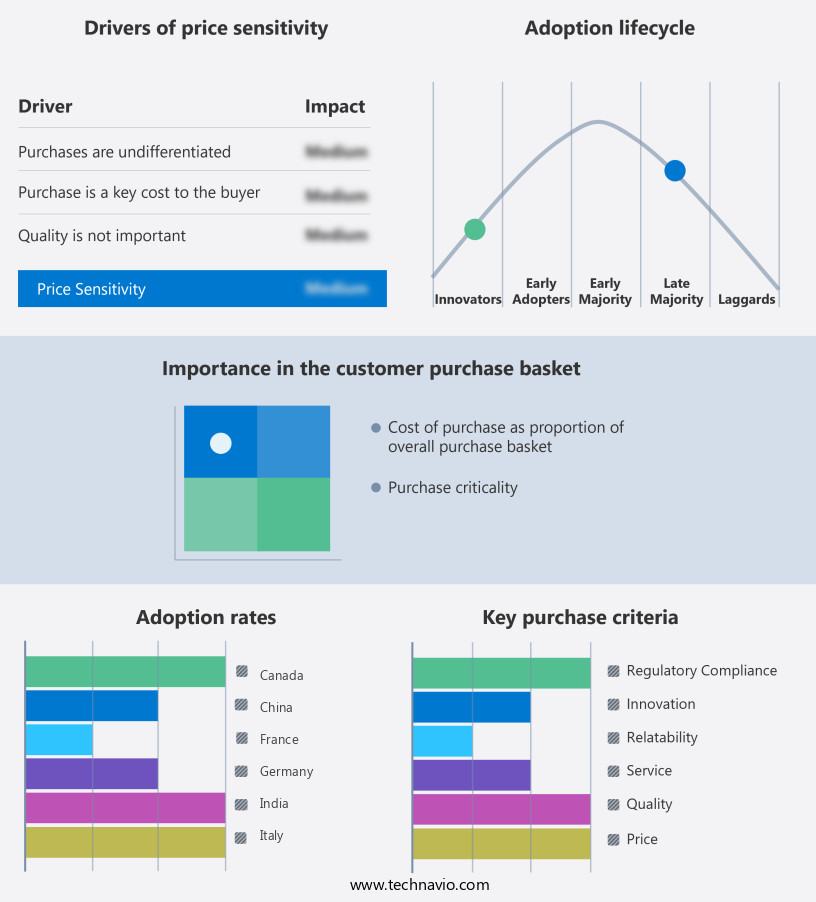

Exclusive Customer Landscape

The feminine probiotic supplement market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the feminine probiotic supplement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, feminine probiotic supplement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp. - This company provides a feminine probiotic supplement, such as Nutrilite's offering for women, which restores, replenishes, and maintains the delicate balance of feminine microflora. The supplement's probiotics work to support overall feminine health and wellness, enhancing the body's natural ability to maintain a healthy microbiome. By incorporating this supplement into daily routines, women can help ensure the optimal balance of beneficial bacteria, promoting overall feminine health and vitality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Anlit Ltd.

- Bayer AG

- BioGaia AB

- Chr Hansen AS

- Church and Dwight Co. Inc.

- DuPont de Nemours Inc.

- Kirin Holdings Co. Ltd.

- dsm-firmenich

- Lifeway Foods Inc.

- OrganiCare

- PanTheryx Inc.

- Probi AB

- Reckitt Benckiser Group Plc

- The Clorox Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Feminine Probiotic Supplement Market

- The market has witnessed significant developments in recent years, with key players focusing on product innovation, technological collaborations, and geographic expansions to cater to the growing demand for women's health supplements. Here are four notable developments in the market:

- In January 2025, Garden of Life, a leading manufacturer of nutritional supplements, launched its new RAW Probiotics Women line, specifically designed for women's digestive and urinary health. This product launch underscores Garden of Life's commitment to addressing the unique nutritional needs of women and expanding its product portfolio (Garden of Life Press Release).

- In March 2024, DuPont Nutrition & Biosciences, a global biotech company, announced a strategic collaboration with Bio-Techne Corporation to develop and commercialize probiotic strains for the feminine health market. This collaboration is expected to bring innovative probiotic solutions to market and strengthen DuPont's position in the industry (DuPont Nutrition & Biosciences Press Release).

- In October 2023, Nestle Health Science, a global leader in nutritional science, acquired Aimmune Therapeutics, a biotech company specializing in food allergies and gastrointestinal health. This acquisition is expected to expand Nestle's offering in the feminine health market, as Aimmune's portfolio includes a probiotic supplement for women's vaginal health (Nestle Health Science Press Release).

- In February 2022, Danone, a leading player in the probiotic market, announced the launch of its new line of Danone Essentials Probiotics for Women, designed to support women's digestive and urinary health. This product expansion underscores Danone's commitment to catering to the unique health needs of women and expanding its market presence (Danone Press Release).

Research Analyst Overview

The feminine probiotic market is expanding as awareness of gut microbiome health grows, emphasizing overall wellness. Probiotic supplements, available as gummies, powders, capsules, and tablets, support digestive health, immune system function, and vaginal health. A key trend is personalized recommendations tailored to lifestyle choices, menstrual cycle, hormonal balance, and conditions like urinary tract infections or yeast infections. Microbiome testing enhances targeted supplementation, improving efficacy.

Storage conditions are critical to maintain probiotic strains' viability, ensuring shelf life and efficacy. Retail distribution channels, including grocery stores, online retailers, and subscription services, must follow strict guidelines to preserve product quality. Rising demand for organic and natural ingredients boosts probiotic foods like yogurt and kefir. Antibiotic resistance underscores the need for effective probiotic strains and dosages, often combined with digestive enzymes for better gut survival. Social media marketing and digital marketing drive consumer engagement, while clinical trials and sustainable packaging align with eco-conscious trends. Innovation in probiotic strains and delivery methods positions brands for success in this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Feminine Probiotic Supplement Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 792.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, Canada, UK, Germany, China, Italy, Japan, France, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Feminine Probiotic Supplement Market Research and Growth Report?

- CAGR of the Feminine Probiotic Supplement industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the feminine probiotic supplement market growth of industry companies

We can help! Our analysts can customize this feminine probiotic supplement market research report to meet your requirements.