Flax Seeds Market Size 2025-2029

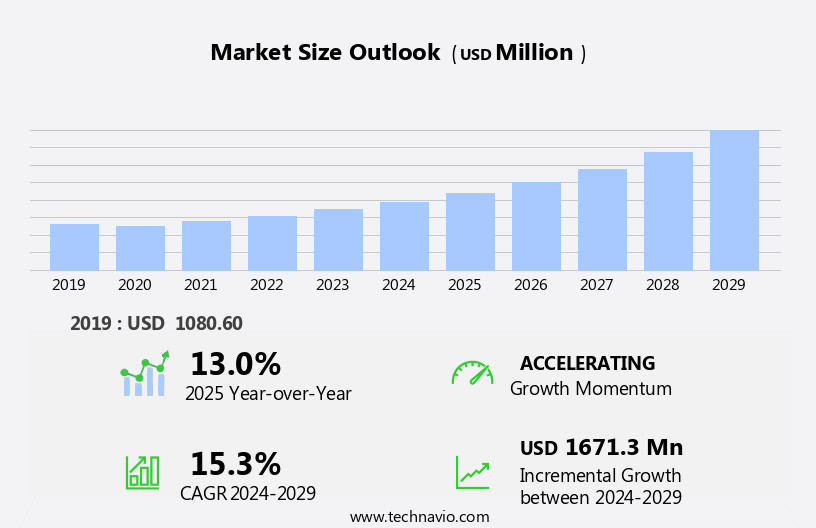

The flax seeds market size is forecast to increase by USD 1.67 billion at a CAGR of 15.3% between 2024 and 2029.

- The market is experiencing significant growth driven by increasing consumer awareness regarding the numerous health benefits associated with these seeds. Rich in omega-3 fatty acids, lignans, and fiber, flax seeds have gained popularity as a superfood, leading to their wide reach through organized retailing channels. However, market growth is not without challenges. Fluctuating prices of flax seeds due to supply and demand dynamics and occasional product recalls can pose significant risks for market players. To capitalize on the opportunities presented by this market, companies must focus on securing a reliable supply chain and ensuring product quality and safety. Rich in omega-3 fatty acids, lignans, and fiber, flaxseeds and flaxseed oil have gained popularity as a superfood.

- Additionally, innovation in product development, such as fortified food products and functional beverages, can help companies differentiate themselves and cater to the evolving consumer preferences. Overall, the market presents a compelling growth opportunity for players able to navigate these challenges and effectively meet the increasing demand for these nutrient-dense seeds. Flaxseeds, also known as linseeds, are rich in essential nutrients, including protein, fibres, carbohydrates, omega-3 fatty acids, calcium, and antioxidants.

What will be the Size of the Flax Seeds Market during the forecast period?

- Flax seeds, rich in linoleic acid and boasting antioxidant properties, have gained significant attention in the health and wellness industry. The competitive advantages of these seeds extend to their ability to support cardiovascular health, hormonal balance, and skin health. Consumer demographics, particularly those focused on dietary trends and health consciousness, are driving demand. Brand recognition and influencer marketing are crucial for businesses looking to capitalize on this market. Food safety standards and sustainable agriculture practices are essential considerations for companies in this sector. E-commerce platforms and supply chain optimization enable businesses to reach a wider audience and streamline operations. They are a good source of essential amino acids, fiber, omega-3 fatty acids, and minerals such as calcium, phosphorus, potassium, and magnesium.

- Price sensitivity and data analytics are key factors in marketing campaigns, with content marketing and product differentiation essential for standing out. Consumer preferences for non-GMO verification, fiber content, and protein content continue to shape the market. Additionally, dietary trends such as vegetarian and plant-based diets are influencing growth. Anti-inflammatory effects and weight management benefits further bolster demand. Businesses must also address consumer psychographics, cost reduction strategies, and customer relationship management. Ingredient labeling and social media marketing are essential for transparency and reaching younger demographics. Food sensitivities and allergies necessitate careful product quality control and innovation. These seeds are rich in omega-3 fatty acids, fiber, protein, and essential amino acids.

- Alpha-linolenic acid, a key component of flax seeds, is linked to blood sugar control and digestive health. Product innovation and fiber content are crucial for addressing these health concerns. Hair health and marketing campaigns that these benefits can help businesses tap into new markets. In summary, the market is characterized by evolving consumer preferences, competitive dynamics, and a focus on health and sustainability. Companies must navigate these trends while ensuring product quality, innovation, and transparency to succeed.

How is this Flax Seeds Industry segmented?

The flax seeds industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverages

- Animal food

- Others

- Product

- Ground flax seeds

- Whole flax seeds

- Flax seed oil

- Type

- Conventional

- Organic

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Rest of World (ROW)

- North America

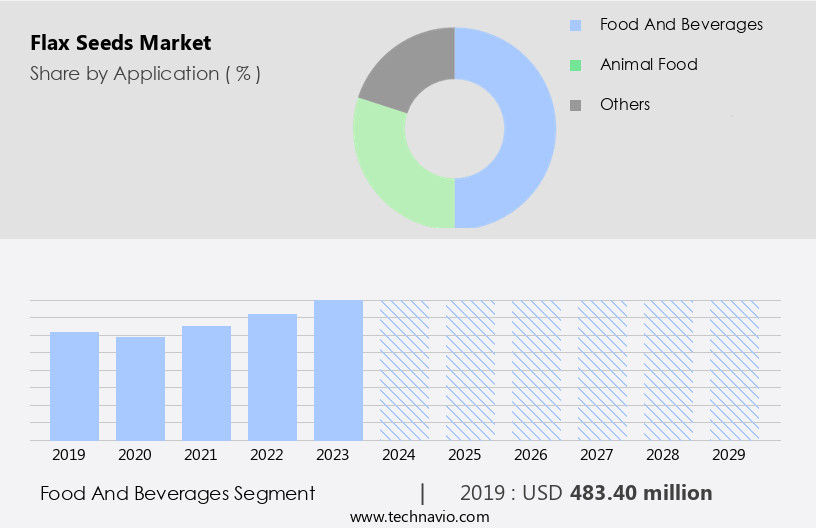

By Application Insights

The food and beverages segment is estimated to witness significant growth during the forecast period. Flax seeds, a rich source of dietary fiber, Omega-3 fatty acids, and protein, are increasingly being incorporated into various food and beverage products due to the global trend towards healthier consumption. The food and beverages segment is experiencing significant growth as a result. Beyond their use as a raw snack, flax seeds find application in a wide range of food and beverage items such as juices, pasta, smoothies, yogurt, cereals, salads, and sports nutrition products. Flax seed powder can be added to fresh foods as a food additive, enhancing taste in cold and hot cereals, and acting as a preservative.

It also increases nutritional value in ice creams, juices, and snacks. In the baking industry, flax seeds are used in cookies, bread, energy bars, and pasta. The versatility of flax seeds extends to their use as an additive in various food manufacturing processes, contributing to the industry's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Food and beverages segment was valued at USD 483.40 billion in 2019 and showed a gradual increase during the forecast period.

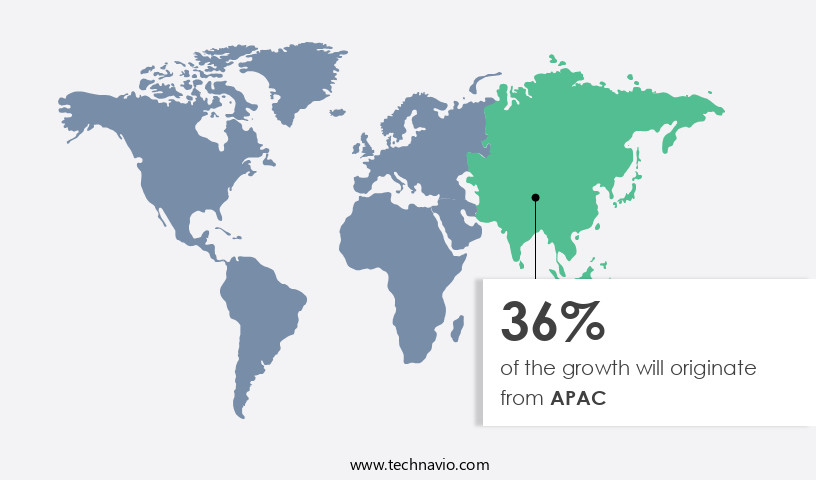

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Flax seeds have gained significant attention in the market due to their health benefits and versatile uses. In various industries, including food and beverage, animal feed, and industrial applications, flax seeds play a pivotal role. The demand for flax seeds is driven by their rich nutritional value, which includes dietary fiber, omega-3 fatty acids, and protein. In the food industry, flax seeds are used in various forms, such as whole, ground, or as oil, for culinary purposes and the production of supplements. Flax seeds are incorporated into a wide range of food products, including cereals, baked goods, and plant-based alternatives, catering to vegan and health-conscious consumers.

The Flax Seeds Market is thriving due to rising demand for flaxseed protein, flaxseed fiber, and whole flaxseeds in various industries. Products like flaxseed bread, flaxseed crackers, flaxseed yogurt, flaxseed pudding, flaxseed salads, and flaxseed sauces cater to evolving flaxseed vegan options. Additionally, flaxseed animal feed, flaxseed aquaculture feed, flaxseed poultry feed, and flaxseed pet food support agricultural needs. Processes like flaxseed oil extraction, flaxseed processing, flaxseed milling, and flaxseed packaging ensure efficiency, while flaxseed labeling and flaxseed traceability maintain quality. Focus on flaxseed sustainability enhances brand value. Insights into flaxseed pricing, flaxseed market share, flaxseed regulations, flaxseed certifications, and flaxseed nutritional value further drive flaxseed market growth. Innovative strategies like flaxseed product development, flaxseed marketing strategies, and flaxseed online sales strengthen flaxseed consumer awareness and foster flaxseed brand loyalty

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Flax Seeds Industry?

- Growing awareness about health benefits of flax seeds is the key driver of the market. Flax seeds are nutritious seeds, renowned for their health benefits for both humans and animals. These seeds are the richest source of omega-3 fatty acids, with over 50% linolenic acid content. The health advantages of flax seeds are extensive. They contribute to cardiovascular health by lowering blood pressure, bad cholesterol, and inflammation due to their high omega-3 fat content and antioxidant properties. In addition, flax seeds are beneficial for individuals with diabetes as they are rich in alpha-linolenic acid (ALA) and fiber. These nutrients help prevent metabolic disorders such as dyslipidemia and insulin resistance, which are significant contributors to diabetes. Incorporating flax seeds into your diet can lead to improved heart health and diabetes management. Beyond cardiovascular health and diabetes management, flaxseeds offer numerous other health benefits.

- In the animal feed sector, flax seeds serve as an essential source of nutrition for poultry, livestock, and aquaculture. The market for flax seeds is expanding, with an increasing number of companies focusing on product development, innovation, and marketing strategies to cater to the growing consumer base. The e-commerce sector has significantly contributed to the market's growth, enabling direct-to-consumer sales and expanding reach. The industry is also witnessing a trend towards sustainable and traceable production and processing methods, as well as certifications that assure consumers of the product's quality and authenticity. Despite the challenges posed by regulations and supply chain complexities, the market for flax seeds is expected to continue its growth trajectory.

What are the market trends shaping the Flax Seeds Industry?

- Wide reach through organized retailing is the upcoming market trend. Flax seeds have gained significant attention in the global food industry due to their nutritional benefits. These seeds are primarily sold through organized retailers, including supermarkets and hypermarkets, which have experienced expansion worldwide. Supermarkets serve as a major distribution channel for affordable and nutritious food, making them a preferred choice for consumers. The rise in population and increasing awareness of health and wellness have contributed to the growth of supermarkets in various regions, such as South America and India. On average, a consumer spends approximately USD30 per trip to the supermarket. The high degree of penetration of supermarkets in countries like Brazil, Chile, and Peru in South America, and India, indicates a promising market for flax seeds. Organized retailers' dependence on these channels underscores the importance of supermarkets in the distribution of flax seeds. Moreover, they provide essential amino acids, fiber, and protein, making them a valuable addition to nutrition-rich products like bakery items, breakfast cereals, healthy snacks, energy bars, and even pet food.

- The potential for expansion in emerging markets, such as China, Japan, and India, presents significant opportunities for market participants. These countries have shown a growing interest in superfoods and healthier food options, making flax seeds an attractive addition to their diets. In summary, the market for flax seeds is experiencing steady growth due to increasing consumer awareness, health benefits, and versatile applications across various industries. Companies are focusing on product development, innovation, and marketing strategies to cater to the evolving consumer demands and expanding their reach in both established and emerging markets.

What challenges does the Flax Seeds Industry face during its growth?

- Fluctuating prices of flax seeds and product recall is a key challenge affecting the industry growth. The flax seed market has experienced significant price fluctuations due to the increasing gap between demand and supply, leading to increased raw material costs. This trend poses a challenge for manufacturers, as any increase in the cost of raw materials can significantly impact their profit margins. To remain competitive, manufacturers are exploring alternative, cost-effective options. Furthermore, the pricing power of raw material suppliers can significantly impact market dynamics. For instance, the price of flax seeds in the US was approximately USD 1.7 per kilogram in 2023. By 2025, this price is projected to increase to around USD 1.5 per kilogram, reflecting the volatility of the market.

- Pricing strategies have become a critical factor in the market, with manufacturers and retailers striving to offer competitive prices while maintaining profitability. Flaxseed meal, a byproduct of oil extraction, has found its place in various industries, including food and animal feed. Packaging and distribution networks have evolved to cater to the growing demand for flaxseeds, ensuring their freshness and availability. Golden flaxseeds, with their attractive appearance, have gained popularity in the culinary world, adding texture and flavor to a wide range of dishes. From ground flaxseeds in baking to flaxseed smoothies and sauces, the possibilities are endless. In addition, flax seeds are used as a functional ingredient in energy bars, breakfast cereals, and snacks.

Exclusive Customer Landscape

The flax seeds market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flax seeds market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flax seeds market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - The company specializes in providing high-quality flax seeds, including whole brown and golden varieties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Bioriginal Food and Science Corp.

- BTL Herbs and Spices Pvt. Ltd.

- CanMar Foods Ltd.

- Eastmade Spices and Herbs Pvt. Ltd.

- Gingerly Naturals P. Ltd.

- Grain Millers Inc.

- Healthy Food Ingredients LLC

- Howe Seeds

- KRBL Ltd.

- Linwoods Health Foods

- Mother Herbs P Ltd.

- Mr Fothergills Seeds Ltd.

- Pragati Agribiz Pvt. Ltd.

- Satva Industries

- Shape Foods Inc.

- Stoney Creek Oil Products Pty Ltd.

- TA Foods Ltd.

- Terra Ingredients

- Waltanna Foods Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Flaxseeds have gained significant attention in the global market due to their numerous health benefits and versatile applications. This tiny seed, rich in dietary fiber, omega-3 fatty acids, and protein, has expanded its reach beyond human consumption and found a foothold in various industries. The retail channels for flaxseeds have witnessed a demand, with consumers increasingly seeking out this nutrient-dense ingredient for their diets. Flaxseed's versatility extends to various sectors, including poultry feed and pet food, where it serves as a valuable source of nutrients. Labeling plays a crucial role in the flaxseed market, as consumers demand transparency and accurate information regarding the product's origin, quality, and nutritional value.

E-commerce has revolutionized the way flaxseeds are sold and distributed, allowing consumers to purchase this nutrient-rich ingredient from the comfort of their homes. The market share for flaxseed supplements has grown significantly, as people seek convenient ways to incorporate this superfood into their daily routine. Flaxseed's nutritional value, including its high fiber content and health benefits, has fueled innovation and product development. Consumers' increasing awareness of the seed's health benefits has led to the creation of flaxseed cereals, vegan options, and various other flaxseed-based products. Flaxseed's sustainability is a growing concern for both manufacturers and consumers.

Certifications and traceability systems have been implemented to ensure the ethical sourcing and production of flaxseeds. Direct-to-consumer sales and marketing strategies have emerged as effective ways to build brand loyalty and increase sales. Flaxseed's health benefits extend to various industries, including aquaculture feed and animal feed, where it serves as a valuable source of nutrients. Processing techniques, such as oil extraction and hull removal, have evolved to meet the growing demand for flaxseed products. Regulations and standards have been put in place to ensure the quality and safety of flaxseed products. Online sales and the supply chain have become essential components of the flaxseed market, allowing for efficient distribution and availability.

Flaxseed's versatility extends to various applications, including bread, crackers, and pudding. Organic flaxseeds have gained popularity due to the growing demand for organic and natural food products. Flaxseed oil, a popular ingredient in the health food industry, has seen significant growth in recent years. Brown flaxseeds, with their nutty flavor and crunchy texture, have found their place in various dishes, from salads to baked goods. Flaxseed demand continues to grow as consumers seek out this nutrient-dense ingredient for its numerous health benefits and versatile applications. In summary, the flaxseed market is a dynamic and evolving industry, driven by consumers' increasing awareness of the seed's health benefits and versatility. From retail channels and labeling to product development and sustainability, various factors are shaping the future of the flaxseed market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.3% |

|

Market growth 2025-2029 |

USD 1.67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.0 |

|

Key countries |

US, China, India, Canada, Japan, South Korea, Germany, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flax Seeds Market Research and Growth Report?

- CAGR of the Flax Seeds industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flax seeds market growth of industry companies

We can help! Our analysts can customize this flax seeds market research report to meet your requirements.